Being Aware of Opposing Views

Revisiting the Case for Higher Rates, co-authored by Danny Dayan

I wanted to ensure that all subscribers were able to read the below, where I invited Danny Dayan to collaborate on a red-team effort that made us aware of the risks that reaccelerating inflation posed to our exposure and how we might hedge against that.

You can find the article for paid subscribers, where this appeared originally, here:

CitriniResearch Q1 Review & Outlook

Too busy for April Fool’s today, as I’ve got some new ideas spurred by some much needed vacation time that I definitely did not spend half of thinking about how to be positioned for next quarter… Okay, I’m lying.

Before we revisit that, a quick update to our macro book:

The SFRZ4Z5Z6 fly that we put on April 2nd (discussed below) is up ~+30bps and the hedges we added to the Citrindex1 are back in positive PnL territory.

So, if you didn’t read Danny’s case for higher rates, I highly recommend reading it now in light of the recent CPI print.

Hedging Against Macro Volatility

When you’re performing well, as we currently are, your portfolio reviews become much more about anticipating potential threats than trying to capture even more upside.

It’s not easy to hold two opposing views in your mind, and most times it’s much better to become informed about the contra case to your own forecast by speaking with those who are in the opposite camp. Unfortunately, this can get difficult on a forum like twitter where everything comes with an extra side of drama. I’ve noticed that Danny Dayan, despite being diametrically opposed to my own view, has always presented his case respectfully and engaged in good faith debate.

I commonly trade “against” my own view in our tactical trading allocation in order to hedge our broader thematic equity portfolio, which makes it extremely important to be well informed of the case that bolsters that hedge playing out. That’s why I stay in touch with Danny.

For example, right now we are short Z5 on the SOFR Z4Z5Z6 fly, a bet that the amount of cuts priced into 2024 is too high at 77.5bps relative to the -16.5bps priced into 2025.2

I’ve invited him to share his own thesis so that we might be better informed to the risks posed by it to our own.

Here’s what Danny has to say about the potential risks to the upside on inflation that he believes we are facing down the barrel of for the remainder of 2024.

He really does a great job of explaining his thesis and I feel much more prepared to react to it potentially posing a risk to our exposures and proactively hedge against them after having read it. Hopefully, you’ll feel similarly informed.

The Case for Higher Rates

-Danny Dayan

As an admirer of Citrini’s work when he asked me to provide an alternative macro viewpoint, in particular risks to his core AI and tech themes, I said I would be happy to. I was recently a guest on the Forward Guidance podcast, which you can also listen to for my recent detailed views.

In this note, I will make the case for why interest rates need to remain higher for longer based on two arguments.

The first case is based on demographic analysis and the structural changes going on in the economy. To provide some background, I was very early in the last cycle in recognizing that in the post GFC economy, there were many deflationary impulses. The most obvious ones were the deleveraging forces due to the subprime housing collapse, but bank regulations also played a role. More importantly, we had a major demographic overhang the entire cycle.

Demographics will not tell you anything that will help you predict this year’s GDP. For that reason, many people ignore it altogether because they feel they cannot design trading strategies around it. In fact, the real value in demographic analysis is in understanding the economy’s capacity and constraints. We do this through studying what is called the life cycle hypothesis. Essentially, as a person progresses through different age groups, their savings, consumption, investment patterns change in predictable ways. Income, wealth accumulation and productivity trends also materialize in predictable ways. Thus, by understanding the changing composition of the labor force, we can then deduce structural changes in the economy. The post GFC period was one dominated by two demographic trends: a surplus of labor from China, which depressed wages throughout the developed world, and the aging of the baby boomer generation as they worked in their final 10 years to retirement. The baby boomer generation was the largest and wealthiest group in the history of the U.S., so their period approaching retirement consisted of elevated savings rates in order to maximize their nest eggs. Both of those forces were large deflationary impulses that happened to coincide with the disinflationary deleveraging dynamics.

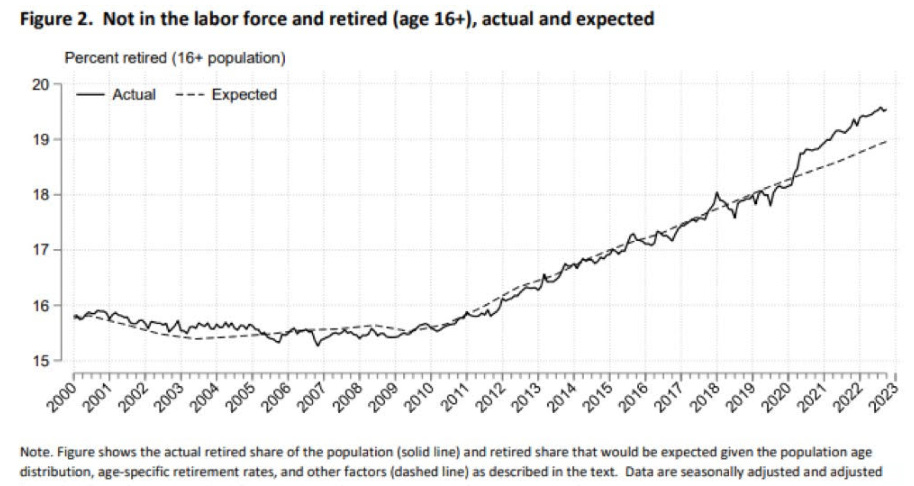

This decade is entirely different. The baby boomers have retired and done so much faster than demographic analysis would have implied. This has reduced labor supply and raised wages. We also dropped the least productive labor force group from the workforce (as people in their 60s don’t work 18 hours/day, they are senior and rest on their established reputations).

A common misconception is that consumption falls off a cliff in retirement. It does not. In fact, it remains very strong, but what does change is this group goes from becoming a saver (i.e. strong demand for fixed income), to a dissaver (spending down savings). This is inflationary.

The next largest labor force group, millennials, have entered into peak family formation phase. This means transitioning from living in city centres and with a consumption basket on services, i.e. experiences, and moving to consumption of housing, durable goods and things for their families. This is inflationary. Also coincidentally, they are hitting their peak productivity point, which occurs in your early 40s.

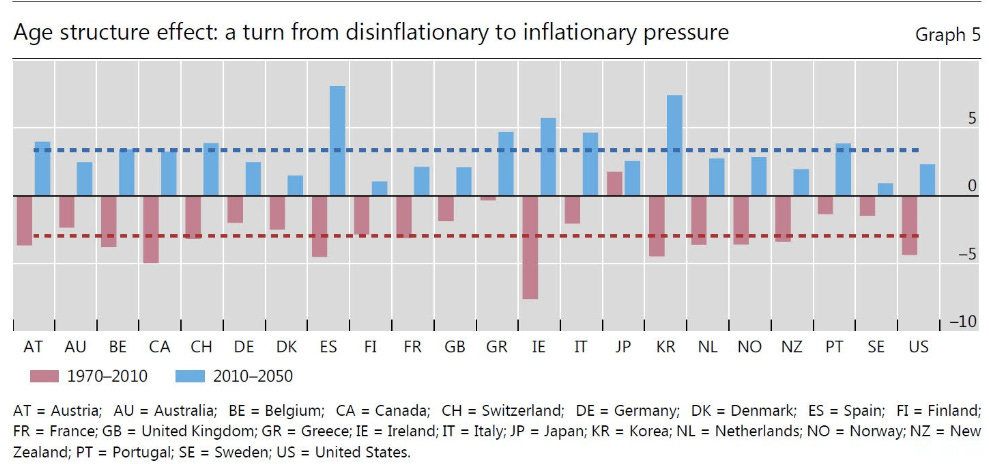

The impulses to inflation by age group are below. The most inflationary groups are called the dependent groups (children and elderly) as they do not save nor produce, yet consume a substantial amount.

The global support ratio is declining rapidly. In other words, we have fewer workers available to support the dependent groups. This is inflationary.

The impulse from all these changes is shown below.

None of this means we have to have a specific inflation number any given year. Remember, demographics simply tell you the capacity and constraints of the economy, and it is up to us to look at cyclical dynamics as we navigate these trends. However, what the above does tell you is a major force that has a negative beta to inflation now has a positive beta. A headwind has now become a tailwind. These impulses will be with us for a decade or so.

In aggregate, demographics tell us we: reduced the savings rate, increased productivity, increased demand for housing and durable goods in a sticky manner, and have labor shortages and thus higher wages.

Onto cyclical dynamics. Due to the deleveraging post GFC, both households and corporates entered the COVID episode in good shape. With the extraordinary policy responses in 2020, they were able to improve on that situation by terming out debt. As such, it has been hard to argue that rates are biting either of these groups.

The U.S. household is the cleanest of all countries by far.

With massive liquid assets, which currently earn 5+% for doing nothing.

And one of the lowest savings rates in history. Despite these higher rates, consumers are not foregoing consumption to save. They do not see a slowdown in sight.

It’s hard to argue higher rates have hurt the corporate sector either.

My view is that the economy is in a good place, we have inflation under control, albeit around 3% or so levels, and we have strong growth. Roughly 3% inflation +3-3.5% real GDP = 6-6.5%

nominal GDP. This is a very strong economy. Inflation has come down in spite of this strong growth, which was certainly a surprise to me. A big factor was that we had supply side improvements (strong labor force supply, productivity and non residential construction). This has led to goods deflation while we have maintained sticky services inflation. I think too many people are extrapolating these trends into the future.

It looks like core goods inflation has upside from here.

Median CPI, which excludes shelter, remains elevated.

Sticky CPI has never really moderated at all.

Everyone is banking on goods inflation to stay contained, and for shelter inflation to collapse. However, I have been hearing about the latter for 18 months, and with housing having bounced significantly over the last 12 months, with sticky demand from demographics, I struggle to see why everyone is so confident in it. It looks more likely to me that PCE Shelter significantly understates the real housing cost of what people are feeling in the economy.

So, with a strong economy, I am less convinced inflation has been beaten to death, and that we all ride into the sunset with strong nominal growth and no stalling or pickup in inflation.

Additionally, it is undeniable that the massive easing in financial conditions supports growth. With household wealth at a record high 550% of GDP, sharp wealth gains support consumption. Lower rates support housing activity. With full employment, strong wages, strong household balance sheets, the economy moves on the margin. These marginal impulses lead to re-accelerations in activity from the status quo that transpired prior to these FCI easings.

The economy underwent two major re-accelerations last year that were preceded by 2-3 months from large FCI easings: Early 2023, with over 800k job gains in 2 months, and Q3, where we had nominal GDP over 8%.

The concern I have is both of those were smacked with tightenings from events not related to the Fed: SVB, and the term premium tantrum. What if we don’t get lucky this time around?

None of the above has me calling for rate hikes. What it does have me call for is no rate cuts. The mere mention of rate cuts in December led to extreme animal spirits. We are growing above 6% nominal with only 2% YoY credit growth. Why tempt fate by stimulating the credit channel here?

The Fed’s framework is to think that because the Fed Funds rate is 5.375% and their estimate of neutral is 2.5%, unchanged from last cycle. On this basis, they want to cut rates because they think being 3% above the neutral is very restrictive and bad things will happen if they don’t. This makes no sense to me. If the economy is proving resilient to higher rates, maybe the neutral rate has changed. The Richmond Fed Lubik model has the real neutral rate at 2.17%, or 4.17% nominal, which is much higher than the Fed’s estimate that comes from the Williams model. It also did decline last cycle and has now returned to pre-2007 levels.

My argument is this: due to the strong cyclical dynamics coupled with demographic changes, I believe the neutral rate has changed. I am not smart enough to come up with a precise level, but maybe the post GFC economy was the anomaly, not the norm. if I am wrong, let the economy show us that rates are restrictive and they have lots of room to cut and stave off a recession before it worsens. But do not cut based on hypothetical neutral rates when they very well might be wrong! These decisions are exactly how you get a second wave. A second wave would be disastrous. It is the scenario that leads to them hiking again, breaking the economy and a 10x worse recession than the one everyone is concerned about because “rates are too high”.

Ok, enough rambling about my macro views. You own a ton of AI stocks and want to use macro hedges to protect. There are a few ways to think about this.

Potential Hedges

If you truly believe a recession is close, I suggest locking in gains and move to cash, build up your shopping list and wait for discounted prices to pounce on. If that is not an option, or the wise wizard Citrini says he prefers to stay in these names (who am I to question him on his expertise, I don’t know anything about single name investing), then here is what I suggest.

Thus, you need hedges for higher rates. SOFR Z4 94.75/94.625 tight digi style put spread is 10:1 for no cuts. December 2025 SOFR prices 170 bps of cuts, so Z5 95.5/95 put spreads are 5:1 payouts for much more modest cuts.

These trades can take awhile to play out, so shorting ZN is also an easy hedge.

If my demographic story becomes consensus (it took years for this to happen last cycle but it did), then I think equities will learn to live with higher rates. Thus, the real scary scenario for your tech themes is an inflation revival. That is what leads to the Fed turning hawkish, dropping soft landing, telling Goolsbee to go stare at a wall in silence and seek to break the economy. 2yr break-evens are priced at 2.3%, when headline is at 3% and has been for 3 years. Thus, this becomes the best hedge for you and is positive carry.

If you want a recession hedge, I suggest either going long the dollar (I prefer against EUR or CAD) via longer dated, deep OTM options. The forwards are steep such that it offsets some of the theta cost, and the dollar will certainly rally hard when a recession hits, only really reversing when the effects of easing start to loosen conditions (usually 3-6 months after).Alternatively, good old fashioned equity vol is cheap. 3m SPY vol at 12.3% has a monthly breakeven of +/3.4%. We rallied 22% in 3 months, puked 2% yesterday, and rallied 1% today. In the event of a recession, equities are going to fall very hard, and that 3% breakeven will be surpassed 5-10x over.

Do not buy bonds as a recession hedge at this stage. Bonds are doubling down on your tech themes. When rates move lower, at least for now, this supports your core position. YOU NEED A HEDGE.

As things stand now, the biggest risk to equities is if the FOMC decides that rate cuts are optional due to a higher neutral rate, and/or even worse would be if inflation moves higher from here and the Fed ultimately concludes they need to re-start the hiking cycle.

Thus, you need hedges for higher rates. The current SOFR pricing is below, with 75 bps of cuts expected this year and next.

A few ideas:

No cuts in 2024. SFRZ4: 94.75/94.625 put spread: 0.02 for a max payout of 0.125, or 6:1 for no cuts this year.3

Fade cuts in June 2025 by selling deep out of the money call spreads. SFRM5 96.75/97 Call spread can be sold for 0.05 to fade for a deep cutting cycle to 3% by the middle of next year (237 bps of cuts). While there is a high probability this trade does indeed expire worthless, it opens a tail risk where equities selloff and rates price deep cuts in a recession scenario. So this one requires caution, and if you make money on it (say it drops in value by half or more), I suggest monetizing it. For those less experienced with rates, I suggest skipping this one.

Additional Rate Hikes. In this case, I prefer to focus on June ’25 again as there are still 5 cuts priced in. If the Fed is going to hike again, it most likely will be more than once. Thus, SFRM5 94.5/94 put spreads can be bought for 0.05, for a max payout of 0.5 or 10:1.

Term Premium Expansion. If we look at 2023, we had 150 bps of rate cuts priced by May that were obviously not delivered. What hurt equities was a term premium expansion led by 10y rates moving sharply higher. If they were to upgrade the neutral rate estimate, we could get a repeat of this and re-test of 5% 10y yields. ZN May 107/106 put spreads can be bought for 4/64, for a 16:1 payout for a return to 5% in the next month. If you want more time for the trade, then June 107/106 put spreads can be bought for 8/64, or 8:1 payout.

If my demographic story becomes consensus (it took years for this to happen last cycle but it did), then I think equities will learn to live with higher rates. Thus, the real scary scenario for your tech themes is an inflation revival. That is what leads to the Fed turning hawkish, dropping soft landing, telling Goolsbee to go stare at a wall in silence and seek to break the economy. 2yr break-evens are priced at 2.3%, when headline is at 3% and has been for 3 years. Thus, this becomes the best hedge for you and is positive carry.

Thank you for coming to my ted talk.

This is a repeat of our SOFR fly earlier in the year, expecting that the same kind of evening out happens in the relation between 2025 and 2026 as did in the relation between 2024 and 2025 that we played using the H4Z4Z5 spread, described in the article below. This trade ended up producing significant returns on a very modest level of risk.

Market Memo: A Short Macro Insight

There’s some confusion currently in macro, especially in STIR. You’ll all recall that I’ve been pretty vocal on the need for cuts to be priced into 2024 since October. We owned Z4 and M4 calls on SOF…

Don’t know how to trade SOFR? Stop being an idiot and read Global Macro Trading for Idiots: Part 3!

Global Macro Trading for Idiots: Part Three

Hello, idiots. If you thought yield curves and FX were fun, we’re about to go on a journey to the heart of global macro. Short term interest rate (STIR) instruments add a whole new dimension to the ex…