Trade Update: Holiday Edition

Long Gold/Short Oil Position Update

Seasons greetings to all of my subscribers, free and paid alike.

I appear to have made an oversight in a previous publication. In the article titled “Market Overview: Rates-maggedon Edition”, I put a pretty killer trade idea above the paywall.

From what I hear, I am supposed to have people pay for the part where I share trades that end up killing it. But it’s okay, now I don’t have to go gift shopping for any of you. Consider this your early, non-denominational holiday gift from Citrini.

There were 6 more trades below the paywall that also worked (and one that didn’t, AUDNZD being annoying as always), so it was more of a stocking stuffer I suppose. In keeping with the spirit of the season, I’ll also be making this trade update to the Long Gold / Short Oil position free for all subscribers.

I certainly received some pushback in my DMs about this one (of the “shorting oil into maybe WW3 is dumb, citrini” variety mostly), but I viewed this trade as somewhat geopolitical risk-premium neutral in the sense that there was a discrepancy between the premium placed on oil due to Yom Kippur War 2.0 fears and very little on gold. It also helped that I was very bullish on rates and expected real yields to fall after ratesmaggedon (BoJ/FOMC/QRA triple play).

Gold has outperformed oil since the article’s publication by 22.85%.

Trade Update: Book Profits on 1/2 Position, Replace with Long Gold / Short Oil & Copper (50/50)

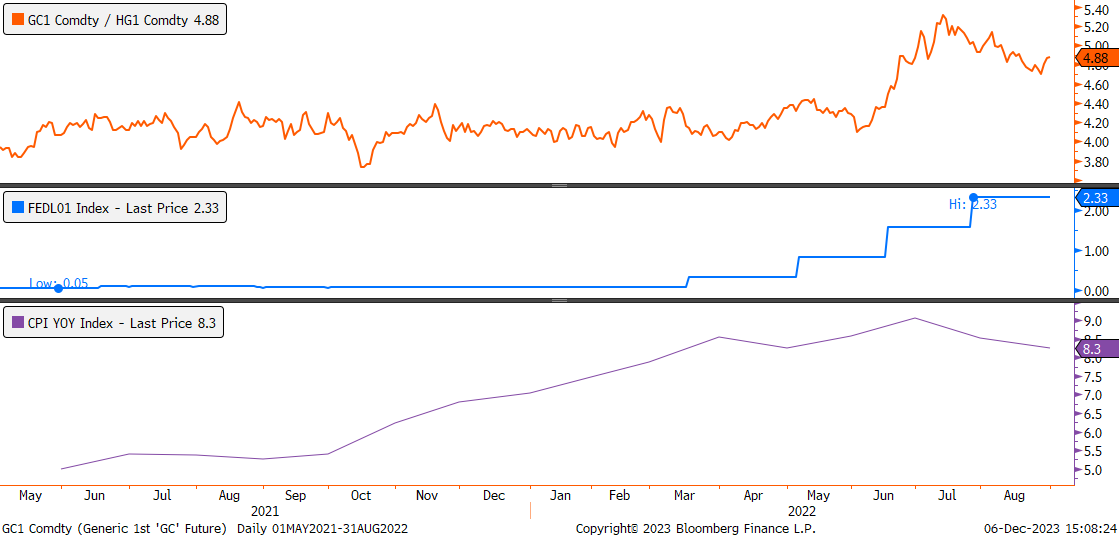

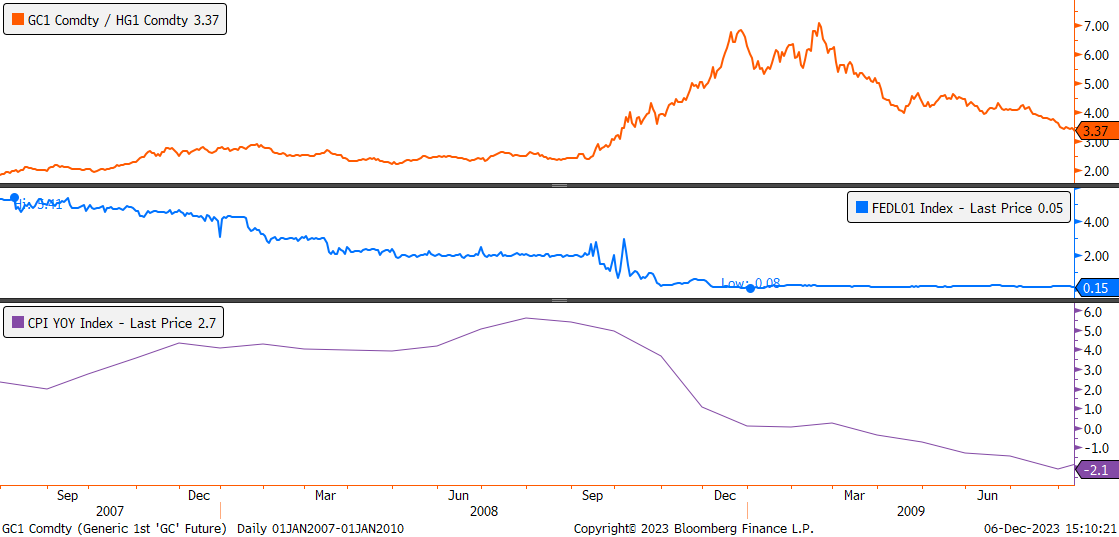

As the above chart shows, the inverse correlation between real yields and gold that tends to come about during periods of financial and/or geopolitical volatility (which I highlighted as part of the reason for the trade in the original article) peaked in mid November and has been resolving. Additionally, while the market has been increasingly pessimistic on oil I do believe there is a certain degree of support that still exists from the refill of the SPR and KSA’s determination to dampen volatility.

Since we have just taken profits similarly in our Euribor spread and will be looking to pare back the long bond calls we took on 10/31, I think that we can adjust this trade a bit to avoid the complexity of oil as it goes lower and replace it with a short on copper, which will similarly hedge against an economic slowdown and allow us to retain our exposures to the fiscal beneficiaries and semiconductor heavy AI basket (both relatively cyclical despite thematic tailwinds).

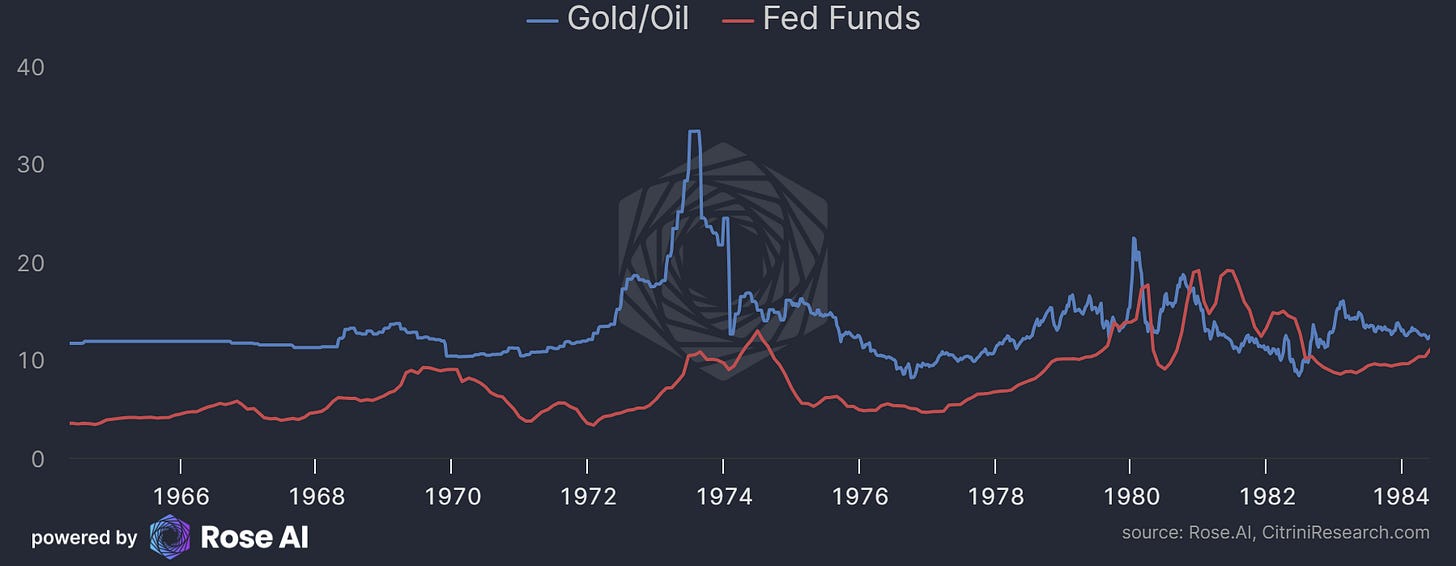

As we can see, the Gold/Oil ratio is approaching a level which has been somewhat of a significant area for reversals. (Since oil went negative during Covid, it’s a bit of an outlier, but otherwise we are certainly approaching the upper bound).

Let’s take a look at the past 5 years with a bit more granularity:

Outside of the pandemic, this is a line that the ratio has spent very little time above during the past 5-6 years. Now, I’m not the kind of person that rules out tail risks and I can personally verify whatever the latest respiratory virus out of China is bad, but I don’t think we should necessarily be positioning for another covid.

Let’s look how this ratio has performed in the past 5 years during some rate cut cycles. First, the outlier (technically the ratio went negative but, also technically, the profit on being long gold short oil was infinite during that period):

Going back to the GFC, it did similarly well:

It was already rallying when the Fed cut rates to fight slowing growth on January 3rd 2000, but continued rallying significantly until the last cut:

The ratio also rallied during the 75bps of cuts that the Fed did quickly during the 1998 Currency Crises & fallout of LTCM, and continued rallying a bit beyond although the gains were quickly reversed after it became clear the Fed would raise again into the booming 1999 economy.

It begins getting a bit less clear-cut during the famous Greenspan “soft landing”, which could be presented as a potential framework for a counter-case to any sort of severe economic slowdown awaiting us in the next few years. The erratic 3 25bps rate cuts of 1995 and 1996 (beginning in July 95, with the last in January 96) accompanied a rally that only went up ~15% from first to last cut. If you’d went along with the market in anticipating the cut a month or so before it occurred (as the pair began notching consecutive daily gains) you’d still have only made ~22% - around what we have made on this pair in the past month with zero rate cuts materializing!

Needless to say, the pair (and the Fed Funds rate) has gotten a bit more volatile in the past two decades.

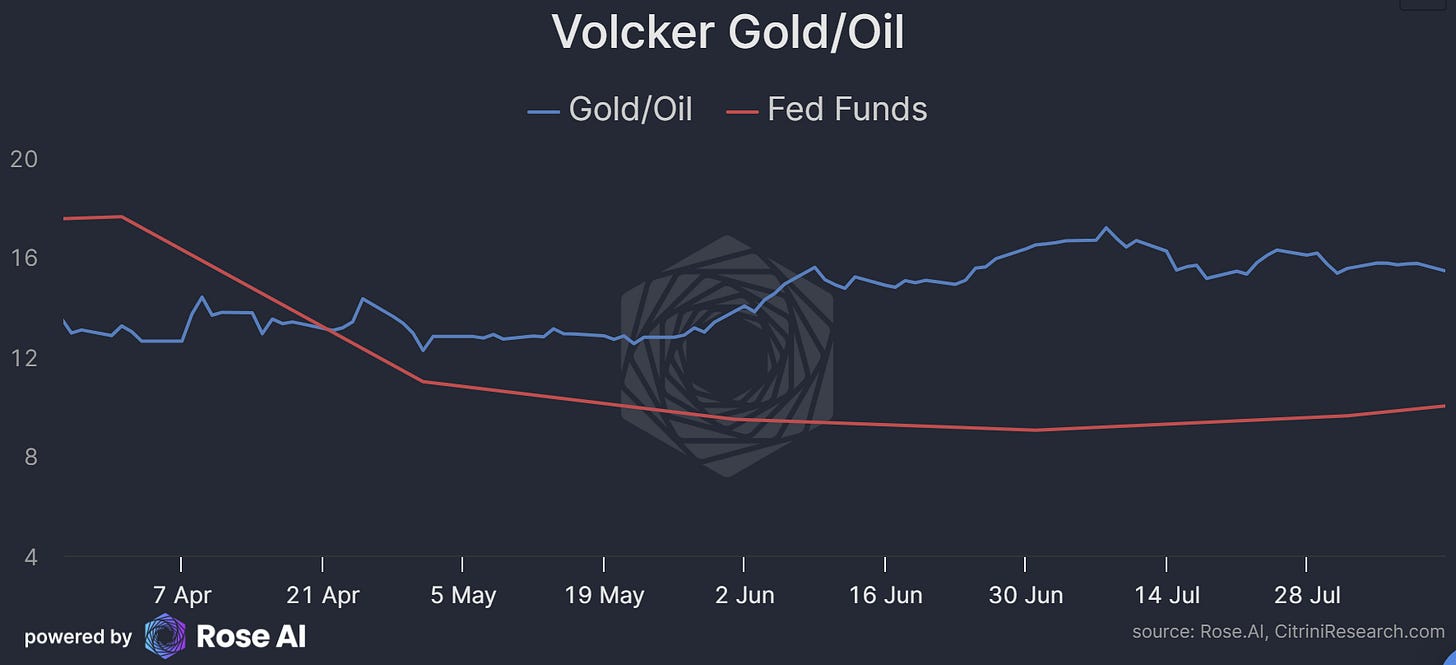

While we can see that this is a bet that pays off asymmetrically in a severe recession and still maintains upside in a hypothetical soft landing, where it begins to get more blurry is when we examine the stagflationary 1970s and early 80s. While this isn’t my base case, it’s the opinion of many macroeconomists I respect that inflation may begin to reaccelerate into the back half of 2024. If that were to happen, it could represent a risk to this pair (pretty obviously if it is caused by an oil spike).

Switching over to rose, since Campbell Ramble is a data junkie that could probably give you a time series on rates since the Roman Empire fell and Bloomberg struggles with anything before the 90s, we can see a much less clear cut relationship:

The first 1980 rate cut, which was accompanied by a pretty steep drop in oil, saw the pair rally:

This was quickly reversed by the next series of rate hikes. Looking before that, we see that the relationship between gold and oil was much less predictable, at times being essentially correlated with the Fed Funds rate, during the Great Inflation beginning in 1965.

All this taken into account, the weakest spot for this ratio would be a reacceleration of inflation. The ratio performed similarly poorly as inflation climbed, independent of rate hikes or not:

This is why I believe the best way to keep this on, without having to worry too much about the distinct possibility that rising inflation results in some poor performance, is to replace half of the oil short with copper. This performed relatively well during the period of rising inflation + rate hikes…

…and similarly well during the recessionary impulse of the Global Financial Crisis:

Amazing article, thank you. Are you still somewhat bullish on China stimulus, though (long your Chinese basket / not really short CNY anymore)? If there is life in China, copper and oil will rip.

Cheers mate!