When tariff rhetoric began ramping up in earnest this year, I sent a text message to a friend detailing a very specific fear of something I would likely have to do in 2025…

And yet, as we stated in our piece “Tariff-ied”,

The Trade War is not an empty threat […] Motivated by a longer-term strategy of balancing trade deficits and spurring domestic industry, the short term effects will likely come with supply chain disruption, export weakness, and price pressure.

That’s been proven painfully true, as the Trump administration's tariff agenda represents the most comprehensive restructuring of U.S. trade policy in centuries – pushing levies beyond the level of the Smoot-Hawley Tariff Act of 1930. The proposed measures include:

Universal 10% tariff on all imports from all countries, effective April 5, 2025

Additional "reciprocal higher tariffs" on countries with which the US has the largest trade deficits, effective April 9, 2025

Exclusions for certain goods including copper, pharmaceuticals, semiconductors, lumber, and energy products

Special provisions for Canada and Mexico tied to USMCA compliance

Authority to increase tariffs if trading partners retaliate

The methodology used to calculate reciprocal rates is simply driven by the relative trade imbalance of the counterparty (Trade Deficit ÷ Total Imports x 100)– not their actual tariffs imposed on US goods. This means these tariffs are not simply a bargaining chip to reduce trade restrictions on the US, but rather a more sticky policy meant to shrink the trade deficit. In other words, they may be much more prolonged than the market hopes.

If you traded during 2022, the very concept of considering stagflation probably brings back memories of macroeconomic doom posts that kept you short way longer than you should have been. But the context today is different. Rising prices against negative growth is a real risk – one that cavalier trade policy may be underestimating. Restructuring the global trade order poses risks to both the economy and stable prices that the Fed simply may not be able to effectively combat.

We’ve spoken at length about the recessionary impulse that tariffs and policy uncertainty can bring about. But there’s another aspect that we haven’t fully explored.

Thus, to my great dismay, let’s explore how Trump’s proposed tariffs could lead to a slowdown and quantify the risk of stagflation.

Could it happen? Do tariffs make it more likely?

We’re determined to be prepared either way.

So far, our base case has been that tariffs are deflationary.

But we’re determined to be prepared either way and most “stagflation” baskets right now are simply “what worked in Q1 and Q2 2022 baskets”. This risk calls for a more nuanced approach.

Stagflation: Then vs. Now

"Stagflation is like being forced to treat two opposing diseases with the same medicine."

-Paul Samuelson

Stagflation is unnatural. After all, the cure for high prices is, usually, high prices. Inflation is eventually supposed to erode demand until a meaningful slowdown occurs and a recessionary environment takes hold.

The 1970s was the only other major historical episode of “stagflation” and, although the economy was very different, any discussion of stagflation would be incomplete without a brief history lesson.

Stagflation wasn't a single event – it was a series of policy mistakes colliding with external shocks that created an economic nightmare cocktail. It began with the Nixon administration's decisions in 1971. Facing rising inflation and a gold run, Nixon abandoned the Bretton Woods system, ending dollar convertibility to gold. Simultaneously, he imposed wage and price controls that temporarily suppressed inflation symptoms while the disease progressed underneath.

Then came the supply shocks.

The first OPEC oil embargo of 1973-74 quadrupled oil prices practically overnight, from $3 to $12 per barrel in just six months. The second oil shock in 1979 following the Iranian Revolution doubled prices again to $39.50.

These weren't just energy price shocks – they were economy-wide productivity shocks. Oil powered everything. Manufacturing, transportation, heating, chemicals – entire production processes were built around cheap energy. When that input cost quadrupled, the productive capacity of the entire economy shrank dramatically.

Tariffs as the New Oil Shock?

The traditional Fed playbook says raise rates to fight inflation. But this inflation wasn't coming from excess demand – it was coming from constrained supply. So when the Fed tightened, it crushed growth without addressing the root cause.

Arthur Burns, Fed Chairman from 1970-1978, initially treated the inflation as transitory. By the time he recognized its persistence, inflation expectations had become entrenched in wage demands, creating the dreaded wage-price spiral.

When Paul Volcker finally broke the back of inflation in the early 1980s, it required interest rates of 20% and triggered the one of the worst recessions since the Great Depression. The medicine nearly killed the patient.

An important disclaimer: The US/developed economy was much more industrialized, energy dependent, and labor intensive in the 1970s than it is today, creating a condition ripe for wage price spiral. Severing the gold standard likely amplified the price dynamics.

We are in a different economic environment today and, despite the irony of the administration trying so hard to have our economy return to the 70s, stagflation today would look different.

What makes today's scenario uniquely dangerous is that tariffs create similar economic conditions but through a different mechanism and with broader reach.

Inflationary pressures are not a result of overly aggressive monetary policy but rather due to a policy of import taxation that will have a material and immediate effect on consumer prices. Lowering interest rates will not change this policy – and might actually lead to increasing inflationary pressure in stubborn rate-sensitive areas like housing.

So, how will Powell react?

On one hand, the Fed has allowed inflation to run above target for over four years, and progress on inflation has crawled to a stop over the past year. And while soft data shows growing labor market agita in the past month, we have yet to see a breakdown in employment that would dominate the dual mandate.

There is an argument that the Fed should simply look past policy driven inflation and ease to counteract the likely domestic slowdown. To some extent, the market is already giving room – treasury yields have traded off materially since Trump whipped out the big board. But given the context and experience of the past several years, this may be a tough headline to sell.

The Tariff Framework

The Inflation

A 10% baseline tariff immediately raises prices on imported goods. Unlike targeted tariffs on specific sectors, this broad-based approach affects virtually all consumer goods, manufacturing inputs, and capital equipment, even if there are certain carveouts.

Manufacturing supply chains are global and complex. In the 1970s, companies faced a single input cost shock (energy) and could respond by reducing energy intensity. Today's global supply chains mean tariffs compound at each production stage. A 10% tariff on steel becomes a 12% cost increase in auto parts, which becomes a 15% increase in vehicle costs, and so on.

And we are already seeing manufacturing input prices spike on the tariff talk before today’s announcement.

Further, tariffs shield domestic producers from international competition, allowing them to raise prices more aggressively without losing market share. Trade tensions typically pressure the dollar, making imports even more expensive beyond the tariff impact.

Finally, when trading partners impose retaliatory tariffs, exports become more expensive in foreign markets, reducing demand. This forces domestic producers to raise prices in home markets to maintain profitability. If reciprocal tariffs persist, this can end up causing a feedback loop.

While it may seem like tariffs allow U.S. goods to be more competitively priced domestically, it’s very easy for them to be a license for price increases without the risk of losing market share.

And Tariffs don't just hit once, they compound, amplifying the stagflationary pressure. The washing machine market – a target of the Trump 1.0 trade war – tells the story. When steel and aluminum tariffs hit in 2018, manufacturers raised prices by 12% – despite these metals representing only ~5% of total costs. Why? Because tariffs cascade through supply chains in non-linear ways, creating price multiplier effects that amplify the inflationary pressure of tariffs.

The Stagnation

Global supply chains optimized over decades cannot be reconfigured overnight. The sudden imposition of broad tariffs creates bottlenecks, production delays, and inefficiencies that constrain output. The uncertainty of policy alone can stall activity – which may already be showing up in the data.

Companies forced to source from higher-cost or less efficient suppliers experience reduced productivity - a particularly dangerous outcome when productivity growth is already sluggish. The uncertainty created by tariffs implemented through emergency powers leads businesses to delay capital investments and investors to sell stocks - compounding the negative growth impulse through the wealth effect (as we described in our article “Haves vs. Have Nots”).

Most critically, retaliatory tariffs would reduce the competitiveness of US exports, leading to production cuts and job losses in export-oriented industries. With inflation pressures mounting, the Federal Reserve would likely maintain higher interest rates, further constraining economic growth.

Unlike the 1970s stagflation primarily driven by OPEC oil embargoes:

Today's global supply chains mean tariffs affect all sectors simultaneously

This is an intentional policy choice rather than an external shock

The economy is still recovering from recent inflation pressures

Today's workforce has less ability to demand compensating wage increases

Do these differences mean stagflation is a thing of the past? Potentially not…

The Market's Blind Spots

Assuming Easy Supply Chain Adjustment

The administration's core argument is that tariffs will simply shift production back to America, creating a manufacturing renaissance. It's a compelling political narrative but economically naïve.

Manufacturing capacity can't materialize overnight. Factory construction takes years. Worker training takes months. The connection of a complete US-based supply chain takes even longer, if it is even possible at all, and results in significantly higher costs relative to international supply chains built around specialization or economies of scale.

We analyzed capacity utilization rates across US manufacturing sectors and calculated the gap between current capacity and what would be needed to replace just 25% of imports. The results are sobering:

Those red bars represent capacity that simply doesn’t exist. Until it does – a multi-year process at best – we can end up with inflation without the growth.

In fact, this experiment has already been tried – and failed – on multiple occasions before, as the WSJ has covered.

During this process, as US companies try to reconstitute a more US-centric/friendly supply chain, either tariffs or additional costs and production inefficiencies are passed onto the consumers that drive inflation. At the same time, the reconstitution of the currently sluggish labor market could lead to pockets of unemployment and further depresses economic activity against an inflationary backdrop.

These labor market dynamics are being acknowledged by Fed officials, who expressed much higher concern about the labor market in their most recent meeting amidst the beating of the trade war drum.

Meanwhile, because there’s an adjustment process as firms assess the permanence and scope of the tariffs and seek out solutions, the price adjustments are drawn out instead of being a one-off step change in prices. This is akin to the price adjustments in the US economy in response to the COVID fiscal stimulus. Instead of a one-off price change to reflect the monetary debasement, firms and consumers made staggered investment and consumption changes that became inflation or sustained price increases. This uncertainty complicates demand and investment planning, adding to the “stag” in “stagflation”.

Many sectors and companies will be negatively impacted by this painful supply chain adjustment. The two that come most immediately to mind are outsourced manufacturing and trucking providers.

Companies like Flex (FLEX) and Jabil (JBL) built their businesses on arbitraging the cost of manufacturing in historically low-cost jurisdictions (primarily in Asia and Latin America) against the price of goods in the U.S. At a minimum, tariffs will soon impact their margins while a stagnating economy reduces demand for their services. But as supply chains are eventually re-aligned, these businesses are at risk of a substantial decline in demand for their services.

More immediately, the trucking industry has already been struggling, despite some boost from the well-documented rush to stock up on inventories ahead of the implementation of tariffs. Truckers’ recent struggles are the result of a post-COVID bullwhip, but the reality is things would be even worse if it were not for this artificial demand created by inventory stocking. Going forward, not only will demand for logistics services be reduced as these stockpiles are worked through, but it will also take longer for customers to deplete inventory in a weaker economic environment. This immediate demand airpocket, followed by more anemic volumes, will weigh on the results of companies like ArcBest Corporation (ARCB) or WERN, SAIA and KNX.

That’s not just our view - the trucking industry itself has been quite outspoken on the matter.

Misunderstanding Tech's Vulnerability

There's a dangerous consensus view that tech's high margins provide insulation from tariff impacts. Nothing could be further from the truth. Back to our chart on the cascade effects. Notice anything interesting?

Source: Federal Reserve’s G.17 Industrial Production & Capacity Utilization Report (March 2025), U.S. Census Bureau and Bureau of Economic Analysis International Trade Report (January 2025), CitriniResearch Calculation

What stands out to us is that some of the categories most impacted by an inflationary tariff cascade are in technology – consumer electronics, telecom equipment, and medical devices.

In fact, technology companies face a perfect storm in a tariff-driven stagflation environment. The aforementioned, painful adjustment in supply chains is a big problem for many technology companies, but so are other aspects of a stagflationary environment:

Hardware margins are already razor-thin, making tariff absorption impossible

As economic growth slows, consumer spending and enterprise IT budgets come under pressure

Rising interest rates from inflation particularly punish growth stocks with distant earnings

The damage is particularly severe for hardware-dependent and / or consumer-oriented companies, many of which have more exposure to these headwinds than most appreciate. There are obvious losers that are entirely or mostly dependent on consumer hardware purchases – companies like AAPL, GRMN, PTON, and SONO.

Companies like DELL, HPQ, and ROKU also have exposure to consumer hardware spending. The risks here are obvious. These companies will see the cost of their products inflate, while demand for their products from a weakened consumer will stagnate.

But dig a little deeper and many companies that are commonly perceived as asset-lite “software” businesses are vulnerable. Enterprise software companies like NTAP, PANW and ZS depend on sourcing hardware to offer their products. Take PANW, which trades at a cool 13x revenue and 58x earnings (discount rate anyone?) selling expensive network security technology to enterprises – they note in their annual report, “The manufacturing operations of some of our component suppliers are geographically concentrated in Asia and elsewhere, which makes our supply chain vulnerable to regional disruptions…We are also monitoring the impact of inflationary pressures and the tensions…between the U.S. and China, which could have an adverse impact on our business or results of operations in future periods.”

That does not sound great, but pales in comparison to the risk facing IOT.

This vendor of vehicle telematics and dashboard cameras has a hardware-intensive business model that has depressed the unit economics of the business relative to other companies that claim to offer software, likely due to the inherently low-margin nature of hardware sales and a customer base that is unwilling to pay higher prices. That has not stopped the market from bidding the valuation up to 17x revenue for this currently unprofitable business. And the company notes in their annual report that they are heavily reliant on sourcing their hardware from Taiwan.

Dig a little deeper still and many medical technology companies are also exposed to rising hardware costs & softening consumer demand.

Diabetes is a disease that is managed with a lot of hardware, and innovations in glucose monitors and insulin pumps have certainly helped the lives of many. But these innovations are priced at a premium to traditional methods of managing diabetes, so companies like PODD and DXCM are at risk from a weakened consumer. Meanwhile, both recently moved the production of their devices overseas to Malaysia – one of the targets of the recent tariff announcements – while trading at growth multiples that are vulnerable to higher discount rates.

Worst of all is MASI, a producer of pulse oximeters and other patient monitoring equipment that was traditionally sold to hospitals. In recent years, the company has made a significant push into consumer “wearables”, and they also acquired a high-end consumer audio company called Sound United. Not a great product mix in a stagnating economy, and they are also heavily reliant on Malaysia for sourcing their hardware.

Finally, speculative & unprofitable “growth” tech companies that haven't yet achieved profitability will likely be hit both via risk-off sentiment. It is astounding to think that RGTI, QBTS and IONQ all still have a 2 billion dollar+ market cap…

Note, “electronic transfers” aka data has enjoyed a global tariff moratorium via WTO policy dating back to 1998, which has primarily benefitted large cap US tech. This moratorium was likely to expire in 2026, but is effectively over now that Trump has stopped WTO funding and ripped up existing trade agreements on the pretext of a national emergency.

Given US technology’s massive foreign revenue, stock market importance, and foreign anti-tech sentiment, it’s a logical target of retaliatory action. Already we have seen the headlines that the EU is considering targeting US tech.

Ignoring the Productivity Destruction

When tariffs hit, companies face an impossible choice. They can either pay the tariff (expensive), scramble to find new suppliers (disruptive), or attempt to rebuild production domestically (time-consuming and costly). None of these options are clean or cheap.

The reality? Most will pursue a messy combination of all three, creating a web of inefficiencies that compound through the supply chain.

The consensus view severely underestimates how tariffs demolish productivity. Global supply chains weren't built on a whim – they evolved to maximize efficiency. Chinese and Vietnamese factories have optimized for lead times and production over the course of decades - pivoting to sourcing from domestic manufacturers would be significantly inefficient and rife with issues.

For every 10 percentage point increase in domestic sourcing, overall productivity in the sector drops by an average of 3.7%. That's not a one-time hit – it's a permanent efficiency loss until new technologies emerge.

It’s easy to create an economic model that assumes static variables. I've spent the last month talking to small business owners and executives, and they're all saying the same thing: "We have no idea what’s going on”. This uncertainty itself becomes a tax on efficiency that nobody's pricing in.

This productivity destruction is precisely what creates the "stagnation" in stagflation.

Frozen Monetary Policy

The Fed's standard inflation-fighting tools – raising interest rates – can't fix supply-side inflation without creating severe recession.

If the Fed hikes to combat tariff-induced inflation, they'll crush demand while doing nothing to fix the supply constraints. If they don't hike, inflation expectations become unanchored.

In the short-run the Fed will struggle to respond to the tariffs and is terrified of stepping onto a political landmine or being seen as publicly negating or criticizing fiscal policies. They didn’t do that during the Biden admin either. They cannot react until the effects of the tariffs have clearly translated into hard data such as loss of output/real business investments or rising unemployment.

One year inflation swaps have already violently repriced - moving back up to the highest level since the first quarter of 2022…

And at the same time, the number of cuts priced-in by December 2025 has not budged in response. Year-to-date, we’ve gone from expecting 1 year inflation at ~2.5% with 2-3 cuts by December 2025 to 3.5% and 4-5 cuts.

In macro, we believe this can continue. This should manifest as continued dollar weakness and a flattening of the yield curve.

How We’d Trade It

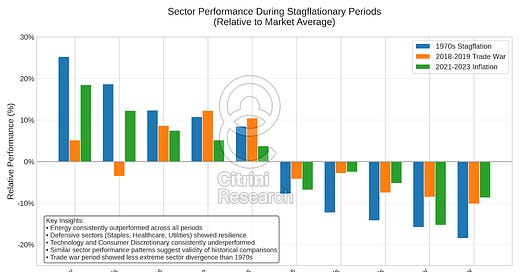

“Stagflation baskets” abound, but the majority are relics of 2022 - created to trade the threat of stagflation during the 2021-2022 inflationary environment. Most are overindexed to energy as a result of the “supply shock” dynamic from the 1970s and Ukraine Invasion impact that drove these fears the last time.

While we’re not ready to go full tilt on the idea of stagflation, we do think that a distinct form of the “stagflation trade” can take effect - at least tactically and in equities.

Over the next couple months, it’s possible we continue to see bonds pricing in a classic recession while equities simultaneously fear lower growth & higher input costs.

We have focused more on the overall impact of tariffs driving potential stagflation & current market environment to create our basket.

The ideal long in our basket has domestic revenue dominance, proven pricing power, supply chain resilience & inelastic demand.

The ideal short has global supply chain dependency, thin margin structure, limited pricing power, discretionary purchase exposure & significant fixed costs.

COUNTERPOINTS AND CATALYSTS

Counterpoints to Stagflation

Policy Reversal: Unlikely but possible if economic damage exceeds political tolerance.

Trump has an excess of political capital and will to accomplish his goals, making a serious and/or immediate reversal without some gains unlikely

It’s possible, even plausible, that this is a strategy by the Trump administration to start tariffs as high as possible in an effort to bully the rest of the world. The questions become numerous once one realizes that. First, will the world (mainly China and Europe) give in? Second, the impact to the economy could be significant even if the tariffs were completely reversed in one month’s time. This could end up a simple slowdown rather than stagflation, but it’s important to be attentive to the back and forth.

Faster-Than-Expected Supply Chain Adjustment: Manufacturing capacity could come online faster than models project, given the significant increase in adaptability to supply chain shocks that many companies experienced after COVID, though historical evidence suggests this is unlikely.

Global Coordination: Trading partners could coordinate responses rather than retaliate, minimizing disruption. We’ve seen some suggestions of China, Japan and South Korea cooperation (for the first time since the Mongol Invasion…)

The fact is, a plain old economic slowdown is probably more likely in the long run than stagflation. While we do not consider stagflation to be the modal case or consequence of tariffs, we think it’s a distinct possibility (and one that can drive price action for a bit) which is why we’re writing about it here.

The Reciprocity Paradox

How the Trade War Ends With a Whimper, Not a (Stagflationary) Bang

While we’ve laid out the ingredients necessary for the stagflationary case, intellectual honesty demands we examine the most compelling counterargument. There's a non-trivial possibility that this entire tariff regime ends with a typical vanilla slowdown rather than the spicy stagflationary nightmare I've described.

The fundamental contradiction in the administration's tariff policy creates what I'll call the "Reciprocity Paradox" – and it might ultimately undermine itself before stagflation takes hold.

First, let's understand the paradox: The policy defines "unfair" trade primarily through the lens of bilateral deficits, yet simultaneously imposes a universal 10% tariff regardless of deficit status. More critically, the stated goal is reciprocity – for other countries to "terminate your own tariffs, drop your barriers."

This creates a mathematical impossibility. If the goal is balanced trade (zero deficits), and the mechanism is reciprocal tariff cuts, the logical endpoint would be zero tariffs globally – directly contradicting the protectionist intent.

Most countries would be prone to recognizing this inherent contradiction. Rather than caving to what they’ll view as bullying, they'll most likely engage in targeted, strategic retaliation while simultaneously offering hollow "concessions" that appear substantial but preserve their competitive advantages.

Japan's approach to auto imports illustrates this perfectly. Their tariff rate is lower than America's old rate, yet European manufacturers succeed there while American companies don't – because non-tariff barriers and regulatory frameworks matter more than headline rates.

Without a comprehensive framework addressing everything from safety standards to tax systems to currency policies, simply matching tariff rates accomplishes very little. And no administration – this one included – has the bandwidth to negotiate such comprehensive frameworks with dozens of trading partners simultaneously.

The likely result?

A series of superficial "wins" where trading partners make minimal adjustments, the administration declares victory, and most tariffs eventually come down before the supply chain disruptions fully materialize.

In this scenario, we get a standard cyclical slowdown from policy uncertainty and initial disruption, but avoid the extended stagflationary episode that would occur if tariffs became permanent fixtures.

I do see significant stagflation risk – but the internal inconsistencies in the policy itself may ultimately prove self-limiting. The math simply doesn't work otherwise.

This is evident by our allocation decisions, we still hold a significant long bond position on the idea that investors and the Fed alike will “look through” the inflationary aspect to the eventual slowdown.

In short: The greatest risk to the stagflation thesis is that the policy collapses under the weight of its own contradictions before the full stagflationary impact can take hold. In the meantime, however, it’s entirely possible that we see some significant “stagflation-esque” sector trades take shape - more so in equities than in rates (which will likely continue their bull flattener).

I’ll be honest - the perpetual optimist in me wants to default to “tariffs are a negotiating tactic that will be gone in 3 months” or “corporate America has become remarkably adaptable in their supply chains since COVID” or even “productivity gains from AI could offset them!”

Still, sometimes we have to confront our bias if we want to be aware of all the risks. And, man, there are a lot of risks.

Key Catalysts to Watch

Initial Implementation (April 5-9): Market will begin pricing real-world impact

If reciprocal tariffs are already significantly reduced from the now infamous chart by April 9th, we can probably sleep more soundly and chalk this up to negotiation (potentially even successful negotiation)

First Round of Retaliation (likely April-May): Will confirm trade tension escalation

Retaliation ensures the Trade War goes on longer than many are likely prepared for. Even if this is a “negotiating tactic”, retaliatory tariffs risk forcing the bluff.

Q2 2025 Earnings (July-August): First corporate reports reflecting tariff impact

I tend to agree with the counter view you put out here, "whimper not a bang". This is a multiplayer game in a complex, underdetermined system. And it remains to be seen how much of a real-economy shock this is. This is definitely against my political bias, and the tariffs are stupid and haphazard in a brain-damaged sort of way, but 1. everyone has had five years since COVID to practice handling supply chain shocks and 2. it's not like this is a surprise, I've been seeing supply chain/tariff questions on earnings calls for six months. Tariffs will bite in the areas where importers have no good alternative, but those are areas where the supplier delivers high value anyway. Meanwhile, there certainly are many domestic producers who are about to reap a windfall of business. Tariffs tend to rearrange winners and losers far more than they create winners or losers on net.

Another blitzkrieg of supply chain disruptions just as manufacturers are recovering from those of of the COVID era.