Election 2024: Investment Implications & Preparations

Expect the Unexpected…Then Expect it Again

This article provides three potential baskets to play rising odds of Trump as the Republican Nominee and/or Next President in the 2024 election as well as the results. The baskets can be inversed to play Democrat odds/win and we’ve included two versions - a net long and market neutral - to play election odds and then one to play post-election outcomes.

The purpose is to highlight risks, both upside and downside, in both equities and macro. It’s quite early on, but tomorrow is Super Tuesday and we will be hearing a lot more about this - and likely seeing a lot more implications on the way our portfolios move. If we’re doing groundhog day, it’s at least good to be prepared.

Same Disclaimer as Last Time: I’m apolitical by necessity. My firmly held belief, formed by experience, is that one cannot be an effective trader while at the same time being strongly ideological politically. Eventually, the bias and cognitive dissonance will get you, and you will double down on a trade that has no basis in reality but all the basis in the world in what you think reality should look like.

Therefore, please understand that I comment not on who I think should win the election or which candidate I think will be best, but only on the most likely course markets will take in response to the election’s odds/outcome. Overall, I enjoy trading much more than being opinionated about political parties but - every four years or so - there comes a time where I have to care about them in order to discern their impact on stocks. That’s all this is.

Also, as interesting as it would be for a dark horse candidate to pull ahead (and maybe one does), it’s looking right now like it will be Trump vs. Biden - that’s what I’ll be basing this framework off of. If things change I will update for that.

Back to our regularly scheduled program…

Investing through Election Day 2024

As we discussed in our “U.S. Fiscal Primacy” piece, it is our view that the two-party split on fiscal discipline has given way to a more broadly dirigiste view of government spending that is likely to continue regardless of who controls the government. I would highly recommend going back and reading the Fiscal Primacy thematic primer, as we will be implementing some core ideas from that thesis in our basket construction here. Mostly, the Fiscal Primacy basket is heavily over-indexed to the beneficiaries of the “Big Three”, the IRA, IIJA and CHIPS Act. While certain benefits are likely to persist, and there are some issues that fiscal spending is likely to continue on regardless (more likely in a divided government), it is fair to say that the Fiscal Basket is at least 50% a Biden Fiscal Basket.

Since we won’t be delving deeper into the measures already taken by the Biden administration that are likely to be expanded upon in a Biden win scenario, I’d highly recommend reading it to get an idea of the effect of Bidenomics in the markets thus far:

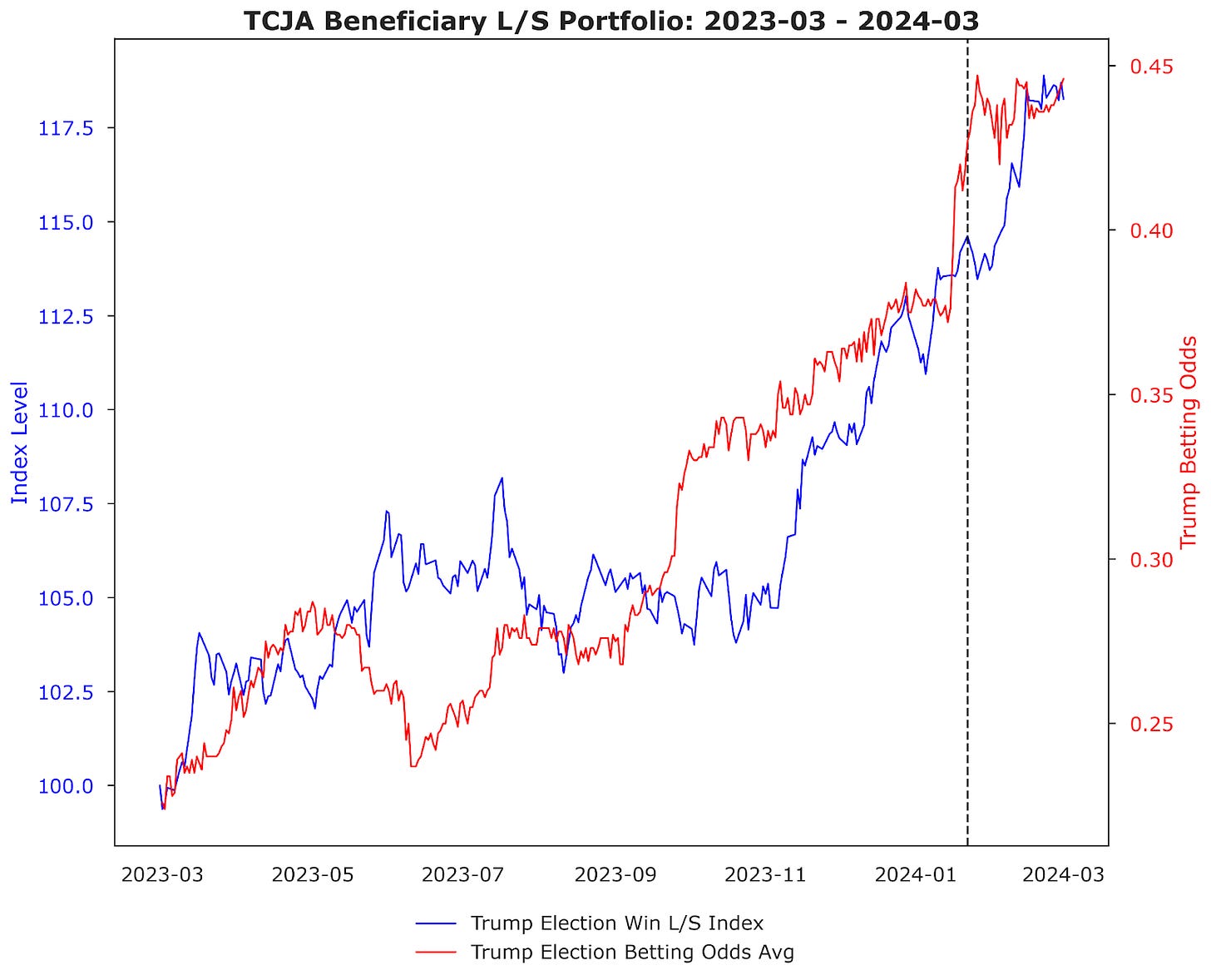

When it comes to the 2024 election it’s pretty much assured that it will be a repeat of Trump v. Biden/Harris (or just Harris, if Biden is incapacitated), and Trump’s odds to win have been very steadily rising:

Although this is a “repeat”, we have to be careful about simply assuming markets will repeat the past. Simply backtesting performance during respective administrations risks creating exposures to things we don’t really care about.

The fact is the chances of another COVID, with all the demand side stimulus and ZIRP it entails, happening again under Trump…pretty low. Another bout of geopolitically driven energy sector ascendancy off the lows followed by a historical mega-cap tech rebound happening again under Biden? Also low. History might rhyme, but it’s not a spotify playlist with one song on repeat.

I did a bit of looking around equity sell-side research on the election and I see some baskets that are “which stocks outperformed the most in 2016 when Trump won and which stocks outperformed the most in 2020 when Biden won”. That approach completely ignores the plethora of confounding variables in a basic Trump/Biden admin comparison versus a Trump/Biden rematch.

Listen, if anyone here loves simplicity - it’s me. You have all seen this in action, I love myself a good thought-pretzel but when it comes to making money I try to keep it as straightforward as possible without getting in over my head on risk.

UBS gets to buy Credit Suisse for essentially zero dollars in a Swiss government kiss on the cheek? I’m buying UBS. Semiconductors for artificial intelligence are woefully short? I’m buying the companies that make those chips. Weight loss drugs work now? Yeah, I’m buying the drug makers.

However, in this instance, nuance is not the enemy. There are many adages of how certain stocks perform under GOP vs. Democrat administrations that simply do not apply. As we will discuss later, the “higher US military industrial complex profits under GOP presidents” trade likely does not apply, nor have we seen significant and broad underperformance in the energy sector under Biden. Furthermore, both presidents are protectionists when it comes to China (albeit with Trump being more aggressive on trade policy). Yes, a second Trump Administration may increase tariffs, but the economic impact may be less than his first term since many measures are already in place. In years past, a republican sweep would be viewed as excellent for the private sector while fiscally contractionary and negative for big government contractors

I’ve been working on this basket for two months now and do you want to know why it didn’t take me a week? Because it’s f*cking infuriating (not to say that I don’t think I killed it in the final product - I do). Seriously, imagine yourself going back in time and showing this chart to the sell-side analysts predicting what the impact of a Trump to Biden presidential transition would be.

Truly aneurysm inducing stuff. Tell me, do you still want to base your basket off what happened on two individual election days when people were speculating without appreciation for how insane things would get with zero context? Yeah, that’s what I thought.

There are a lot of variables that occur over 4 years, let alone 8, that are a lot more important than who’s president. That’s why I think this theme has the most juice during the election year - I’m not necessarily trying to anticipate what happens in the 4 whole years of whoever win’s presidency, first and foremost I’m trying to anticipate how the market will react to them winning (or having higher odds of winning). Throughout this article, we will go back and forth between the implications of likely policy measures that we believe can impact the next 4 years and those that the market is acutely aware of and will therefore be impacted by election odds this year. The biggest difference between Trump and Biden presidencies (as it relates to markets) are likely the fiscal stimulus programs not in size but in focus, as well as their respective Tax Policies.

I have created two baskets:

A Tax Policy Basket: The most obvious implication of a Trump/Biden rematch and a GOP victory is the extension/permanance of Trump Tax Cuts (the TCJA) while a Democratic victory will result in significant impact for some companies from U.S. agreement to a Global and Domestic Minimum Corporate Tax Rate of 15%. This is much more objective and less speculative than the next basket, which is why it probably is better utilized as a reactive play on the outcome rather than a proactive play on the odds.

An Election 2024 Basket: To create our election 2024 basket, we create a series of sub-themes that are specific to individual aspects of each candidates likely impact on policy - on a sliding scale that does not over-index to Republican or Democrat “trifectas” in which all party wishes are granted and similarly takes heed of the areas in which both parties are, for the most part, similarly aligned. Additionally, we consider (from an as-apolitical-as-possible standpoint) the social implications of not just a Trump or Biden presidency but another Trump/Biden election.

Therefore, we’ve narrowed this theme down to sub-themes reflective of the nearly 8 years since Trump first took office and the end of the first term of the Biden presidency. Each of these sub-themes are likely to generate some impact relative to market perceptions of the presidential election outcome (more so than ever, for the next 8 months or so, this theme is going to be pure reflexivity - that is, perceptions affecting reality in markets - because it’s all hive-mind speculation). As I said earlier, we have already done much speculation (relatively successful speculation, considering the returns) on the major beneficiaries of Biden’s fiscal spending plans, therefore this article will focus on the beneficiaries of a Trump/Biden election with a potential GOP win by using themes for a Long/Short basket where longs benefit more from a GOP win and shorts are hurt either by GOP policies or a repeal of current Democratic ones. Therefore, this basket can ultimately serve also as a hedge for our current fiscal exposure.

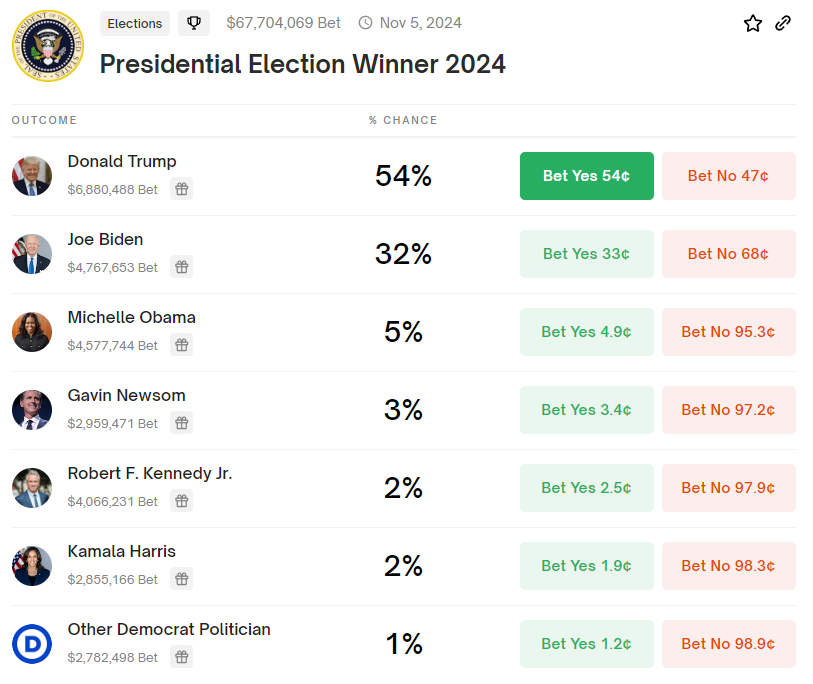

By any metric, it’s quite likely to be a close race, but betting markets like polymarket already have Trump with a >50% chance of winning.

Tax Policy Basket

TCJA Extension vs. “Made in America”

If reelected, a top priority for President Trump would likely be making permanent the personal tax cuts from his 2017 Tax Cuts and Jobs Act (TCJA) which are currently set to expire in 2025.

Extending the tax cuts could add $3.5 trillion to the national debt over 8 years according to CBO estimates, which could require large concessions and would likely require some sort of adjustments to current fiscal spending plans.

In order to pass legislation extending the tax cuts, Trump would need Republican control of Congress and would likely use it to alter the budget - specifically as it relates to the IRA. Control of the House is a toss-up in 2024, while Republicans have a good chance of flipping the few seats needed to take control of the Senate.

A Republican-controlled Senate would be more sympathetic to Trump's policy goals like permanently extending the TCJA personal tax cuts, such as the expanded child tax credit, doubled standard deduction, and limits on the state and local tax (SALT) deduction.

In a surprise outcome that reelects Biden with control of the house, senate or both the Biden administration's changes to companies' tax burdens could look significantly different from the current landscape. Based on President Biden's Fiscal Year 2024 budget proposal and other policy discussions, several key changes could be anticipated that would affect a significant number of companies. As much as 10% of the S&P500 currently pays less than the statutory corporate tax rate and more than a handful pay zero tax at all.

We reevaluate the companies that are most likely to be affected by the renewal of the TCJA (or Trump’s making it permanent) and the new minimum taxes (both global and domestic) likely to be continued or passed under Biden to create a basket to play the result of the election, then create a basket to play market perceptions of the winner in the run up.

[Paywall Below: Beneath the paywall, there are two baskets as well as justification for each sub-theme in the election basket. Additionally, I provide some FX and Rate considerations for a potential Trump or Biden victory]

Companies Likely to See Significantly Less After-Tax Net Income Due to TCJA Expiration in a Democrat Trifecta

Large Multinational Corporations: These companies benefited significantly from the reduction of the corporate tax rate from 35% to 21% and the introduction of international tax provisions aimed at encouraging companies to repatriate foreign earnings. Companies with substantial international operations might see a notable increase in their tax liabilities as these provisions expire.

Companies with High Capital Expenditure: The TCJA allowed for full expensing of certain types of capital spending from their pre-tax earnings. Companies that have leveraged this provision for significant investments in equipment, property, or technology may face higher tax bills as these benefits diminish. Bonus depreciation was changed by the TCJA to be applicable at 100% for both new and used equipment, if the GOP manages to win enough influence to extend it beyond 2025 - something that could benefit companies like URI and HRI.

Firms Engaging in Extensive Share Buybacks and Dividend Payouts: Many companies used the additional cash flow from TCJA tax savings for share buybacks and dividend payouts. As the tax benefits recede, companies that have not reinvested these savings into sustainable growth avenues might struggle to maintain the same level of shareholder returns.

Retail Sector Companies: The retail sector was among the most vocal about planned increases in investment linked to the TCJA. As such, they might be among those to see a significant impact on their after-tax net income with the expiration of these cuts.

Technology Firms: Given their high levels of profit and, in some cases, extensive international operations, technology firms that benefited from lower effective tax rates and international tax provisions may see a notable impact on their after-tax income.

Companies Likely to Be Relatively Unaffected by TCJA Expiration

Companies Primarily Operating in Sectors with Historically Low Effective Tax Rates: Some sectors, such as real estate or specific service industries, might not have benefited as significantly from the TCJA due to already enjoying various tax breaks and incentives that kept their effective tax rates relatively low.

Small to Medium Enterprises (SMEs): While the TCJA provided benefits to SMEs, the scale and impact of these benefits were not as pronounced as for larger corporations. These companies might not see a significant change with the expiration of the TCJA tax cuts, especially if they were not fully leveraging the available benefits.

Companies with Minimal International Operations: Firms that operate primarily within the U.S. and have limited exposure to international tax provisions might see less impact from the TCJA's expiration.

Businesses Focused on Sustainable Investments: Companies that have used the tax savings from the TCJA to invest in long-term growth initiatives, such as R&D or expanding their operational capacity, might be better positioned to absorb the impact of the tax cuts' expiration.

Industries Less Affected by Corporate Tax Rate Changes: Certain industries that are less sensitive to changes in the corporate tax rate, possibly due to existing government subsidies or regulations that offer other forms of tax relief, might not experience a significant impact from the TCJA's expiration.

If there were to be a Democratic sweep of the House, Senate, and Presidency in 2024, the Biden administration's changes to companies' tax burdens could look significantly different from the current landscape. Based on President Biden's Fiscal Year 2024 budget proposal and other policy discussions, several key changes could be anticipated:

Increase in Corporate Tax Rate:

President Biden has proposed increasing the corporate income tax rate from the current 21% to 28%, which would directly impact the tax burden of corporations.

Tax on Stock Repurchases:

The administration has proposed increasing the excise tax on certain corporate stock repurchases from 1% to 4%. This would affect companies that buy back their own shares as a way to return capital to shareholders.

US Corporate & Global Corporate Minimum Tax Rates:

A minimum corporate tax rate of 15% for US corporations, targeting those that may pay little to no tax under the current system due to various deductions and credits, became effective for 2023 and will apply to corporate profits made that year. This is part of an effort by the Biden administration to ensure that all profitable corporations contribute a baseline amount in taxes.

The Biden administration's proposals (found in the Treasury’s Green Book) include reforms to U.S. international tax rules, such as raising the tax rate on the foreign earnings of U.S. multinational corporations. These reforms aim to address concerns about profit shifting and tax base erosion. Completely separate from the 15% Corporate Minimum Tax in the US which becomes effective for profits earned last year, the 15% “Global Minimum Tax” that the Biden administration wishes the US to become signatory to with 140 other nations is still struggling to pass the house and senate with the requisite legislation.

If Joe Biden wins reelection, the likelihood of passing a global minimum tax of 15% could increase, especially if the Democratic Party also gains control of both the House and Senate. The global minimum tax has been a significant part of Biden's tax policy agenda, aiming to ensure that multinational corporations pay a minimum tax rate on their profits worldwide, thereby reducing incentives for profit shifting and tax avoidance. Yellen said she thinks Congress will eventually adopt legislation in 2025, as part of a deal when the 2017 Trump tax cuts expire.

Therefore, companies currently paying less than 15% effectively in tax could be negatively impacted while those paying more than 15% are unlikely to see a net negative impact.

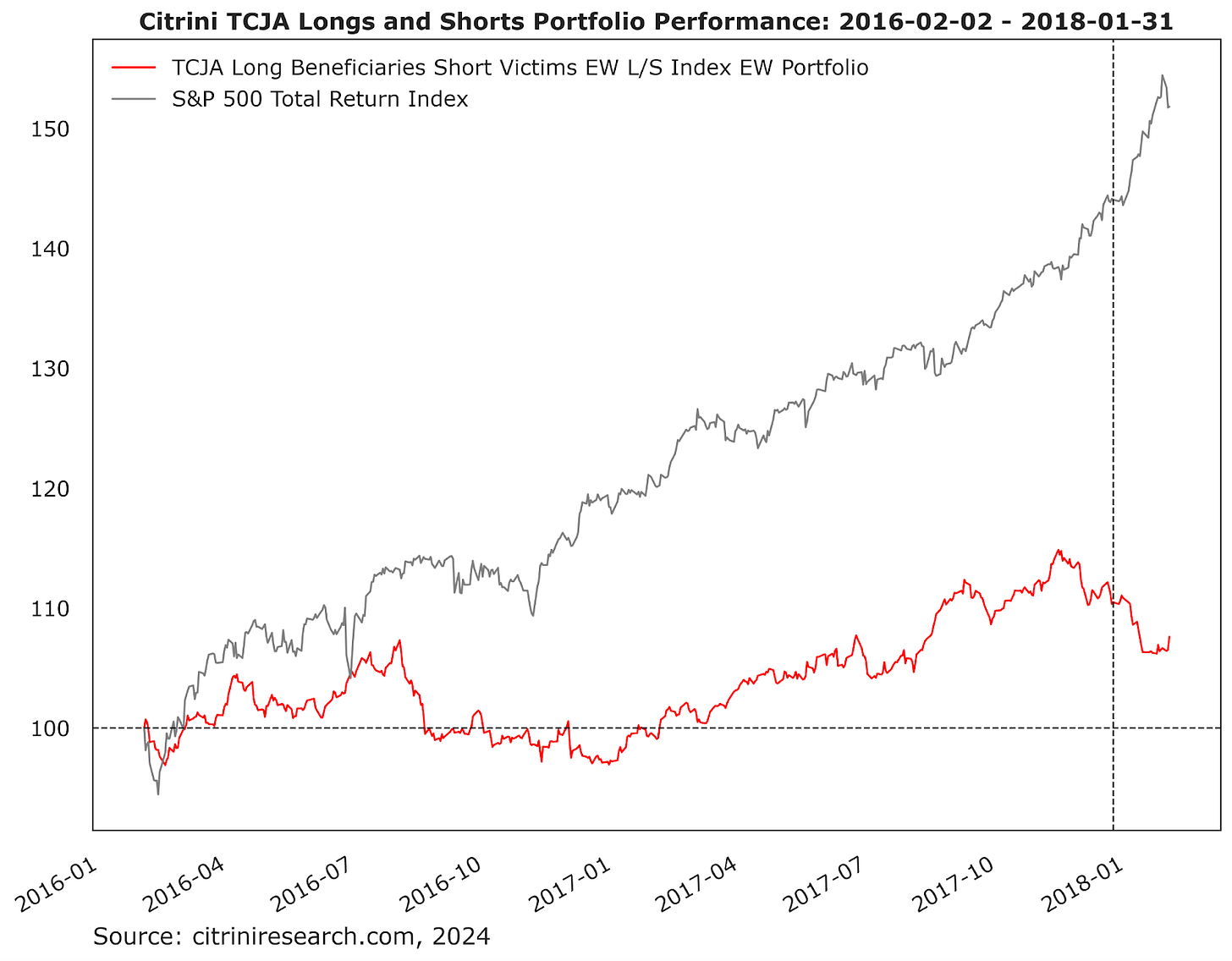

In the end, to make a Tax Policy basket that would be useful as the election outcome becomes clearer, what we get are names that habitually take the most advantage of tax cuts and have the most to lose from tax hikes or a minimum tax that’s globally & domestically applicable. It ends up outperforming significantly (partially because of the fact that large multinational tech companies don’t pay much tax) but also captures the overall economic outlook regarding tax policy and underperforms on market fears of Democratic Tax Policy (i.e. in the aftermath of the 2020 election).

To assess the impact of the TCJA and potential impact of another Biden term’s tax policy, we’ve done screening. The TCJA had its most significant impact on corporate effective tax rates beginning in 2018 and until 2021 when some tax breaks began to be phased out and the confounding variable of COVID and the CARES act skews the data. We take the Russell 1000 and then sort it by effective tax rate pre-TCJA, post-TCJA but pre-CARES (which was a bipartisan bill) from Jan 1 2018 (when the TCJA became effective) until January 1 2020 and currently (post-IRA). We filter by companies that have positive pre-tax income and then further narrow it down by companies that are currently paying less than 15% effective tax (who would be harmed by a corporate minimum + global minimum tax under a Democratic government) and those that are paying more.

The basket, which is equally weighted (+100% evenly long TCJA beneficiaries, -100% evenly short TCJA unaffected/losers) can be downloaded by clicking HERE.

Zooming in to the front-running period as TCJA was drafted & passed, we can see exactly how well this basket did during the run up to the passage of the TCJA (and how it might respond in the future to more Trump Tax Cuts):

This long/short basket also massively underperformed in reaction to Biden winning the election:

It’s pretty important to me that a price-naive basket (e.g. created using a screen that was not based on net total return during specific windows) still performs in the way I would expect it to around specific dates.

I believe this is a pretty versatile basket (i.e. you can reverse the long and short components in a Biden win scenario), but one that’s more suited for putting on after the result of the election.

This is the “reality” basket, which will benefit from further clarity on each candidate’s tax plans, the progression of the R&D Tax Credit under the Tax Relief for American Families and Workers Act of 2024 and clarifications on FDII and - of course - the likelihood that specific promises are actually kept. It’s likely that this basket is already poised to benefit from the election as we are in the unique position of already knowing what the priorities of each candidate in an actual presidential term are, but it’s still more suited to being put on immediately post-election. What we need now is a perception basket.

We can see that this basket has not tracked Trump’s election odds as closely as I’d want them to - so we are going to have this basket ready for any Trump Tax Cut or Biden “Made In America Tax Plan” themes or to play after a Biden or Trump win, and we will closely monitor it as the election gets closer, but we’re going to go deeper and more granular to form a basket for the lead in to the election:

In order to avoid picking up existing fiscal stimulus beta, I will try to structure the “election odds” basket as a long/short with Trump on the long side. As I mentioned before, we already have a Biden long side (the US Fiscal Primacy basket). Let’s get into the breakdown of the sub-themes for the election odds basket.

Election 2024 Basket: Playing Market Perceptions on Trump v. Biden Odds

We’ll review the campaign promises of each candidate thus far, with an eye for not highlighting social/culture war issues that have no bearing on financial markets, in order to formulate our sub themes:

Trump's 2024 Campaign Promises

Former President Donald Trump's campaign for the 2024 election emphasizes a continuation and intensification of several policies from his first term, with a particular focus on immigration, economic nationalism, and law enforcement. Key promises include:

Immigration: Trump has pledged to terminate open borders policies of the Biden administration, stop the southern border invasion, and initiate the largest domestic deportation operation in American history. He aims to reinstate and expand travel bans targeting certain Muslim-majority countries and finish building a U.S.-Mexico border wall.

Trade Policy: He proposes a universal 10% tax on all goods coming from countries outside the U.S. to prioritize domestic production and has threatened tariffs on companies that outsource production, with a 60% tariff on Chinese goods. This "America first" economic approach has drawn criticism from economists across the political spectrum.

Law Enforcement and Crime: Trump suggests using the National Guard and deploying the military domestically to address crime, advocating for a military crackdown in cities he describes as "crime dens." He has also proposed the death penalty for certain low-level crimes and drug offenses.

Dismantling the 'Deep State': Trump plans to strip tens of thousands of federal employees of their civil service protections to facilitate mass firings, targeting those he perceives as part of the "deep state." This includes reissuing the "Schedule F" executive order.

Education Policies: Trump also aims to terminate the Department of Education and influence local school curricula towards "patriotic education". Trump has also expressed plans to dismantle the Department of Education and Department of Commerce.

Energy Policy: Trump's energy strategy includes ramping up oil drilling on public lands, offering tax breaks to fossil fuel producers, and rolling back electric vehicle adoption efforts. He plans to exit the Paris Climate Accords again and eliminate regulations targeting energy efficiency and emissions.

Project 2025: While unlikely, a GOP “Trifecta” (house, senate & executive control) could end up drawing its goals from the Heritage Foundation’s recent “Project 2025” document, an ambitious plan designed to implement a conservative agenda across all levels of the federal government, leveraging the unitary executive theory as its guiding principle. Other goals include giving the FBI a “hard reset”, assembling an "army of aligned, vetted, trained, and prepared conservatives" ready to implement the conservative agenda from day one.

Biden's 2024 Campaign Promises

President Joe Biden's campaign for re-election in 2024 focuses on completing the agenda from his first term, with significant emphasis on civil rights, healthcare, education, and climate change. Key areas include:

Tax & Economic Policy: "Bidenomics" focuses on stimulating the economy from the middle out and bottom up, including the American Rescue Plan and infrastructure projects. Biden contends with criticism regarding inflation and regulatory policies. Biden’s tax policy is focused on funding renewable and social welfare initiatives and aims to increase corporate tax rates as well as place a minimum domestically and globally, while taxing higher earners more significantly and potentially changing capital gains treatment. We expand on this below.

Climate Change: Biden has set ambitious targets for reducing greenhouse gas emissions, supporting electric vehicles, and investing nearly $375 billion in climate change initiatives through the Inflation Reduction Act.

Foreign Policy: Biden's foreign policy emphasizes support for allies, including military support for Ukraine and Israel. He has faced criticism for the withdrawal from Afghanistan but continues to advocate for international cooperation.

Both candidates present contrasting visions for America's future, with Trump advocating for a return to his administration's policies and Biden seeking to continue and expand upon his first-term agenda.

Election 2024 L/S Basket: Universe

Click HERE to download and view in Excel (it’s the third sheet).

We’d like to let you be the arbiter of whether the GOP or Dems will be good for markets or not, so we have also made a narrowed net long index that should be run as +200% longs and -100% shorts:

As you can see, the basket is oriented long/short towards a “Trump/GOP Win” (i.e. longs are related to outperformers due to GOP policy and shorts are related to either existing outperformers due to Democratic policy or expected underperformers due to GOP Policy). The important point to make here is that - in my opinion - this is a separate basket from the “actual election winner” basket which should be much more heavily focused on a) tax policy and b) fiscal spending plans that are not campaign promises (obviously, campaign promises rarely materialize as-is). No, this basket is purpose built to capture the market’s perceptions before the election occurs.

Ideally, this basket goes up as Trump odds increase, and if Trump odds become too significantly priced in, the longs can be swapped with the shorts and then the basket will go up as Trump odds decrease. That is more or less what we observe with this basket when it is equal weighted:

Equally weighted, it is clear there is some correlation. It is somewhat, if even mostly tracking, but there are some areas where it diverges. That’s where the weighting of these individual sub-themes comes in. First, let’s discuss some brief thoughts on the stock market implications for the outperformer categories in the event of a GOP victory in the 2024 presidential election so we can get an idea for which aspects should be overweighted vs. underweighted. Still, it is important to recognize that while betting odds were increasing in betting markets, the narrative of another Trump v. Biden election (let alone a Trump victory) was still quite nascent in early 2023, so I would expect that it would track better the closer that’s gotten.

Sub-theme: NATO (Long EU Defense/Short US Defense)

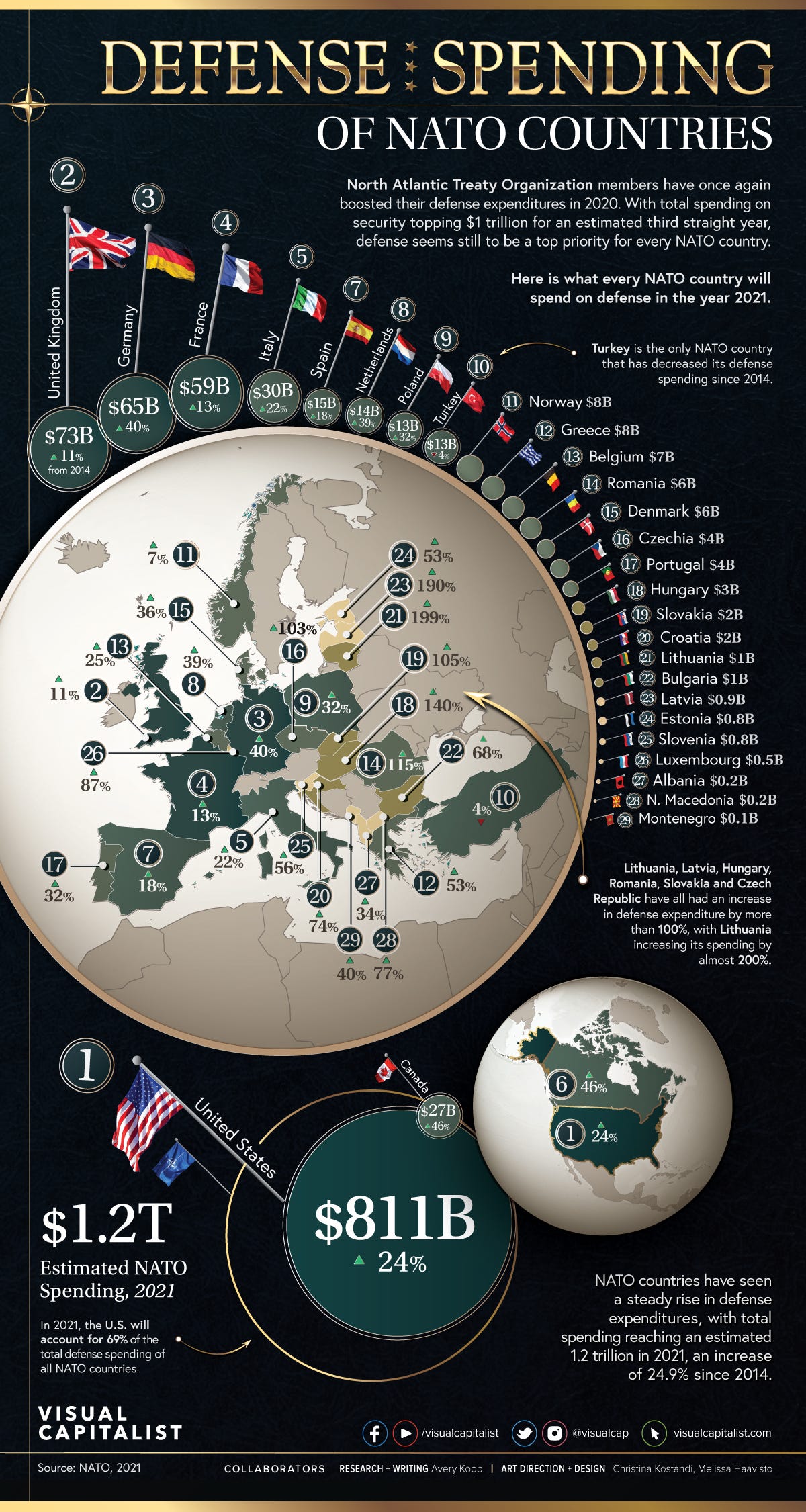

A GOP win, especially with Trump, could strain transatlantic relations and spur European countries to increase defense spending. This would likely benefit European defense contractors. Donald Trump's recent comments on NATO and the 2% GDP defense spending requirement have reignited discussions about the financial contributions of NATO members to their defense budgets. Trump suggested that the U.S. might not protect NATO countries that do not meet the 2% GDP spending target, a stance that has raised concerns about the future of the alliance and its collective security commitments.

European Allies' Defense Spending

European allies and Canada have significantly increased their defense spending, reaching record levels. Since Russia's annexation of Crimea in 2014, NATO members have been encouraged to move toward spending 2% of their GDP on defense within a decade. This target has mostly seen slow progress, but the invasion of Ukraine by Russia two years ago has accelerated efforts. As of 2024, 18 NATO allies are expected to meet or exceed the 2% GDP defense spending target, marking a significant increase from 2014 when only three allies met the target.

Trump's Remarks on NATO and 2% GDP Requirement

Trump has criticized NATO members that fail to meet the 2% defense spending guideline, warning that he would allow Russia to do whatever it wants to NATO members that are "delinquent" in devoting 2% of their GDP to defense. These comments have been branded as "dangerous" and "un-American" by President Joe Biden and have sparked concerns among European leaders and NATO officials. NATO Secretary-General Jens Stoltenberg warned that Trump's remarks undermine the security of the alliance by calling into question the U.S. commitment to its allies16.

Potential Consequences

Long EU Defense: European NATO members would likely feel heightened urgency to rapidly boost defense budgets to meet the 2% GDP target and ensure continued U.S. security guarantees. Already on a long-term trajectory towards hitting the goal, sharper spending increases could accelerate under fears of the NATO umbrella weakening. This spending momentum benefits European defense contractors.

Increased Pressure on European Allies: European NATO members may face increased pressure to boost their defense spending to meet the 2% GDP target to ensure continued U.S. support

Strained Transatlantic Relations: Trump's stance could strain relations between the U.S. and its European allies, potentially impacting the cohesion and effectiveness of NATO

Reevaluation of U.S. Commitments: The U.S. might reassess its financial and military commitments to NATO, focusing on a more transactional approach to alliance security.

Meanwhile, Trump's transactional emphasis on NATO benefits being conditional may result in reassessing the scale and nature of U.S. defense commitments in Europe regardless of allies meeting targets. Reduced U.S. military footprint in Europe over the long run weighs on the revenue outlook for American defense companies. The combination of accelerated European defense investments coupled with potential softening of U.S. spending supporting NATO creates a case for overweighting continental defense stocks over American peers. Just the heightened uncertainty itself around NATO could be a trading catalyst. Clearly execution risks abound, but the setup offers a directional rationale.

Short US Defense: This is a complex and somewhat counterintuitive call. Historically, Republican administrations have been associated with higher defense spending, which would typically benefit US defense contractors. However, there are a few reasons why this conventional wisdom might not hold in a Trump GOP victory scenario:

While Trump's comments primarily focus on the defense spending of European NATO members, his stance could also have implications for U.S. defense spending and its role within NATO. The U.S. has historically contributed a significant portion of NATO's total defense expenditures, spending an estimated 3.49% of its GDP on defense in 2023. Trump's approach may lead to a reevaluation of U.S. financial commitments to NATO and its willingness to support allies that do not meet the 2% spending guideline.

Strained alliances: As mentioned in the EU defense section, Trump's foreign policy approach strained relationships with traditional US allies. If this trend continues, it could lead to reduced collaboration and joint military projects, potentially impacting US defense companies that rely on international partnerships.

Pivot to domestic priorities: Trump's platform heavily emphasized domestic issues like infrastructure, trade, and immigration. If a GOP administration redirects federal spending toward these areas, it could come at the expense of defense budgets, especially in a divided government where compromise is necessary.

Unconventional defense posture: Trump has criticized US military interventions abroad and advocated for a more isolationist approach. If this translates into a pullback from global commitments, it could mean less demand for US defense products and services.

Reputational risks: Defense companies could face heightened scrutiny and reputational damage if they are perceived as enabling controversial Trump administration policies, such as border enforcement or domestic use of military resources. This could lead to divestment pressure and contract pushback.

Disruption to status quo: Even if defense spending remains stable, a shift in priorities and procurement strategies under a new administration could disrupt existing programs and contracts, creating uncertainty for defense companies.

Shorting US defense stocks would be a contrarian play based on the view that Trump's unique brand of populist GOP politics might diverge from the party's traditional pro-defense stance.

Sub-Theme: Long Tariff Winners/Short Tariff Losers

Trump and Biden are both protectionists when it comes to China, but they differ in key areas and in the blanket-application of Tariffs. Of all potential changes, trade policy is where the executive branch has the most impact. If Trump pursues protectionist trade policies and tariffs like in his previous term, companies with primarily domestic supply chains and less reliance on imports could outperform.

Still, getting overzealous with the Trade/Tariff risks is a dangerous game, as mentioned earlier despite the fact that the names on the ballot are the same, there’s a significant difference between right now and 4 or 8 years ago. Despite the Trump tariff threats and trade war tweets and popular idea that Trump will hurt the mexican economy, the fact is that nearshoring has taken place for years now and it’s very unlikely that a new president can just stop all of that. Take a look at the total imports from China as a % of total imports:

While the vast majority of 2018-19 tariffs remain in place today, former President Trump has floated the idea of a new 10% worldwide tariff and a 60%+ tariff on Chinese imports.

Given Trump's history of implementing protectionist trade policies and imposing tariffs on imports from China and other countries, companies with significant exposure to international supply chains could face challenges, while those with primarily domestic operations may benefit. Let's examine the potential long and short positions:

Long Tariff Winners:

BJ's Wholesale Club (BJ US): As a membership-based warehouse club with a focus on domestic products, BJ's may be less impacted by tariffs on imported goods. The company's value proposition could become more attractive to cost-conscious consumers if tariffs lead to higher prices on imported items at competitors.

Arhaus (ARHS US): Arhaus is a luxury home furnishings retailer that emphasizes its U.S.-based manufacturing and sourcing. If tariffs increase the cost of imported furniture, Arhaus' domestic production could give it a competitive advantage and potentially expand its market share.

Deckers Outdoor (DECK US): While Deckers has some exposure to international manufacturing, particularly in its UGG brand, the company has been diversifying its supply chain and has a significant presence in domestic production. Its focus on premium, high-margin products may also allow it to better absorb any tariff-related costs.

Kohl's (KSS US): Kohl's has been working to increase its proportion of domestically sourced products, which could help insulate it from the impact of tariffs. The company's focus on value and its strong loyalty program may also help it retain customers in a higher-priced environment.

Short Tariff Losers:

Target (TGT US): While Target has been investing in its private label brands and domestic sourcing, it still relies heavily on imported goods, particularly in categories like apparel and home goods. Tariffs could pressure Target's margins and force it to raise prices, potentially impacting its competitive position.

Nike (NKE US): Nike has a substantial global supply chain, with significant production in China and other Asian countries. Tariffs on footwear and apparel imports could increase Nike's costs and force difficult decisions around pricing and margin management.

RH (RH US): As a luxury home furnishings retailer, RH sources a significant portion of its products from international markets. Tariffs could make its high-end goods even more expensive, potentially impacting demand from price-sensitive consumers.

Urban Outfitters (URBN US): Urban Outfitters' brands, which include Anthropologie and Free People, rely heavily on imported apparel and accessories. Tariffs could pressure the company's already thin margins and force it to raise prices, which could alienate its trend-conscious, value-seeking customer base.

Sub-Theme: Education & Welfare Programs

The GOP tends to have a more favorable stance toward for-profit education. Easing of regulations and oversight from the Dept of Education could boost for-profit education stocks.

Long For-Profit Education:

Rationale:

Deregulation: Republicans have historically favored a more hands-off approach to regulating for-profit education, arguing for market-driven solutions. A GOP administration could roll back Obama-era rules that tightened oversight of the sector, such as the gainful employment rule and borrower defense to repayment regulations.

Accreditation: A GOP-led Department of Education could ease accreditation standards for for-profit colleges, making it easier for them to access federal student aid and expand their programs.

Enrollment trends: Economic uncertainty and job market disruption could drive more people to seek education and retraining, benefiting for-profit providers that offer flexible, career-focused programs.

Stock sentiment: Reduced regulatory scrutiny and the perception of a more favorable political environment could boost investor sentiment toward for-profit education stocks.

Risks:

Reputational concerns: For-profit colleges have faced criticism over student debt, job placement rates, and predatory marketing. Even with a friendlier administration, companies will need to address these issues to maintain enrollment and avoid public backlash.

Competitive pressures: Traditional colleges and online education platforms could also benefit from increased demand for education, potentially limiting market share gains for for-profit providers.

Short Adult/Elderly Care:

Rationale:

Medicaid funding: GOP healthcare policies have often called for reduced federal spending on Medicaid, which is a key payer for long-term care services. If a GOP administration tightens Medicaid eligibility or shifts to block grants, it could pressure adult/elderly care providers that rely on Medicaid reimbursements.

Immigration restrictions: The adult/elderly care sector relies heavily on immigrant workers. Stricter immigration policies could exacerbate staffing shortages and increase labor costs for care providers.

Sentiment shift: Concerns about potential Medicaid cuts and staffing challenges could weigh on investor sentiment toward the sector.

Risks:

Demographic trends: The aging population and increasing lifespans will drive long-term demand for adult/elderly care services, potentially offsetting short-term political headwinds.

Essential service: Adult/elderly care is a necessity for many families, which could provide some resilience even in a challenging policy environment.

Diversified payers: While Medicaid is significant, many care providers also receive substantial revenues from Medicare, private insurance, and out-of-pocket payments, mitigating the impact of any single policy change.

The relative performance of for-profit education and adult/elderly care sectors under a GOP administration would depend on the specific policy priorities and actions taken. For-profit education could benefit from a more laissez-faire regulatory approach, while adult/elderly care could face challenges if GOP healthcare and immigration policies put pressure on funding and staffing. However, both sectors would still be influenced by broader economic, demographic, and industry-specific factors beyond the political landscape.

Sub-Theme: ACA, Medicare Advantage & Healthcare

Donald Trump wins the presidency in 2024, that he will attempt to repeal the Affordable Care Act (ACA), commonly known as Obamacare. Trump has expressed a clear intention to revisit the contentious issue of the ACA, indicating a desire to replace it with an alternative. His comments have sparked significant pushback from the Biden campaign, which has highlighted the potential negative impacts of repealing the ACA, including the loss of health insurance for millions of Americans.

Trump's stance on the ACA has been consistent, as he has previously attempted to repeal the law during his first term. Despite the ACA's increasing popularity among Americans and its more entrenched position in the U.S. healthcare system, Trump has doubled down on his commitment to fight for what he describes as "much better health care than Obamacare," which he labels a catastrophe. His efforts to repeal the ACA in the past were notably thwarted by a narrow margin, including a decisive vote by the late Senator John McCain1.

The Biden campaign and its allies have seized on Trump's renewed calls to eliminate the ACA, planning to use this stance as a key issue in the election. They argue that Trump's America would result in millions losing their health insurance and have mobilized to inform the public about the stakes of the upcoming election. Despite the political challenges and the ACA's deeper integration into the healthcare system, Trump's promise to try to repeal the law again underscores a significant policy difference between him and the current administration5.

Given the historical context and the political implications, Trump's pursuit of repealing the ACA if he wins in 2024 would likely face substantial opposition, both from the public, given the ACA's current favorability, and potentially from within his own party, as some Republicans have moved on from the repeal and replace agenda. However, Trump's statements make it clear that the ACA would be a significant target in his policy agenda if he were to be re-elected.

Centene (CNC US) is the most exposed to the Obamacare Marketplace, while Humana (HUM US) has withdrawn and is more exposed to Medicare Advantage.

Overall, although worth monitoring rhetoric as we approach the election, this area seems very opaque and idiosyncratic to factors outside. Lobbying pressure to repeal Obamacare is probably very low, but if Trump were to focus more heavily on it I’d also expect hospitals to trade down.

Sub-Theme: Green Hydrogen, Carbon Credit Beneficiaries, EVs, Lithium & Solar Modules Underperform in GOP victory

Donald Trump's views on renewable energy, particularly in the context of the Inflation Reduction Act (IRA), reflect a broader skepticism towards policies aimed at accelerating the transition to a cleaner energy economy. His stance on renewables and potential changes to the IRA can be understood through his positions on electric vehicles (EVs), solar tariffs, tax breaks, and heat pumps.

I will quickly summarize this here, but to get a full picture of what the current status quo is I would highly recommend taking a look at our last Fiscal piece here:

Electric Vehicles (EVs)

Trump has expressed opposition to the Biden administration's efforts to promote electric vehicles, which are a significant component of the IRA. The IRA includes provisions to accelerate the adoption of EVs through tax credits and other incentives. Trump's advisors and associates have indicated that dismantling these aspects of the IRA would be a priority, potentially stalling the shift towards cleaner industries and affecting efforts to reduce greenhouse gas emissions. Trump's criticism of Biden's EV policies suggests a return to policies that favor fossil fuels and possibly a reduction or elimination of federal support for EV adoption.

We have added some EV names and lithium names to the short side of our basket.

Solar Tariffs

During his presidency, Trump imposed tariffs on imported solar panels, a move that was seen as a significant blow to the renewable energy industry. The tariffs, which started at 30% and gradually reduced to 15%, were intended to level the playing field for domestic manufacturers but were criticized for potentially harming the solar industry and leading to job losses. A return to such policies could undermine the growth of the solar industry, which has benefited from incentives under the IRA.

Tax Breaks for Renewables

The IRA's backbone consists of hundreds of billions of dollars in federal subsidies for renewable energy sources, including solar and wind, as well as for technologies like heat pumps. These subsidies are primarily delivered through tax credits, which allow companies or individuals to reduce their federal tax obligations in exchange for making environmentally friendly investments. Trump's opposition to the IRA suggests a potential rollback of these tax breaks, which could dampen investment in renewable energy and related technologies.

Heat Pumps

While specific comments from Trump regarding heat pumps are not detailed in the provided sources, the IRA includes incentives for the adoption of heat pumps, a technology that can significantly reduce greenhouse gas emissions from heating and cooling buildings. Given Trump's broader agenda to bolster the oil and gas sector and his skepticism towards policies aimed at reducing reliance on fossil fuels, it's plausible that incentives for heat pumps and similar technologies could be at risk under a Trump administration.

Trump previously signaled that infrastructure packages would focus on transportation projects and 5G wireless infrastructure. He has no intention of spending on green energy. Fiscal spending would likely be tilted away from the renewables aspect of the IRA while focusing on small businesses and economic support, but would still likely prioritize modernizing the grid, transportation and digital infrastructure.However, a split Congress may slow any fiscal rollout, as seen from the current spending bill deadlock.

To reiterate, Trump and Biden are both protectionists, so it is important to discover the very specific areas where tariffs are most likely to differ. Here is what I’ve found from Barclay’s Renewables coverage on that: “Presidents Trump and Biden both support safeguards against low-cost crystalline silicon solar module imports via a Section 201 tariff, which mis at 14.25% today. However, Biden's exemption for bifacial solar modules weakens the tariff and it is likely that he will retain the exemption in the ongoing. Section 201 mid-term review (decision likely in next few weeks). If elected, Trump would likely revoke the exemption for bifacial solar modules, as he had during his first term, which we estimate increases module prices by 15%, or ~ $0.02-0.03/W. Higher module prices are positive for FSLR and MAXN in our coverage.” Therefore, we focus on names that would suffer from higher module prices in our solar Trump underperformers.

Overall, a Republican victory in the 2024 presidential and congressional elections would have a likely net negative impact on the companies that have benefited from the Inflation Reduction Act (IRA) and the Biden administration's focus on clean energy and decarbonization. We are long some of these in the Narrowed Fiscal Beneficiaries basket, although we have also tried to focus more on names that will see resilient fiscal benefit regardless of administration due to the key areas they operate in such as MLM US, ETN US, PWR US and others.

The names most exposed to risks of IRA changes under a GOP-controlled government are:

Clean Electricity, EV, and Battery Storage: Companies like NextEra Energy (NEE US), Tesla (TSLA US), NextEra Energy Partners (NEP US), AES Corporation (AES US), DTE Energy (DTE US), SolarEdge Technologies (SEDG US), Enphase Energy (ENPH US), Sunrun (RUN US), Albemarle (ALB US), and Piedmont Lithium (PLL US) have been or will be major beneficiaries of the IRA's provisions for clean energy and electric vehicles.

The IRA provides significant tax credits and incentives for renewable energy projects, electric vehicle manufacturing and adoption, and domestic production of critical minerals and battery components. These policies have accelerated the growth of these companies and supported their long-term investment plans.

Under a Republican administration and Congress, there is a risk that these policies could be scaled back, modified, or repealed altogether. The GOP has historically been less supportive of clean energy subsidies and more aligned with traditional fossil fuel industries. If the IRA's provisions are weakened or eliminated, it could slow the growth trajectory of these companies and make their projects less economically viable.

Green Hydrogen: Companies like Plug Power (PLUG US), Bloom Energy (BE US), Air Products (APD US), and Linde (LIN US) are focused on the development and deployment of green hydrogen technologies. Green hydrogen, produced using renewable energy, is seen as a critical component of decarbonizing hard-to-abate sectors like heavy industry and long-distance transportation.

The IRA includes a new production tax credit for clean hydrogen, which has boosted the outlook for these companies. However, under a Republican government, there is a risk that support for green hydrogen could be diminished in favor of other energy priorities. This could slow the pace of adoption and make it harder for these companies to scale their operations and achieve cost competitiveness.

Carbon Credit Beneficiaries: Companies like Celanese Corporation (CE US), Weyerhaeuser (WY US), PotlatchDeltic (PCH US), and Ecolab (ECL US) are positioned to benefit from the growth of carbon markets and the increasing value placed on carbon sequestration and emissions reduction.

The IRA includes provisions to support the growth of domestic carbon markets and to incentivize land-based carbon sequestration through forestry and agricultural practices. These policies have created new revenue opportunities for companies involved in these activities.

Under a Republican administration, there is a risk that support for carbon markets could be weakened, particularly if there is a broader rollback of climate-related policies. This could reduce the demand for carbon credits and make it harder for these companies to monetize their environmental services.

Energy Efficiency: Companies like Carrier Global (CARR US), Trane Technologies (TT US), Johnson Controls (JCI US), and AAON (AAON US) provide energy-efficient heating, ventilation, air conditioning, and refrigeration solutions. The IRA includes provisions to incentivize energy efficiency upgrades in buildings and homes, which could boost demand for these companies' products and services.

Under a Republican government, there is a risk that these incentives could be reduced or eliminated, particularly if there is a broader push to cut government spending or roll back environmental regulations. This could slow the pace of energy efficiency adoption and make it harder for these companies to grow their businesses.

It's important to note that while a Republican victory poses risks to these clean energy and decarbonization beneficiaries, the impact may not be uniform or immediate. Many of these companies have already made significant investments and have strong market positions, which could provide some resilience. Moreover, the transition to clean energy is driven by a complex set of factors, including technological progress, changing consumer preferences, and growing corporate sustainability commitments.

Sub Theme: Trump Supporters & Donors (GOP)

Donald Trump has had varying levels of support from different business leaders and CEOs throughout his political career. While the current sentiment among CEOs towards Trump's 2024 campaign appears to be lukewarm, with no Fortune 100 CEOs contributing to his campaign thus far, there have been notable supporters in the past. Here are some examples of companies and CEOs that have been associated with Trump:

Oracle (ORCL US): Oracle's CEO Safra Catz has been known to support Trump. Oracle co-founder Larry Ellison also hosted a fundraiser for Trump in 2020.

Wynn (WYNN US): Casino mogul Steve Wynn has had a complex relationship with Trump, evolving from rivals to friends. Wynn raised close to $100 million for Trump’s inaugural committee.

Blackstone (BX US): While Blackstone's COO Jon Gray has given to Democrats, Blackstone's CEO Steve Schwarzman has been a supporter of Trump.

Palantir (PLTR US): Palantir's co-founder Peter Thiel has been a vocal supporter of Trump and spoke at the Republican National Convention in 2016.

Energy Transfer: CEO Kelcy Warren of Energy Transfer Partners has been a donor to Trump's campaigns.

Some other names that are less closely associated but have supported trump in the past include LVS US, TREE US & EL US. It's important to note that the business community's support for Trump has seen a decline, particularly after his claims of election fraud and the events of January 6th.

Sub-Theme: LNG and Thermal Coal (GOP)

Trump promoted US energy exports and rolled back regulations on coal. While long-term trends favor cleaner energy, these fossil fuel industries could see near-term relief under GOP policies. Since I’m wholly uninformed in this area, I’ve asked Matt Warder for comment:

“Broad takeaway is that a Trump win raises morale, as everybody from labor up to the C Suite will know that they can produce without issue. In addition, EPA pressure on western coal-fired plants probably goes away, which means we are no longer in immediate danger of retiring 40MW of baseload capacity in the Midwest, south, and west, which would decimate the PRB and pull our grid reliability into serious question.

LNG facilities also go forward without a doubt, delivering a much needed tightening of the domestic natural gas market and giving US thermal coal producers at least a few years of new life. A Trump win is broadly positive for thermal coal and LNG.

On the metallurgical coal side, it gets a little trickier. Trump does not appear to be in favor of the Nippon/X US merger, despite the fact it would almost 100% ensure that US blast furnaces would operate longer and we would probably produce MORE steel not less. Canadian steel operations are transitioning to EAF pretty soon and that ~3Mst of coal demand going away with it. This is important as EPA is also taking aim at domestic coke plants

So under Trump, while EPA pressure goes away, Nippon might as well, which keeps domestic consumption on the same downward track, and forces more coal into the seaborne market which softens prices over time. At the 10,000 foot level a Trump win is: good for labor, good for LNG export, great for thermal, and not so great for met.”

Sub-Theme: Onshoring (GOP) versus Nearshoring (Dem)

“We Used To Make S*** In This Country, Build S***. Now We Just Put Our Hand In The Next Guy’s Pocket.”

-Frank Sabotka, The Wire

Onshoring is only a potential reality for first-world countries in a world where automation makes significant strides. The reasons why production and manufacturing have been offshored is due to a higher quality of life and higher wages in the US that create "labor arbitrage" opportunities elsewhere.

While the pivot away from China under Biden has heavily favored "nearshoring", it is my belief that a Trump administration would look unfavorably upon the heavy reliance on Mexico (and negotiating position this confers upon them) that comes with there, therefore it is our conclusion that the only way forward for "onshoring" would be automation. This is compounded especially by the GOP's stance on illegal immigration.

The US has long relied on cheaper labor from undocumented immigrants, most significantly in agricultural production. Reduced illegal immigration would significantly affect agricultural input costs which are highly dependent on cheaper seasonal migrant labor. In 2019, almost 57 percent of crop production workers were immigrants, including 36.4 percent who were undocumented. Farmers are largely overrepresented in Trump’s base, meaning it is likely that he will make campaign promises that appeal to both his median voter’s dislike of undocumented immigration and their need for labor. The answer lies in automation, and it is likely that lobbying groups are already whispering this in his ear:

Favoring Onshoring over Nearshoring:

A GOP victory, particularly with Trump at the helm, could shift the balance between onshoring and nearshoring, with potential implications for companies in both the US and Mexico. Here's a closer look:

Rationale:

America First policies: Trump's signature trade policy focused on bringing manufacturing jobs back to the US. If a GOP administration doubles down on this approach, it could accelerate the onshoring trend at the expense of nearshoring to Mexico.

Incentives and penalties: The administration could use a combination of tax incentives, subsidies, and tariff threats to encourage US companies to repatriate production, making onshoring more economically viable compared to Mexican operations.

Domestic political pressure: In a climate of heightened economic nationalism, companies may face political and public relations pressure to prioritize US jobs and production, even if nearshoring remains cost-competitive.

Supply chain resilience: The COVID-19 pandemic exposed the risks of overreliance on global supply chains. If a GOP administration emphasizes domestic production as a matter of national security and economic resilience, it could further tip the scales toward onshoring.

Automation and skills: Advancements in automation and a focus on high-skilled manufacturing could make US production more competitive with low-cost labor destinations like Mexico, reducing the nearshoring advantage.

Trade tensions: Trump's previous term was marked by a contentious renegotiation of NAFTA and threats of tariffs on Mexican imports. If a GOP administration takes a more aggressive stance on trade with Mexico, it could disrupt the flow of goods and investments, hurting Mexican companies that have benefited from nearshoring trends.

Border friction: Stricter immigration enforcement and potential border closures could impede the movement of workers and materials between the two countries, causing supply chain disruptions for Mexican manufacturers and logistics providers.

Shift in manufacturing strategy: If US companies face pressure or incentives to prioritize domestic production over nearshoring, it could lead to a slowdown in the expansion of manufacturing capacity in Mexico, impacting industrial real estate and infrastructure players.

Peso volatility: Political uncertainty and trade frictions could put pressure on the Mexican peso, increasing costs and reducing profitability for Mexican companies with significant USD-denominated expenses.

Sentiment shift: Even if actual policy changes are limited, the perception of a less favorable environment for US-Mexico economic integration could dampen investor sentiment and lead to reduced capital flows into Mexican assets.

Beneficiaries and Losers:

US industrial real estate, construction, and equipment providers could benefit from increased demand for domestic manufacturing capacity.

US-based automation, robotics, and advanced manufacturing companies could see heightened interest as companies look to make onshoring economically viable.

Mexican manufacturing and logistics companies, particularly those heavily dependent on US clients, could face reduced growth prospects and increased competition from US-based operations.

US consumers could face higher prices if companies pass on the increased costs associated with domestic production, although this could be offset by job creation and economic stimulus in certain regions.

Considerations and Risks:

Global competitiveness: Onshoring may improve US manufacturing resilience, but it could also lead to higher costs and reduced competitiveness in global markets, particularly if other countries continue to leverage low-cost production.

Limited scope: While onshoring may accelerate in politically sensitive sectors like electronics, automotive, and pharmaceuticals, many industries may still find nearshoring to Mexico more viable due to labor costs and proximity.

Unintended consequences: Aggressive onshoring policies could lead to trade retaliation, supply chain disruptions, and inflationary pressures, potentially offsetting the intended benefits.

Implementation challenges: Rebuilding domestic manufacturing capacity takes time, and companies may face short-term costs and disruptions as they transition away from nearshoring.

Favoring onshoring over nearshoring would be a significant shift in the economic relationship between the US and Mexico. While it could create opportunities for certain US sectors, it also carries risks of higher costs, reduced competitiveness, and potential trade frictions. The net impact would depend on the specific policies implemented and the ability of companies to adapt to a new manufacturing landscape.

Sub-Theme: Financial Deregulation & Industry Favorable Appointees

Financials and M&A

Trump's first term was marked by a deregulatory agenda that significantly impacted the financial sector. The administration's efforts to roll back parts of the Dodd-Frank Act and ease restrictions on banks and financial institutions catalyzed a wave of optimism across the sector. A second Trump term could potentially amplify these deregulatory measures, further easing the path for M&A activities.

Looking at names like JEF, CG, EVR and others that are likely to be the front-runners in capitalizing on an M&A-friendly environment is a good idea for the long side of our long/short basket.

Biotech

Under Trump's administration, there was a noticeable shift towards accelerating drug approval processes and reducing regulatory barriers, a trend that could see a resurgence if he were to win the 2024 election.

Investing in biotech names that stand to benefit from a more lenient FDA involves identifying companies with promising pipelines of drugs or therapies that are in the late stages of clinical trials. These companies are likely to experience a shorter path to market approval and commercialization, translating into significant upside potential for their stock prices.

Sub-Theme: Idiosyncratic Trump Beta

These are names which trade more like betting odds on a Trump victory than they do as having to do with any sort of fundamentals. I’m sure they could probably be joined with Trump NFTs or crypto tokens. DWAC, RUM, FNMA/FMCC etc.

I wrote up the thesis for FNMA &FMCC back in December and we made some money off of it, whether it actually happens under Trump is irrelevant, but the market odds of it happening are are good reflection of how the market views a Trump presidency’s likelihood.

Sub-Theme: Immigration Reform, Private Prisons & Law Enforcement

For a GOP victory, companies that could potentially benefit from stricter border control, increased law enforcement spending, higher prison populations, and immigration reforms under a Trump administration would be longs that likely reflect higher odds.

Private prison operators: Companies like GEO Group (GEO US) and CoreCivic (CXW US), which operate private prisons and detention facilities, could see increased demand for their services. A crackdown on illegal immigration and a push for stricter sentencing could lead to a higher number of detainees and prisoners, benefiting these companies.I have not looked into this area much, because it has been difficult to justify inflows that rerate these names in an environment where private prison operators have faced criticism and divestment pressure as well as reduced flows due to ESG priorities from asset managers.

However, I am familiar with a colleague of mine on substack, Left , who does cover this and have asked for comment on how a GOP / Dem presidency may impact it:

“There is currently a strong underlying perception that a republican presidency or GOP trifecta represents a good outcome for the private companies and that a continuation of democratic presidency would be bad.

This is fundamentally disconnected from the reality of Geo Group as it stands today. Under the Biden administration, a large contract between Geo Group and ICE for a program titled “Alternatives to detention” or the “Intensive Supervision Appearance Program” was expanded, resulting in material operating income growth due to the margins of this revenue. All the while the stock has been hammered with multiple compression as their “core” prison business was perceived to be at risk.

As of today, the federal government is posturing at expanding this contract dramatically. The original appropriations bill signaled posturing by both republicans and democrats alike to expand the program into the entire non-detained docket (currently stands above 6 million people) while mandating GPS tracking over the entire duration of an immigrant’s asylum process. This degree of escalation, even if participant costs were to be reduced by over 50%, would require something on the order of $2-5B USD to implement, depending on the technology utilized. Inside the border bill that was recently shot down by the senate, an additional $1.3 billion USD for this program was allocated to this program over the next 2.5 years, which comes with the implicit assumption that there’s political will behind expanding this budget. In addition, if you’re to read the ICE FY 2023 report, you will see that expanding the program is a priority.

For differing political motivations, it appears that this program has moderate levels of bipartisan support, creating a win-win situation for the company for either outcome. It’s my impression that for republicans this broadly relates to the government remaining aware of these individuals’ locations at all times, while for democrats it serves as a more humanitarian option than incarceration.

There are varying technological components to the program, however under Trump the per enrollment cost was materially higher as GPS ankle bracelets used to be a mandatory part of the program. Today their prevalence is nearly absent, whereas the application of a program called SmartLink is ubiquitous. You can access the monthly statistics of this program here.

A discussion of the utilization of higher cost ATD equipment under republicans is discussed here around the 36 minute mark.”

Overall, for this basket, we focus on:

Domestic security and surveillance technology: Companies that provide border security technology, such as surveillance systems, drones, and sensors, could benefit from increased spending on border enforcement.

Examples include Parsons Corp (PSN US) and Elbit Systems (ESLT).

Law enforcement equipment and services: Companies that supply equipment and services to law enforcement agencies could see increased demand under a Trump administration.

Examples include companies that provide body cameras, like Axon Enterprise (AXON), Parsons (or those that offer crime analytics and software, like Motorola Solutions (MSI) and Palantir Technologies (PLTR).

If there is a push to increase funding for local law enforcement agencies and to equip officers with new technologies, these companies could be well-positioned to benefit.

Identity verification and background check services: If immigration reforms lead to increased scrutiny of workers' legal status and a greater emphasis on employment verification, companies that provide identity verification and background check services could see increased demand.

Examples include Sterling Check (STER US) and HireRight (HRT US), which offer employment background screening services, and Mitek Systems (MITK US), which provides mobile identity verification solutions.

Staffing and outsourcing services: Companies that provide staffing and outsourcing services to government agencies, particularly those involved in immigration and border enforcement, could benefit from increased spending and hiring in these areas.

Examples include ManTech International (acquired by Carlyle Group) and CACI International (CACI), which provide technical and professional services to government clients, including in the areas of national security and immigration.

It's important to note that the impact of immigration and law enforcement policies on these companies could be complex and may vary depending on the specific measures

Hedging Social Instability in a Rematch

Something we can reasonably assess without any speculation as to who the winner is comes from the fact that another Biden/Trump election in 2024 greatly raises both the perception of and chances of protests, riots and other social instability in the United States.

I personally believe that a Trump/Biden rematch increases the odds of social unrest following the election - so the names related to this are not in the basket for the run up to the election but may be useful to have if there’s a major upset that sees rioting, protests or civil unrest.

While elections tend to be good years for gun and ammo sales (but have not been overly positive for the actual gun makers - see SWBI and RGR vs. VSTO and OLN) on fears of unrest or fears of a Democratic president passing anti-gun legislation, it’s likely that ammo names like POWW and OLN see higher sales and that ASO and VSTO (but not DKS, which does not sell Assault Rifles anymore) would see increased volume if fears of a Democratic Trifecta materialize.

Apogee Enterprises (APOG US) specializes in the design and manufacturing of architectural glass and framing systems for commercial buildings, is well-positioned to benefit from the potential social instability that may arise in the aftermath of the election, regardless of the outcome. If you know what happens to glass when people start expressing their displeasure with political institutions…

The 2024 election, if it is a repeat Biden v. Trump face-off, will occur in a deeply polarized political climate and the history of protests and unrest surrounding recent elections makes it increasingly likely that the losing side will express their discontent through demonstrations, protests, and potentially riots.

In the event of a Trump victory, Biden supporters may take to the streets to voice their opposition, as seen in the widespread protests following Trump's 2016 win or during the Black Lives Matter protests. Conversely, if Biden secures a second term, Trump's base may engage in demonstrations, citing concerns over election integrity and political grievances or engage in a repeat of the January 6th capitol riots.

This social instability could lead to an increased demand for Apogee's products and services. As businesses seek to protect their storefronts and commercial properties from potential damage during protests or riots, they may invest in reinforced glass, security framing systems, and other protective measures offered by Apogee. The company's expertise in designing and installing durable, high-performance glass and framing solutions positions it to capitalize on this demand. Additionally, Apogee's national footprint allows it to respond to increased demand in multiple regions affected by social instability.

It is worth noting that Apogee's business is not solely dependent on the election outcome and potential unrest. The company has demonstrated resilience and adaptability in the face of economic challenges, such as the COVID-19 pandemic. Apogee's focus on innovation, operational efficiency, and strategic acquisitions has helped it maintain a strong financial position and pursue growth opportunities in the architectural glass and framing market and it may benefit from a potential rebound in retail commercial real estate as well. Additionally, historiccally speaking it’s pretty cheap on EV/EBITDA:

Miscellaneous Macro Musings

Onshoring, Immigration and Wage Pressures

We have discussed the likely strides that would be made under a Trump administration in agricultural and industrial automation to enable onshoring, but there are other areas reliant on immigrant workers that could see significant wage pressure. Perhaps the most hard hit in a compound manner (if there are continued threats of ACA repeal) would be the healthcare sector, which also relies on a significant number of immigrant workers, particularly in roles such as nursing, home health aides, and support staff. A restrictive immigration policy could exacerbate the already pressing shortage of healthcare workers in the United States. This could lead to increased competition for skilled healthcare professionals, a negative for hospitals, by driving up wages and potentially straining the finances of healthcare providers. It could also impact the quality and availability of care, particularly in underserved areas and for vulnerable populations. To mitigate these impacts, the healthcare sector may need to invest in training and education programs to develop a domestic pipeline of workers. However, this will take time, and in the interim, a labor shortage could pose significant challenges.

Between wage pressures, pressure on monetary policy, continued tax cuts and fiscal deficit spending (albeit with different priorities) and aggressive trade policies, it is our expectation that a Trump victory - and especially a republican trifecta - would be generally inflationary. Whether this reaches 2022 “crisis” levels likely would depend on some other factors like commodity prices (Trump is more determined to play hardball with Iran), but regardless we would expect that the 2% target would be completely impossible during a Trump presidency.We already expect that the country/global economy will slide into a modestly inflationary environment. (~3-3.5% core inflation on average regardless of what the Fed seeks to do) that will ultimately benefit equities, but without the exported deflation from China that could be significantly higher.

Wage pressures are not unilaterally limited to Trump’s immigration policies, a Democratic trifecta that raises the Federal Minimum wage would also have a similar impact.

Business Investment & CapEx

As electoral uncertainty increases, businesses tend to adopt a more cautious approach to capital expenditures (capex). They may delay or scale back investments until there is greater clarity on the policy direction and economic outlook post-election. This is because major investments often involve long-term commitments, and companies want to avoid making decisions that could be rendered suboptimal or uneconomic by shifts in the political landscape.

However, the impact of electoral uncertainty on capex can vary depending on the sector and the specific policies at stake. For example, businesses in industries that are heavily regulated or dependent on government contracts may be more sensitive to election outcomes. On the other hand, sectors with strong secular growth trends or those benefiting from bipartisan support may be less affected by electoral uncertainty (power grid, transportation, AI, domestic Semiconductor Fabrication, etc).

Semiconductors have become a strategic priority for the U.S., given their critical role in powering advanced technologies and their importance to national security. Both the Trump and Biden administrations have recognized the need to bolster domestic semiconductor production and reduce reliance on foreign suppliers. Initiatives like the CHIPS Act, which provides incentives for U.S. chip manufacturing, have received bipartisan support. As such, semiconductor companies are likely to benefit from ongoing government investments and favorable policies.

Similarly, AI is seen as a transformative technology with wide-ranging implications for economic competitiveness and national security. Both parties have emphasized the need to invest in AI research and development, foster innovation, and maintain U.S. leadership in this field. Companies at the forefront of AI, including those involved in machine learning, natural language processing, and computer vision, are likely to benefit from sustained policy support and funding.

Other sectors that could enjoy bipartisan support include cybersecurity, advanced manufacturing and transportations / communications infrastructure. These areas are seen as critical to U.S. technological competitiveness and have the potential to drive productivity gains and economic growth.

If Biden secures a surprise re-election, it could be a strong bullish catalyst for our Bidenomics narrowed fiscal basket (see “US Fiscal Primacy” basket as it currently appears in the Citrindex). This refers to the sectors and industries that have benefited from the Biden administration's expansionary fiscal policies, such as infrastructure spending, clean energy investments, and social programs. A Biden victory would signal continuity in these policy priorities, providing a tailwind for companies in related sectors. Some have called this the status quo, but I think a continuation of Bidenomics would be far more interesting than that considering what we’ve seen so far.

AI Regulation

A Republican Win

If former President Donald Trump wins the election in 2024, along with Republicans maintaining control of Congress, it likely means minimal advancement of AI regulation and oversight in the near future. The Trump administration has historically been reluctant to impose regulations that could discourage AI innovation and development. It is more likely we would see calls for self-regulation from the industry. Without strong pressure or incentives from the administration, comprehensive federal AI policy is unlikely.