Rough Seas Make Strong Sailors

Navigating the Healthcare Policy Tsunami

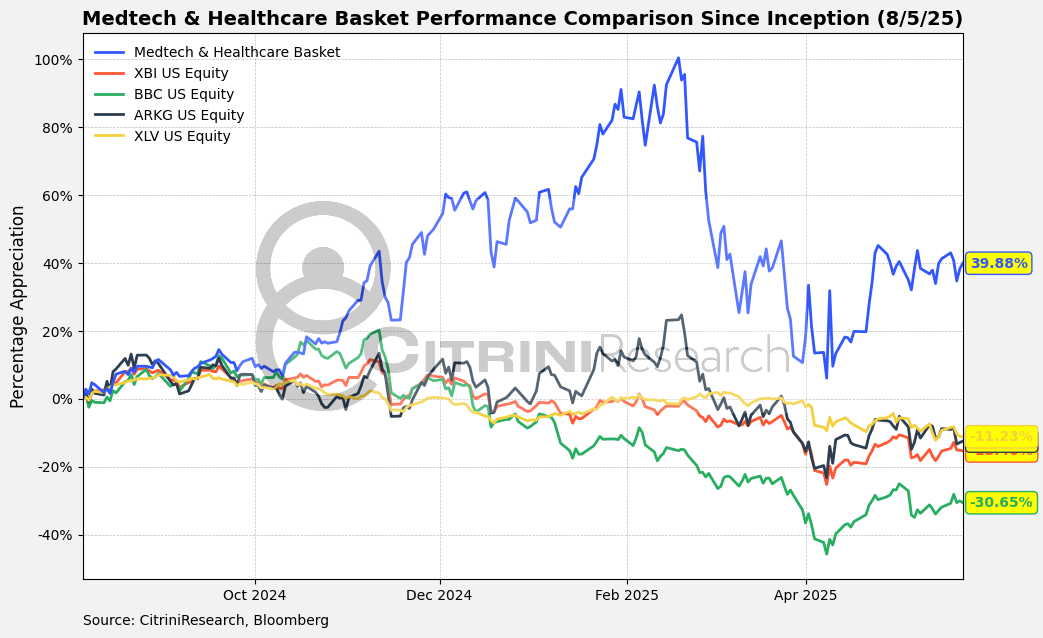

We first published our Medtech & Healthcare basket in August 2024, during those halcyon days when healthcare investors did not have to contend with weekly policy-driven tape bombs. Indeed, the powerful cyclical and secular thesis behind the basket laid out in our primer did not (and still does not) depend on government policies and macroeconomic developments. Of course, if the market always agreed with us, there would be no opportunity for alpha, and since the publication of our basket, the market seems to be fixated on how policy and macro impact healthcare. The arrival of RFK and the MAHA movement, along with a volatile macro backdrop over the last ten months, have driven a significant amount of volatility in the sector – and created some compelling opportunities, in our view.

By keeping a clear head and remaining attentive to what is (and perhaps more importantly, what is not) happening in Washington as it relates to healthcare, we have been able to capitalize on multiple market dislocations through both security selection and overall exposure management. We increased the size of the basket in late 2024 in the midst of the initial, RFK-induced panic selling in healthcare, covered in our piece Markets Gone RF-Krazy. We covered our shorts in early January as yearend tax-loss selling had punished the sector again in late 2024 in January Musings. We doubled down on our best long ideas – despite many skeptics in our comments section – in late March in Insuring Against Insanity, and we increased our allocation to the basket in mid-April in Talk to Me, Goose. These decisions have allowed us to outperform any healthcare-related benchmark by a significant margin.

We have also generally managed to navigate the policy backdrop effectively, with a focus on domestically-focused, share-gaining smaller companies in life sciences and on catalyst-rich, idiosyncratic medical technology stocks. Remaining attentive to healthcare policy is likely to remain important going forward, both because of the real and the imagined impacts on the sector. Indeed, policy is inherently political, and with politics comes bias. Bias creates misperceptions, and as legendary investor Michael Steinhardt knew, misperceptions create profit potential.

In the piece that follows, after revisiting our original thesis, we dive into recent policy developments and then examine four different popular market narratives that we believe are based on significant misperceptions versus reality. Within each area of misperception, we examine potential beneficiaries – many of which have already been our biggest winners. Finally, we introduce our spiciest healthcare sub-theme yet as a standalone basket.

With all of that said, “anchors aweigh” as we explore how to best navigate the choppy waters of healthcare – and the opportunities they are creating – going forward.