MARKET OVERVIEW: RATES-MAGGEDON EDITION

Enter the QRA/Geopol/BoE/AAPL/Uedadome

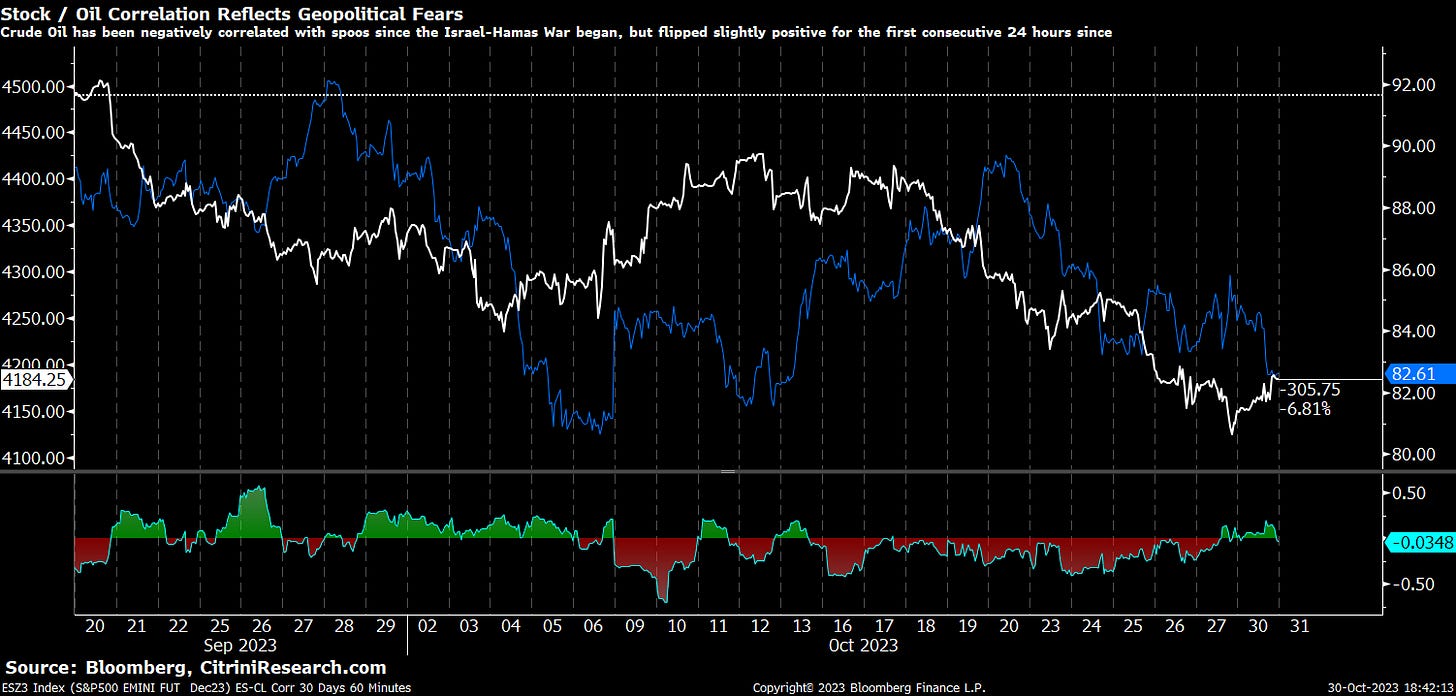

Market was reasonably constructive today as geopolitical tensions ease on Israel’s execution of a “slow roll” invasion resulting in a lower probability of regional conflict in response to an all-out ground invasion that forces gulf states to declare allegiance - in a surprising twist, it seems that rates are going to be more interesting than commodities despite the…*checks notes*…ground war in the Middle East. Crazy times, eh?

Trading preparations for the FOMC/BOE/BOJ were in full swing entered - dollar eases, yen strengthened, rates got a bit of a reprieve midday from the treasury announcement and oil and gold came off highs.

I think the risk reward on short oil/long gold is decent here and somewhat geopolitically neutral assuming Israel continues its “slow roll” invasion, the tail risk of regional conflict has receded back to the tail of probabilities, where it belongs. Today we saw a weakening dollar, oil down, yen up, gold coming off the highs.

In US rates we’ve got a significant move lower in SOFR swap spreads with 10s experiencing the most significant drop, which seems to be mostly technical and liquidity driven although I do believe there is an element of credit risk being perceived here.

QRA HYPE & IMPENDING BOND RALLY

The QRA is probably overhyped (not in terms of whatever the absolute amount is going to be - I will be honest I genuinely have no read on what the number will be, but what I do have a read on is how obsessed everyone is with it and the fact that the market seems very well prepared for anything except a truly astonishing number) and if the BoJ goes okay this could be a good spot to be positioning for a bit of a rally in bonds pre-QRA&FOMC:

Although I’ve written most of my thoughts on the BoJ already in the subscriber chat, which you can check out here:

I figured I’d go over a bit of what consensus expectations are, despite the left field play here as a 10bps hike out of NIRP by the BoJ rather than continued YCC adjustment (unlikely but asymmetric).

USDJPY weakening into the BoJ meeting is quite interesting as was the Nikkei press test but it is a huge mistake to think this telegraphs anything for certain. They are testing to see if YCC adjustments are enough to buy breathing room on FX, which it does seem to currently but I’m unsure on whether it’s enough. Additionally, they will likely hint at further YCC adjustments and the market has priced in, already, a 10 year JGB rate higher than 100bps):

What’s consensus?

The Bank of Japan (BOJ) is teetering on the cusp of stasis and change as market participants await its policy decision on October 30-31. The prevailing consensus, rooted in both recent policy stance and surveys, leans towards the BOJ maintaining the status quo but hinting at further YCC adjustments. Specifically, the short-term interest rate is expected to remain at -0.1%. A Reuters survey conducted between October 17-25 lends weight to this expectation: 25 out of 28 economists predict no change in the immediate term. The BOJ's existing framework, including its flexible Yield Curve Control (YCC) and fixed-rate purchase operations at 1.0%, are also expected to remain intact. There's a palpable hesitancy to rock the boat, but this inertia isn't universal.

A minority view, both intriguing and disruptive, suggests that the BOJ might begin a gradual shift away from its ultra-accommodative stance. The external environment—marked by a recent surge in U.S. 10-year yields and a ballooning U.S. budget deficit—has raised questions about the sustainability of the BOJ's current approach. Some commentators argue that the BOJ should proactively adjust its yield curve control to mitigate potential shocks. It's an area of contention and speculation; Bank of America, for instance, suggests the BOJ might raise the YCC ceiling to 1.5%, while ING envisions a possible increase in the 10-year JGB target. Despite these dissenting voices, the probability of an immediate shift seems low, yet it’s substantial enough to keep traders on edge. Even more in the minority are those who believe that the BoJ will adjust the policy rate rather than YCC.

I think playing this in FX rather than rates is a good idea and proposed doing 1/3rds short CHFJPY, EURJPY & USDJPY.

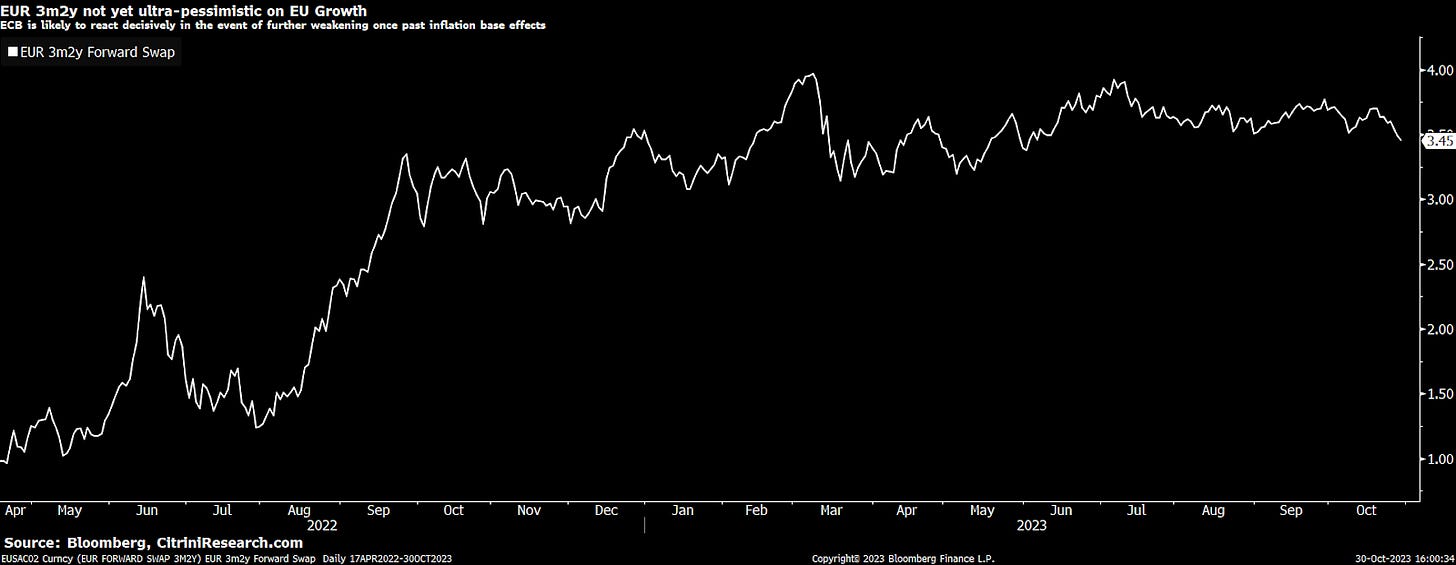

TRADE: EURIBOR SPREAD

Europe continues to make some very, I guess “irresponsible” or “stupid” are accurate words? EUR has experienced strength since last October in relation to higher inflation pricing in higher rates but I have high conviction that the eurozone will be in a recession inside of 6 months if they aren’t already. As discussed earlier and implemented, wingy upside on euribor out to z4 may be a superior play here than our current M4 and Z4 SOFR calls as a hedge. It could would also provide some likely downside protection we’d need from the secondary effects on Chinese-EU trade.

Euribor is pricing in nearly the same amount of cuts by the ECB between March 24 and March 25 as the Fed, despite SOFR being 144bps higher, but should still likely price in more by the end of the year (trade: initiate short ERH4H5 at -0.835).

Other FX

Although I saw virtually no coverage of this the reason I began paying attention to CHFJPY was because of the actions of the SNB:

Per BBG:

(Bloomberg) --The Swiss National Bank is cutting the amount of money lenders can get by parking funds at the central bank, a move that’s set to save it about 600 million francs ($660 million) per year in interest costs.The move follows a series of interest-rate hikes that lifted the SNB policy rate to 1.75% from a low of minus 0.75%. With the policy rate determining the interest on so-called sight deposits, that was increasing the amount the SNB had to pay out.

Although inflation picked up in CHF I think that is artifact and unlikely to continue, and provided that geopolitical tensions do not cause a flight to safety short CHFJPY could have more potential upside than short EURJPY as the risk premium on CHF is taken out. I’ve implemented one third long JPY against CHF, EUR and USD.

Elsewhere in FX, AUDNZD is continuing a move that looks like it has serious momentum with continually narrowing rate differentials and may head further towards YTD highs of 1.1088 with a relatively well-defined stop at 1.08.

I think this move on the BTP-Bund spread is interesting as well, with the spread narrowing for 3 consecutive days:

As I have been expressing various bearish views on the EU economy and credit which have worked well, I am looking to continue that with a bit more of a nuanced implementation. Pure BTP-Bund may not work because Germany is in a pretty dire position this cycle as well. So far, the simplest and most major being the short on SX5E futures we took towards the end of July in response to a very grim outlook from EU earnings season, that ended up being within 50 ticks of the top and doubling down below 4200. I have recently closed out our short on Eurostoxx anticipating a shorter term technical bounce (although I will immediately put it back on in size if we break this level, I’m pretty satisfied with a 10%-ish gain).

Now that we’ve covered the short on euro equities, it is simpler to be playing ECB rate cuts directly than be short the index as you pickup both soft landing/recession as upside.

I am seriously considering bringing back the boxed flattener on BTPs I had on from December 22 until the SVB collapse - but using bunds instead of treasuries. And I might actually just cut out the middleman and go long schatz and short BTPs.

Reviewing some of the things discussed in the subscriber chat:

In earnings, we hedged LLY/NVO with MCK puts as it is the first impacted by GLP-1 volume that reports. I think it will do fine and I have also bought the dip on STVN due to the fact that it seems fully derisked on WST read through which is not as significant a beneficiary of the GLP-1 volume as STVN is, which is why despite being told by a bunch of people it should be it was never included in the basket

I’ll be watching CCJ earnings closely as a indication on the stage of this uranium hype cycle we are in. OKTA continues to fall significantly, and both standalone short OKTA (reccomended in mid-September) or long CRWD short OKTA (which I mentioned as a potential L/S in the last article on MFA/IAM and the MGM/CZR hacks) should do fine.

A few of our tactical trades have been stopped in the previous couple weeks - which I discussed in the subscriber chat, but we also successfully hedged most of the drawdown with SPX puts, long gold (which we exited this morning from an entry of 1875) and various oil and FX trades.

TRADE: INCREASE LONGS ON AI

For the first time since April I am starting to see some bargains in semiconductors and potential AI beneficiaries therein, and I think that adding back long to the AI basket after having taken some solid gains throughout the summer is beginning to be a good idea here, it has almost retraced to May levels.

I bought MPWR after their earnings just now.

Hedging the Citrindex

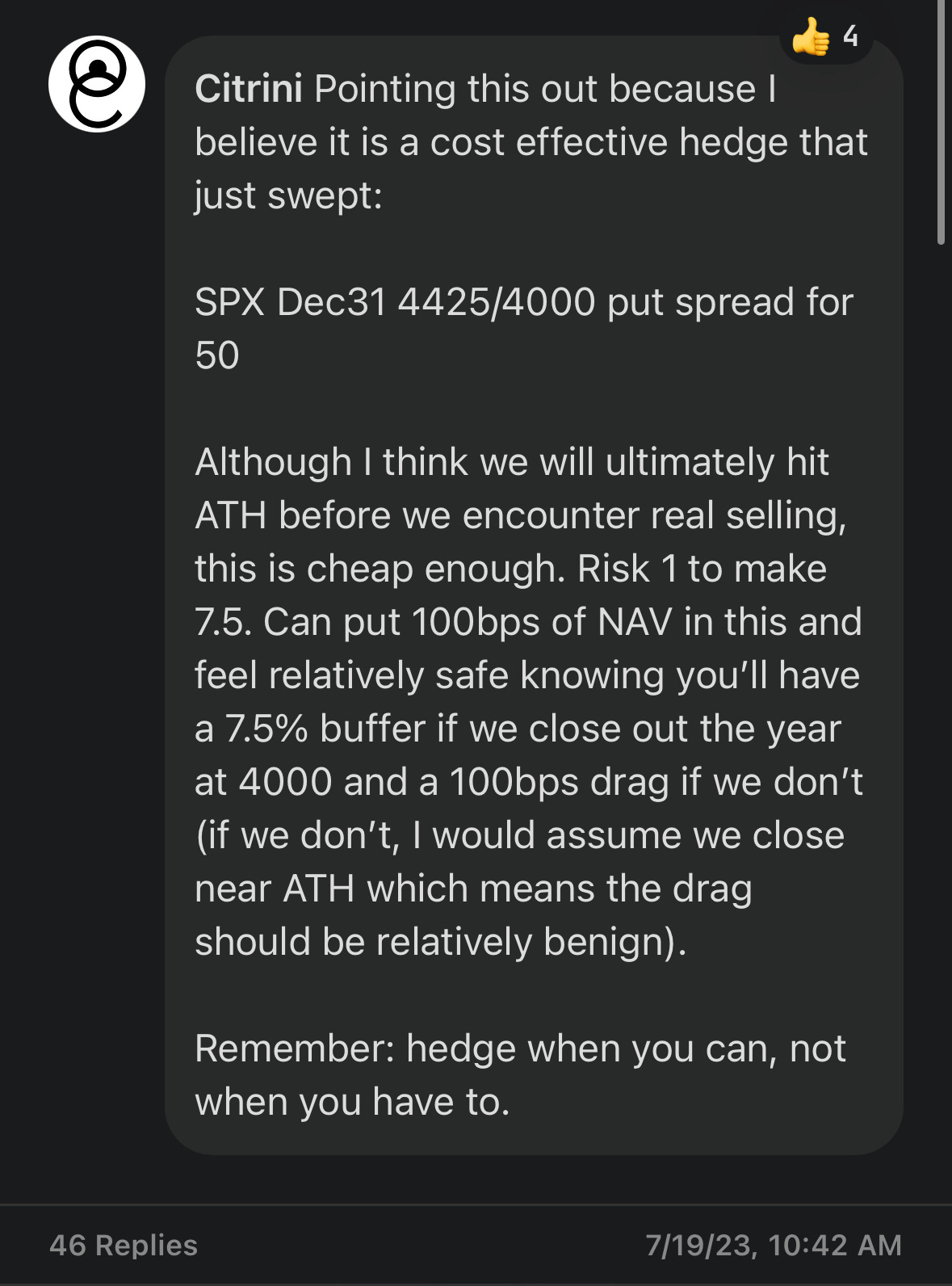

I wanted to also highlight something here which I often say, “hedge when you can, not when you have to”. On July 19th we put 100bps of whole-book NAV into end of December SPX 4425/4000p spreads and then increased that to put in 2.8% of my entire book (or 4% of the core L/S portfolio) in December SPX put spreads.

I actually shared my reasoning when we had gotten the position up to full size after the end of July. It was quite simple: don’t let a win make you cocky, have it make you freak out a little:

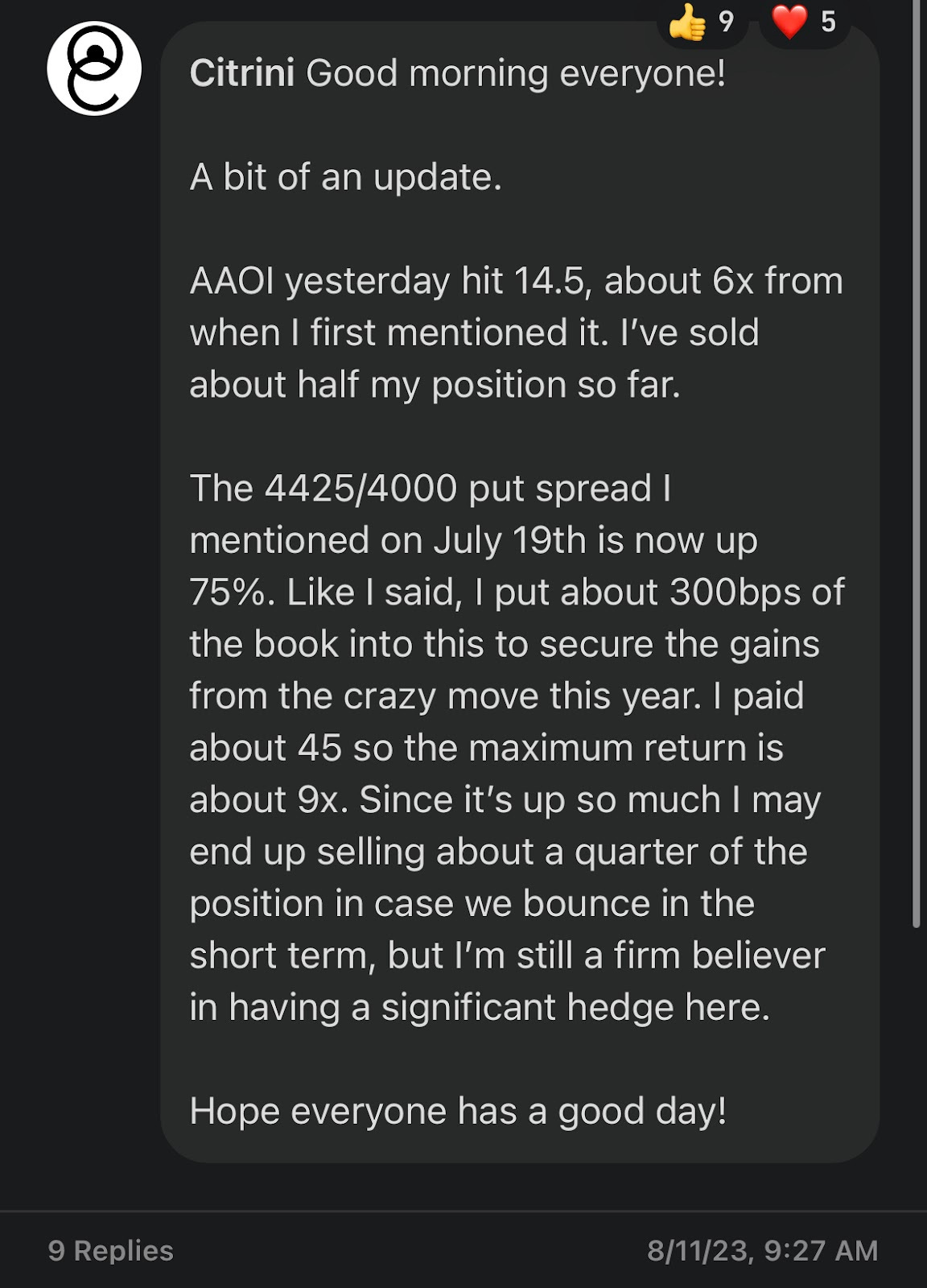

So, derived from paranoia about having a good year in a single direction (namely, up in equities) and taking the necessary precautions (as Soros would say, insecurity analysis, we managed to take a pretty gnarly drawdown in the unhedged core book, but augmented with the put spreads as a hedge everything was pretty much fine.

Here’s what the “Citrindex” core L/S portfolio looked like with only the core positions (ex-the 2s10s30s steepener which was also somewhat of a hedge, all things considered)

And here’s the performance of the put spreads that represented 4% of the core L/S allocation, which we were buying below 50 from mid to late July (chart is total return %):

Now take a look at what the portfolio looks like when you add our hedge.

Whereas the unhedged portfolio experiences a maximum single intra-day drawdown of ~5% (it was less by the close) due to some unfavorable earnings - namely, CLS & KNSL - and a relatively serious drawdown in higher beta thematic names - namely, AAOI and WW - despite the fact that we sold half them up 100%, they still were up so much that they represented some significant enough portion of the portfolio).

The willingness to potentially sacrifice 2.8% of the book by paying for very asymmetric (my own cost basis on the puts from scaling in to them between 50 and their low at 38 is around 45, which gives a potential maximum return of 9.44x if the market were to close on Dec 29 below 4000) protection didn’t just prevent the ass-puckering drawdown, the ~+315% total return on the 4% of the core portfolio (2.8% of 70% allocation) resulted in a return right now that’s nearly 10% higher than the unhedged portfolio and is still within 1% of highs.

I know I was sharing my conviction on these with everyone because I very rarely would post something like “still holding on to x”:

So we hedged when we were able to, not when we had to :). It’s important to keep track of. I don’t think we need this hedge anymore.

For institutional clients I’ve got a couple trades that could be interesting:

USDJPY: 8 Nov 147.50 vs 13 Dec 145.25. Equal legs. Gets you downside JPY gamma, sells some vega, courtesy of a brainstorm in the Citrini Research IB p-chat :)

Receive Fixed on EUR 3m2y

This will work similarly to the short Euribor H4H5 spread that we discussed for non-institutional above, but likely slightly better, That’s all folks - this started as a continuation of the macro week overview in the subscriber chat but got way too long so I kind of just rolled with it and changed it to a market memo.

Feel free to reach out in the chat if you want to discuss anything else, I’ll be nocturnal this week cause of an old Japanese man. I’ll be sure to be giving commentary in the chat and on twitter.

Any opinion on long-ing big japanese banks?

Like $MUFG, $SMFG, Mizhuo etc. Net interest margin and all that ...(if BOJ lets the 10 yr go up)

The advantage with American trading Japanese banks is that, one could do options!!!

(cannot/unable to do options on straight Japanese tickers on ibkr, due to some SEC rule for US citizens)

Any thoughts on the continous ACMR dip Cit? amazing writeup as always