I Can See Clearly Now… The Rain Is Gone?

Healthcare Innovation in Calmer Times (for Now)

Introduction

Fifteen months ago, we initiated our Healthcare Innovation basket with a clear and (in our humble opinion) compelling long-term thesis: advances in medical technology and life sciences were on the brink of unleashing a super-cycle of more effective and efficient healthcare, and yet the market was overlooking the opportunity due to transient cyclical factors. But the situation quickly became complicated.

Almost immediately following Election Day last year, we faced Markets Gone RF-Krazy as investors panicked about the new Trump administration’s healthcare policies and the potential impact on company fundamentals and valuations. At the time, we argued that this reaction was directionally incorrect and that the administration’s new policy agenda would ultimately prove highly supportive of our healthcare industry thesis.

Since then, we’ve seen a see-saw of policy-induced freakouts and easing concerns – again (January Musings), again (Healthcare’s AI-Powered Trump Card), again (Insuring Against Insanity), again (Talk to Me, Goose), and again (Rough Seas Make Strong Sailors). Each time, we made the case for staying the course and used the volatility to increase our exposure to the theme. And if that was not contrarian enough, we focused our healthcare exposure on *gasp* small caps, the market’s ugliest step-children over the last several years.

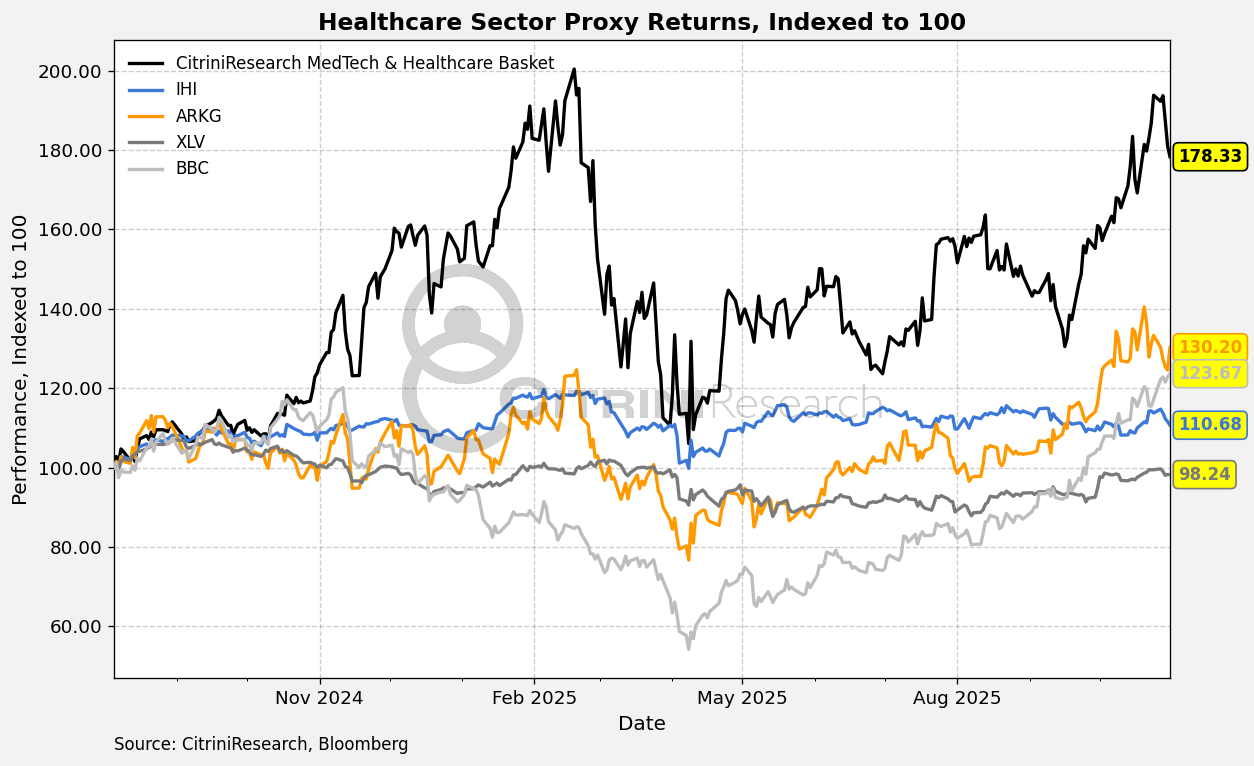

But this conviction has been rewarded, at least in the short-term, with various proxies for our thematic staging a sharp rebound and the basket itself handsomely outperforming those proxies.

More than just a deadcat bounce, we think this the start of a multi-year industry upswing that leaves us more positive on the theme than ever before. In the pages that follow, we detail what we are watching and how we are positioning ourselves to best capitalize on this opportunity.

Patient Status: Industry Health Improves, Investors Still Feel Sick

Anyone invested in the healthcare space over the last twelve months will remember the headlines: “anti-science” MAGA officials were going to defund healthcare providers and researchers, increase red tape, and cause progress in the industry to grind to a halt.

Despite these scary predictions, very few have come to pass. Instead, we have seen the following:

Threats of major research funding cuts have been walked back or reversed

Major pharmaceutical companies have struck deals with the US government to boost domestic manufacturing capacity while reducing the risk of negative pricing actions

Landmark approvals have been handed down in the most cutting-edge areas of medicine

Reimbursement for innovative new diagnostics has received more support than at any point in the past

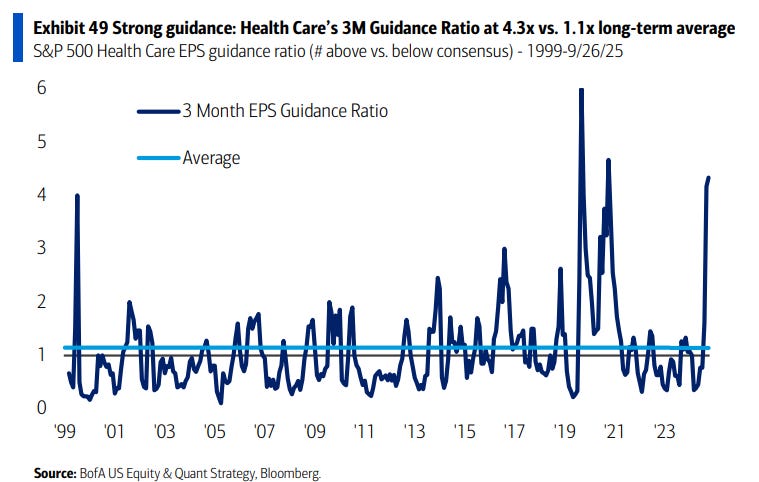

These dynamics have helped contribute to strong industry fundamentals since our last update. The number of companies in healthcare guiding above analyst expectations in the last two quarters is near record highs.

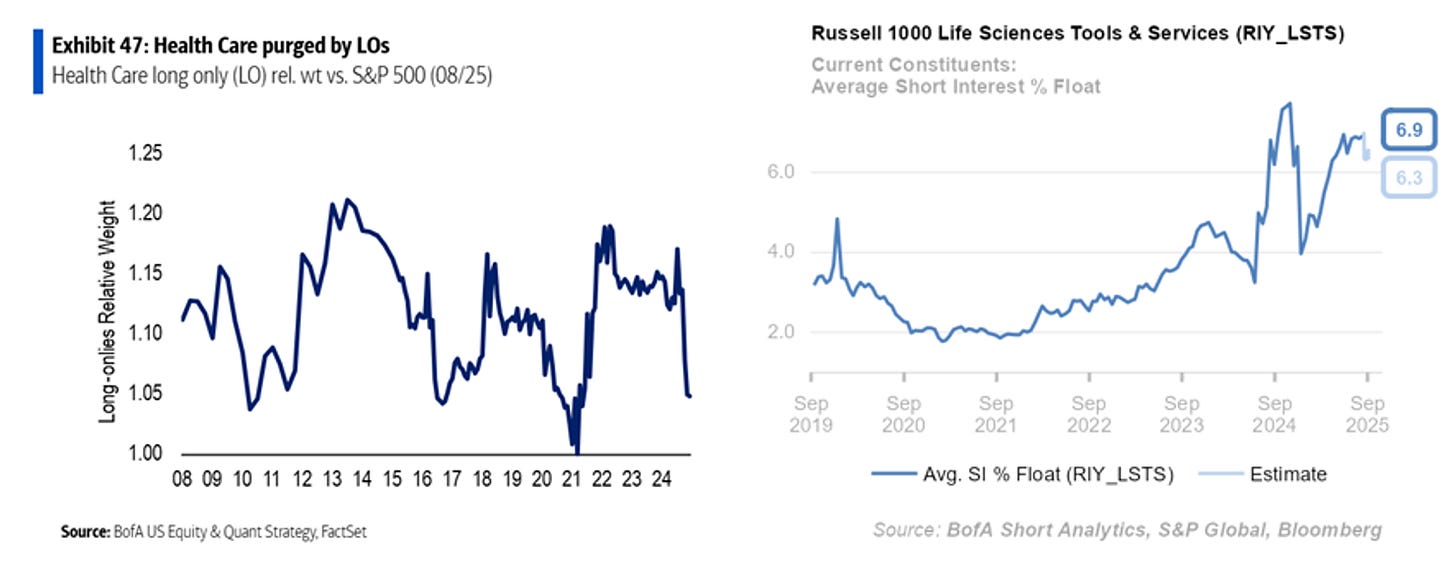

You might expect that the combination of improving news flow and positive fundamental surprises would have investors feeling euphoric, but the reality is quite the opposite. Despite this improving backdrop, long positioning in healthcare hovers around the lows of the last twenty years, while short interest in some of the most dynamic corners of healthcare is testing a post-COVID high.

The combination of negative sentiment and positioning has weighed on valuations, which remain depressed despite recent equity appreciation in corners of the healthcare industry.

We have previously stated our preference for smaller companies in life sciences and medical technology, especially those with long growth runways. As the current revenue multiple of the Russell 2000 healthcare growth sub-index demonstrates, there is significant upside in a reversion to average historical multiples (especially as fundamentals improve and interest rates come down).

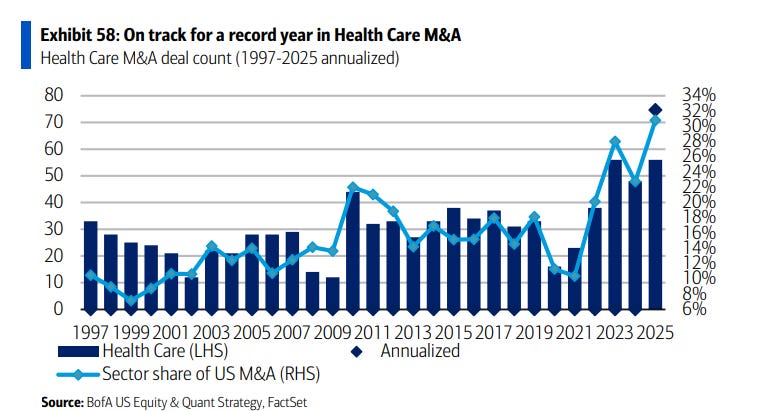

What happens when improving fundamentals meet depressed valuations for a prolonged period of time? We have predicted in the past that if public market participants ignore this dynamic for too long, strategic investors would step in to take advantage of the disconnect. Indeed, so far in 2025 we have seen a surge in healthcare M&A, with the number of deals so far in 2025 tracking substantially ahead of any prior year on record.

We think more than a few of the members of our basket are attractive targets for potential M&A, if the public market does not recognize the opportunity first. So, with that said, let’s dive into the specific themes within our healthcare coverage.