Global Macro Trading for Idiots: Part Four

It's the Economy, Stupid

Hello, idiots.

Do you ever wonder why it’s shortened to “global macro”? I don’t think it’s because “economics” is too long of a word.

I think it’s because we’d all rather forget about the economic part and just go punt FX & rates based off vibes. I know I would.

Unfortunately, sometimes the economy begins to get a little too interesting and runs the risk of becoming the sole driving force for every asset’s returns. Idiosyncrasies don’t matter and correlations go to one.

We’ve been publishing our series “Global Macro Trading for Idiots” series for nearly a year now, but never gone into too much detail on economics.

Now, however, it seems we’re at one of two potential inflection points - either;

a) Jerome Powell pulls off the Herculean feat of navigating us through Covid and the ensuing inflationary cycle to gently thread the economy through the eye of a needle and achieve the soft landing…

or,

b) we blow it, overshoot to the downside and have a recession (whether that’s a severe or run-of-the-mill recession is a whole different story).

What’s for sure is that the biggest macro risk has shifted from inflation fears to growth scares. What’s more, the US economy is currently in…a weird place.

The Fed does have a chance of pulling off the fabled “soft landing”. But in terms of scenario analysis and attributing probabilities to potential outcomes, the fact remains: history tells us it’s unlikely to have a rate hike cycle not followed by a slowdown. And risks of slowdowns snowballing are real, they’re very feedback loop-y.

Not just that, the riskiest part of the cycle does seem to sadistically be when everyone goes from convinced there’s a recession coming to believing things will be fine.

Concerns going forward are likely to continue shifting away from inflation and towards whether we get the good kind of rate cuts (“yay, the economy normalized”) or the bad kind of rate cuts (“oh god no, the economy normalized and it’s not stopping!”).

There will be no “soft landing accomplished” banner and no aircraft carrier upon which to fly it. Investors will be left to decide whether we are there or not - and investors over and under react quite often. So, we might be in for a bit of volatility while the market navigates that. It’s important to have a touchstone in some data.

Unless there’s a serious unforeseen shock, we have the uninversion of the yield curve and the first Fed rate cut of the cycle to look forward to in the next few months.

Both of these things have been associated with some unpleasant outcomes in the past:

Zooming in on these charts really makes a case that it’s probably time to get a little bit…I don’t know if paranoid is the right word, but the word cautious seems too tame.

On average, the stock market does pretty well while the yield curve is inverted. The first 48 weeks following 2s10s inversion average a 12.8% SPX return.

It’s typically the uninversion that is worrying.

SPX tends to have subpar returns on average beginning around 30 months after the first point of yield curve inversion:

Despite any potential risks this may signal (along with other indications of weakness discussed below), the stock-bond correlation has remained significantly positive.

This makes it trickier to hedge against a potential recession and means we have to get a bit more creative than the ol’ 60/40:

If you’ll recall, our thesis in 2022 & 2023 was that the U.S. economy would avoid a recession primarily due to the lagged effects of demand side stimulus and the significant unlocks of funding from supply side stimulus translating into spending.

That has continued to play out and have a pronounced impact - especially on the supply side with industrials and manufacturing - but we’re entering a period of heightened uncertainty regarding fiscal policy. Furthermore, the procyclical fiscal stimulus we discussed in our piece “US Fiscal Primacy” seems to have normalized somewhat during the election year.

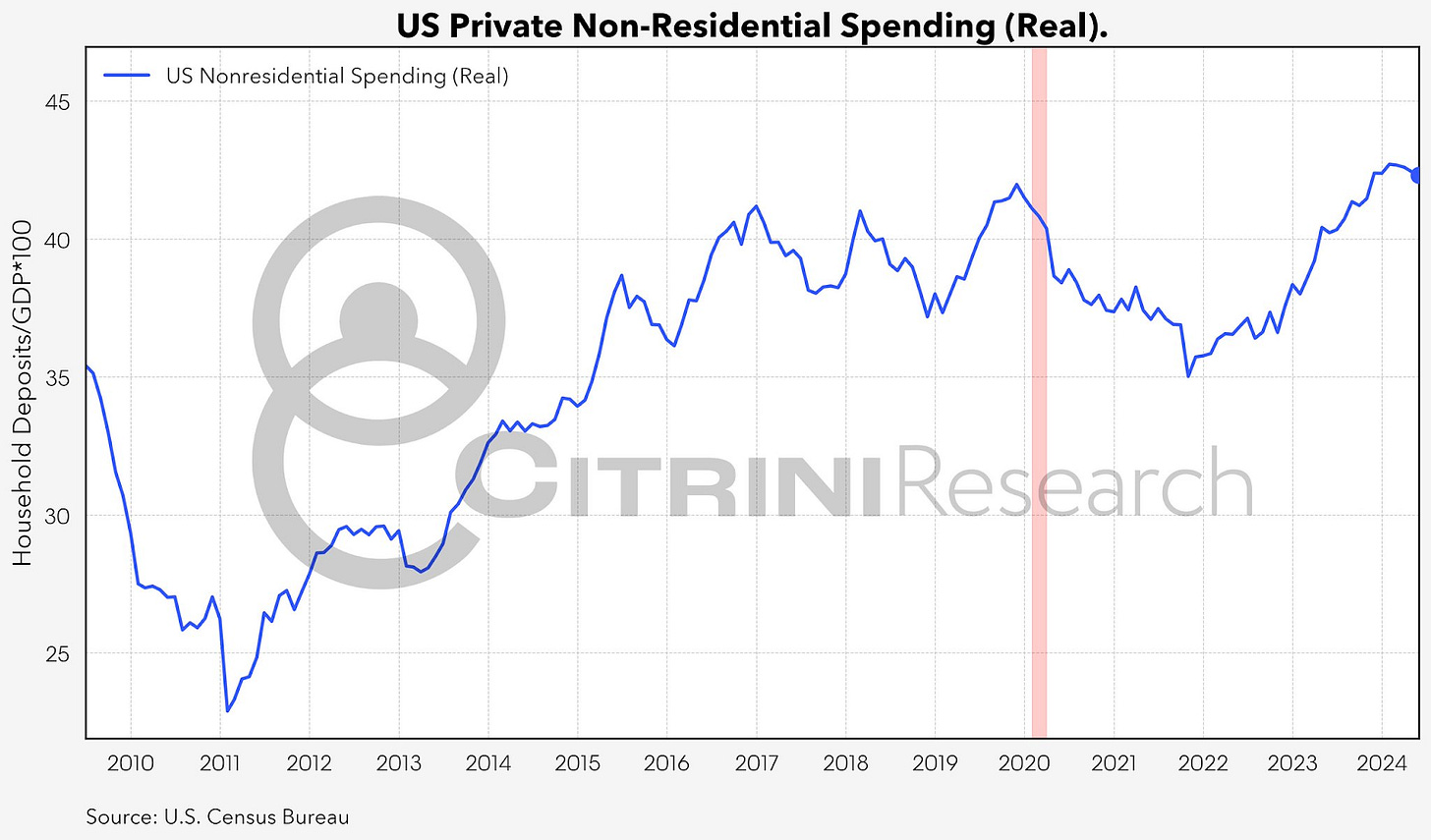

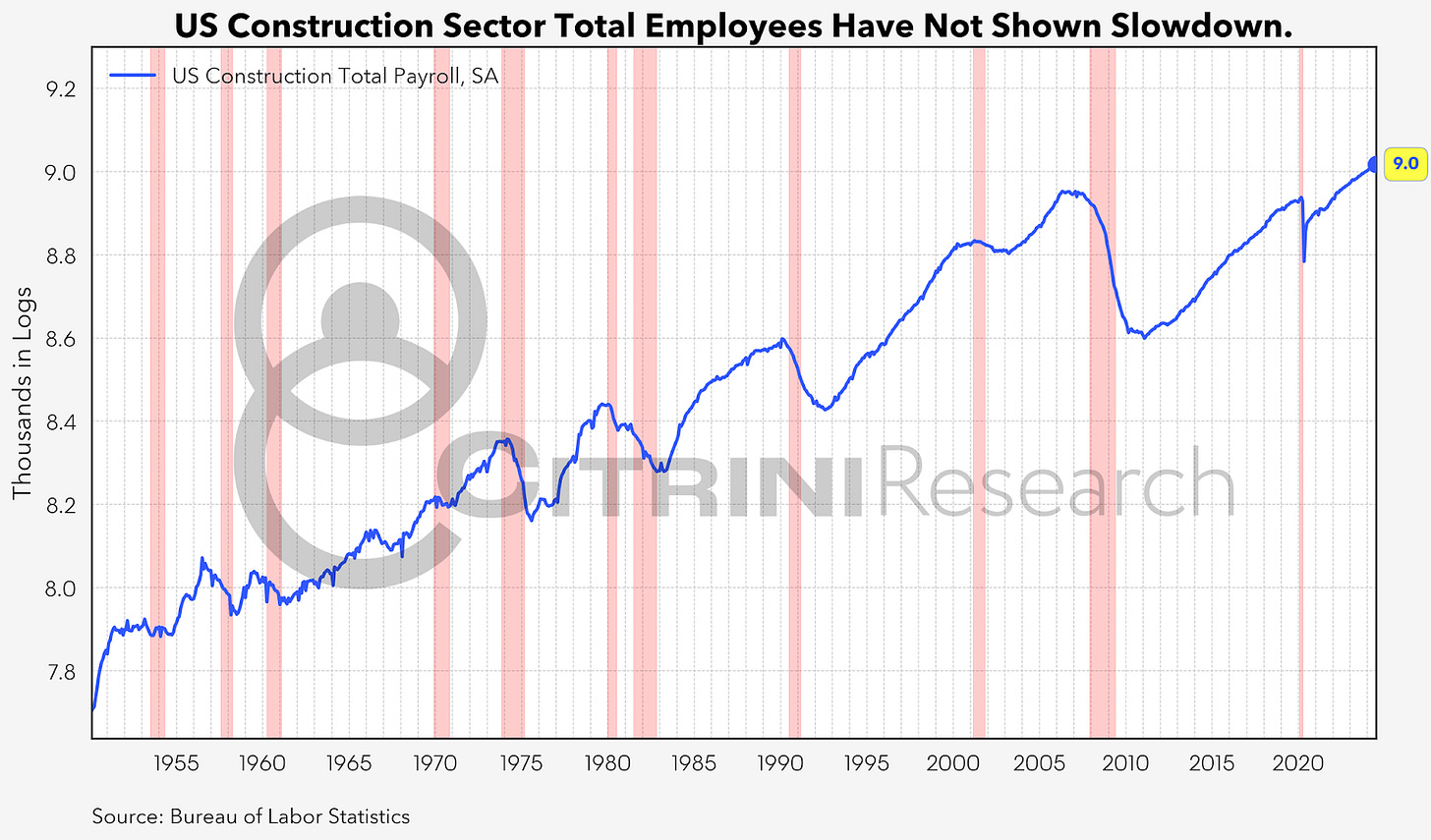

Of course, this doesn’t mean that the impact of legislation like the IIJA and IRA has abated. The funding is still translating into spending that has continued to have a very supportive effect on manufacturing and construction:

Furthermore, whether due to a generally strong economy or those lagged effects of fiscal stimulus, there’s still a wealth effect that seems distinctly above trend.

It’s also increasingly a tale of two economies, as the lower quartiles of earners and net worth bear the brunt of the recent inflationary episode.

Perhaps that explains why we’re beginning to see a durable uptick in delinquencies…

That all being said, part of the soft landing is…the landing. And we’ve all put up our tray tables and have our seats in the upright position.

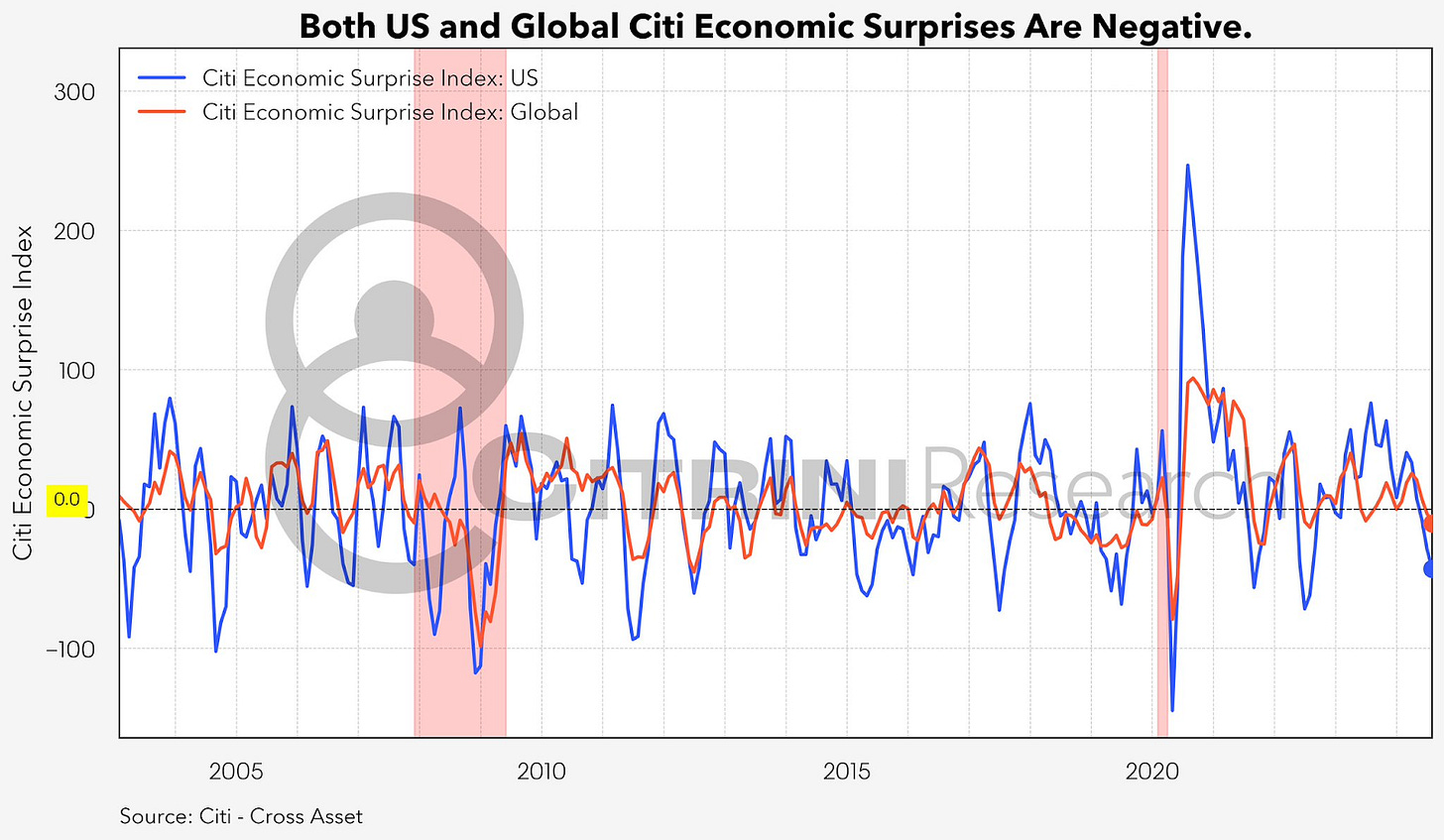

The economy has definitively weakened, evident in wage growth & the labor market. Citi’s Economic Surprise indices are negative in the US and globally right now.

So, this installment of Global Macro Trading for Idiots is going to focus on economic data. Specifically, US economic data (because freedom).

This will function as both educational and oriented towards reviewing the current economy. That way you can form an opinion on it yourself and I can go back to pontificating about weight loss drugs and artificial intelligence stocks.

We’ll be periodically updating charts in this series until we think that the risk to the downside has dissipated (if it materializes, probably best to get used to a lot more of them).

So, where do we begin?

Like previous GMTFI articles, this will start simplistically and progressively get more complex.

Let’s look at the skeleton of the current U.S. economy:

UNDERSTANDING GDP

GDP is the total value of goods and services produced within a country. The U.S. economy has been experiencing a slowdown in GDP growth, raising concerns about a potential recession.

While nominal GDP growth rates have steadily slowed down since 2021, real GDP growth, which captures the actual quantity of economic activities, has in fact staged a clear rebound since the start of 2023, which has given economy watchers hope that we may indeed be headed towards a “soft landing”, where inflation comes down (towards Fed’s 2% target) but the real economy does not enter a recession.

Nominal GDP growth is the sum of inflation (change in nominal prices) and the real GDP growth. The business cycle is fundamentally about understanding the dynamics of these two objects. The challenge is that each of these objects is highly uncertain and multi-dimensional, hence requiring the need to observe them from different angles, a la the blind men feeling the elephant.

Although there’s no real way to get everyone to agree on what a recession is, one classic (and flawed) definition is two consecutive quarters of negative GDP growth.

UNDERSTANDING INFLATION

Inflation refers to the general increase in prices of goods and services over time. An important distinction is that inflation is measured as a price index (the “Consumer Price Index”, for example) which you can frame similarly to a stock index.

CPI

The most familiar measure is the Consumer Price Index, which is prepared by the Bureau of Labor Statistics or BLS. The CPI is calculated through a multi-step process that involves collecting price data, weighting items, and comparing changes over time. Just to get a sense how complex this process is, here is roughly how CPI is calculated.

The CPI reflects a basket of goods and services that the BLS determines (via the famously infallible mechanism of consumer survey) to try to reflect the spending habits of American consumers. This includes price data on around 80,000 items each month from about 23,000 retail and service establishments, as well as 50,000 rental housing units.

Each item in the basket is assigned a weight based on its proportion in the aggregate consumer expenditures, similar to how the S&P 500 might weight stocks by market cap. For example, housing costs typically have a larger weight than entertainment expenses.

The basic formula is:

CPI = (Cost of basket in current period / Cost of basket in base period) x 100 When you hear someone say “Inflation is coming down”, what they mean that the rate of change is decreasing (termed disinflation, and not that the index level is outright declining (which would be deflation).

The calculation of inflation sounds simple until one tries to actually consolidate all the various prices in the economy from a bag of potato chips, to a plasma TV, to a home insurance policy into a single number.

How do you deal with quantity change, quality changes over time, sales and promotions, so on and so forth?

How does one account for “substitution effect” (consumers switching to cheaper alternatives) or smooth out predictable changes due to seasonality without muting too much signal value?

The “change in the general increase in prices of goods and services over time” is by no means a simple thing at all.

We often hear people allege that government agency-released inflation measures are “heavily manipulated”.

No shit. Of course they are! There’s simply no other way around it, inflation measurements are ultimately a function of the model used to measure it.

For us, however, it’s not so important that we measure inflation in a manner that accurately reflects the real increase of cost of living (it will not) but rather to recognize that the measure captures imbalances in aggregate demand and supply.

These various measures are all just different ways of capturing and gauging a high dimensional object. This is why there exists more than one “inflation metric”.

The most common inflation measures for headline CPI, core CPI and core PCE price index.

Headline vs Core

investors and policymakers alike sometimes find it helpful to look at the “core” inflation by stripping away the volatile sub-categories of the basket of goods and services such as energy and food because they are famously seasonal and “noisy”.

The reason to strip out the noisy components is not to conveniently look away or cherry-pick favorable numbers to understate the severity of inflation. Rather, it’s because we believe that based on extensive historical data and experience, the inflation in such categories tends to jump up and mean-revert quickly. To the extent that the goal is to identify persistent underlying imbalances of demand and supply in the aggregate economy, it makes sense to examine the less volatile categories in isolation.

CPI vs PCE

While the CPI is the more commonly known measure of inflation, core PCE is historically the Fed’s preferred gauge of inflation.

The Personal Consumption Expenditures Price Index or colloquially “PCE’ is different from CPI in several important ways (but not in the way Econ 101 textbook tells us): PCE contains a much bigger basket, obtains expenditures data from businesses rather than consumer surveys, and allows more frequent consumer substitutions therefore tends to be lower than CPI.

The Fed prefers the PCE for several reasons. Rather than the household survey, the PCE comes from the same data that is used to calculate GDP and contains a wider range of consumer expenses. The PCE allows for more frequent (monthly rather than annual) updates to weights of items hence captures consumer behaviors esp the substitution towards cheaper goods and services. This is perceived to be closer to the cost of living changes actually experienced by consumers. There is an argument to be made as to whether this captures “cost of living” more accurately, but it is the metric that the Fed historically focuses on.

During this most recent great inflation episode, the Fed has taken into account numerous measures - the idea of a favorite has not really played in.

Fed officials from Powell down to FOMC members have repeatedly emphasized that they shouldn’t and wouldn’t wait until “inflation returns to 2%” before cutting. In fact, if we remove housing, which has been the most stubborn component of services inflation, core PCE is already under 2%!

Unfortunately, people do still kind of need housing in order to live. But those housing prices could be skewed. More on that later.

Goods vs Services

Here’s another way of cutting inflation to get a higher resolution into the underlying dynamics hence better forecasts of future inflation.

Services inflation tends to be more sticky or sluggish than goods inflation.

Of the things consumers consume, they broadly divide into “goods” and “services”, think a bag of chips or a car vs a medical treatment or health insurance policy.

Services tend to require more direct labor input or interaction, whose wages tend to be negotiated in longer term contracts and adjusted slowly. Further, services tend to be more local and personal at the point of consumption (think haircut or renting an apt) and thus have fewer substitutes and face less competition.

Unlike goods inflation, services inflation tends to be asymmetrically sluggish to the upside. Services cannot be hoarded, have excess inventory. Services workers tend to expect wage gains and experience little productivity gains from automation, therefore rarely experience outright deflation.

Early on in this inflation cycle, there was the worry that goods inflation if left untreated and running hot would eventually seep into services inflation and become entrenched, which it indeed had done. This had led to a lot of worry that inflation would have a particularly difficult time of coming down without causing a severe slowdown or recession in the economy. Fortunately, services inflation, sticky as it may be, has shown lots of hope for optimism too as we will discuss in greater detail below.

PPI

Goods and services, however, are not just purchased by consumers. They’re also purchased by the companies who produce and provide those goods. PPI or the producer price index captures cost inputs, which we can think of commodities. This is a less direct measure of the consumer prices, but when the inflationary picture is dire, we take a look at it.

Wage growth

Wage growth is important to watch because it’s closely associated with income, which ultimately becomes consumption.

Persistently high wage growth can lead to high rent inflation while declining wage inflation tends to support declining rent inflation.

People need jobs to keep buying things. And those jobs need to pay a commensurate amount more if things start costing more money. If either of these things begins not happening, people will buy less things.

Simple.

Wage growth is declining across different strata of the US labor force as seen in the following chart: the median worker wage growth is slowing as is that of the job switchers.

That means workers are no longer receiving as big of a pay bump when they jump from one employer to another, which we saw a lot of during the pandemic

More directly than anything else, wage growth tends to be closely correlated with rent inflation (historically speaking), which is about ⅓ of CPI services inflation.

Rent Inflation

We can see in the following chart how CPI rent inflation as measured by owners’ equivalent rent (OER) remains stubbornly high at 5.4%.

However, this is a year-over-year measurement in growth rates of existing rent leases & is not representative of the experience of someone, who is looking to rent an apartment today. Zillow’s rent index is much closer to the cost inflation faced by new renters.

This is further evidenced by the Atlanta Fed’s newly published series, where they calculated the repeat rent inflation of “all tenants” and “new tenants”, respectively. Notice how while all tenant rent inflation remains positive at nearly 4% increase YoY, new tenant rent inflation is already solidly in the negative territory. This highlights what’s so unique about this cycle that there’s such a large gap between two measures that normally ought to be fairly close.

Inflation Expectations

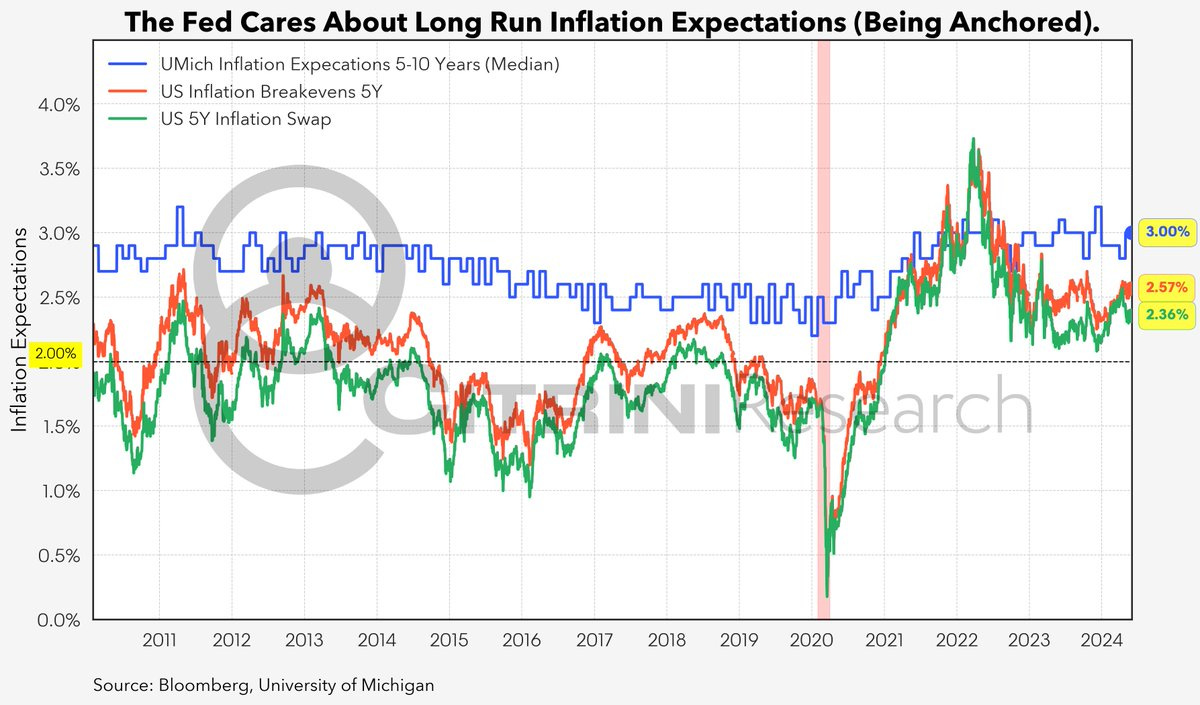

Inflation expectations are watched because the Fed watches them, in particular the Fed wants to make sure that the long run inflation expectations are “well-anchored”.

In some countries, especially in Latin America, Inflation Expectations are really the only thing that matter in determining the policy rate. One could have made a very decent living simply trading Chilean rate forwards off a model of inflation expectations.

There exists a theory (without much evidence) that assumes if consumers expect that inflation will be high in the future, they may decide to consume more today because money is worth less in the future, which creates inflation in a self-fulfilling fashion or even an inflationary spiral.

Unfortunately, consumers are, by and large, unpredictable in their reaction to inflation, especially to high inflation after decades of low inflation like we’ve just seen.

This theory probably works very well when you’re in, like, the Weimar Republic and your daily wage buys a loaf of bread when you clock in and a half a loaf when you clock out. However, when the Fed was in a panic and doing risk management, even a tail risk theory is taken seriously, which is what happened in 2021 and ‘22.

The most commonly cited survey-based and market-based inflation expectations measures are the University of Michigan inflation expectations survey, the inflation expectation inferred from the “breakevens” based on nominal Treasury bonds and TIPS, and finally inflation swap contracts (most commonly Zero Coupon Inflation Swaps or ZCIS).

Those short-term breakevens? Just don’t look at them.

Apart from suffering from liquidity and risk premium contaminations, short maturity inflation breakevens particularly suffer from a “roll/generic issue” where there’s a mismatch between TIPS and the corresponding nominal treasury instrument.

This can be seen in the following chart, where the 1 year inflation breakeven has violently fluctuated suggesting implausibly large swings in expectations. Of course that did not happen. The inflation swap implied expectations are much more stable hence reasonable.

The survey has its own set of problems.

Inflation expectation measures typically target the headline CPI number. Below, we have also plotted the realized headline CPI alongside these two measures, moved forward 12 months to be comparable.

We can see that the UMich survey is really just not very good at forecasting, having spent much of the last decade over-forecasting inflation. The inflation swap rate has done a more reasonable job, although it has big misses as well.

Ultimately when it comes to inflation expectations, as discussed before, it’s not the short-run expectations. The Fed cares about the long-run inflation expectations being “well anchored”.

If we look at the UMich survey for the 5-10y horizon, it’s clearly higher than the 5 years immediately preceding COVID but mostly in-line with the first 5 years of the 2010s, during which inflation was considered a non-issue and certainly very stable.

If we flip over to market-based, both inflation swaps and breakevens tell a similar story: a bit higher than immediately pre-COVID but not too different from the first 5 years of 2010s. This is btw why the Fed has been saying exactly this message as well. They are looking at the same thing.

Now, you can’t have inflation without people spending money (please, do not mention stagflation to me right now. If that’s your reaction you are wasting your time reading this section. Skip ahead, nerd.)

So inflation tends to correlate with people having a job and generally spending money, while deflation and/or disinflation tends to correlate with people getting laid off and generally choosing to save their money instead of spend it. The Fed’s goal is price stability. As much as inflation is bad, deflation is worse.

The job market has remained relatively strong, with low unemployment rates despite clamor for a recession.

Contrary to popular belief (during 2022) the Fed does not want to cause a recession in order to get inflation under control. It wishes to normalize the labor market in terms of aggregate supply and demand to a degree that ensures prices don’t rise exponentially while also managing to not have everyone lose their job.

That’s termed the Fed’s dual mandate.

The Fed’s dual mandate is inflation and maximal employment, whose converse is unemployment (It turns out unemployment is not the same as minus employment, but we’ll come back to that.)

Inflation generally happens in an economy that is overheated and has excess demand relative to its potential to produce supply. There can be exceptions where there can be an adverse supply shock and there’s just generally a shortage, in which case there’s also inflation. One can argue that that was part of the reason we experienced so much inflation during the pandemic. However, that’s still a mismatch of demand and supply. To the extent inflation measures excess, unemployment captures a lack of economic demand and economic activities. The Fed doesn’t like either.

UNDERSTANDING EMPLOYMENT

Let’s look at the labor market historically and in its current state.

The Unemployment Rate

U3 Unemployment Rate is the official unemployment rate used by the U.S. government and measures the percentage of people who are jobless but actively seeking employment.

U6 Unemployment Rate is a broader measure of labor under-utilization. It includes all individuals counted in U3, plus discouraged workers who have stopped looking for work. It’s generally higher than the U3 rate. It’s considered by some to be a more accurate representation of unemployment.

The overall picture on the labor market can be summarized by the following chart: unemployment rate is rising and the non-farm payroll increases, while still positive, are becoming smaller and smaller.

The Sahm Rule

While the rise in unemployment from historically low levels seems modest, the now-famous Sahm rule (which reliably indicated the onset of all post-WWII US recessions) highlights the significance of the increase.

Yes, just like one might attempt to time the stock market with moving average crossovers and trend-following indicators, the Fed attempts to time the economy in the same manner. The Sahm Rule, specifically, measures the increase in the three-month moving average of the unemployment rate over its low during the previous 12 month

It’s reasonable to expect that if this triggers (goes above the 0.5% threshold) the Fed will begin acting a lot more dovishly.

Historically, once the unemployment rate starts rising and breaches a certain threshold it (typically) gathers momentum and continues rising a meaningful amount more.

Unemployment Claims

Continuing claims refer to the number of people who have already filed an initial claim for unemployment benefits and are continuing to receive weekly unemployment benefits. People remaining jobless for an extended period of time is typically the worst case scenario.

However, as shown below (this is an important point if you want to guard yourself against the horde of macro doomers) in absolute terms this increase is so small as to be meaningless.

Quality of Employment

Full time employment growth has turned negative.

The quality of the labor market growth has deteriorated as the new jobs added are increasingly not full time jobs with full benefits, which in turn highlight weakening of workers’ bargaining power hence softening of the overall income strength and by extension purchasing power.

Hires and Quits

Some do not consider job openings to be a good indication of the labor market - as it has become increasingly cheap and easy for companies to post listings.

The hire/quit rate is (shockingly) the number of hires/quits during an entire month as a percentage of total employment and can serve as a more firm indication of what the market is currently like.

The Bureau of Labor Statistics (BLS) measures this through the Job Openings and Labor Turnover Survey (JOLTS) monthly. This is a relatively important economic print (the monthly ones tend to be).

Quits specifically refer to voluntary separations initiated by the employee, excluding retirements and resignations for health reasons.

Layoffs, which are involuntary separations initiated by the employer, are not included in the quit rate.

Generally, a higher quit rate is associated with a strong job market where workers feel confident in finding new opportunities, while a lower quit rate may indicate economic uncertainty.

Job Openings & Labor Turnover

Job openings are steadily going down since peaking at the end of 2021.

This is measured in both the Job Openings and Labor Turnover Survey (JOLTS) by the BLS and the leading private job search platform Indeed.

By both accounts, employers have scaled back from the fervor of COVID era and steadily removed job vacancies, even after the economy had avoided a much dreaded recession in 2022 and clearly turned around in 2023.

UNDERSTANDING THE JOURNEY

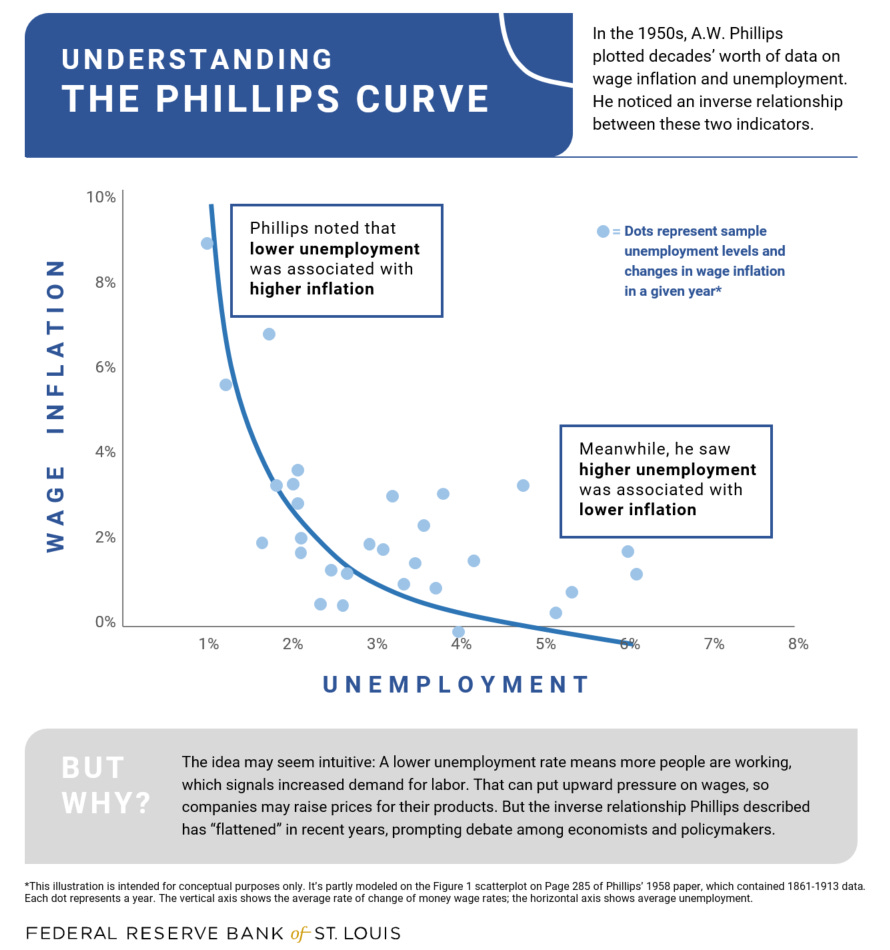

The Phillips Curve: Sacrificing the Sacrifice Ratio

There’s a causal intuition in classical economics that there is a trade off between inflation and unemployment. When unemployment is very high, there’s a lot of spare capacity (in particular labor input) to produce, low wage income, hence low inflation.

On the flip side, when unemployment is too low, we could have a labor shortage, high wage growth, excess demand and high inflation. This suggests a negative relationship between unemployment and inflation, which is the so-called “Phillips curve”.

It turns out once again this theoretical intuition is quite a bit nuanced in reality.

Here’s one of the classical economic indicators that the Fed has paid attention to, the Phillips curve.

Below is what the Phillips curve(s) looked like over the past few decades.

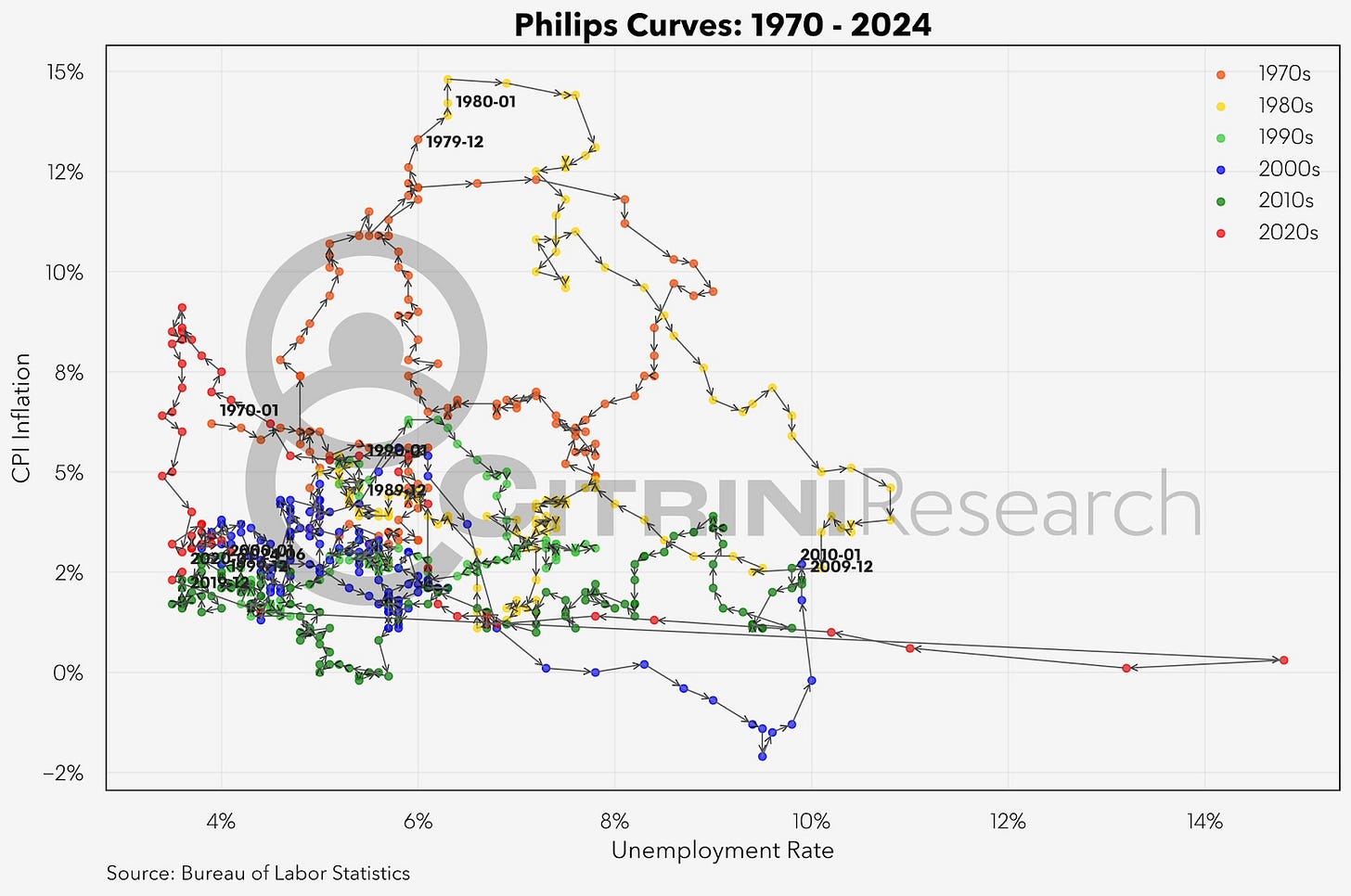

Since the 1950s, the realized observations of the Phillips Curve have looked nothing like a curve at all, linear or nonlinear.

In the 70s and 80s, the Philip Curve was quite “steep” in that as unemployment decreased, inflation rose a lot. In the last couple decades, PC became a lot “flatter” where there doesn’t appear to be a strong linear trade-off between inflation and unemployment.

Taken altogether, one could be forgiven to think that the whole thing is a just a mess with no clear discernible relationship whatsoever.

There’s a reason they call it the “dismal science”, I suppose. But recognizing these models is key to understanding how central banks will act.

We have essentially traveled through a counter-clockwise cycle, where the unemployment rate initially surged at the onset of COVID to around 15% and then gradually receded to 6%, at which point inflation started rising sharply with CPI peaking over 9%, after which point CPI inflation started dropping while unemployment rate holds steadily under 4% (mostly through the expansion of the labor force).

Recall that this transition was highly doubted by most economic observers in 2022, when the Fed started hiking interest rates. It was commonly expected that inflation could only be reduced in exchange for higher unemployment rates - the so-called “sacrifice ratio”.

So far, that hasn’t ended up being the case. We’ve ended up exactly where we began while unemployment stayed low:

These two charts basically tell the whole story. Inflation has fallen like a stone as this chart illustrates without causing the unemployment rate to rise as many had feared was necessary in 2022.

So we are in a good position now, a Goldilocks situation has been playing out and we are poised for a soft-landing, why would the Fed cut now if everything is fine?

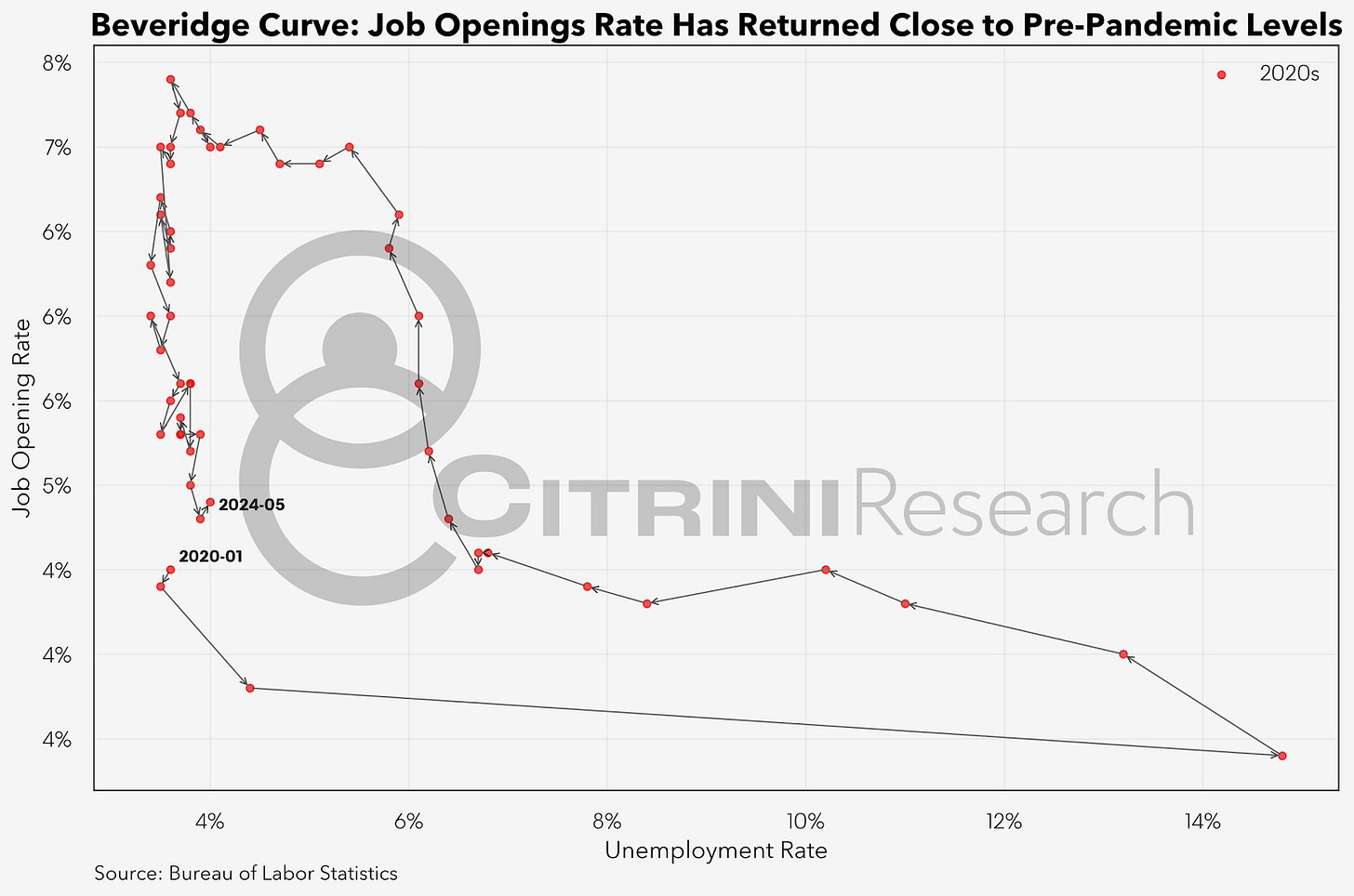

The Beveridge Curve: Why the Fed Will Cut Now

A different way to visualize the evolution of the job vacancies post COVID is to plot the vacancy rate against the unemployment rates.

This is the so called Beveridge Curve.

You can see how job openings fell almost in a straight line down:

Here we also track the evolution over time with little arrows.

We see that we start the decade just before COVID hits in the bottom-left corner of the chart with unemployment and job openings rates both low. Then COVID hits in Feb 2020 and unemployment rate surges from under 4% to nearly 15%. As COVID case rates peaked, dropped and the arrival of vaccines heralded the reopening and reflation trade, workers return to the labor force and firms begin hiring earnestly again.

Unemployment dropped sharply until it hit just over 6% at which point the unemployment rates stopped falling and instead we saw a sharp rise in job openings rates. We simply could not find enough workers to fill all the job roles that were needed.

Finally as inflation hit fever pitch and the Fed started raising interest rates aggressively (creating a common expectation at the time by firms and consumers alike that a recession was imminent), unemployment started falling again as more workers finally re-entered the workforce. Eventually, the job opening rate started falling alongside inflation rates. We see that both rates fell in nearly a vertical line downward.

Inflation and job vacancy rates fell while unemployment rates held steady.

This is exactly the channel Fed board member Chris Waller had predicted early on as the mechanism through which disinflation would occur without causing a recession hence a rise in unemployment. His comments mentioned an important indicator for understanding how the Fed will view cutting - through the lens of the Beveridge Curve.

He and Figura argued that we could travel back along the steep portion of the curve and see vacancies decline rapidly without a big rise in unemployment rate.

Their argument is perfectly illustrated in this chart of the Beveridge Curve since 2020, where instead of a rise in unemployment as inflation comes down the Phillips Curve), the cooling of the economy is manifested in a reduction of job vacancies or openings.

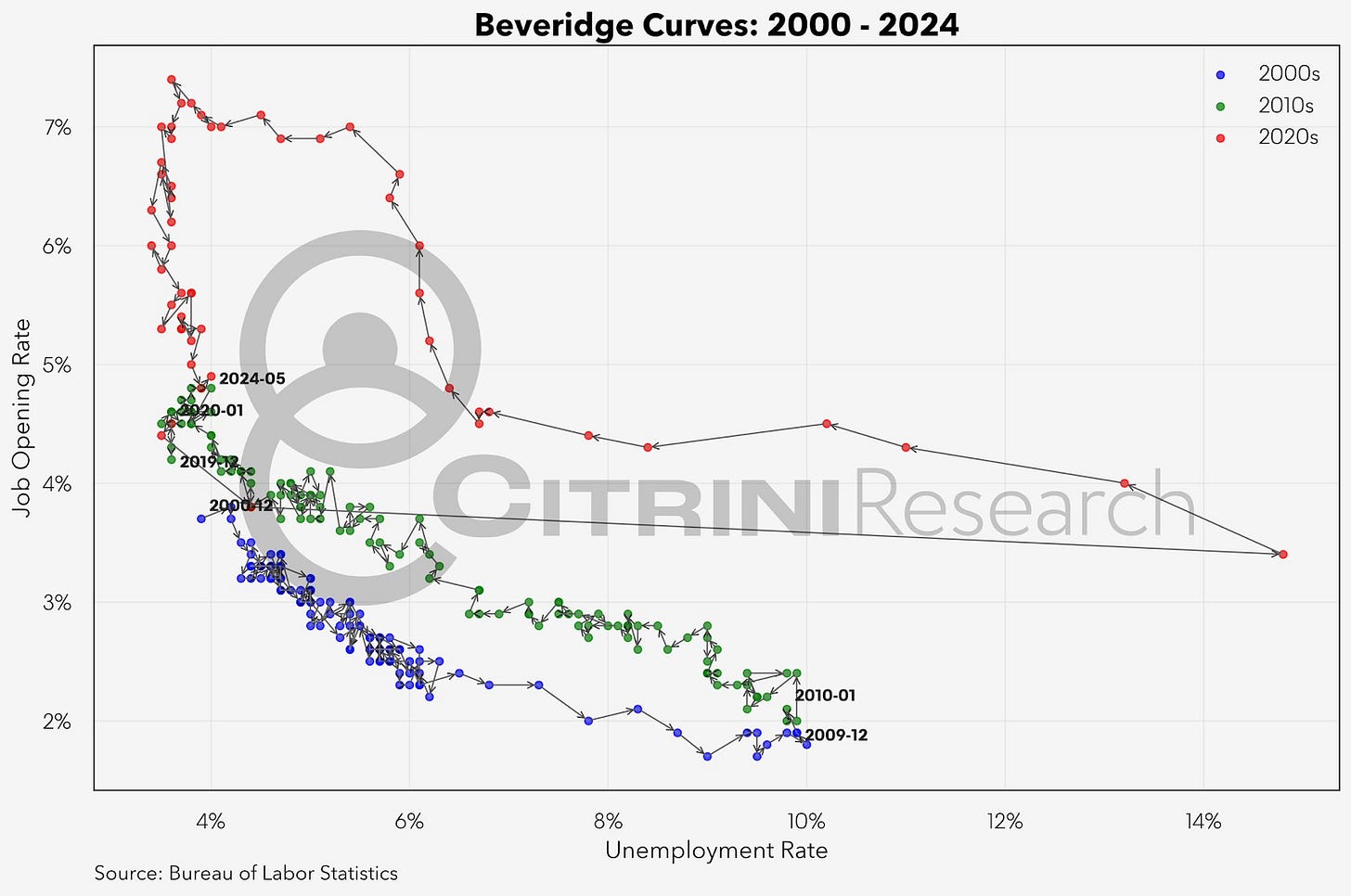

We have basically returned to where we had started (green line). Historically, further evolution from here out will likely be traveling along the green or blue lines again.

In either case, it would involve a meaningful rise in unemployment - and that’s not the goal.

That, specifically, is why the Fed will begin cutting rates now. It really has been immaculate disinflation.

I think it’s a winning bet so far to have believed the Fed capable of pulling off what some would deem impossible.

Still - it’s entirely possible they don’t cut quickly enough or that they should have already begun. This is why I believe the first move by the Fed will be to cut 50bps, putting any rumors of them being behind the curve to rest. In the very unlikely case they wait too long, it is likely that we overshoot the target on inflation, as the labor market is very evidently beginning to weaken.

Why “This Time is Different” might be different this time…

As a trader, I don’t really shy away from saying things that people think are stupid.

Most of you thought it was stupid to get positioned for a massive technology bull run in early ‘23. C’mon, admit it - you were freaking out about the bank runs.

But even people I know who internalize this kind of contrarianism are afraid to say “this time is different”. Even I am afraid to say it, despite massive evidence that it is. Why is that? Because we’re afraid of looking stupid. In the context of a macroeconomic missive, that’s a worthy fear.

In the context of a trading rag, the reason I’m saying it is to inform one thing: positioning.

It would be stupid to not be prepared for this time to be different. Soft landings are not unicorns. They’re more like zebras. You’re unlikely to see one for real, but that doesn’t mean the circumstances can’t align so you do.

It would be equally stupid to not be preparing for history repeating itself. The Fed has handled this well so far - that doesn’t preclude them from going full Trichet on a whim.

The economy is unmistakably slowing down, but not necessarily going into a recession. We can avoid the worst of the slump with a reversal in monetary policy…and it should in fact happen before the election regardless of how it looks politically. The summer slowdown extending into prolonged autumn/winter slowdown has happened before and can happen again.

We’ve covered that inflationary pressures continuing to ease, why rent inflation is likely to stall out from here, looked a bit into how the labor market has shown its first signs of cracks since this entire drama began and described the idiosyncrasies in the buy-to-own housing market that define this current cycle.

The argument that a recession cannot happen while we’re in a bull market or that the Fed should not cut while SPX goes up I believe are too simplistic and ignore the reflexivity of recessionary drawdowns that happen extraordinarily quickly.

They also definitively misunderstand the idea that the market doesn’t actually care about rate cuts as much as it cares about the expectation of rate cuts. Every rate cut priced in that gets priced out is just a future reason for an equity market that has largely ignored macro to rally.

There are definitely some different aspects about this cycle that can mean the weakening we are observing is not as significant as it seems:

Other areas that are potentially different this time:

Interest rate immunization

Household locking in low rates and high home equity. This home equity is somewhat locked away currently, due to the same reason why the housing market has been “locked up” - higher rates make tapping that home equity using a HELOC difficult. But if rates are lowered with home equity so high, we can see some significant wealth effects as it begins being tapped.

Corporates locking in low rates and having generally lower leverage.

Immigration

The growth of foreign born employees has been particularly strong during this cycle, which has likely delayed the organic rise in unemployment rate, as the labor force continues to expand. This point is underestimated by the undocumented immigration, which is not captured well.

UNDERSTANDING HOUSING

There is a famous paper in economics called “Housing IS the business cycle”, by Harvard economist Ed Leamer.

Lemur argues forcefully using statistical evidence that residential housing investments are a reliable predictor of recessions because of the sheer quantity of money and human input involved. We can see in the chart below how that indeed seems to be the case, until this most recent cycle.

We will discuss later why this cycle has bucked the trend.

Housing Activities Continue to Slow

Harvard economist Ed Leamer once famously declared in a paper that “housing *is* the business cycle”.

It is, after all, the largest sector in the US economy and real estate is one of the largest asset classes (next to stocks and bonds) - representing the most equity wealth most American households own. Similar to the labor market, we should look at both the price and quantity of housing investments/stock. Leamer for example focused on “quantity” as he found that the declining quantity of residential investments to be a great leading indicator or precursor of recessions.

This cycle’s housing market, however, has been so absolutely distorted. This has been compounded both by the mad dash to buy a suburban home from which to video-conference in your underwear from at historically low mortgage rates during the ZIRP era and the subsequent complete freezing of the secondary home market as mortgage rates suddenly shot to three decade high.

All of this was happening against a backdrop of US households being awash in cash and heightened net worths…

…home equity rising to decades-long highs after US households deleveraged post-GFC and a massive under-construction of homes during this period creating a secular structural shortage of homes right as Millennials began to start families. All of this makes inferences about the broader economy using the lens of the housing market extremely challenging.

With all of that caveat in mind, let’s take a look at the housing market.

To the extent that the housing market is the business cycle, housing is surely slowing down. Note that “housing” here does not refer to home prices but rather housing activities, including construction starts as well as permit applications.

Another look at this is the number of homes under construction, which continues to decline from the peak, which has historically preceded recessions with varying degrees of lag.

While construction starts have slowed, building permits remain relatively stable, indicating cautious optimism and preparation for future demand among builders.

Higher rates have indeed translated to lower home prices…in some cases. The percentage of homes with price reductions increased from 14.1% in June of last year to 18.3% this year. But we’re coming from a very high base and it’s unlikely anyone is going to be thinking housing is cheap anytime soon.

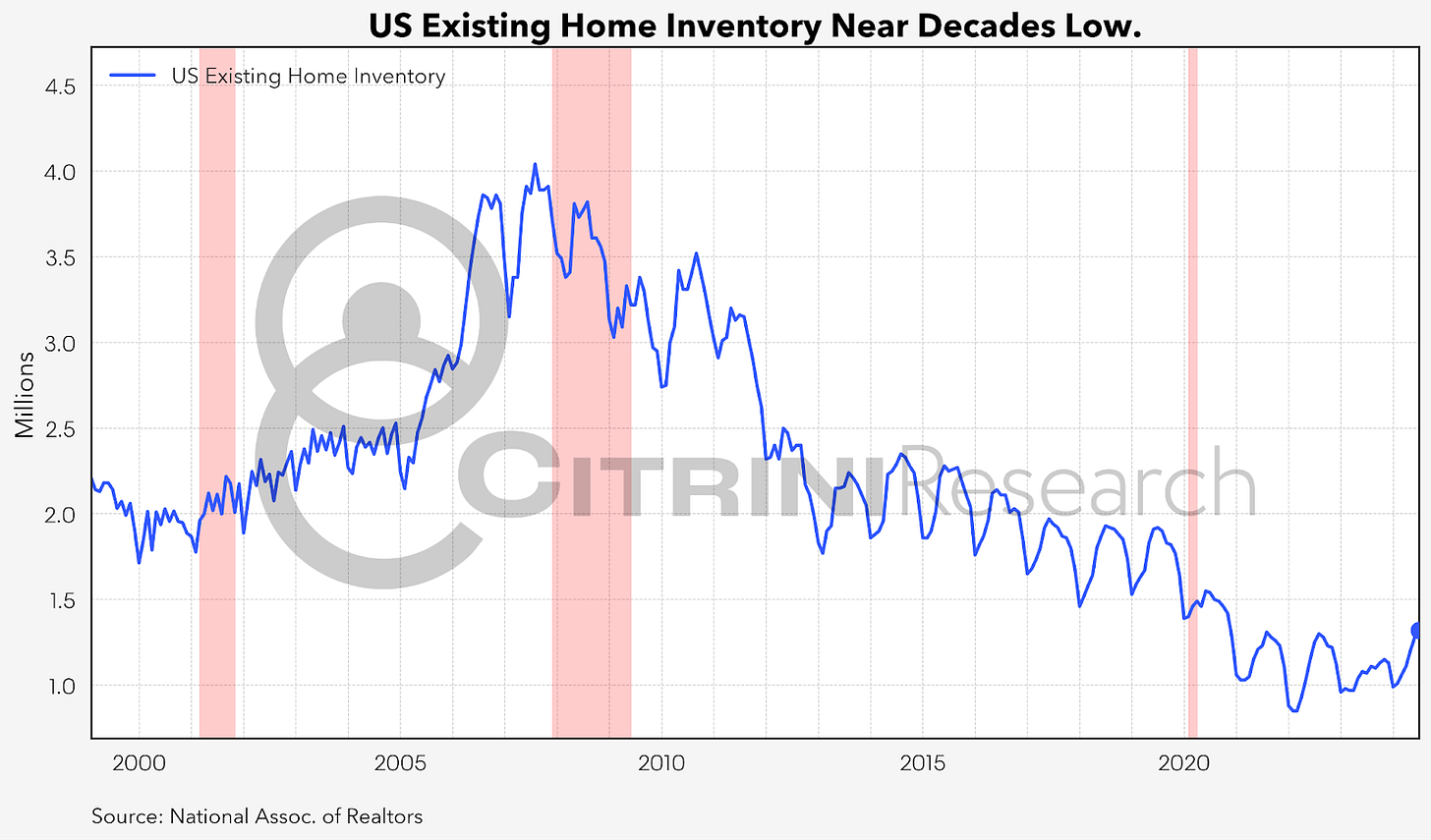

Also, this data is significantly skewed by markets which were extremely overpriced during COVID. There is still a degree of lack of supply in the market that’s due to the unwillingness of existing homeowners to sell (lest they have to find another place and take on a higher rate mortgage) and buyers opting to rent or unable to buy:

..but Home Prices remain supported by many factors

Despite some increases, inventory levels remain relatively low compared to historical norms. This ongoing shortage of available homes helps support prices and prevents a more severe market downturn.This is certainly not the overbuilding of the mid-2000s (which led to a surplus of homes, contributing to the sharp downturn during the Great Recession). Homeowner equity is at historic highs, providing a financial cushion that helps prevent a wave of distressed sales and supports price stability.

But while homeowners might feel rich on paper…

It’s pretty difficult for them to tap into that wealth (while there are more listings and more price drops, the number of housing transactions in residential real estate has not inflected up in a similar way). The alternative would be a HELOC, and considering higher rates make HELOCs pretty unattractive…there is a consideration of the “wealth effect” that could come about via rate cuts unlocking this equity. Either way, the housing market has slowed a bit from its extreme strength but is nowhere near panic levels.

Existing home inventory is pretty low - another supportive factor for prices…but if I was a betting man (I am, it’s literally my job) I’d be long this chart:

BELOW THE PAYWALL:

We discuss five equity basket focused trade ideas for various scenarios in the U.S. economy and update two existing macro trades we have on.

Microeconomic Indications and Trade Ideas

Trade Ideas

You have probably read by now that there is plenty of evidence to support the notion that the economy is weakening at the company level. And while these anecdotes make for juicy headlines, the reality is more nuanced – for every American Airlines indicating weakening travel demand, there is a Royal Caribbean Cruises telling you travel demand is fine.

A big contributor to this murky picture is the ongoing normalization from various post-pandemic dislocations at the company and industry levels, leading to asynchronous cycles in different parts of the economy. In fact, you might not have noticed if you are only paying attention to Citrindex longs, but the S&P 500 excluding the six largest constituents just went through an earnings recession!

Against this complicated backdrop, all we can say with certainty at this point is that it is best to have your pipeline stocked with trades tailored to a variety of economic scenarios and be ready to act as the economic outlook becomes more clear.

Rates & STIR Trade Ideas

We have a big week coming up.

Our negative beta FX trades are more promising to hold through this week than the steepener which I still firmly believe uninverts soon but has gotten crowded and can have a flush out during a week like this.

I am keeping on the SOFR Z4Z5 Steepener paired with the Euribor Z4Z5 Flattener that we put on July 12th at a -36.5bps spread (which is now trading -24.5bps).

FX Trade Ideas

In GMTFI part 2 we covered the idea of negative beta in FX and the carry trade unwind.

We alerted subscribers to put on our negative beta carry unwind FX strategy on July 10th. We represented it as long GBPAUD, USDCAD & NZDJPY. You could also say it’s long 33.3% GBP, USD & JPY each while short NZD, CAD & AUD at the same ratio.

It’s gone vertical since on a broader unwind of the carry trades that have defined this year.

Equity Trade Ideas

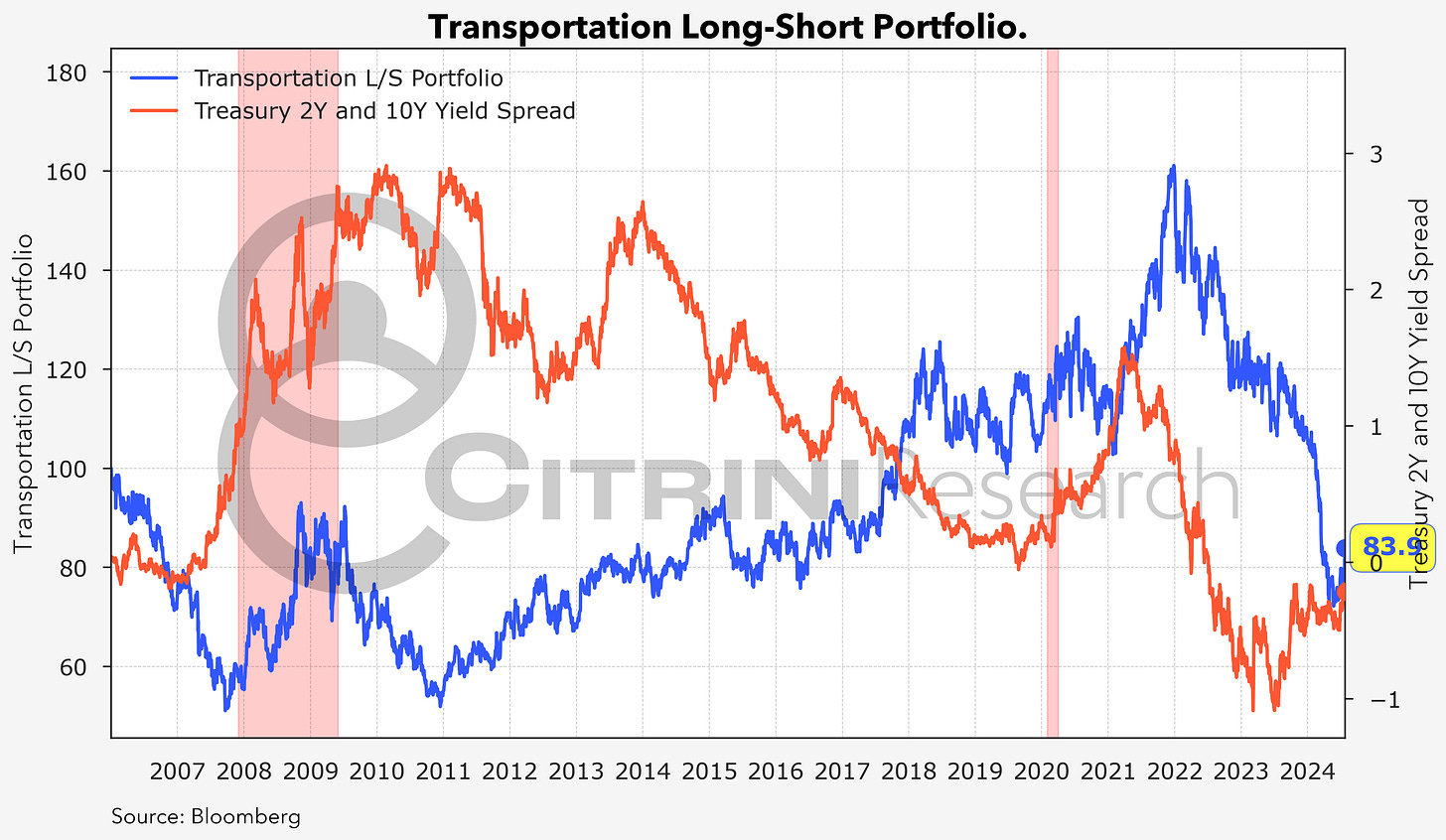

Something I noticed while scrounging around for recessionary equity trades is that all of these recession trades began performing very well in June, at the same time 2s10s started to steepen. This might seem obvious, given that the recessionary equity trades and the 2s10s steepener tend to benefit from economic weakness, which arrived with the summer economic slowdown. But what is interesting is that these recessionary equity trades have not performed nearly as well in prior periods when 2s10s steepened.

Why does this matter? Well, once again, this is another indicator telling me we are in a period that is uniquely complicated as a result of all of the economic crosscurrents, and so you better have more than one tool in your toolkit.

With that in mind, below is a collection of equity trades designed to benefit from a variety of economic scenarios. Some of these are idiosyncratic enough that they likely work well in most economic outcomes and are worth putting on now, while others can be deployed as the future trajectory of the economy becomes more clear.

TRADE #1: Transportation Operators vs. Transportation Capital Equipment Providers for any type of landing

Trade construction:

Long Transportation Operators: JBHT, ODFL, KNX, UNP equally weighted

Short Transportation Capital Equipment: 50% PCAR , CMI, WAB each 25%

The shortage of transportation capacity (trucks and railroads) after the pandemic, combined with stimulus-fueled consumer demand, incentivized huge amounts of new capacity that came online in 2021 and 2022

The subsequent “goods recession”, where retailers saw weak demand and responded by reducing inventory, caused a demand shortage that has inflicted significant pain on transportation operators

Many of the small operators started in the wake of the pandemic are going bust in this environment, and they are dumping their used equipment onto the market, which is hurting capital equipment pricing

These trends should favor operators over equipment providers in most economic scenarios, from soft to hard landing

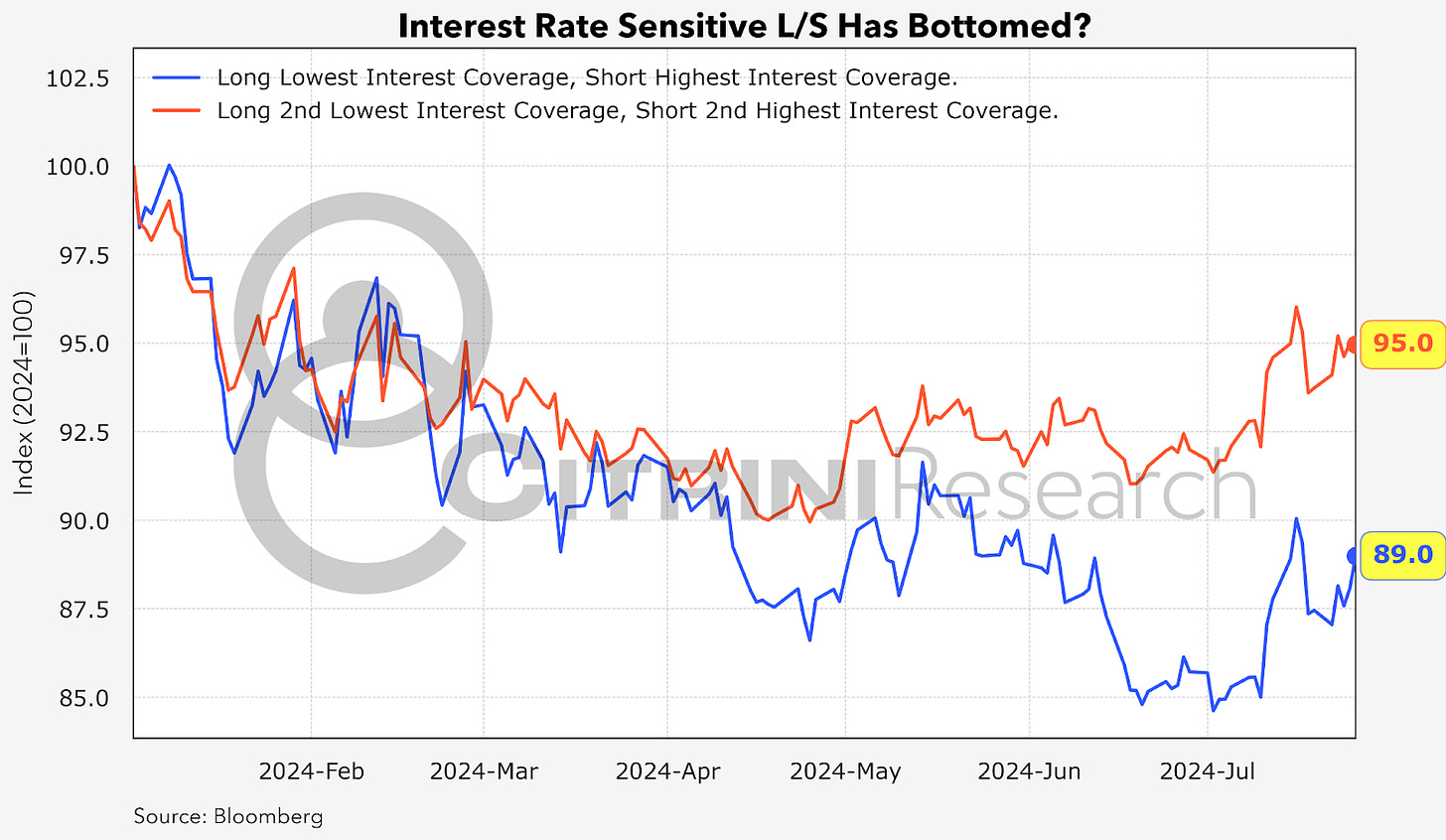

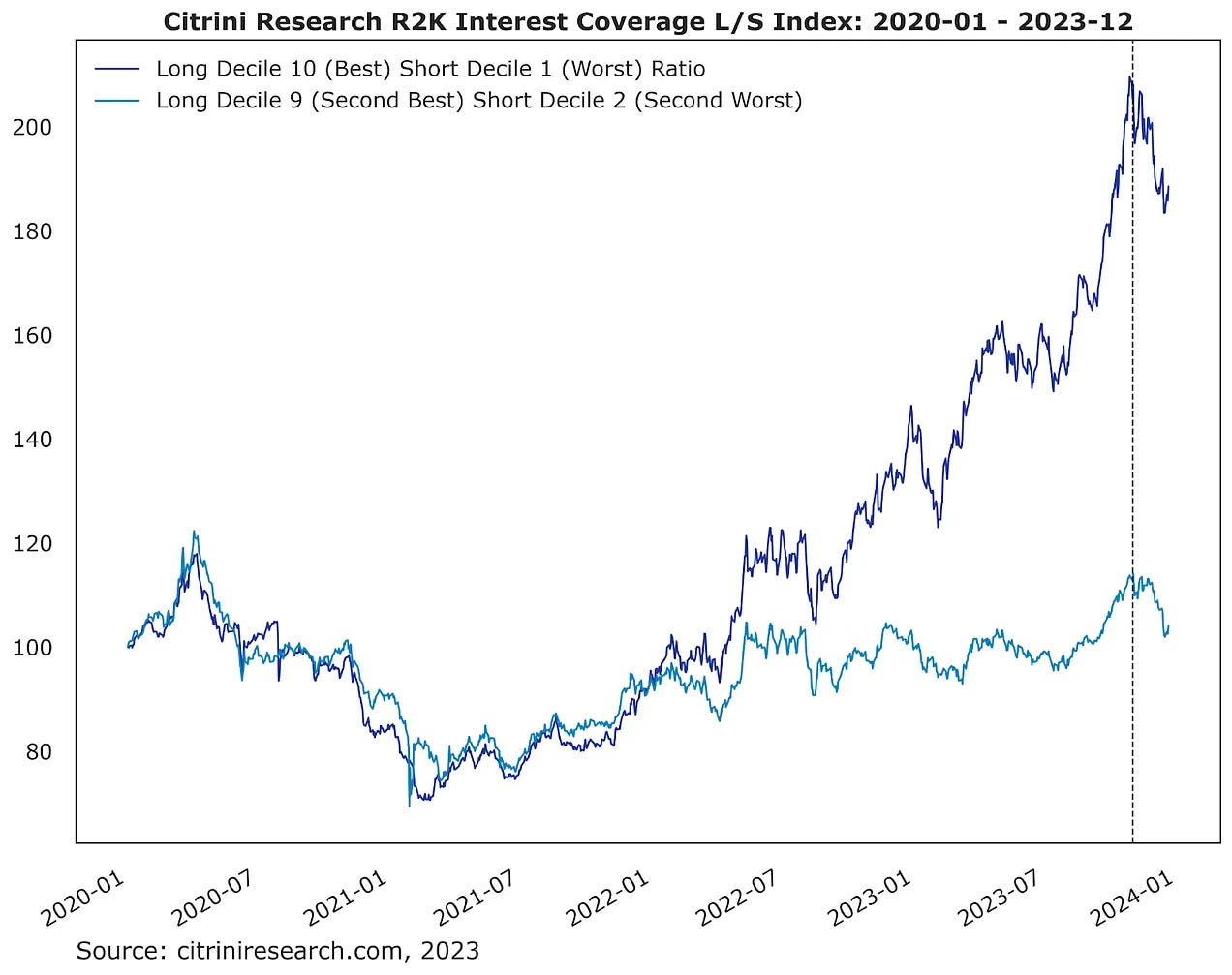

TRADE #2: Long SMID Worst Rate Exposure/Short Best for Rate Cuts with minimal Economic Weakness or Growth Rebounding:

Revisit our Russell 2000 Interest Rate Coverage Decile Baskets (from 24 Trades for 2024)

Trade Construction:

Concerns about the impact of high interest rates on companies with weak balance sheets and cash flow profiles has weighed on low interest coverage companies

Meanwhile, companies insulated from high rates have benefited from a defensive bid

A soft-landing scenario, where rates come down but revenues remain solid for small and cyclical companies (which make up most of the low interest coverage cohort), should unwind this trade

The last time we highlighted this trade, it had reversed hard as rates peaked in October. In 2024, it has resumed its relentless march

TRADE #3: Long Life Science Tools / Short Semicap for a hard landing

Trade Construction:

Long life science tools: A, BRKR, CRL, DHR, ILMN, RGEN

Short semi cap: AMAT AMKR ASML TEL LRCX KLAC

The interest rate hiking cycle and the rising cost of capital favored companies with near-term cash flows over those with longer duration cash flows

This caused violent rotations within sectors like technology and healthcare

In technology, this rotation hurt software companies and favored Mag 7 – and, by extension, the semiconductor supply chain that benefits from Mag 7 CapEx

In healthcare, the rotation favored defensive, cash flow generative companies like LLY at the expense of the biotech sector – and, by extension, hurt the life science tools industry that is dependent on biotech R&D spend

We see tangible evidence that the cyclical bust in life science tools has bottomed, with the long leg of this trade positioned to benefit in many economic scenarios, but given the historically defensive nature of the industry and the benefit of lower rates for the biotech sector, a weakening economy would be much more favorable for this industry than most

Meanwhile, a more severe recession would hit demand for semi capital equipment at a time when expectations and valuation are both high

To be clear, we have much more conviction in the long leg of this trade and intend to write a longer piece on the topic, and the short leg will require a recession to work

TRADE #4: Recession Long-Short Portfolio for a crash landing

This basket is long defensive companies and short cyclical and vulnerable ones, focusing on both companies that do poorly during times of economic weakness and companies with idiosyncratic reasons to outperform during those times (think payday lenders, pawn shops, trade schools, companies benefiting from people going out less etc.).

In an outright recession, the long leg should significantly outperform the short leg. However, it’s typically a short lived trade, and many times the real trade is in flipping the long/short side at the cyclical low.

TRADE #5: REIT Long/Short Basket for a bumpy landing

Trade Construction:

Long CCI SBAC AMT VNO SLG KRC

Short CUBE PSA AVB AMH INVH

We view the current environment as being generally positive for Office CRE if it leads to rate cuts and a continued slowdown in wage growth and labor market weakening. Rate cuts will help with these companies’ debt situation while labor market weakness will increase the supply of workers willing to comply with employers demands to return to office as well as embolden employers to request a return in the first place.

We also would like the exposure of Tower REITs here, provided we pair it against a short on Multifamily Rental REITs (apartments) and Self-Storage REITs.

TRADE #6: Long Lower Rate Convexity/Short Higher for Longer Interest Rate Winners for a soft landing

Trade Construction: Long MarketAxess (MKTX) Short Interactive Brokers (IBKR) and LPL Financial (LPLA)

This trade positions for a scenario where interest rates are expected to decrease, benefiting companies with higher interest rate sensitivity while potentially challenging those that have thrived in a higher rate environment.

MarketAxess (MKTX), as an electronic trading platform for fixed-income securities, stands to benefit from increased bond trading activity that typically accompanies falling interest rates. Lower rates tend to stimulate bond issuance and trading volumes, which could drive higher transaction revenues for MKTX.

Conversely, Interactive Brokers (IBKR) and LPL Financial (LPLA) have been beneficiaries of the higher interest rate environment. These firms have enjoyed increased interest income on client cash balances and higher yields on their own cash holdings.

As rates potentially decrease, IBKR and LPLA may face headwinds in the form of compressed net interest margins and potentially reduced interest income, which has been a significant driver of their recent financial performance.

This trade also factors in the potential for increased market volatility during a transition to lower rates, which could benefit MKTX through higher trading volumes, while potentially pressuring IBKR and LPLA's commission-based revenues if investor activity slows.

The success of this trade hinges on the pace and extent of interest rate cuts, as well as the broader economic implications of such moves. A gradual reduction in rates accompanied by stable economic conditions would likely be most favorable for this positioning.

Expanded Trade Construction:

Long: MarketAxess (MKTX), Tradeweb Markets (TW), Moody’s (MCO), Virtu (VIRT)

Short: Interactive Brokers (IBKR), LPL Financial (LPLA), Charles Schwab (SCHW), State Street (STT)

Expanded Trade Construction reasoning:

Adds broader exposure to fixed income trading (TW) and volatility (VIRT)

Includes potential benefits from increased credit rating activity (MCO)

Expands short exposure to companies heavily reliant on interest income (SCHW, STT)

STT, as the sponsor of the SPDR S&P 500 ETF Trust (SPY), may face additional pressure if market downturns lead to outflows in AUM from passive investments

Overall, this expanded basket provides more convexity to increased bond issuance and trading activity, is better positioned for both soft and hard landing scenarios & offers increased diversification across various financial services, maintaining the original thesis while capturing a wider range of potential market outcomes

Some of these trades, like Trade #3, have idiosyncratic elements that we believe makes them work long-only. We’ve added the pairs to ensure that we could keep them on if a continued slowdown materializes, but for now I think (for example) playing long the cyclical trough in life sciences works better standalone. Paired against semicap, however, you get a strong negative exposure to momentum which - if the past week is any indication - can unwind quite rapidly.

That’s all for now, stay tuned for updates on our view on the economic situation (which will be sent out to paid subscribers monthly until we think we’re out of the woods).

The consensus is for lower FFR to see a lower USD and an un-inversion of the curve with short rates falling faster than long rates. Is there a tipping point in the level of weakness in the USD that will see long end rates actually rise in your opinion?

first