Analytical Frameworks: Evaluating Payments

Sweet Dreams are Made of Fees

Preface

One year ago today, CitriniResearch released “Analytical Frameworks: Evaluating Banks & Insurers”.

Yes, as the leaves turn colors and fall off the trees so does CitriniResearch decide it is time to bore you senseless talking about financials. Our primary aim with this article was to demystify the process of analyzing financial companies by providing a framework at a crucial point in the cycle - with a focus on the opportunities present in a market that had just been through the SVB-induced regional banking crisis.

In our inaugural annual Analytical Frameworks piece, we debuted two new thematic baskets with relatively simple theses - long good financials and short not so good financials. The good ones would make money, the not so good ones would lose out. “Higher for Longer” virtually assured this.

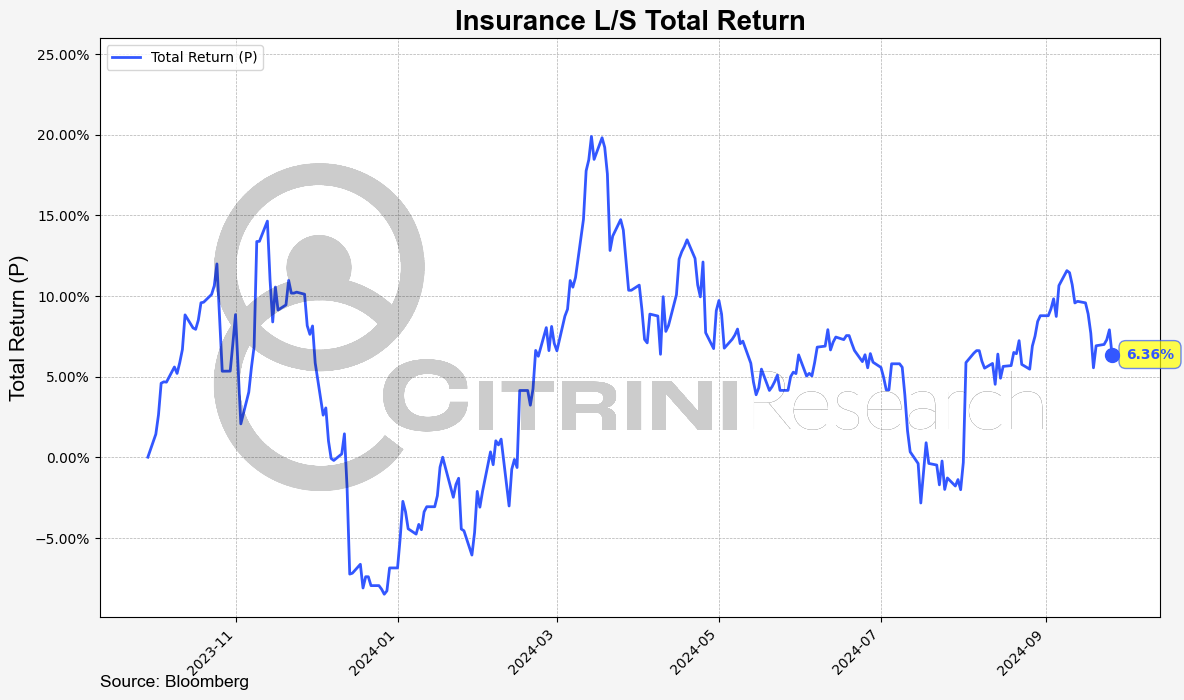

Our Long Good Banks/Short Not So Good Banks basket returned almost 60% on that thesis, and we also got a reasonably good trade & solid hedge against rising rates in our Insurance L/S basket:

Our macro view has changed and so has the landscape for financials. There are new and exciting opportunities in moving past the paradigm that has been defined by “Higher for Longer”.

It is our view that the market will continue to more fully embrace the fact that the seemingly mythical soft landing is directly in front of us, that the Federal Reserve is likely no longer behind the curve, and that the next 5 years are more likely to be defined by economic growth than recession.

Thus, the anniversary of our financials piece gives us a good segue to shift towards a core aspect of economic growth: people and businesses paying each other. And don’t worry, next week we’ll be back to our sexy macro commentary on China and more deeply thought-provoking thematic work.

However, while the plumbing of the payments system is not glamorous, to quote Peter Lynch:

“The more boring it is, the better.”

Our 2024 'Frameworks' piece focuses on the growth-oriented side of financials.

Let’s dive into payments, the infrastructure upon which they operate and what we believe is an excellent opportunity to get exposure to a solid secular growth trend at very attractive valuations.

Introduction

Exciting, game changing innovations are headline news these days – generative AI, cell and gene therapies, and near instantaneous connectivity are reshaping our world. But underpinning these exciting innovations are a bunch of mundane systems and processes.

How do we actually pay for all this stuff? Not in terms of which currency is used or how money is raised or whether CapEx generates a good ROIC…how does actual payment for 100,000 GPUs take place? Does Elon Musk simply hand Jensen Huang a check?

This might seem like a boring question until you consider that the payments infrastructure involved is the literal backbone of the global economy.

The former CEO of Mastercard and the current President of the World Bank once said:

"If you don't get payments right, you're not going to get commerce right, and if you don't get commerce right, growth and prosperity will be unevenly distributed."

In other words, the payments system is critical for economic growth and stability.

It is also a huge market.

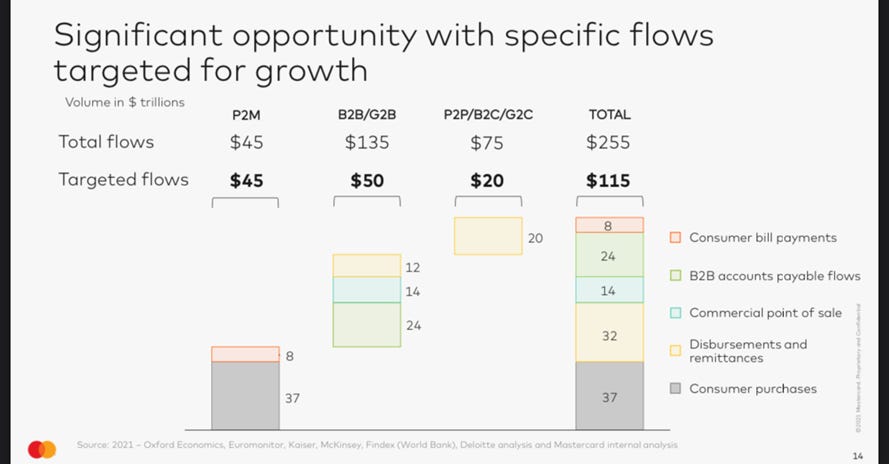

In 2021, Mastercard estimated $255 trillion in global payments volume. In today’s dollars, that number is probably closer to $300 trillion. These flows of money occur across different categories—everything from consumers buying things or paying bills to businesses paying each other for inputs like GPUs. The process of completing these payments is – as we will explore – complicated and inefficient. When you combine a large market with significant inefficiency, you get the opportunity for massive value creation.

Improving payments technology represents an undeniable secular megatrend. But this should not be news to anyone - this shift has been going on for a while. If you were investing during the ZIRP-fueled mania, you definitely have some recollection of all the bullish points that made up this narrative. So why is there an opportunity here?

In 2022, macro became the key driver of returns and just as things were looking better we entered the dawn of the AI era. Competition for narratives became fierce as a virtual dutch disease sucked capital into AI beneficiaries, and we benefitted hugely from that. Investors who bought the payments secular bull thesis were not about to go back into these companies that were likely still a bit overvalued. The peak of inflated expectations had been reached.

None of this, however, means that the original secular thesis was wrong. Most of those tailwinds should theoretically still exist. So, let’s examine the payments industry to see if this bombed out megatrend has a chance of coming back.

How We’ve Gotten Here & Where We’re Going

In our last couple of articles, we wrote about secular growth themes that had the potential to outperform regardless of what happened with the economy, as both of those industries were exiting their own, idiosyncratic downcycles. Healthcare/medtech and connectivity fall into this category - experiencing external tailwinds while the cycle internal to the industry bottomed or neared a bottom...

The payments industry is a different story.

While valuations in the sector have been crushed due to the impact of high and volatile interest rates on the multiples of growth companies, the industry itself never really had a downcycle.

What has made this possible? We would argue that the payments industry was one of the few that was permanently changed by the pandemic but the current bleak performance of the stocks in the industry is only a temporary illusion created by the crushed expectations of ZIRP-era investors.

Historically, most commercial transactions and payments happened in person, and legacy systems revolved around physical payment methods like cash or check. Digital payment alternatives are far more efficient but face barriers to adoption, ranging from consumer habits to businesses wary of accidentally crashing critical systems while upgrading. Indeed, most legacy forms of payment make little sense in the modern world.

With COVID-induced lockdowns, consumers and businesses were forced to transact only online. This dynamic made it painfully obvious to investors how significant the opportunity for payments to be brought into the 21st century was. And they ran with it. Not just it, but everything it touched. Banking as a Service, Buy Now Pay Later, Cryptocurrency. Payments was all the rage. And we all know what happened next.

One day, it’s COVID induced low interest rates, everyone stuck indoors with nothing to do except buy things, the payments sector the darling of the era and the focus of every VC in the world. The next day, it’s inflation & rate hikes & bubbles bursting. Everyone long payments had a surprise waiting for them. The dynamic that this disconnect on the upside for expectations vs. reality created now has been mirrored to the downside, and that’s the third and best opportunity of any bubble.

Early subscribers to our work will recall the concept of the Gartner Hype Cycle from our article on How We View Thematic Investing.

To put the opportunity in payments simply, this is where we currently are:

Despite rates having come up and high valuations having gotten slammed, adoption of these sticky new payment technologies has continued to expand, providing a consistent growth tailwind for companies operating in the payments industry, even as the economy slowed.

The runway for further adoption remains long. The combination of ongoing digital adoption and stable-to-improving economic activity should provide an even more favorable backdrop of fundamental performance in the payments industry.

As the macro environment continues to improve, the payments industry stands to benefit from several powerful secular tailwinds. The opportunity in digital transactions, characterized by the global shift from cash to electronic payments, continued e-commerce growth, and mobile payment adoption, remains robust. The B2B payments space, driven by the digitization of corporate financial processes and the expansion of cross-border commerce, is just as promising and valid a driver now than it was two years ago.

Technological advancements, including the development of real-time payment infrastructures, the integration of blockchain and cryptocurrencies, and the application of AI and machine learning, are reshaping the industry's capabilities. Payments underpins the progression of technology and growth, opening new markets and monetization avenues.

These secular trends did not go away, merely a rise in interest rates resulted in very optimistic prices being deflated. And that’s now our opportunity.

Consider this analysis by William Blair, which shows that while most COVID-era IPO companies missed their revenue and profit projections, more than two-thirds of payments IPOs beat expectations.

Multiple compression and continued strong fundamental performance makes the sector incredibly attractive right now.

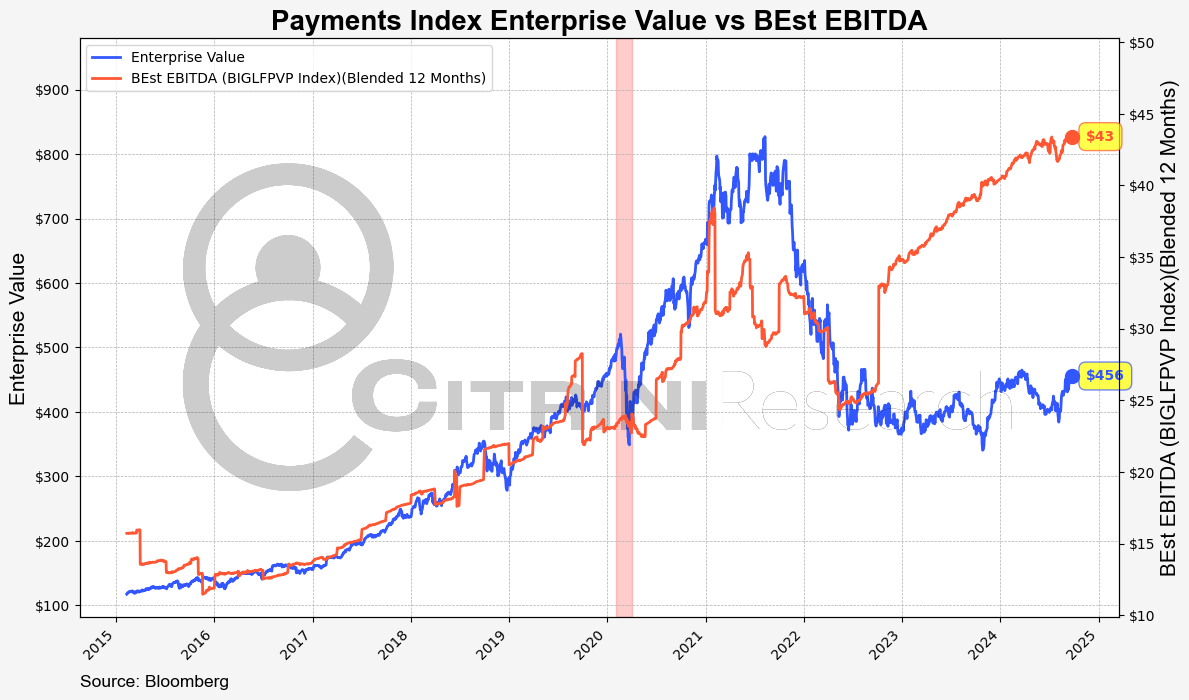

The chart below shows NTM EBITDA (a proxy for cash flow) estimates vs. enterprise value for a Bloomberg-defined basket of publicly-traded payments companies.

The most interesting takeaway from this chart is the massive divergence between growth and valuations in the payments industry over the last two years.

Divergences like these generally do not last long.