Macro Memo: August 2024

Our Outlook: Optimistically Paranoid

The keyword remains “normalization”.

Continuing to “normalize” the economy while walking on the right side of the fine line, across which momentum to the downside overshoots the target, is the current balancing act we’re facing.

Bad news has primarily continued to be interpreted by the market as bad news (i.e. a weakening economy is no longer a positive for stocks on hopes of triggering more cuts, but rather a negative on worries of impacting earnings).

The job market continues to weaken on the surface, but show some signs of resiliency beneath it that we will attempt to illuminate.

As we outlined in GMTFI Part 4, the distinctly dangerous territory we are in economically right now - the fact that we’ll continue getting more clarity as to whether the Fed will cut into a recession or cut and avoid a recession, necessitates an increased level of macro-awareness for all investors, regardless of focus.

We are keeping good on our word to continue with monthly macroeconomic memos to put the data in front of you, hopefully encouraging you to draw your own conclusions.

We’ve shared our thoughts on “Schrödinger’s Soft Landing” (explained in our last market outlook here), in which investors move rapidly between recession panic and economic reacceleration panic. We’ve seen that continue to play out since last month - most significantly in equities with SPX taking a 9% drawdown over 2 weeks that was rapidly reversed and now is fading again.

However, the conclusion that the US economy would end up in a recession as it did with previous hiking cycles is currently unsupported by data. Rather than heading into a recession, we believe that the US economy is well positioned to achieve a soft landing through “normalization” where the pace of economic activities smoothly returns to pre-COVID pace.

The overall assessment we currently have is that the US economy has decidedly cooled over the past two years since the Fed’s hiking cycle began. Various metrics show that the broader economy has slowed from households to firms, from large corporations to small businesses.

And as we shared in GMTFI Part 4, this is the time of the cycle to remain paranoid. That has only become more true.

We’re currently seeing both of the conditions for that aforementioned paranoia play out amidst continually economically unnerving news flow. The two conditions are on the exact precipice.

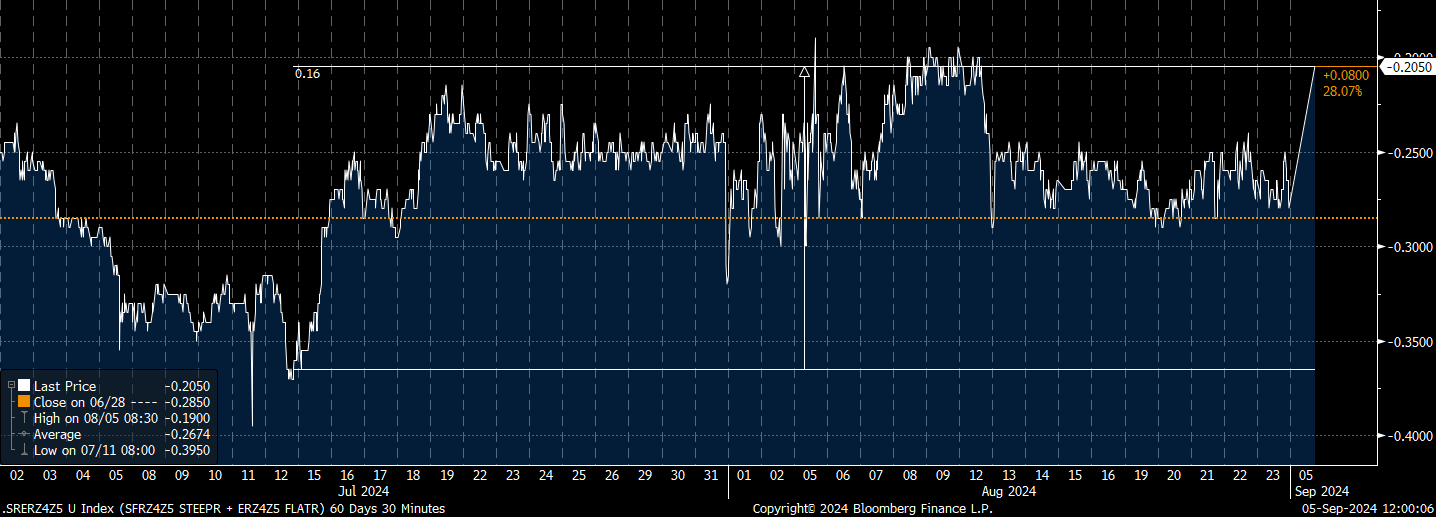

The market is pricing in a 100% chance of a rate cut at the September meeting, with a 35-40% chance of 50bps (changing rapidly as I write this). Our recommendation to remain positioned for a steeper yield curve that would uninvert within months played out in violent fashion for 20bps of steepening, and currently sits at the 0bps level that delineates inverted/normal.

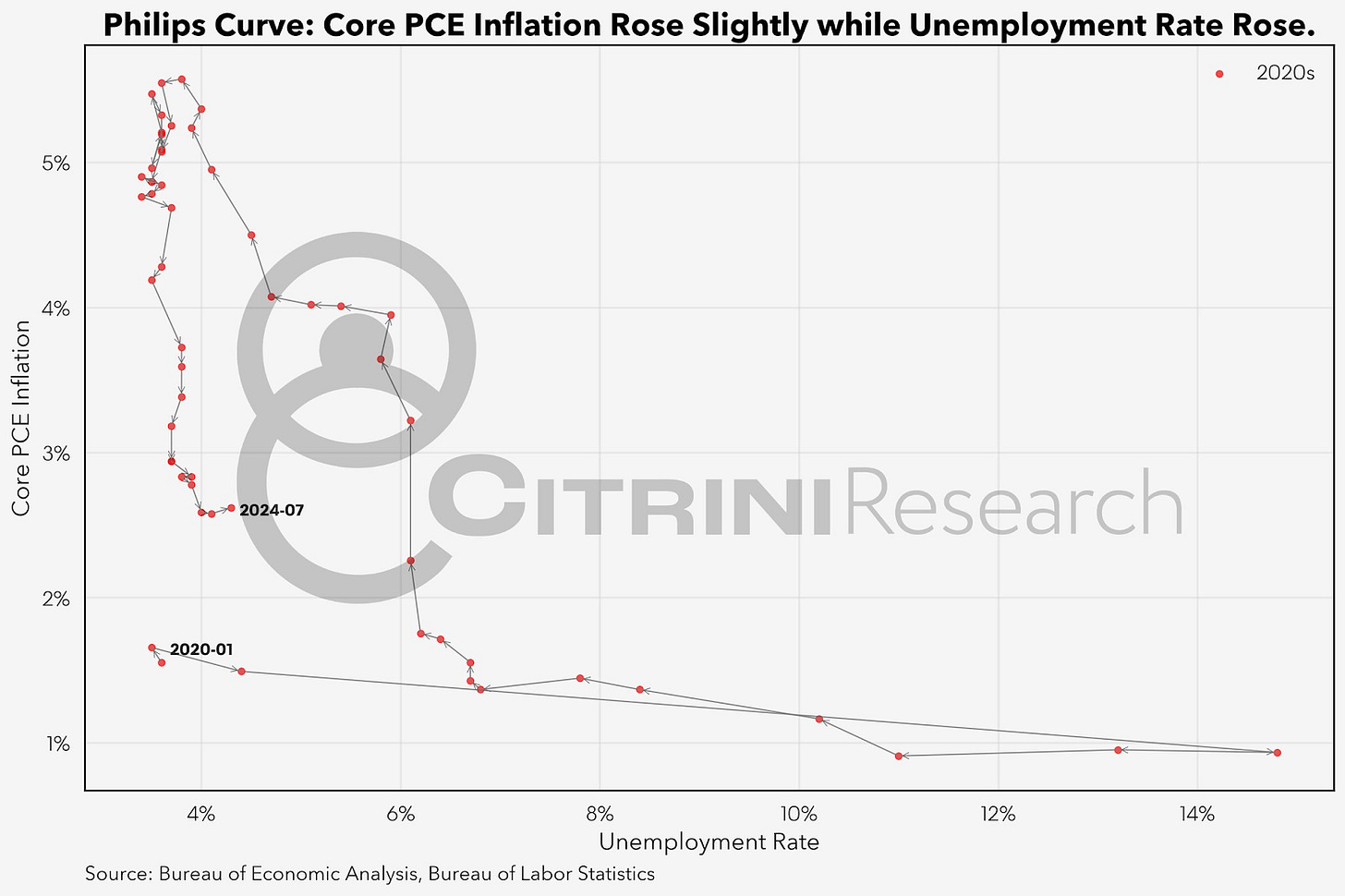

As originally outlined in April and re-stated in July, we believe that the odds of an inflation re-acceleration in the US remains low. Measured inflation should continue to decline towards 2% with the risk remaining and overshoot.

Without a doubt, the key risk remains slowing growth rather than inflation - hence why the Fed will begin cutting this month. The determination of “growth scare” remains in place, so let’s find out if we need to do Halloween early this year.

While our “Global Macro Trading for Idiots” series is free for all subscribers, these monthly macro updates will only be available to paid subscribers of CitriniResearch

To receive all our monthly macro updates and other paid content, please consider becoming a paid subscriber.

The Scare-conomy

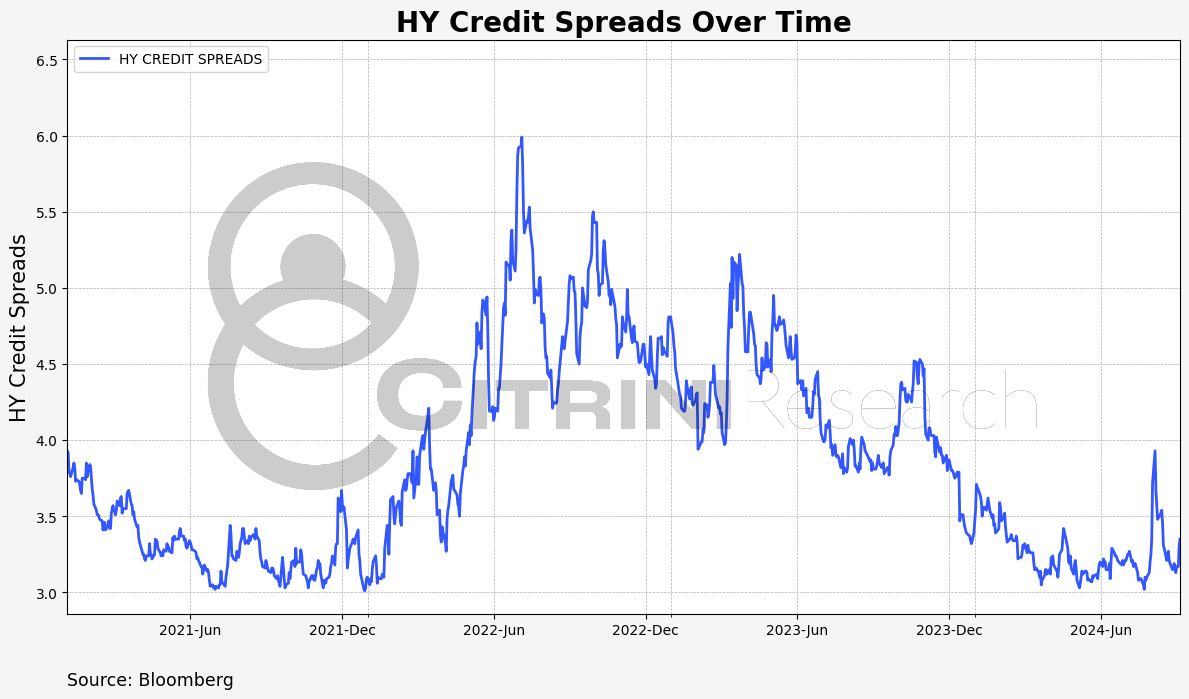

We will likely have more growth scare episodes as the economy continues to decelerate. Investor fear, given the significant underweighting of bonds that has occured in favor of being maximally allocated to equities and significant unrealized YTD gains accrued, is palpable. But we have seen a clear policy playbook and credit conditions have already begun to ease. Businesses and households have already begun to respond, as we’ll highlight later in the memo.

While “growth scare might seem like minimization it’s important not to view them that way - as we saw in August these can be extremely damaging if you are using leverage and can definitely persist longer than the week long panic we saw last month. Keep this potential in mind when you’re assessing the risk of new positions.

There’s always a growth scare or a soft landing squeeze around the corner in Schrodinger’s soft landing.

Credit spreads remain relatively sanguine but have recently begun widening.

So where is the US economy since our July update?

We start in the same place, where we started in our last macro piece: the Beveridge Curve and the Phillips Curve, which sum up the highly dimensional state of the US economy fairly well. Job market continues to loosen with lower job openings rate and has given way to a rise in unemployment. The soft-landing was always going to feel like a recession in real time, hence Schrödinger's soft-landing!

The Fed’s Cutting Cycle

Fed governor Chris Waller, whose thesis of “soft-landing” (“getting inflation down without driving up unemployment through the reduction of job vacancies”) has been fully vindicated, warned in Jan that job vacancies cannot be counted on dropping indefinitely without eventually translating into a “significant increase in the unemployment rate”.

In fact, Waller gave us a very specific threshold of 4.5% job opening rate. Based on the job opening rate from Wed’s Job Openings and Labor Turnover Survey (JOLTS) report, we are currently at 4.55% or about a whisker from the 4.5% threshold.

“Now, we argued that this couldn’t go on forever. We showed in our research that if the vacancy rate continued to fall below 4.5 percent there would be a significant increase in the unemployment rate. So, from now on, the setting of policy needs to proceed with more caution to avoid over-tightening.”

- Chris Waller, Jan 16, 2024, Washington, DC

The important thing is Chris Waller has credibility given his prescient prediction and vindication and likely Powell’s ear. Therefore, it is likely that this threshold much like (perhaps even more than) the Sahm rule will be well known by FOMC members.

Powell didn’t give his Jackson Hole speech in the clearly dovish fashion by accident. He chose his words carefully and sent a clear message that they see the downside risk of overtightening. In fact, it is useful to review the exact words Powell used at the Jackson Hole meeting:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks. We will do everything we can to support a strong labor market as we make further progress toward price stability. With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market. The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.”

- Powell, Aug 23, 2024.

Does “We will do everything we can to support a strong labor market” remind you of Mario Draghi’s “Whatever it takes and trust us it’ll be enough” moment, except without a live crisis?

This is a message that has been received by the market to some extent but would be cemented by a larger than expected cut as the first salvo of the cutting cycle.

Note that Powell said they’d support a “strong labor market” and not “to rescue a weakened labor market after inflation has been assuredly slayed”, which was what the Fed was prepared to do at the start of the hiking cycle. Now, Powell & Co feel confident their focus should be primarily on employment - that they can do both and can comfortably cut rates expeditiously towards neutral (wherever it is but assuredly below 3%) without triggering an immediate re-acceleration of inflation.

Therefore, we believe the Fed will cut by 50bps at the next FOMC meeting to jolt the national narrative into a positive tone. Why would an extra 25bps make a big difference? Well, the latest Beige Book (pg. 2-4), which publishes feedback from regional Feds, shows that businesses are not yet outright pessimistic and resigned to recession, but are just uncertain and rightly cautious.

However, a collective and prolonged state of caution can result in a recession in a reflexive fashion as we described in our last macro piece. We believe the Fed can change that narrative while the economy is still relatively healthy and responds well to lower rates. Once it’s sick, they’d need to up the dosage a lot more with worse effects.

Some positive news

The Beige book is a nice segue for us to look at one of the interesting bits that we didn’t spend as much time on in the last piece: the perspective from small businesses. In the coming weeks, the drumbeat for a recession may get increasingly louder. But it’s useful to remember some positive perspectives.

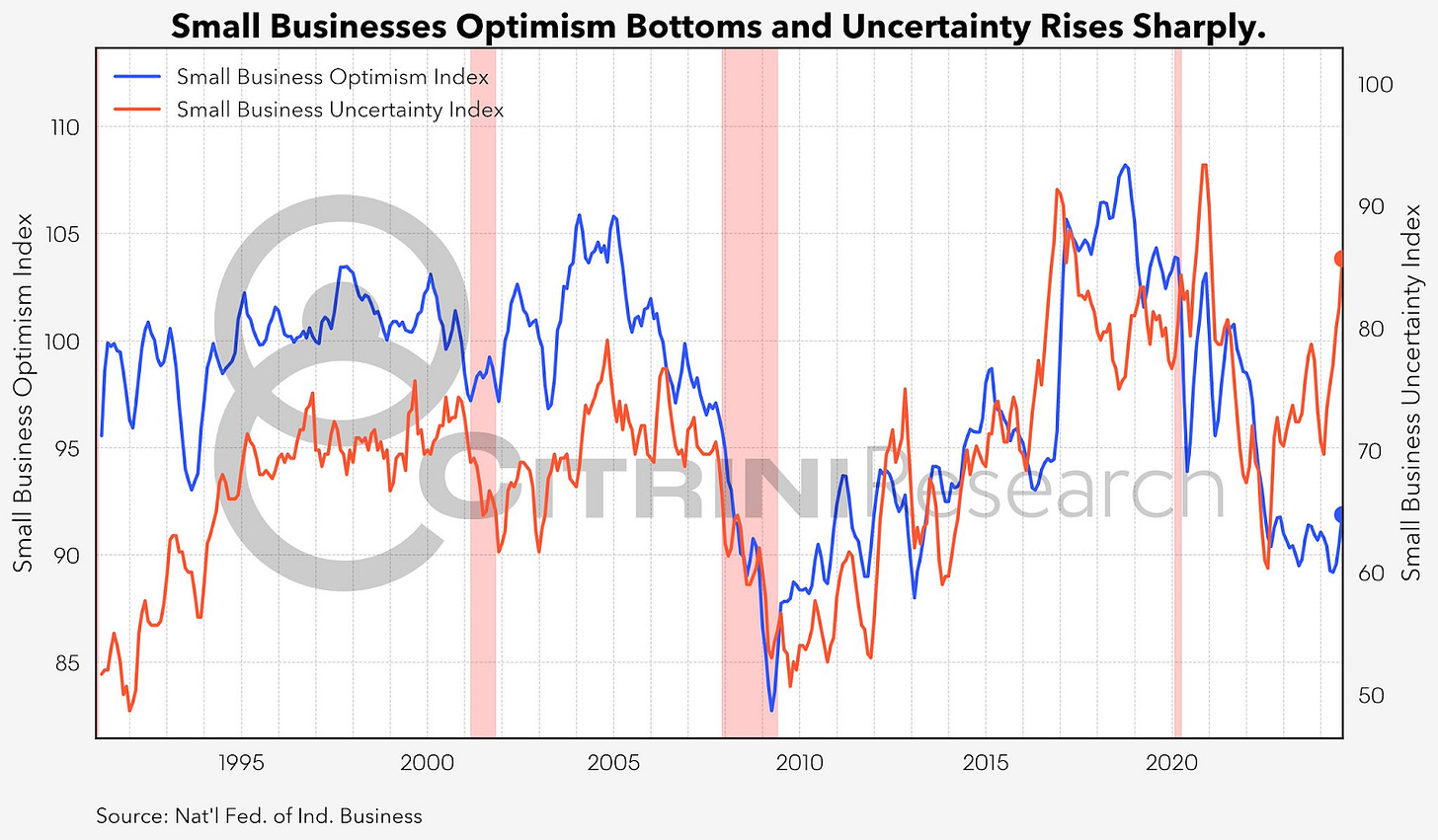

Small businesses are cautiously more positive.

Small businesses have no plans of raising prices in the coming months or spending more on worker compensations.

While remaining at historically low levels, small business confidence appears to have bottomed even as uncertainty spiked, understandably with a general election upcoming.

Small businesses generally have felt the pinch of much higher interest rates. However, credit conditions (availability of loans) have finally bottomed and seemingly started to inflect upward.

The easing of credit conditions is corroborated by the SLOOS survey of bank lending officers. Lending standards, which have begun loosening since the middle of 2023, have finally been felt by small businesses.

The softening of the job market, which has made workers more abundant for small business, has been welcomed with a bottoming of hiring plans and capex plans as well.

Overall, we believe that the Fed has the tools to successfully achieve the soft landing and avoid a recession. We remain optimistically paranoid.

There will be more growth scares out to the end of the year but they will mostly be positioning or seasonality driven and, as is characteristic of growth scares, will represent a level of panic that is unwarranted by the data.

Some context around frequently cited alarming numbers

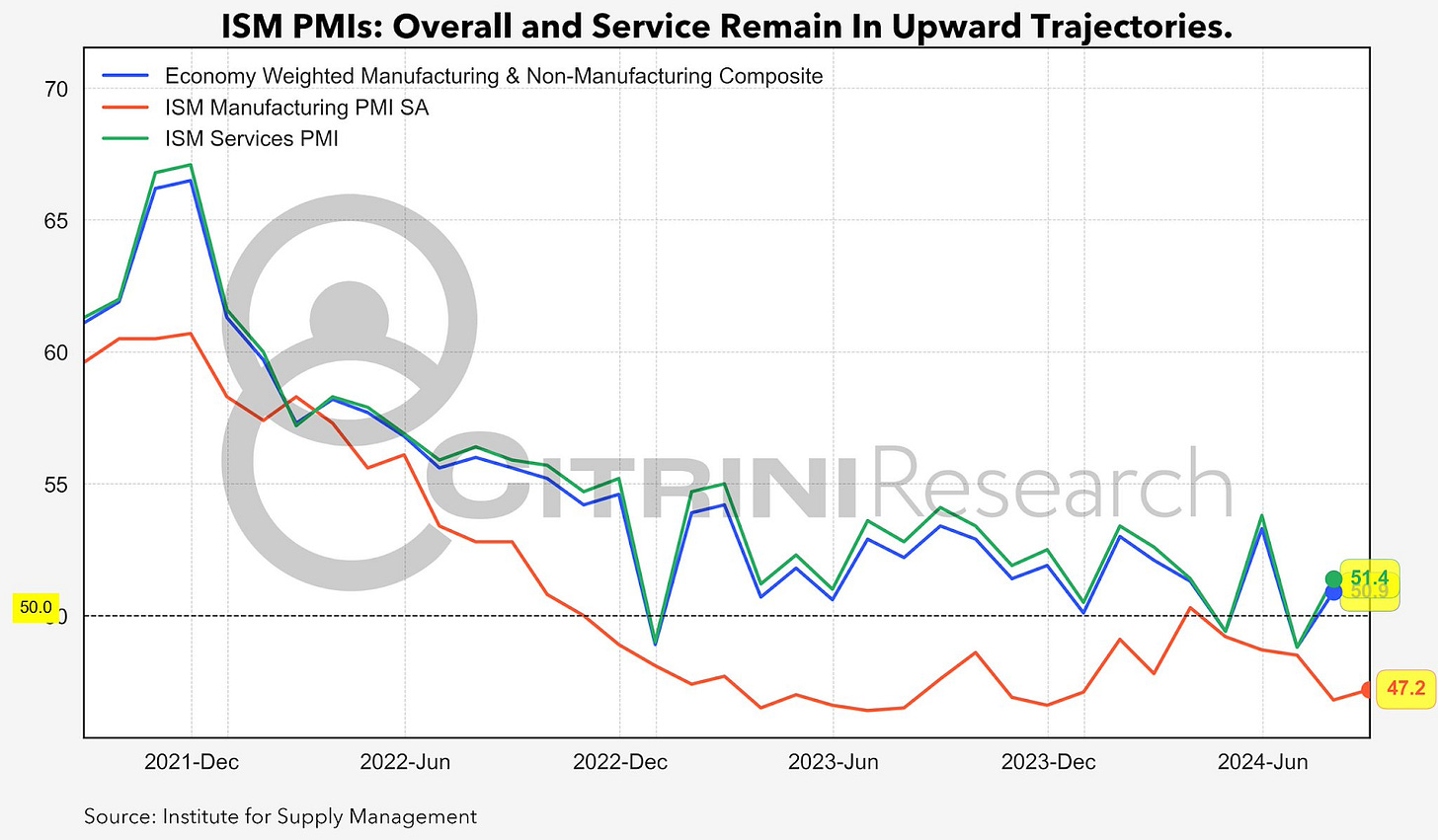

We got some news this week from the ISM manufacturing report. We learned that the ISM manufacturing index, which is a net diffusion index, came in at 47.2.

This is a rather confusing index though and has been extremely noisy to say the least. Even though it came in at 47.2, less than 50, but inflected higher than the previous month, apparently according to the ISM methodology, it is not even necessarily inconsistent with “an expansion of the overall economy”. Indeed, if we look at ISM services and the composite, we see that they are both above 50 or in expansion. This is unsurprising because the US economy is mostly (around 80%) services-based now.

If we look at a longer history, ISM manufacturing has often been in a contraction while the broader economy was in expansion and not in a recession. So it’s entirely possible for the manufacturing sector to be in a recession without the broader economy being in one as well

While we are looking at diffusion index surveys, we find that the S&P global market intelligences led by Chris Williamson to be a more reliable and better constructed set of measures. Here too we find corroborating evidence that the manufacturing sector is weak but services and the broader economy are doing just fine and seem to have in fact rebounded since earlier this year.

This is a pattern we’ll see repeated in other contexts later. By the way, the Apollo academy, which keeps track of higher frequency alternative data like airfare booking, TSA airport traffic, restaurant reservations and Broadway shows etc. show similar suggestive evidence that the services sector remains robust. Recent retail numbers seem to indicate the same.

Jobless Claims Are Still Within Seasonal Ranges

Even though we have also seen or heard that jobless claims have been rising at least on a seasonally adjusted basis, what they actually look like is this: on a non-seasonally adjusted basis, we are tracking seasonal norms as previous non-COVID years. Continuing claims are tad higher, but also nothing particularly unusual.

Consumers Remain Strong-ish

Real consumer spending from non-durable to durable goods to services remains on an upward trajectory. Durable spending is particularly notable as it historically has tended to predict recessions as consumers pull back making major purchases. (Historically, housing/home sales is another indicator but this time around this signal is significantly weakened by the abrupt changes in interest rates.) The recent rebound in durable spending also indicates that the economy has likely responded to the anticipated ease in credit conditions.

Even if the US economy genuinely weakens, US consumers are currently responsive to lower rates:

US subscribers check your Gmail inboxes, you’ll have received offers for HELOC loans to extract home equities, of which American households have a historic amount. I was offered 8.5% before rates came down and I’m sure if I looked again now it would be around 7.5%.

Even though savings rates are low, there’s a lot of net worth through the appreciation of assets, such that the US consumers can be counted on spending for some time to come. It is very much a sad story of K-shaped economy or the haves-and-have-nots. The haves are enjoying broadly lower inflation and lower rates and appreciated assets because the have-nots are being crushed by high inflation, low real income and higher cost of credit.

As rates go down, homeowners that are stuck in their lower rate homes will likely begin doing home remodeling again while Millennial homebuyers will be home hunting again amidst a secularly low inventory of existing homes, most of which locked at much lower rates.

Unemployment has not translated into layoffs, which will only tend to occur with profit margins pressured:

Profit margins remain at historically elevated levels with S&P EPS expected to grow in 2025 and 26. When firms are profitable, they are reluctant and unlikely to let go of workers easily even if they’ve turned cautious on hiring. This is also supported by other measures of corporate profit margins, including NFIB of small businesses and comparison of inflation with UIC.

Inflation running above labor input costs means that firms are profitable and likely more reluctant to let go of workers with ease.1

Additionally, as wage growth has moderated productivity has improved…

Construction sector employment remains solid, for now.

The construction sector employment remains strong and continues to grow. As Guy Berger recently aptly put, the increase of unemployment rate is consistent with mid-recession, the fact that increase of the unemployed is mostly reentrants is consistent with early recession, but the continued growth of the construction employment is consistent with no recession at all! This is perhaps the weaker positive argument as there is clearly slowdown in places not supported by fiscal policy.

For what is worth, we do not expect an immediate re-acceleration

So should we expect an instant rebound of the economy with inflation surging again as soon as the Fed starts cutting as some permabears suggest? No! It is highly unlikely scenario but we thought it might be worth it to walk through. If you are not at all concerned about this tail event, you can skip!

First, most homeowners either have no mortgage (40%) or have rates much lower than the currently mortgage rates that rates will need to fall substantially lower for refi to be activated in any meaningful way.

In the last month, new home sales is supposed to have rebounded some 10% from the month before and causing some inflationistas to celebrate. However, this should not be read as inflationary but indeed welcome stabilizing news. The truth is that new home sales represents a very small share of the overall US housing market, which remains largely dormant as most existing homeowners are locked in by low rates and would-be buyers are locked out. The new homes that are selling are from public homebuilders, who offer generous rate buydowns to buyers, while inventory of new homes from private builders is accumulating!

Meanwhile, homebuyers’ intentions to buy a home, as also reflected in mortgage applications, continue to trend lower even as mortgage rates decline. This is consistent with consumers' broader bearish assessment about the job market and their overall confidence. This may seems somewhat puzzling giving that on the one hand, consumers are right to feel unconfident given jobs indeed have become harder to get as data above demonstrates. On the other hand, consumers continue to spend. I think this is a reflection of the K-shaped economy effect, where the Costco-shoppers and Dollar General/Aldi shoppers are just having vastly different economic experiences.

Predictions, Trade Ideas & Trade Updates

While the primary point of these macro memos is to present readers with the data at a pivotal moment for the US economy and markets, we'd be remiss if we didn’t live up to our mission statement: “You’ll never have to ask ‘What’s the Trade?’”.

It’s important, however, to realize that things have gotten increasingly uncertain and these setups are not as juicy as they were the last time we wrote up a collection of macro trades. Size accordingly.

Cautious Optimism: Aug Jobs Report Rebound

Given the noisiness of the NFP series, notwithstanding the Texas hurricane that the BLS already denies having an impact on the July soft number, we still expect a decent chance of a rebound of the Aug jobs numbers given the underlying strength of the economy as seen in recent retail numbers as well as consumer discretionary earnings call commentaries. Consumers are not as strong but still solid and businesses are still doing relatively well.

Unless the Aug jobs report comes in very strong, we still believe the Fed would likely proceed with a 50bps cut that in combination with a better than expected jobs report, can provide the reassurance and jolt of positive narrative the economy desperately needs - something absolutely necessary to achieve the soft landing rather than simply defeating inflation via overshooting the target to the downside and entering a period of economic recession. However…

New Trade Setup: SFRZ4M5 Flattener

In terms of trading, it is not very asymmetric right now to bet on a 50bps cut for September. With options on U4, you’re looking at roughly a 2 to 1 return betting on either a 25bps or 50bps cut and being right. That’s not very attractive. Furthermore, we don’t necessarily believe that the Fed will cut 50bps more than once.

Therefore, we believe it is more accurate to express a view that the Fed cuts a total of 100-125bps in H1 2025.

As you can see in the chart below, the market has really run with the idea of front-loaded Fed cuts which we believe would require a much clearer picture of definitive economic weakness to arise for the rest of the year. Contrary to this, we believe the data continues to send mixed signals until the end of Q4. As Powell stated in his Jackson Hole speech, their approach is going to be strictly data dependent (I would view this as the diametric opposite of Q2/3 2022 when they were equally data dependent but on inflation rather than employment).

I am short Z4 and long M5 (Z4M4 flattener) with a stop at -75bps looking to take profit at -125bps. I believe this offers more asymmetry than being short Z4 outright as it will benefit from cuts getting pushed out if NFP comes in better than expected but also if expectations that the Fed cuts more aggressively to bring the Fed Funds rate down further than expected over the next few quarters (current market implied rate is ~3.25%) if the economy continues along its worsening trajectory and does not respond quickly to the Fed’s efforts to prevent that.

Existing Macro Trade Idea Updates

FX Updates:

We exited our negative beta FX basket that was playing a carry trade unwind that we highlighted in GMTFI Part 4 on August 5th (link to Subscriber Chat alert) for a total return of +11.16%:

I believe USD has bottomed but that we will still see some economic weakness narratives driving FX. We put back on short USDJPY on 8/12 and exited it recently and currently the only FX trade we have on is long USDMXN, which we originally exited with the rest of our negative FX beta basket but reentered on 8/20 at 18.80.

We currently have 2/3rds of this position remaining and have placed our stop at 19.50, which guarantees a profit regardless. I will be holding this (with the stop in place) through the NFP print.

Curve Trades

As mentioned earlier, we took off our 2s10s steepener that we had entered on June 21st entirely as it uninverted during the carry trade unwind panic in early August.

Entry at -48bps on June 21st:

1/2 Exit at -29bps on July 2nd:

Full exit at -0bps on August 2nd:

We will put this back on if 2s10s manages to stay above 0bps for more than a day.

SOFR/Euribor Box (The Euribox?)

In GMTFI 4, the last macro trade we recommended was a SFRZ4Z5 steepener paired with the ERZ4Z5 flattener. That has worked out well enough and generated +16bps.

I am going to exit half of this and keep the other half on with a stop at -30bps.

Equity Outlook

The bad news is that I don’t necessarily see significantly asymmetric upside to equities from a better than expected jobs report tommorow. Most of the scenarios seem to reinforce seasonality and investor fear thereof contributing to more pressure. I believe we will likely continue to trade within the range set by the mid July-early August drawdown on SPX and will likely revisit those lows once more before rebounding into and after the election. I am keeping on our hedges which we recently sized up to 2% of our book (which reached 3% during recently volatility).

Best of luck out there!

This chart was brought to my attention by Dario Perkins on Twitter

Nice read boss

Great note, very much enjoyed reading it. Would be really helpful if there is a tracker for these macro trades, similar to the sheet tracking the equity stuff. I feel macro is back and there will continue to be themes (as you have subscribed to) that can be unique sources of alpha and complement all the equity stuff.