The Citrindex: Part One

Core L/S Portfolio Performance Tracking for Thematic and Single-Name Equity

It has been nearly ten months since this service’s first published trading opinion, “Sell China, Buy US Semiconductors” in January 2023:

Five months ago, I stopped providing these insights for free and began charging for them using a paid subscription model. I have taken the vote of confidence you’ve given me with your patronage very seriously.

And now, it’s time for me to demonstrate the fruits of that labor: have I generated insights and contributions that resulted in pure alpha for the people who have decided to read my work?

Genuine, selection-effect specific, factor uncorrelated alpha, i.e. outperformance that is specific to my ability to select and recommend positions, is the goal here.

So, in this article - the first installment of what will be an ongoing quarterly series - we are going to examine the equity curve of the Citrini Research Thematic Equity Analysis portfolio. The CitrIndex, if you will, shall track all equity baskets and single name equity theses published as long-form articles with a straightforward equal weighting and a rebalancing schedule determined by article publication.

As I’ve mentioned before, the only reason I enjoy trading, investing, speculating is because you get immediate and consistent objective feedback on whether you’re doing well or really messing up. No, investors know the feedback is immediate, it is objective in its constant presence and it is felt viscerally.

To my great pleasure, that objective, visceral feedback provided by the equity curve since inception of the newsletter has been overwhelmingly positive. This newsletter has, with empirical evidence, nailed it. Truly, objectively, measurably well. That’s something I can say without braggadocio or hubris - it is simply a fact.

We were early on so many things - being bullish on US equities in 2023, the genuine and the hype in artificial intelligence and machine learning, positioning for a treasury supply driven bear steepener that uninverts the 2s10s and 2s10s30s, anticipating that the market would price in not just just higher sales for NVO and LLY on GLP-1 drugs but lower sales for those companies that were dependent on the continued growth of the US obesity epidemic. Not just that, but we weren’t harvesting market or sector beta on these moves. No, our implementations were elegant and accurate to the theme expressed.

As of 10/11/2023, encompassing all published Thematic Baskets and constructed as described below, including no trading and simply buy & hold on the positions and equity baskets published in the newsletter:

The Citrindex Core Long/Short Portfolio is up 30.45% since inception on May 31, 2023, representing 25.79% outperformance over the SPX Index.

This performance, hopefully, is not a surprise to you as a subscriber (provided you’ve taken the time to read my admittedly lengthy & frequent analyses). This is a representation of performance if you had taken a position in all the thematic equity baskets I’ve written up since May, in one portfolio. We’ll break down their individual performance as well.

It’s truly something else to see major sell-side research calling for the most basic of second order effects from GLP-1 drugs literal months after I’ve written it, or to similarly see a piece a month after my “triphasic AI framework” that deals with the “four stage AI path”.

I’m sure they’re coincidences, but what it does mean is these were really f*cking good ideas, timed really f*cking well and hopefully you got in before the crowd. We were even mentioned on Bloomberg for this, by (subjectively) objectively the best anchor there, Mrs. Dani Burger:

The bottom line is, the timing has been good. The plays have been good. The upside materialized.

And that’s what it’s all about.

CONSTRUCTING THE CITRINDEX

It will ultimately include every thematic trend basket, tactical trade, individual option play - whatever. If it has a bid/offer and I’ve said to bid or offer within the confines of this newsletter I’m going to put it in. It is mimicking the way I implement these themes and tactical positions into my own book.

What the reductive description of that overall portfolio construction strategy would look like is:

70% Long/Short International Equities: focused on themes and trends with a 12-18mo holding period, typically. These are the plays that appear inside articles on the main page, with long theses and primers written about them. We will call it the “core portfolio”, for short. This is what this article is about, focusing on thematic baskets that have longer timeframes.

You’ll note that trades like the Chinese Equity Barbell which combined long USD short CNH with two scenario based chinese equity baskets, the Chinese Property Bond trade - which went up about 50% at the peak, travel normalization playing long consumer discretionary short hotels, airlines and cruises and short 10s on the 2s10s30s fly at -104bps are all absent from this section and will be included in the next, as the timeframes and intentions do not match this allocation.

30% Tactical Global Macro & Single Name Equity Trading: focused on capturing outsized moves, shorter term macro inflection points and smoothing core portfolio volatility through uncorrelated returns. Some of the things mentioned in the articles may end up here, if they are presented as a trade rather than an investment. We’ll call this the “tactical allocation”, for short. This is what the next article is about.

However, to make it more digestible, I’m going to do it in two parts, the first (this one) will be focused on the core positions - those that have made up actual articles I’ve published. This allows us to examine the subportfolios (“baskets”) and their performance, which is useful feedback on whether we’re accurately capturing a trend or not. It will also include some of the tactical trades that have turned longer term and ended up in those articles (from the dates they were mentioned in the subscriber chat), namely Long TOPIX Banks in USD vs. Short TOPIX in JPY. I’ll be putting positions with shorter histories (less than 2 months) in the second article as well, so as not to appear that I am skewing the results of this portfolio with regular adjustments. Trades that get a passing mention in the chat do not receive the same weight as a trade I write a 30 page thematic primer on (obviously).

Portfolio construction will be the same as listed in the basket - drifting weight (i.e. LLY starts with 8% of the GLP-1 basket and then is allowed to grow or diminish as it progresses, there is no rebalancing or alteration once the basket is set unless explicitly noted). Inception date will be the date of publication or first mention.

The way the allocations will work is that whenever I post a new article, the allocation to that basket in the core portfolio will be rebalanced to be split among all currently published themes.

I think this is intuitive because my article timing is deliberate. There’s a reason I published AI winners first and AI losers after AI had a massive two week run up, and there’s a reason I published my GLP-1 analysis in time for expected results from NVO and LLY.

Again, I only write about it if I truly believe it is an opportunity worth selling something in the portfolio for, unless I explicitly say something like “I’m only writing about this so you have a shopping list when it gets volatility due to upcoming news cycles” like I did with the Fiscal Primacy piece.

Okay…

Core Long/Short Portfolio Returns & Attribution

Position 1: Long Artificial Intelligence Global Equity Beneficiaries

Inception Date: May 31st, 2023

Exposure Type: International Equity Basket, Equal Weighted, 100% Long

Return Since Inception: +10.73%

Inaugural Post, Comprises 100% of Portfolio until June 15th

Biggest Contributors:

Biggest Detractors:

PnL Chart

From May 31 2023, the Artificial Intelligence Global Equity Beneficiaries basket has realized a total return of 10.7%, outperforming a Bloomberg World Aggregate Equity benchmark index during this period by 9.99%.

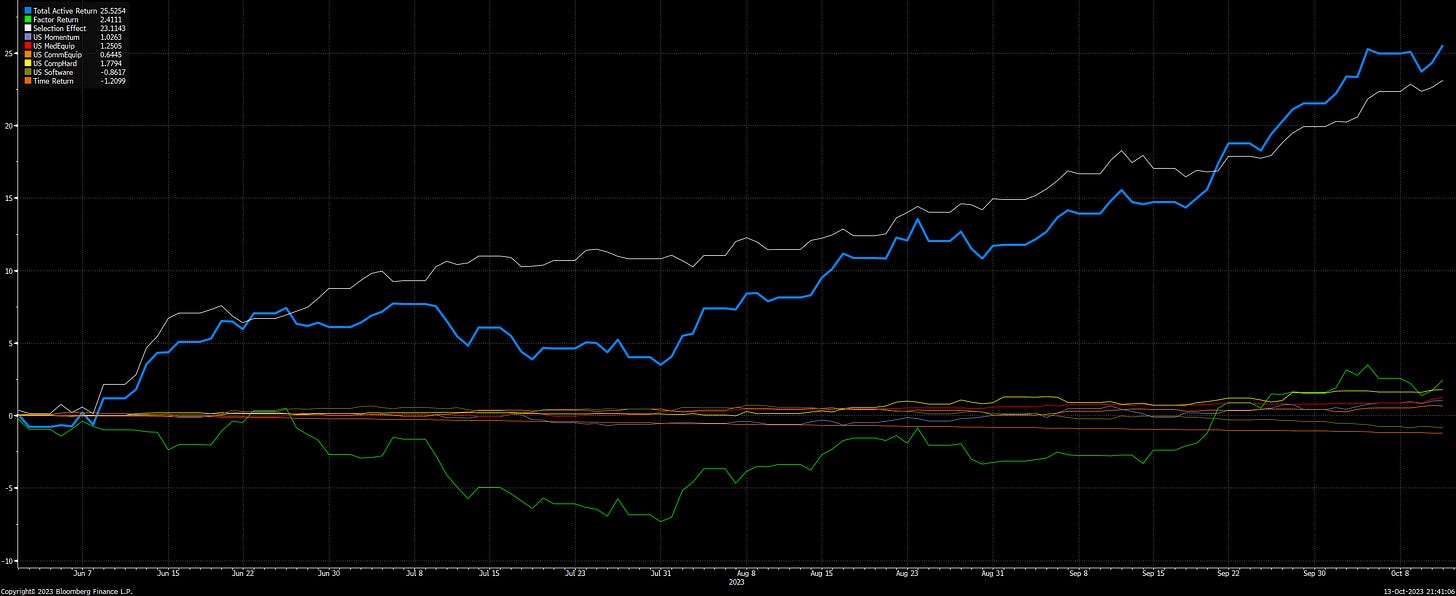

Nearly all of the excess return can be fully attributed to stock selection alpha once known factor and industry and country exposures are fully accounted for. In the Time Trend chart that plots cumulative returns attributions over time, we can see that the pure stock selection alpha (White line/”Selection Effect”) tracks the total outperformance (Blue line/Total Active Return) nearly one for one consistently!

Position 2: Short Artificial Intelligence Losers (1 of 2 Equity Baskets)

Publication Date: June 15, 2023

Exposure Type: International Equity Basket, Equal Weighted, 100% Short

Return Since Inception: +17.8%

Short AI Losers takes 25% allocation from AI Beneficiaries, as 1 of 2 baskets in article

PnL Chart:

Biggest Contributors:

Biggest Detractors:

From Jun 15 2023, the AI shorts basket realized a total return of 17.8%, which stands in contrast with the broader market (Bloomberg US large and mid cap index) realizing a 3.3% total, which bring the total active return to 21.1%, of which just over 10% comes from being net short the market beta, about 6% coming from known style factor exposures, and 8.9% comes from pure stock selection alpha. Over time, we can see that there is a large and persistent stock selection alpha while the factor return contribution fluctuated.

Position 3: Long Relative AI Winners vs. Short Relative AI Losers (2 of 2)

Publication Date: June 15, 2023

Exposure Type: International Equity Basket, Equal Weighted, Long/Short

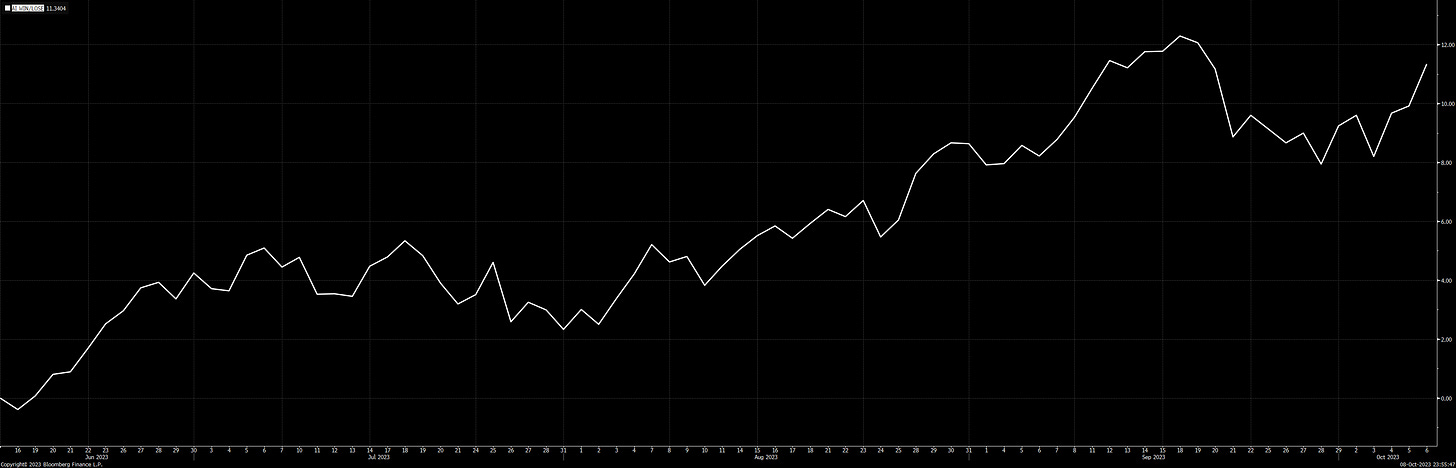

Return Since Inception: +11.34%

Long Relative AI Winners vs. Short Relative AI Losers takes 25%, Positions 1 &2 are now 50% and 25% respectively.

PnL Chart:

Biggest Contributors

Biggest Detractors:

Statistical Summary:

Article Source:

Less Deus, More Machina

Preface As discussed in my piece on how to play AI beneficiaries (which you should read first here), I laid out the case that the best risk reward in my triphasic model came in the form of data center…

Position 4: GLP-1 Impact Long/Short

Publication Date: July 11, 2023

Exposure Type: US Equity Basket, Discretionary Weighting, Long/Short

Total

Return Since Inception: +25.67%

GLP-1 takes 33% allocation from Positions 1-3, which are reduced to 33%, 16.5% and 16.5% respectively

PnL Chart:

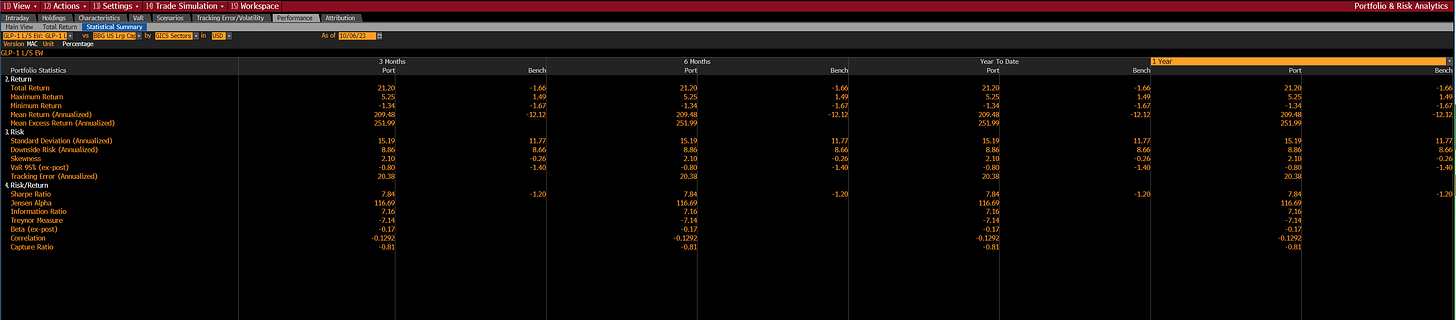

Portfolio Statistics:

From Jul 11 to Oct 6, the GLP-1 EW L/S basket realized a total return of 19.27%, this is compared to the total return of -3.78% from the broader US market (Bloomberg US Large Mid-Cap Index) or a total outperformance of 23% and a sharpe ratio of 7.84. We’ve included the market as a benchmark here.

While, typically, long/short equity portfolios are compared to the risk free rate (3 month T-bill returns, for example). We feel that it’s more “honest” to compare to something with genuine market risk. Since this basket is a self-financing /LS portfolio, it is ultimately more interesting to consider the returns breakdown of the total returns while leaving aside the market benchmark, which was down during this period. Of the 19.27% total return, about 14.6% can be attributed to pure stock selection alpha, while the returns attributed to known factor exposure is only about 4.66%. At multi-strat pod shops like Citadel, PMs are typically only compensated for the alpha they deliver beyond factor exposure returns. In this case, our GLP-1 L/S basket would’ve been very handsomely rewarded!

I hope at least one of you is at a pod shop set to make an 8 figure comp in part because of this strategy (and please remember, I have no qualms about accepting tips if that is the case!) :)

Article Source:

Upgrading from Overweight: The Effects of GLP-1 Drugs on the Investment Landscape

Upgrading from Overweight: The Effects of GLP-1 Drugs on the Investment Landscape The Questions: GLP-1 Drugs and Obesity If you haven’t, please read my article on Thematic Investing & Megatrends here first.

Position 5: Long TOPIX Banks in USD, Short TOPIX in JPY

Publication Date: July 23, 2023 in Subscriber Chat: BoJ Review (see below)

Exposure Type: Japanese Equity Long/Short

Return Since Inception: +17.22%

TOPIXB V. TOPIX IN USDJPY takes 25% allocation from positions 1-4, which are reduced to 25%, 12.5%, 12.5% and 12.5% respectively.

Article Source:

PnL Chart:

Portfolio Statistics:

As a way to play the theme of rate normalization and yield curve control unwinding in Japan using equities and FX, rather than opting to take the risks posed by JGBs, this basket has successfully delivered, moving essentially 1:1 with a steeper JGB yield curve. It’s had a much smoother equity curve as well, which is a function of the FX allocation being short JPY and long the US dollar.

Position 6: Long Celestica (CLS)

Publication Date: July 31, 2023

Exposure Type: US Single Name Equity Long

Return Since Inception: +25.48%

CLS takes 20% allocation from Positions 1-5, which are reduced to 20%, 20%, 10%, 10%, and 20% respectively.

PnL Chart:

Celestica has delivered 20% total returns since July 31st, when I wrote the article. But what I wrote inside the article is what matters. My entry target was looking for a pullback to which I’ve taken the handicap on despite the article below very clearly mentioning you should wait until it pulled back to $20.50 where I bought.

We’re going to split the difference and assume a steady accumulation on CLS as it pulled back, with an average entry of $21, for a total return of 25.48%.

Article Source:

Now we’ve got our portfolio. A few good trades and soon-to-be good trades (imo) are left out of the core portfolio (as mentioned in the beginning), but overall inclusion does not alter the returns significantly (the returns are actually slightly better if they’re included, wait until you see the performance on GUIC vs. NSGUIC…) so I believe it best to keep it to this right now in the core portfolio for purposes of demonstration, while the other shorter term trades can go into the tactical portfolio and be moved over when they have sufficient history.

Position 7: Good US Insurance Companies vs. Not So Good US Insurance Companies

Publication Date: 09/29/2023 in “Analyzing Financials: Evaluating Banks and Insurers” (07/09/2023 in Subscriber Chat - rebalanced on publication date and moved from Tactical Allocation to Core Portfolio)

Exposure Type: US Equity Basket, Equal Weight, Long/Short

Return Since Inclusion: +7.30%

Return Since Inception: 20.65%

GUIC v. NSGUIC takes 16.66% allocation from Positions 1-6, which are reduced to 16.66%, 16.66%, 8.33%, 8.33%, and 16.66% respectively.

PnL Chart Since Inception:

Factor-Based Attribution since Inception:

PnL Chart Since Inclusion in Core Portfolio:

Factor-Based Attribution since Inclusion:

Portfolio Statistics:

Article Source:

Analytical Frameworks: Evaluating Banks & Insurers

Preface and Objective: Financial Frameworks When looking at the investable universe of equities, it’s helpful for most investors to separate them into financials and non-financial corporations. While almost all equities tend to behave the same and are more correlated to each other than other assets, financials are fundamentally different businesses than others. Many investors caution against including utilities and financials in a longer term portfolio because, although they are distinctly different they share one common thread:

The final rebalance looks like this:

Core Portfolio Level, Total Return Since Inception: +29.04%

Now you get to see why this is my favorite part…

For a while, we were running a higher selection effect than total active reutnr (when factor and industry exposures have realized a -ve return together):

This return compares to a 3.54% return for the S&P500:

So a little bit more than 26% of alpha compared to the SPX.

You can see the moments where these allocations build upon the momentum of the trend, early June when AI hype was boiling over as NVDA went parabolic, August when NVO and LLY’s back to back study/earnings results demonstrated the staying power of GLP-1 drugs, then the fact that the returns hold on and consolidate as complimentary allocations like the short basket on AI prevent too much downside capture.

The portfolio is now +36% net long, which I’m comfortable with because the tactical allocation is significantly net short (mostly through SPX puts) and brings it down to about +20%.

What are the risks going forward? The portfolio is still net long, and despite being short higher beta names in general is unlikely to see as much of a benefit on the downside as it has thus far (because most of the air has been taken out of the overvalued ones already, not to say that they won’t go down more). I think you can probably stay more net long than net short, especially once we incorporate the hedges we’ve taken in the tactical portfolio (like the 10:1 december 4400/4000 put spread from mid-late July that I mentioned I had 280bps of NAV in).

The top contributors to the total return of the overall portfolio were, in order, Applied Optoelectronic (AI Longs), Celestica (Single Name Long Equity Thesis), LuxNet (AI Longs), Inspire Medical Systems (GLP1 Short) and Insulet Corp (GLP1 Short)

The top detractors were Torrid Holdings (GLP1 Long), Inmode (GLP1 Long), Bumble (GLP1 Long), Inspec (AI Long) and Splunk (AI Short).

Again, I’m no quant, but even I know these numbers (10.70 sharpe ratio) are good, and it’s only 0.33 correlated (a little bit of correlation to the stock market, which tends to go up over time, is never that bad of a thing):

Now, let’s talk a bit about the more abstract aspects of risk versus reward, portfolio construction, synthesizing new information and expressing a trade in a manner that captures your actual thesis. It’s not as objective and empirical as the PnL component above, but these insights have served me just as well if not better than comprehensive analysis of my own equity curve.

For me, a portfolio is not be a hodgepodge of positions you believe are good, even if you’ve done the work and they genuinely are good positions! I have had some great single positions, but if all my portfolio consisted of was them the volatility would be insane. By utilizing the exposures and the way they might interact with events and each other, I can create a smoother equity curve similar to the one that our Citrindex has experienced since May.

The main benefit of this newsletter should not be replicating the portfolio here but rather forming your own method. Mine works for me, it’s kind of fast and loose (nobody will ever mistake me for a quant, I guarantee it), but it works.

Take the parts that fit your style,

take the theses you agree with,

leave the rest.

The secondary benefit in monitoring these is attributable to the signal value. There’s a specific kind of market you (or I) perform best in. If the portfolio begins suffering, that’s worth being aware of too, because it means the market is changing.

I have written about themes, macro, frameworks et cetera, maybe ad nauseum (depending on how you feel about my writing)…300 single spaced pages in the span of 4.5 months, basically a book, for precisely one reason: I have seen a ton of opportunities in the market that struck me as picking up a dollar for fifty cents.

It is as simple as that. My goal is to provide readers with all the information they could possibly need related to a trend, and then outline the upshot very clearly and delineate the exact trade present. That’s it. Like I said, simple.

I promise I will never inundate you with long-winded trade ideas solely for the sake of doing so. Unless I truly believe there’s a great opportunity the frequency will likely vary accordingly. If you see I haven’t posted an article for a month, your first thought should not be “wow this guy is slacking”. I guarantee you I’m looking, working, writing 20 pages and then deleting it because it’s simply not good enough.

The last thing you need in the market is more noise, I want you as a reader to see an article from me in your inbox and know, instinctively, these two things:

1) It’s going to be thoroughly researched and well-presented.

2) I, personally, am putting on this risk because I believe what I’ve written

I hope you’ve benefitted from being the reader as much as I have from being the writer.

Please stay tuned for part two where I’ll describe how I view trading around a portfolio and making tactical positioning decisions, as well as lay out the returns of every short term trade mentioned in the subscriber chat since the newsletter began.

Cheers,

Citrini

[PAYWALL BELOW FOR ADD’L FIGURES]