Thematic Equity

Primers and Equity Baskets for CitriniResearch’s Equity Portfolio

Primary Themes:

Our currently allocated & primary equity themes for 2025 are:

Artificial Intelligence

Fiscal Primacy

Robotics

Med-Tech & Healthcare

Natural Gas

GLP-1s

Electronic Warfare

Biotech

Small Themes

The theme list will naturally evolve. If you are a new paid subscriber, I really recommend getting up to speed by reading some of our thematic primers (which are designed to stay relevant, as our themes are expected to play out over years). It makes Citrini sad when you pay him for insights and then ask stupid questions that have already been answered by exceedingly in-depth primers. And we don’t want to make Citrini sad, right? …right?

We’ve linked to several below for easy reference.

Yearly Outlook & State of the Themes Updates

Every year at the end of the year we do a “Twenty-something Trades for Twenty-Twenty-Something” (i.e., 26 Trades for 2026).

These include baskets we may or may not put on during the year, a thematic review and outlook and other trade ideas as well as a risk assessment to our current portfolio and a brief (and mostly useless, as most of them tend to be) macroeconomic outlook.

I highly recommend revisiting this article throughout the year whenever you may be struggling for ideas or have recently raised cash and are looking for new positions to deploy into.

This is typically the most broad and exhaustive market review we do. You can read the most recent one here:

Thematic Expansion Primers

We also periodically write thematic updates or pieces that are tangential to our themes:

AI Losers (Short Only & Long/Short Basket) and

Cybersecurity Long/Short

You can read my general approach to thematic equity investing here:

Thematic Investing and Mega Trends

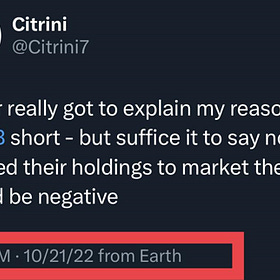

What is a “megatrend”? I did not get to explain the concept of how I look at thematic investing in my first two pieces, so I’m using this as an opportunity to do so. A couple months ago, I mentioned on Twitter what I thought were the current themes with potential to become megatrends for the 2020s: