Another Brick in the Wall of Worry

Our Annual China Macroeconomic Update

Annual China Macroeconomic Update

A little more than a year ago, we wrote “China at the Crossroads” detailing the decisions China would have to make in order for Chinese stocks to ever go up again…

The crisis has built a Great Wall of Worry in their asset prices, but could we be rounding the corner to “Bad News is Good News” in China?

It is not going to be smooth sailing from here…the reaction to the NDRC shows that investors are not ready to trust China (and for good reason). They need to see policymakers deliver, and we’re laying out what we need that to look like in order to stay more than just tactically bullish.

Because everything in China has been so bleak and there have been so many false dawns, investor sentiment and positioning is extremely jumpy. To climb the wall of worry, you’ve likely got to be comfortably numb to volatility.

In the wake of the first drawdown of this large rally, we’re updating you on our longer term views for China and our allocation to it. Is it only a fantasy or will the Chinese policy response help you to carry the stone (a long china position)?1

Let’s explore what it’ll take to climb The Wall in our annual China Macro update. Chartbook download below the paywall with 3 new baskets & updates to our current trades!

The article is in pdf format. Click the substack hosted download or the docsend link below to view it.

Another Brick in the Wall (of Worry)

Direct Link: https://citrini.docsend.com/view/iayvtrfs6y823yu9

If you’re time constrained, here’s the upshot in a few paragraphs. However, highly reccomend viewing it in PDF format by clicking the button above.

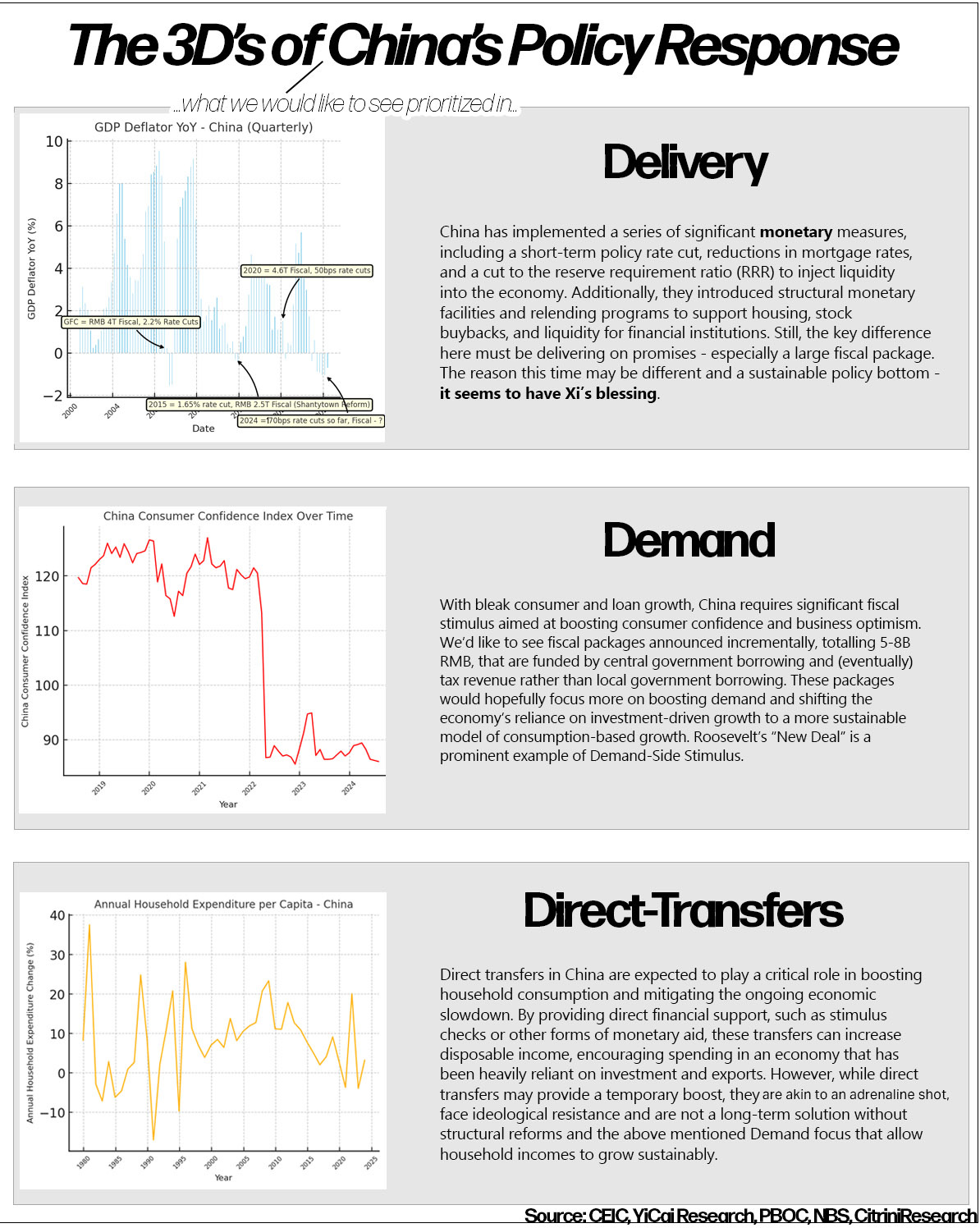

THE NEW 3D

We outlined the 3D’s of Chinas Crisis - debt, deflation and demographics - last August.

Now, we are focused on the 3D’s of China’s Policy Response - what we want to see in order to stay bullish here:

Delivering on Promises for More

Demand Side Fiscal Stimulus

Direct Aid (Stimulus Checks)

First, the past year, the 3D’s of the crisis have been made worse by a failure to Deliver on policy promises and stimulus. Going forward, we need to see the broad monetary stimulus continue to expand (which the government has said is on the table “500B we will do 500 more”)

Given the unemployment picture and the significantly bleak outlook for the consumer and loan growth, the only solution for China is drastic Demand-Side Stimulus. We’d like to see a package that cumulatively is at least double what it was during the GFC (8T Yuan or more in total.

What this means is not that we anticipate the announcement of a massive fiscal stimulus all at once, we think the supplemtary budget (later this October) announcement is ~2B CNY but that incremental packages will be revealed.

We believe the market impact is equally important. We can see the impact of the market perceiving more empty promises with the drawdown in Chinese stocks today, but we actually liked what we heard from the NDRC and believe it sets up well for us to buy the dip into later October after having taken profits off the table during this rally.

An aspect of this stimulus we still believe is very important is Direct Transfers to consumers. Surprising even me (and I’ve been calling for this for a year), they began direct transfers to the extremely poor. It’s a small program that amounts to about 500B CNY, but it is a first - before this was considered “welfarism”. That is a welcome change of attitude.

Consumer balance sheets are the only ones in China that can handle ending the drastic deleveraging, and we believe that China has to tools not just to hand out money but to encourage its spending via eCNY. There has been resistance at the top to this, a reluctance to encourage laziness, but we believe that will end in an equally violent end and 180 shift as the fate met by the three red lines, zero covid and the one child policy. We’ve already seen green shoots of this.

We expand on our explanations of how demand side stimulus (specifically direct transfers during covid but also employment programs during the new deal) have offered the exact kind of sustainable growth impulse in the U.S. that China needs right now.

WHY NOW.

While our reasons are many, the two primary drivers of our belief that this time is different:

As we described in “China at the Crossroads”, China doing stimulus as a very-much still export driven economy while the Fed and global central banks were tightening policy would have been equivalent to pissing in the wind. The Fed’s easing cycle has started and they are focused more on ensuring growth stays strong and achieving the soft landing than with fighting inflation. As we wrote on September 18th, China easing would follow the Fed’s first cut. And it did a week later.

This seems to be driven primarily by central government efforts rather than piecemeal programs and, therefore, likely has the blessing of Xi Jinping - this has been the primary factor in previous false dawns not panning out, XJP’s insistence on continued deleveraging.

WHAT WE WANT TO SEE

As we updated last week, we have trimmed out China exposure back (twice) for a total of a 40% reduction from peak portfolio weight. This isn’t because we are bearish necessarily, it’s because we are pretty confident we’ll get a better entry and we’d like to get as much information and as little risk as possible before that happens.

As we said in August, the only places where China can afford to lever up is the Central Government & the consumer (provided incomes rise). We’d like to see a supplementary budget in October and an announcement of the fiscal “bazooka” in December.

We believe there is room for much more, as well, and see China slowly unveiling up to 8 Trillion RMB in fiscal support - double the GFC.

Incremental is the key word here - there will still be lots of planned promises and investors will likely be disappointed many times before the rally is up. However, we liked what we heard last night - perhaps that’s because we were expecting it to disappoint investors who weren’t listening. The tone has changed and the coming fiscal stimulus is in the right direction - we will be dip buyers.

Large fiscal stimulus, especially direct transfers, can have a huge impact. However, rumors and promises can’t. That is still true, we need to see the rate of change on actual delivery improve.

The upside to the size of China’s fiscal stimulus is going to be determined by the magnitude of the economic response to early stimulus measures both monetary and fiscal. If they’re doing “whatever it takes” then you get a simple framework we are all familiar with:

In China, Bad News is now Good News.

TRADE IDEAS

We explain our expectations and trades for this new chapter.

Our view is that China’s rally continues provided that we are correct the change in stance has come from on high - China policy bottoms only occur when Xi Jinping wants them to.

We believe there is more room to run after a positioning driven drawdown. From here, MSCI China can rally 25% just to close the post-covid discount to MSCI All World (ACWI). his episode of stimulus will look drastically different and that market moves over indexing to the 2015 episode are incorrect.

We do not believe that China’s stimulus will be able to meaningfully increase their oil or steel consumption in the near or medium-term, although we would not position short on that thesis.

Nor do we think its time to buy names like OTIS or KONE or mining names (with the exception of lithium) for the long term. We would favor beginning small longs on select luxury (based on sentiment not on china having a big impact), but would fade any industrial metals that have rallied on this move.

We also discuss PBOC gold buying, China net-nets and some adjustments to our existing holdings.

We believe that the overwhelming behavioral psychology involved is that investors have gotten burned numerous times buying “false dawns” and are likely still jumpy. This will make the path forward bumpy, as always - not for the faint of heart, but by the time it’s not like that all the big allocators will be in and returns will be less exciting. So, pick your poison.

I believe this will provide the fuel for the next leg up out of some initial volatility as China stays dedicated to ensuring that in the market this recovery continues and the central government begins to release their plans for fiscal stimulus in a stepwise manner, focused for maximum impact.

We update our approach to the “Chinese Equity Barbell”, which has worked quite well and helped us stay allocated to china while avoiding the worst of the drawdown in broad indices, and overweight the demand-side versus the supply side.

We continue to favor the “don’t fight the fed” approach with Chinese characteristics. We align our Chinese equity allocation with the priorities of the government. We analyze commentary by the CCP at the highest level on areas like AI, semiconductors, manufacturing, dairy, agriculture and consumption to guide our equity selection and macro view.

New & Updated Baskets

By now you’re probably looking at this Pink Floyd themed macro research and asking “why”. My response - why not. And yes, of course, your next response is “well, lots of reasons” but it doesn’t matter, the worms have already ate into my brain.

all in all, it's just another Cit in the wall

Hi,

Super interesting. Just two observations: on the table of next events, Year of the Dragon is this current year right? Do you mean spending will be boost by year end?

On the three exempts policy, I have been trying to look for other sources (including Xinhua that you cite) but I cannot find it. Could you please guide me to the original source?

Much appreciated. Thanks a lot for all your work, I really enjoy it.

Best