The Art of Being Wrong

And the BoJ's Hawk LaCroix

I have only seen a handful of traders that make me say “this is someone doing art”.

Let me tell you the most impressive thing about one of them. I was super early in my trading journey, just kind of observing. And he has on a pretty massive L/S position trading intraday sector rotation.

The trade goes against him, quickly at first. His book is down 65bps on the day. It goes past his risk limit and he puts in his order to close the position, but it’s twice as large as the position.

Without any distress or emotion; the market told him he was wrong and that the money to be made was on the other side, so he just exited it and took the exact opposite position in one move. “Stop and reverse” is an order but I’ve found it to be incredibly rare that people will be humble enough to immediately say “I was wrong, actually I was so wrong that the move is going to be significant in the opposite direction. I should be positioned for that”.

Memory of a goldfish. Just because you were wrong 10 minutes ago should not impact your decisions determining what your PnL looks like 10 minutes from now.

His book was up 200bps by the close on that trade. Truly amazing.

That’s why I’m thinking of this dude. Sometimes the narrative just changes instantaneously and you have to adapt because it changes the entire narrative.

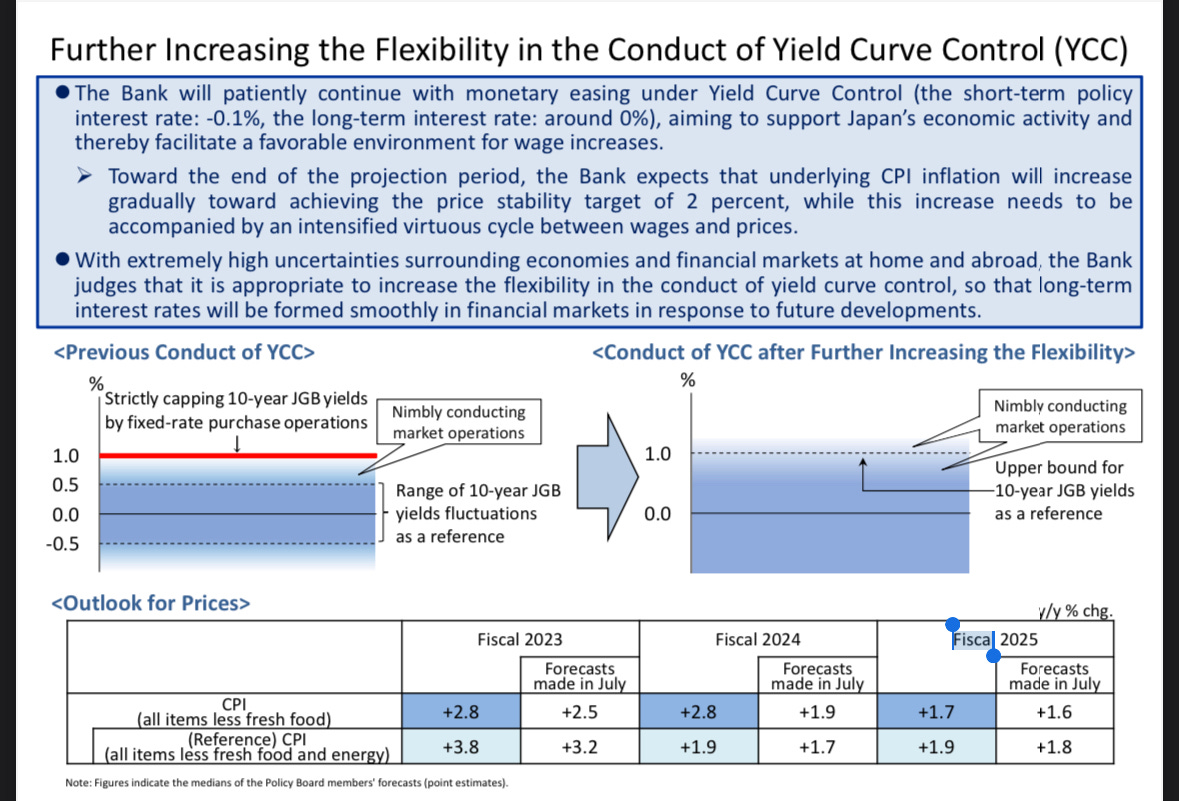

Yesterday night the BoJ was expected to “adjust yield curve control” - and that’s what they did. only they kind of didn’t, too. Let’s take a look:

They got rid of the “strict cap” which entailed a daily bond buying operation to bid for unlimited JGBs. The BoJ would lift your ask every single day, regardless of size, provided you were offered at 100bps.

This was part of their “soft cap/hard cap” approach. That was the hard cap at 100bps and then they gave themselves the flexibility to conduct unscheduled bond buying between 50bps and 100bps, the “range of 10yr JGB fluctuations”. So they had flexibility there, but none at 100bps.

Now - does that mean they are going to let yields go above 1%? Well, consider that they knew the market reaction and Ueda still did not send an overtly hawkish tone. If they wanted to, they could have easily just raised that strict cap to 1.25%, or they could have done the “flexibility” upper bound reference 25 or 50bps higher. They didn’t, because they want to retain optionality. Maybe the global economy weakens and they don’t have to engage at that 100bps level. Maybe bonds (and yen, potentially) rally globally off of geopolitical developments. But if they don’t, it’s clear that the cap is effectively unchanged everywhere except in theory.

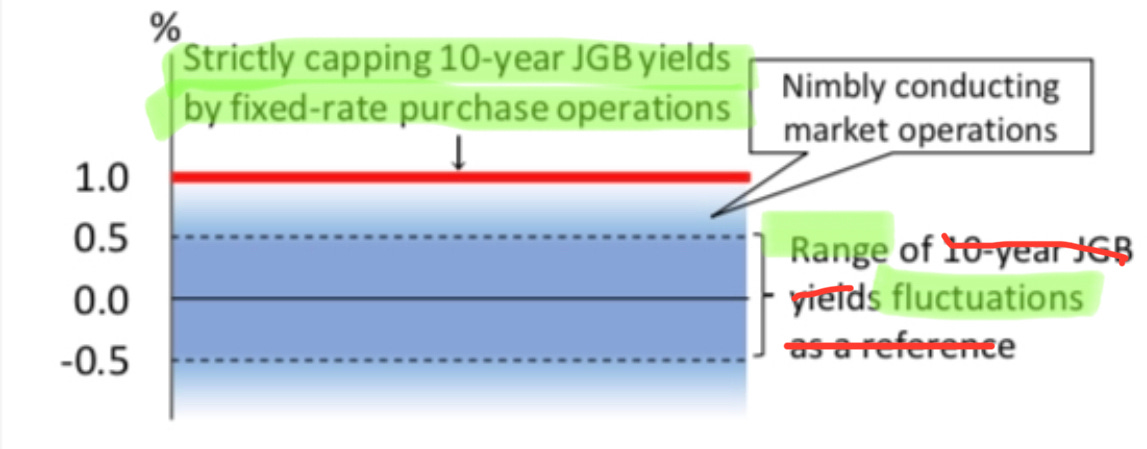

I’ve highlighted the parts I was focused on last night prior to the Press Conference.1

In the previous conduct: “rates can fluctuate between 50 and 100bps, at 100bps we are always a buyer” meant one thing and one thing only: “rates are going to 100bps”. that’s why we stayed short JGBs.

While this, now, is “rates can go to 100bps and then we start buying, we’re not always buying, but we are buying above 100bps and maybe sometimes below if rates move too fast”. that, in my mind, relative to market expectations, is essentially the same thing.

This is not hawkishness, this is hawk flavored La Croix. A YCC normalization Spindrift.

At first glance, the Bank of Japan’s move appears hawkish, they’ve softened their strict limitations on long-term yields. However, a deeper examination reveals their desire to persist with the current complement and negative interest rate strategy, aimed at economic stimulation while alleviating stresses on the complement system. This suggests the BOJ remains skeptical about the economy’s readiness for significant rate hikes, indicating that a comprehensive policy shift is not imminent.

It is a surface-level gesture towards normalization, but the core remains firmly committed to monetary easing. This nuance is vital for market participants to grasp, lest they misinterpret the BoJ's true intentions. Much like a LaCroix, this hawkish hint is fleeting and quickly dissipates, revealing the dominant underlying and all too familiar tangy essence of dovish Japanese carbonated water.

There was little immediate bearishness for rates (although one could make the argument the ever so slight shift could signal more volatility), in fact JGBs immediately reversed the first reaction of a gap down on the news. So relative to expectations but there was significant bearishness for the yen - the BoJ is still going to have to print yen to buy bonds, and it’s clear they are planning on doing so above 100bps. I don’t even think they will let it get much more than 3-5bps over for now.

The central bank is acutely aware of Japan’s economic challenges, from an aging population to decades of deflationary pressures. These aren’t issues that can be resolved overnight, and the BoJ knows it. Driving the pivot to hawkishness could derail any economic progress and send the country back into deflation. This concern is so significant they are willing to risk massive FX depreciation to avoid it. That’s what I saw - and that’s what I needed to be positioned for.

Humility is one of the traits required to be a good trader, albeit a weird mix of humility and confidence, but humility nonetheless. The kind of humility that retains that “memory of a goldfish”. If you’re humble enough about what you don’t know and competent / confident enough to generate actionable insight from it, you can recognize not just that you’re wrong - but that you can make more money than if you hadn’t had the losing trade to begin with.

And if that sounds dumb just consider this;

What kind of size are you gonna put on pre-BoJ in a USDJPY long? In all likelihood, you’re acutely aware of the fact that there could be a surprise (it’s the BoJ…) and of the possibility of serious volatility that exceeds your limits even if you’re directionally accurate. So you probably size accordingly.

And you are now short, sized accordingly, and understand exactly what needs to happen for your short to work. The press release hits and it’s not that.

If you can maintain your composure, you take the time to quickly synthesize this new information and recognize that this isn’t just a risk to your short, it’s a huge opportunity for a parabolic move. It’s clear: not only should you cover, but you should get very long because its a rare, poorly understood and significant development that kind of necessitates a strong directional move. So, you can confidently size up on the reverse, because you understand the trade from both directions and the events that have occurred as they related to their probability. You have the conviction to pull way more PnL out of it than you would have otherwise.

To be clear, this is a rare occurrence. I am not out there executing stop and reverse trades every day. But I also think it is imperative that you don’t let failed trades cause missed opportunities on great trades in the same instrument solely because they failed.

I had come into the BoJ press release short USDJPY at an average entry price of 149.364.

The position was up somewhat earlier, but then immediately prior to the release went negative - which put me on edge already. My anticipation of a stronger yen was based on various factors, and I felt confident in my position. However, markets have a way of challenging even the most well-reasoned trades. Just minutes after the Bank of Japan’s press release, the market reacted swiftly. My short position was immediately tested, and I found myself stopped out at an average of 149.812. This rapid movement represented a move against me of 0.448 from my entry, translating into a dip of 40bps in my Net Asset Value (NAV) as it was nearly a full size trading position.

What I’ve learned is that in the world of FX trading, flexibility and adaptability are paramount. You’re not just adjusting to the market forces, especially with the BoJ you are forced to adjust to the whims of governments and central banks. Those who did not recognize this as CBs became more prominent in FX met with significant difficulty and many were unable to adjust and ended up blown out. These days, most know you don’t try to arb the government. When the BoJ made the announcement, I looked over the release carefully (not the news; that’s a mistake - trust me) and decided that this was a stop and reverse situation.

Recognizing the change in market sentiment, I decided to adjust my strategy. Instead of dwelling on the short-lived loss, I executed a stop & reverse order, entering into a long position with twice the size of my initial short. This wasn’t just a reaction; it was a calculated countermove based on the market’s response to the BoJ’s announcement.

I knew that dollar yen had to go higher; and I wanted to capture that because it was an easy layup to recoup the loss and maybe make some more on top of it. I also put on a smaller sized long in JGBs in case the market had the same read that the risk reward in a “BoJ will defend 100bps aggresively” scenario was quite favorable at 0.94% yield. However I realized that this was more risky and advised subscribers to only go long if futures traded down to 143.50 - the area where I would increase my size from a very small ⅛ position to full size - and they did not.

This shift in strategy proved fortuitous.

The long position I entered yielded substantial gains as the presser confirmed my initial suspicions that the market had not reacted to just how dovish this carbonated water was. This single FX position resulted in a gain that represented 3% of my NAV. Between this gain and the two losses on the USDJPY short and the smaller 10yr JGB short I ended the trading session with NAV up by 238bps. Two wrong trades, one right one, one great day for the overall book. This is, as someone on twitter said, the “art of being wrong”.

Recognizing the importance of capital preservation, I decided to book some profits. I liquidated half of my position at around 151.70 and implemented a trailing stop. This decision not only locked in some of my gains but also protected against potential market volatility, especially with the looming possibility of intervention by the Ministry of Finance.

Trading is as much about intuition as it is about analysis. The Bank of Japan’s move might have initially disrupted my position, but by staying agile and responsive, I turned a challenge into a significant opportunity. My experience with this trade underscores the importance of adaptability in trading. Markets are dynamic, and as traders, our strategies need to be equally fluid.

I can be a bit more direct - after all this is a blog not a bank’s sell side research - sometimes shit happens that’s very straightforward and all you gotta do is say “this is going to make the exact opposite of my base case happen and I need to drop the ‘I wanna be right’ stuff and switch to the ‘I wanna make money’ stuff immediately”

To touch more on the psychology of risk here; when I speak about my admiration for the trader mentioned in the first paragaph and about the idea of doing the stop and reverse on these kinds of “it has to go this direction, which is the opposite direction of my position”, there’s a common response I receive. It was even a response to my tweet about this:

There is no difference whatsoever between being wrong twice back-to-back in the same instrument versus being wrong once in one instrument and then wrong again in another. There is always a risk that two trades in a row will be wrong, as you should well know.

Now, ask yourself this: assuming you are clear-eyed and collected, compared to initiating a new trade in an entirely new instrument; what is the likelihood you’ll be wrong on a trade in the same instrument, having already had the insight and immediately visceral market feedback that exposure with negative PnL provides?

Keep this in mind: by exiting a position, you have already decided to buy/sell. Stop and reverse is actually one decision, a whole new trade represents two separate ones: I had already made the decision to go long on the USDJPY by covering my short.

Now we were just deciding “in what quantity.” We made the call — the risk is to the upside now. We just have to determine whether or not, and in what magnitude, we try to benefit from that.

While I tend to disagree that it’s the sole driver most times, there is always an aspect of “it’s all the same trade” where a certain percentage of whatever move you’re playing is happening due to the same market reactions and trends.

If you stop out of position A1 (initial) and then take position B1 (different instrument), there will still be an aspect of either doing a stop and reverse or doubling down that would have existed in A2 as well. For example, if I were short USDJPY and then said, “Ah, screw it, it’s not working. I’ll stop out and go long on USTs/Gold/Spoos,” you’re still doing the same thing. Spoos and USTs will likely go up if the dovish carbonated water is emphasized and embraced, but you could make more on USDJPY’s move if that happens and you’d be exposed to less tertiary factors.

You just don’t have as much information on B1 as you would on A2 because you haven’t experienced the unique qualia of having exposure in that market at that time.

As I regularly have said, and as I mentioned in the article on my Investment Philosophy here:

PnL is the best indicator you have. It’s visceral, immediate, and provides a true sense of how the market is moving and what it believes. It’s valuable not to discard that insight because of some sunk cost fallacy and to instead utilize it to your advantage.

As an aside here, please be sure to always actually read this. Actually, maybe ONLY read this. There was a TON of misinformation and confusion last night. Even Reuters, which is pretty reliable, had to issue a correction when they said the BoJ had decided to let rates go above 1%.

Beautifully written. Bravo

Really enjoying reading about your trading philosophy.