Citrindex Retrospective: July 2024

Changes to our holdings, performance and “Schrodinger’s Soft Landing”

Citrindex - July Retrospective

Hope everyone is having a fun and relaxing summer…

Just kidding, welcome to the thunderdome!

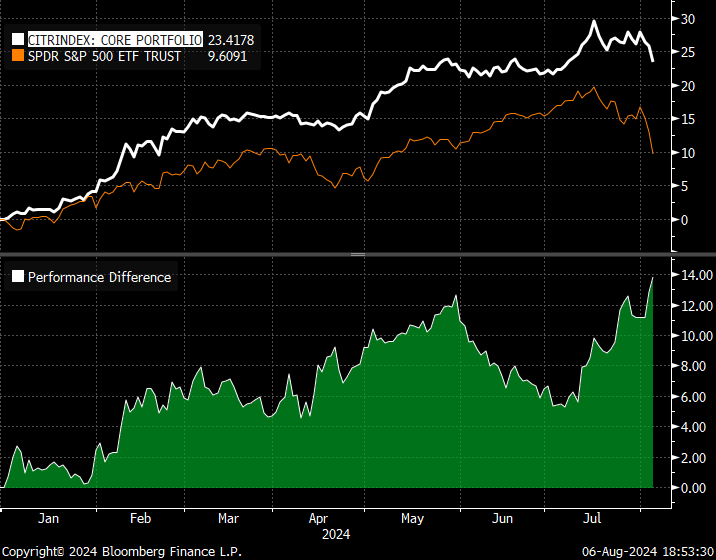

Year-to-Date, our core portfolio is up +23.4% versus +9.6% on SPY (as of August 5th 2024)

This brings our Since Inception return to +101.15% vs SPY’s +26.25% over the same timeframe.

In the past month, we’ve gathered back the outperformance we lost in May/June being underweight mega cap tech back and hedging a bit too aggressively.

Since our last portfolio update on June 2nd, the Citrindex is up 1.49% vs. a loss of -5.76% for SPY.

We all know that the Citrindex has been riding momentum for a while. The thing is - I never became oblivious to this. There wasn’t a moment where I thought that actually, in fact, I was a genius for making some relatively obvious calls and then riding a bull market.

No, like I said at the end of 2023, outperforming should make you more paranoid that you’re wrong - not less.

If you've been subscribed for the entirety of 2024, you'll know that I've had a tough relationship with hedges this year. I'm a strict adherent to the school of "hedge when you can, not when you have to" but that comes along with some unpleasant performance drag as - most of the time - those hedges go to zero. Up until the end of the first half, our hedging activity provided a more than 300bps drag on the portfolio’s returns:

Recapping Changes Since Our Last Update

We began highlighting the risks of disinflation turning into a growth scare on June 15th and got more serious about it after CPI printed negative MoM:

We began putting on hedges more aggressively for August & September when SPX dropped below 5600:

We traded around them a bit (some good trades, some bad) but, overall, have maintained hedges on the portfolio ~95% of the time over the past month.

In our Global Macro Trading for Idiots article last Monday, we said it was time to become paranoid and…it seems it was.

Still, it’s one of those things where the thing you’re trying to protect against happens as soon as you decide not to protect against it. Luckily, we didn’t give up. Our hedge allocation has had a rough start to the year, but has recovered significantly, rallying nearly 300% since we began putting hedges back on in July.

Currently most of what is in the hedge basket is cash, raised from monetizing hedges during Monday’s VIX spike, but we still have some protection from the remaining puts (the SPX ones have had the remaining half turned into a put spread).

Beyond just hedging, the allocation decisions we've made over the past couple weeks, have been broadly correct. While it may be too early to call, I feel comfortable at this juncture saying that I don’t think we are out of the woods yet on this drawdown…and even if we are - there’s a lot of cushion from the outperformance so far that I am willing to whittle down to prevent getting sucked in to getting long before the “next leg down”.

On July 17th, we turned our Software Basket into a pair trade against short SMH to try to bring down our net on semiconductors.

This was joined by short Crowdstrike soon thereafter, in the wake of their massive f*ck up.

These sizeable shorts contributed a lot to offsetting some of the drop and cushioned our call on the bottom in software (which was far too early, but still outperformed SMH & CRWD). Both of those shorts were in the top 5 contributors along with our various hedges.

Top Gainers by CTR (Since July 2nd)

Top Losers by CTR (Since July 2nd)

After Kamala Harris was announced as replacing Biden as the Democratic Nominee, we exited our Long Trump/Short Biden basket on what I perceived to be maximally priced in odds of a Trump victory.

Both the returns of that basket and Trump’s odds have fallen precipitously since:

On July 29th, we allocated to the “Cyclical Normalization Long/Short” basket comprised of five of the six trades found below the paywall in our last article Global Macro Trading for Idiots Part 4…

Here’s how that’s done since:

Then, last week, we decided to exit 1/2 of our AI exposures (Edge AI & our Global AI Basket) in favor of our Recession Long/Short basket.

It’s called “Recession Long/Short”.

You can call it “economic slowdown” or “late cycle dynamics” or whatever makes you feel better. The point is, it goes up when SHTF.

We can always take it off and rotate back into AI if that stops happening, but I like the offset for now and it will help me keep ~10% of the book invested in AI even if there’s some more volatility. Remember, just because AI is a thing does not mean semiconductors are not cyclical anymore!

Even though it’s only been a few days, it has in fact felt like a few years - evidenced by the fact that, since, our AI longs are down 12% and the basket we entered after selling half of them is up 9%:

Citrindex Updates

The Citrindex has had some changes that have come at a fairly quick pace (and absolutely needed to), so it's time for some housekeeping.

First off, we’ve consolidated a couple baskets which were redundant.

This alone does not represent a change in allocation, we are simply combining two baskets under one umbrella in two places.

After selling half the AI basket, we were weighted ~6% to our Global AI basket and ~3.9% to our Edge AI basket - we’ve combined these two under the header “Global AI Basket”.

Additionally, we’ve merged our “Cyclical Normalization Long/Short Basket” & our “Recession Long/Short Basket”. While they’re playing two different things, they act relatively similar and it’s much more organized - you can find those under the header “Cyclical Normalization”.

During Monday’s gap down, we made our medtech & healthcare shopping list:

We elaborate and add slightly to this basket in our article on the asymmetric setup currently in life sciences that we’ll be releasing tomorrow morning - detailing our thoughts on the cyclical inflection these names are experiencing, as well as their more defensive nature that can benefit from a momentum unwind or economic slowdown.

We’ve added this basket to the Citrindex, which has been updated under the Citrindex tab on the homepage.

The Year-to-Date Attribution Analysis for the Core Portfolio has been updated as well, and can be found on this link.

Changes to the Citrindex

Added Healthcare and Medical Device Basket (from our “shopping list” and primer).

The new weightings reflecting this addition are:

In AI, cutting 3017 TT (Asia Vital Components), Taisol Electronics (3324 TT), Wiwynn (6669 TT), Supermicro (SMCI)

Adding to AMD, ADBE & SNPS.

In GLP-1s, added back STVN & BRBR long

In Elder Care, added BFAM

In Fiscal, exited ALB, JCI, NRG & SMR, added Mitsubishi Heavy (7011 JP), Fluor (FLR) and Aecom (ACM US)

In Cyclical Normalization, broadening out long MKTX / short IBKR & LPLA to the “expanded basket” added to GMTFI Part 4. Click here to see the reasoning.

Market Outlook

I see no reason to embarass myself too much by making wild calls about broad market moves over the next month. I think my positioning speaks for itself and I’m more concerned with being properly allocated for maximum upside in a range of scenarios than overindexing to one.

With that being said, the way the market has dropped recently does not surprise me - nor does the relative lack of panic associated with it. It is mechanical, almost newtownian. For every action there is an equal and opposite reaction. While that’s rarely true in the stock market (which tends to defy gravity over time), it certainly becomes true after the dynamic we witnessed during May and June - NVDA up 10% on no news whatsoever is a good example. Perhaps we just needed to reverse all that and then trade in a range for a bit.

The exuberance got irrational in both macro and equities - essentially a global short vol trade (through its many expressions, long USDJPY being one and short bonds another) became the norm, even for stupid people who should never be levered & short vol.

The manner in which the “Higher for Longer” trade unwinds is in, almost naturally, the “Lower Quickly” trade. Whether that’s purely positioning driven is an investigation that must be done on a subjective basis, as it’s indistinguishable from the recession trade.

As I said in GMTFI 4, while the economy is no doubt weakening and we’ll likely see a growth scare…it’s actually not that bad under the surface and there are a LOT of levers the Fed can pull. Rate cuts will unlock significant home equity almost immediately.

While we’ve spent the past year cyclically going back and forth between growth scares of varying flavors and complacency. Every 2-3 months we were experiencing brief periods of macro dominated news flow - some associated with too much growth (inflation) or too little growth (recession) - and otherwise ventured into the Goldilocks zone to price in the softest landing possible. I think this describes investor psychology over the past couple years pretty well:

Now, however, we have entered a new paradigm where this cycle speeds up to an almost comical degree. This is actually the positive outcome in the scenario analysis going forward. It’s when everyone agrees about macro that things get bad. In other words…

We have entered Schrodinger’s soft landing.

It is the act of investors observing the economy that will make it recessionary or strong. That’s not just in terms of price action (although that’s what I am talking about here), but also in terms of reality. If investors throw a big enough fit, and if the Fed responded with some hasty policy action (like Siegel’s whining for a 75bps cut) they’d all but ensure the negative feedback loop that would result in a real recession.

Expect more of this dynamic - one data print shows weakness, people cry about the monetary policy mistake that will crash everything, another data print shows strength, people cry about how the Fed has backed off too soon and will cause an Arthur-Burns-esque reacceleration in CPI.

We have a relatively catalyst light week, as well. Bond auctions and weekly claims are about it. So, you know what that means in Schrodinger’s soft landing? Yep.

I’ve included below the text of our flash-note before the claims print on Thursday1because it’s truly too illustrative of this dynamic to leave out:

We are about to act like this one single Initial Claims print determines the path of the entire economy for years to come. Because investors are “rational” and “logical”.

Please remember this is a WEEKLY print with extreme variability and the market is just generally starved for catalysts in a bigly volatile week so will ascribe too much meaning to it.

That being said, from the MARKET’S POINT OF VIEW (after last week’s triggering of the Sahm rule and the volatility we’ve experienced):

>260K = it’s over, sell your stocks, buy bonds, beans and ammunition, GFC 2.0 incoming, don’t own anything except government obligations because all the consumers are broke and jobless

<242k/4 week <240k = we’re back, buy everything, unemployment rate was an artifact of weather BS, AI is going to save the world again and bonds are useless pieces of paper to be shorted in order to get long more stonks

Of course, none of these things are true. It’s one week. Imagine if you extrapolated stock performance by randomly picking a week.

However, mister market doesn’t care about what’s true. Just about what he can convince the most people of.

I think this print comes in at or below expectations and we see some renewed belief in the soft landing (which, again, will not present as “look how happy we all are about everything being ok” but rather as an intensely bipolar market that oscillates rapidly between certain of a recession and worried about inflation).

It remains to be seen where we go from here but - if you’ve been positioning like I have you’re probably sitting on some nice gains and your motivation here should be to protect them rather than get greedy the day after a large drawdown. Survivorship bias might tell you that’s how you get rich, but in reality it’s how smart people go broke. You can always buy on the way up, missing a couple percent is not going to kill you this time.

That’s all for tonight.

Thanks again for being a subscriber,

-Citrini

Slightly edited for flow to include the note in this article after we published it prior to the jobless claims print Thursday morning.

You can get our flash notes on macro, trading views, daily insights and various other musings by checking out the chat feature.

Here’s the link to the original note from the morning before Thursday’s print where we anticipated a bounce back following less initial claims than expected.

If you wanted to protect yourself over the next month but don’t want to maintain a basket what are the one or trades you would do?