Market Memo: Tariff-ied

How Trump Ruined Everyone's Weekend (And How We're Playing It)

While the market eagerly accepted the Trump Bump following election day, it has willfully had its head in the sand on potentially markets-disruptive aspects of the new US administration. Up until this weekend, the threat of new tariffs – a hallmark of Trump’s economic policy agenda – has generally been written off as a negotiating tactic or campaign bluster. That has fundamentally misunderstood the concept.

As we have said - Trump has come into this second term with plans for executing his strategies that have essentially nothing in the way of roadblocks.

Even with the slide after headlines hit on Friday, there was still a distinct feeling in markets of disbelief, complacency or perhaps a combination of both. Beneath the surface of the weakening index, trading in single names did not hit obvious victims of 25% tariffs on Canada and Mexico much harder than their better insulated peers if at all.

The market’s default stance seemed to be that even if tariffs were implemented, they’d be of the gradual or selective variety as suggested by Treasury Secretary Bessent or CEA Chairman appointee (and one-time CitriniResearch co-author) Stephen Miran. Perhaps U.S. trading partners were assuming the same. This view has been and will continue to be wrong. Trump will tell you as much himself.

This is exactly what has spurred Trump’s weekend announcement.

While ostensibly linked to the fentanyl crisis and triggered via the International Emergency Economic Powers Act (IEEPA), we think this is merely a convenient justification. The Saturday announcement of tariffs on the U.S.’s top three trading partners (25% tariffs on Mexican and Canadian goods, (10% on Canadian energy), and an incremental 10% duty on Chinese goods) is a wake up call.

The Trade War is not an empty threat, and investors should be keenly aware that although this is certainly a negotiating tactic there is very little stopping Trump from upping the ante even further if he doesn’t get what he wants. His intent is to get the world to believe him for the rest of his term - and when you’re a U.S. trading partner, announcements that result in this kind of USD price action are hard to forget.

As with all wars, this trade war will bring casualties on both sides. Unsurprisingly, retaliatory actions have already been announced. Trump, confident in his asymmetric advantage, appears ready to bear the pain. Put bluntly in the announcement:

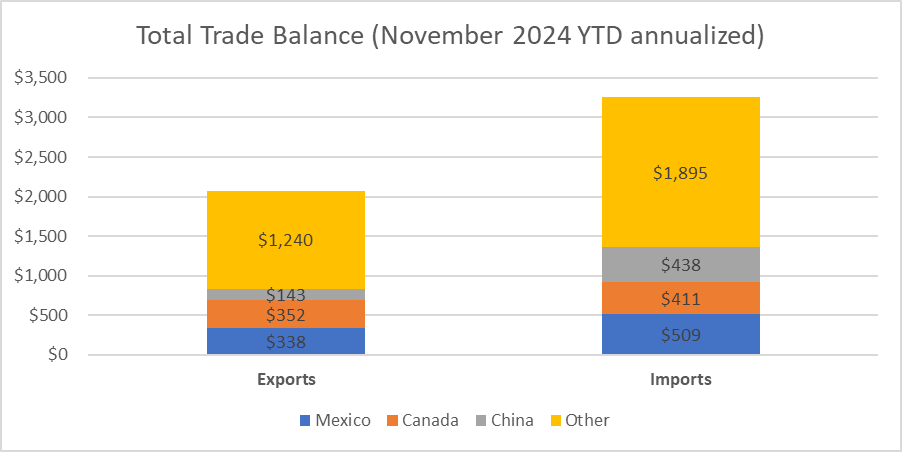

“While trade accounts for 67% of Canada’s GDP, 73% of Mexico’s GDP, and 37% of China’s GDP, it accounts for only 24% of U.S. GDP. However, in 2023 the U.S. trade deficit in goods was the world’s largest at over $1 trillion.”

These three countries represent roughly 40% of international trade with the United States. In 2024, U.S. imports from Canada, Mexico, and China totalled $1,358 billion (42% of total), while U.S. exports totalled $832 billion (40% of total). The newly imposed tariffs would amount to over $250 billion in annualized duty on these imports, while retaliatory tariffs would add over $150 billion to exports.

In short, we believe this move is an intentionally manufactured pain trade. The purpose is to cause trade, market, and FX disruption, with the expectation that effects will be felt disproportionately on the foreign side. The ambiguous pretense offers little in the way of an actual path towards appeasement for Canada or Mexico and allows Trump to offer “reprieve” at his discretion.

Motivated by a longer-term strategy of balancing trade deficits and spurring domestic industry, the short term effects will likely come with supply chain disruption, export weakness, and price pressure.

While the market may take time to digest the practical impact on individual names (as well as handicapping the duration of the tariffs), we expect to see an initial knee-jerk reaction focused primarily on the most obvious first-order winners and losers.

So, after having our weekend ruined by the market’s reaction to DeepSeek (and our insistence on being prepared), we’re running it back by preparing to trade the trade war.

Here are some ideas we are considering in equities and macro…

My reasoning on creating this basket/watchlist is twofold.

First, these tariffs were largely unexpected by the market (as evidenced by the futures open), which largely believed they’d be a bluff. It became evident that they would not be on Friday when a deadline was announced, locking the administration into action that they were required to take lest they lose leverage. There may be more juice to squeeze from this, even after tomorrow’s open.

Second, one can create a collection of long/short pairs that otherwise would trade very tight but - in light of this development - could see very significant divergence. Whenever that’s the case the asymmetry makes constructing a basket worthwhile. We can observe that close correlation that could violently breakdown in the long and short side performance over the past year:

Our Framework: Overview

Long: Domestic Substitutes Benefiting from Tariffs

U.S.-based manufacturers and suppliers that compete with Mexican and Canadian imports will gain pricing power as tariffs make foreign goods more expensive.

U.S. domestic lumber and steel producers, for example, benefit from a decline in Canadian competition, while Canadian lumber producers (and potentially domestic US companies that rely on importing Canadian lumber like homebuilders could suffer).

U.S. agricultural producers could benefit if tariffs make imports from Mexico uncompetitive.

Long: Relative Pricing Power with the U.S. Consumer

Companies that can pass through higher costs to consumers will be less affected.

Certain commodity producers (U.S.-based oil & gas, domestic metals, etc.) may benefit from an inflationary environment caused by supply chain disruptions.

Short: Import-Dependent Companies Facing Higher Costs

Companies relying on Mexican/Canadian supply chains for raw materials or intermediate goods will see input costs rise.

Homebuilders are vulnerable as Canadian lumber and Mexican labor costs increase.

Auto manufacturers with North American supply chains could be hit hard (many auto parts come from Mexico).

Short: Mexico/Canada-Exposed Companies Facing Demand Destruction

Mexican and Canadian firms exporting to the U.S. will face volume declines and margin compression due to higher tariffs.

Mexican consumer-focused companies (like Alsea SAB) may be shorted if U.S. spending on their products declines.

Canadian steel and lumber firms may be shorted due to competitive disadvantages in the U.S. market.

We’ll go over some of the reasoning behind our ideas here to provide a firm framework for examining our overall basket and watchlist.

Our broader watchlist of Potential Tariff Longs/Shorts in US, Mexico & Canada’s equity markets:

Automotive and Auto Parts

The modern auto supply chain, particularly for Detroit’s Big Three (General Motors, Ford, and Stellantis NV), spans both the Northern and Southern border with parts and final assembly often crossing multiple times. A 25% tariff on Mexican imports will likely inject massive cost inflation into the production process, posing the immediate threat of tighter margins or higher consumer prices—both negatives for demand. General Motors (GM) and Ford (F) have historically maintained sizable manufacturing footprints in Mexico for small cars and certain truck components, leaving them vulnerable to rising costs. Meanwhile, cross-border automotive suppliers such as Magna International (MGA), which is headquartered in Canada but manufactures heavily in both Canada and Mexico, also face the squeeze on two fronts.

Retaliatory tariffs imposed by Mexico or Canada on U.S.-made auto parts or finished vehicles would further challenge the entire North American ecosystem. Although these automakers could accelerate shifting production within the U.S. or to other low-cost regions (e.g., Asia), that pivot is expensive and time-consuming. As a result, those with the most entrenched cross-border supply chains (GM, Ford, and key Tier 1 suppliers like Lear Corporation) are at risk of margin compression and volume declines.

Meanwhile, domestic-centric supply chains can sidestep many tariff costs. Tesla primarily relies on U.S.-based assembly, mitigating border taxes. Engine supplier Cummins and parts maker Dana may gain from any “reshoring” of supplier relationships as automakers seek to reduce cross-border exposure.

Trade Ideas

LONG Insulated Supply Chains:

Tesla (TSLA)

Cummins (CMI)

Dana Inc. (DAN)

SHORT Exposed Supply Chains:

General Motors (GM)

Ford (F)

Lear Corporation (LEA)

Magna (MGA)

Toyota (TM ADR)

Honda (HMC ADR)

Stellantis (STLA)

BorgWarner (BWA)

O’Reilly Automotive (ORLY)

Genuine Parts Company (GPC)

Gentherm (THRM)

Consumer Goods and Retailers

Many large U.S. retailers rely on produce, beverages, and household goods sourced from Mexico and Canada. Walmart (WMT), Costco (COST), and Target (TGT) all feature grocery and general merchandise that flow across the southern and northern borders. A 25% tariff could quickly translate into higher input costs for items like fresh fruits, vegetables, and other consumer staples. Mexico exports a substantial share of fresh produce to the U.S., including tomatoes, avocados, and berries—staple items for companies like Dole (DOLE) and Fresh Del Monte (FDP). Producers like Calvado Growers (CVLG) are especially exposed. Retailers typically pass at least some portion of these costs on to shoppers, which risks dampening demand and squeezing margins if consumer traffic shifts to lower-priced alternatives or simply buys less.

Beer, wine, and spirits also face direct tariff exposure. Constellation Brands (STZ) relies on Mexican breweries for well-known labels like Corona and Modelo, meaning the cost to import these products may rise dramatically. Meanwhile, certain U.S.-based alcoholic beverage companies that produce stateside like Boston Beer Company (SAM), Brown-Forman (BF.B) could see incremental gains.

Trade Ideas

LONG Domestic Goods Producers:

Boston Beer Company (SAM)

Brown-Forman (BF.B)

American Outdoor Brands (AOUT)

Yeti Holdings (YETI)

SHORT Consumer Goods Importers:

Walmart (WMT)

Home Depot (HD)

Lowe’s (LOW)

Constellation Brands (STZ)

Dole (DOLE)

Fresh Del Monte Produce (FDP)

Calvado Growers (CVLG)

Best Buy (BBY)

Nike (NKE)

Under Armour (UAA)

VF Corporation (VFC)

Dollar Tree (DLTR)

Dollar General (DG)

TJX Companies (TJX)

Retaliation: Heavy Goods, Machinery, Agriculture,

High-profile targets like Boeing planes or Caterpillar equipment are natural choices for retaliatory measures. Canada could impose fees on heavy machinery imports, and Mexico might hit large-scale agricultural and construction equipment. These companies also sometimes rely on cross-border supply chains for components.

Meanwhile, A 25% tariff on competing steel and aluminum imports from Mexico and Canada raises the relative attractiveness of domestic metals. Manufacturers that need steel or aluminum could look to “Buy American,” boosting these firms’ volumes and possibly allowing for some margin expansion.

Trade Ideas

LONG Domestic Steel:

Nucor Corporation (NUE)

Steel Dynamics, Inc. (STLD)

United States Steel Corporation (X)

SHORT Heavy Machinery and Agriculture:

Caterpillar Inc. (CAT)

Whirlpool Corporation (WHR)

Deere & Company (DE)

Boeing Company (BA)

Archer-Daniels-Midland Company (ADM)

Tyson Foods, Inc. (TSN)

Energy: Oil Producers and Refineries

Canada’s energy sector received somewhat of a reprieve, with a 10% tariff rate rather than the 25% levied on most other Canadian goods (and on Mexican energy exports). Still, the duty will tighten the differential between heavy Canadian crude (WCS) and the light, sweet crude from U.S. shale formations (WTI), broadly benefitting U.S. producers at the expense of Canadians.

Given the significant quantities in question, we don’t expect crude oil to stop flowing from Canada, or for refined products to stop flowing back. But even the 10% tariff (~$6/bbl) could have meaningful implications for U.S. refineries. Given that many of the larger U.S. refineries are configured for this heavy crude, it is unlikely that they will be able to immediately switch feedstocks, and could experience compressed crack spreads in the near term. Meanwhile, several smaller refiners that utilize domestic feedstock will likely benefit.

Trade Ideas

LONG Domestic Producers and WTI Refiners:

Diamondback Energy (FANG)

EOG Resources (EOG)

Devon Energy (DVN)

PBF Energy (PBF)

Delek US Holdings (DK)

SHORT Canadian Producers and Heavy Refineries:

Cenovus Energy (CVE)

Suncor Energy (SU)

Canadian Natural Resources (CNQ)

Valero Energy (VLO)

Phillips 66 (PSX)

Homebuilders & Lumber

A large fraction of U.S. softwood lumber and other building materials comes from Canada. A 25% tariff means that U.S. homebuilders will face higher raw material costs, which will further tighten profit margins that have already come under pressure due to high mortgage rates and growing inventory. With Canadian lumber slapped by a steep tariff, U.S. timber companies and sawmills may see an increase in market share and pricing power.

Trade Ideas

LONG Domestic Lumber:

Rayonier Inc. (RYN)

PotlatchDeltic Corporation (PCH)

UFP Industries, Inc. (UFPI)

Weyerhaeuser Company (WY)

SHORT Homebuilders and Canadian Lumber:

Acadian Timber (ADN CN)

Boise Cascade Company (BCC)

Beazar Homes (BZH)

Canfor Corporation (CFP CN)

D.R. Horton (DHI)

Lennar (LEN)

PulteGroup (PHM)

West Fraser Timber (WFG CN)

Interfor Corporation (IFP CN)

Western Forest Products (WEF CN)

Click here to view our overall basket, which touches on more broad areas than just those expanded on above.

Macro Commentary: Trade Update

We will discuss more on the macroeconomic implications of tariffs in our February Macro Memo, but I am offering some knee-jerk thoughts and updating a trade we already have on.

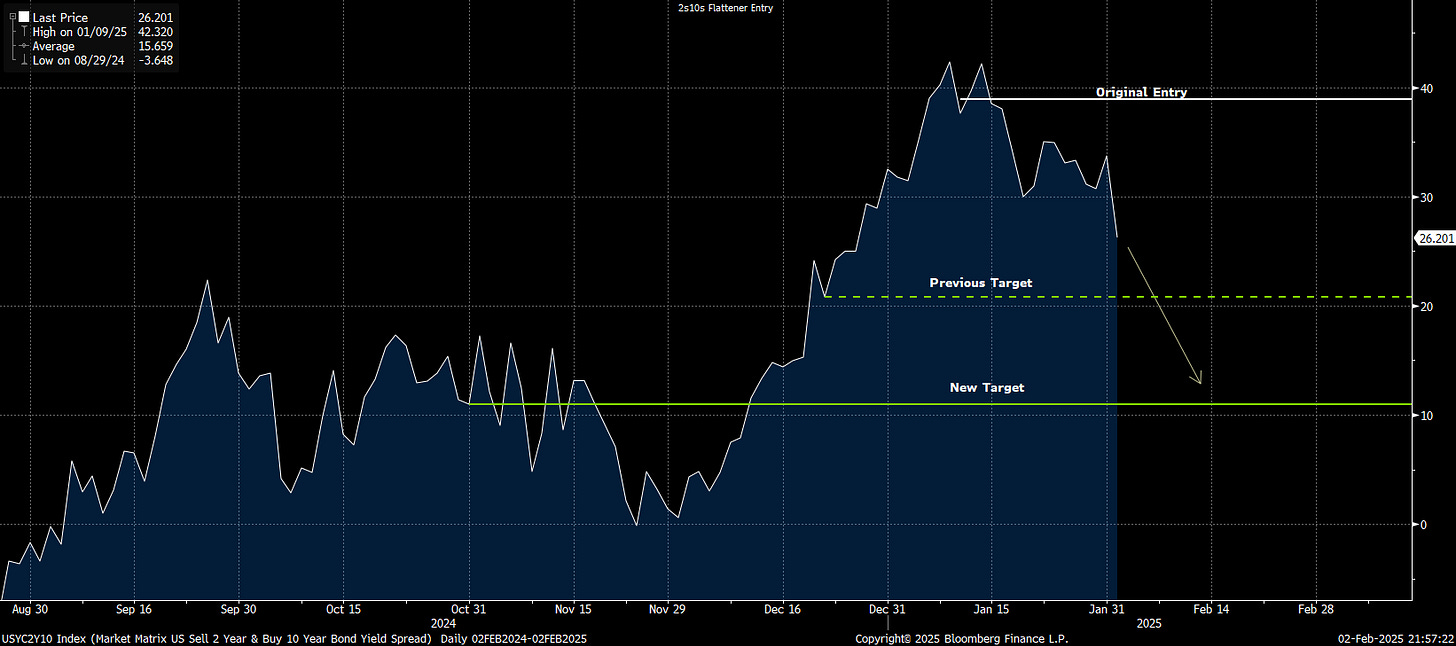

I think that the primary framework for macro investors to use here is more similar to an increase in taxation than an increase in prices. Given that tariffs will likely represent a one-time price increase, I would lean towards their ultimate net impact being deflationary on the hit to discretionary spending and a negative to growth rather than inflationary. The immediate reaction in bonds seems to agree. However, I think for now the risk/reward is still better being in the flattener than simply being long 10s

From a rates perspective, I’ll be increasing the DV01 of our 2s10s flattener we put on January 10th by 50%. We entered on 1/10/25 at +38.6bps with a target of +20bps on 2s10s - I am moving our stop down from +45.6bps to +40bps. At 2s10s = +20bps, I will cover the 2s short and be only long 10s.

Original Entry:

Most recent macro update:

Current FX Positions:

Long 80% JPY + 20% BRL

Short 80% CHF + 20% CNH

Entry Dec 19, 2025

Current Rate Positions:

SFRM5M6 Flattener

Entry Jan 16, 2025

2s10s Flattener

Entry Jan 10, 2025

Long TLT 06/20/2025 100C

Entry Jan 2, 2025

Current Commodity Positions:

Long NGZ5 (Dec 25 NatGas), or NatGas Equity Basket

Entry Jan 9, 2025

Long Lumber (Front Month) or US Lumber names (WY US, PCH US) vs Short ITB US

Existing: Short Homebuilders Dec 19, 2024

New Position: Long Lumber (Today)

Initial Thoughts on the Fed’s Reaction

We do have an indication of how Powell & the Fed might respond to tariffs - based on his answers during the Q&A during last December’s FOMC:

Back in 2018, the opinion of Fed staffers was that the correct course of action was to “look through” tariffs and that a Fed response (i.e. a hike) would put the economy into a recession.

Perhaps the most important aspect of that report, which Powell brought with him to the December meeting (foreshadowing, much?), is the following excerpt:

“However, the desirability of this strategy depends on firmly anchored inflation expectations and the passthrough of cost shocks into inflation being relatively short lived. If those conditions do not hold, then the alternative approach assumed in the previous scenario could be more attractive. In particular, inflation and inflation expectations might run persistently higher if the tariff hike leads workers to raise their wage demands or firms to raise their markups. These effects might be intensified in a very tight labor market. “

In September 2018, the labor market was actually tighter than it is right now, so it seems like the default stance from which the Fed will approach this is the “seeing through”. That’s before anyone considers the potential for these tariffs and their responses internationally to actually be deflationary. Overall, I do not think this is a reason to short bonds and I would be more keen to cover the short 2s portion of our flattener than exit our long on 10s.

In FX, given the U.S. trade deficits with these three countries, the immediate reaction is likely to be dollar strength and foreign weakness in these FX pairs. More broadly (and somewhat ironically), uncertainty could also trigger a flight to safety – benefitting the USD vs. foreign currencies broadly, particularly if traders begin to more seriously anticipate similar tariffs on the European Union, Japan and Korea.

Beyond the obvious dollar strength, one risk we’d like to flag: we would not be too surprised to see China move towards devaluing the Renminbi in response, rather than engaging in straightforward retaliatory tariffs. But we also believe that this possibility is part of the reason why the U.S. has not come out of the gate with Chinese tariffs at 25% like Mexico or China. This is unlikely to be the opening salvo by China.

The Upshot

We believe Trump has been emboldened to play hardball, even if it comes with pain for certain domestic industries, consumer prices and the stock market. The market tantrum won’t dissuade him.

Retaliatory responses are simply the cost of leverage, one he is willing to endure to support his wider picture agenda. This weekend’s announcement will likely serve as a wake up call to investors to more seriously consider a sweeping reform of trade agreements.

In the short-term, we expect continued downwards pressure in equities that we deem the “Tariff Tantrum”, a flight to safety, relative value trades domestic producers vs. importers, and companies pausing OpEx while pulling forward import demand (negative for GDP). Short term weakness in USD that ultimately resolves, longer term, with strength.

However, unlike our peers, we do not expect any selloff in rates due to tariff development. The threat of tariffs will be bullish for bonds.

Let it never be said that you don't put in the work, because my goodness, you put in the work

This was a great read -- I'm also super interested in your thoughts on the suspension of the de minimis exemption