Citrini Research: 24 Trades For 2024

Introduction - What is this?

Every year, around the end of December (always after the last FOMC), I create a list of trade ideas for the coming year. Some I already have on, some I am planning on entering within the next few weeks, some never get put on.

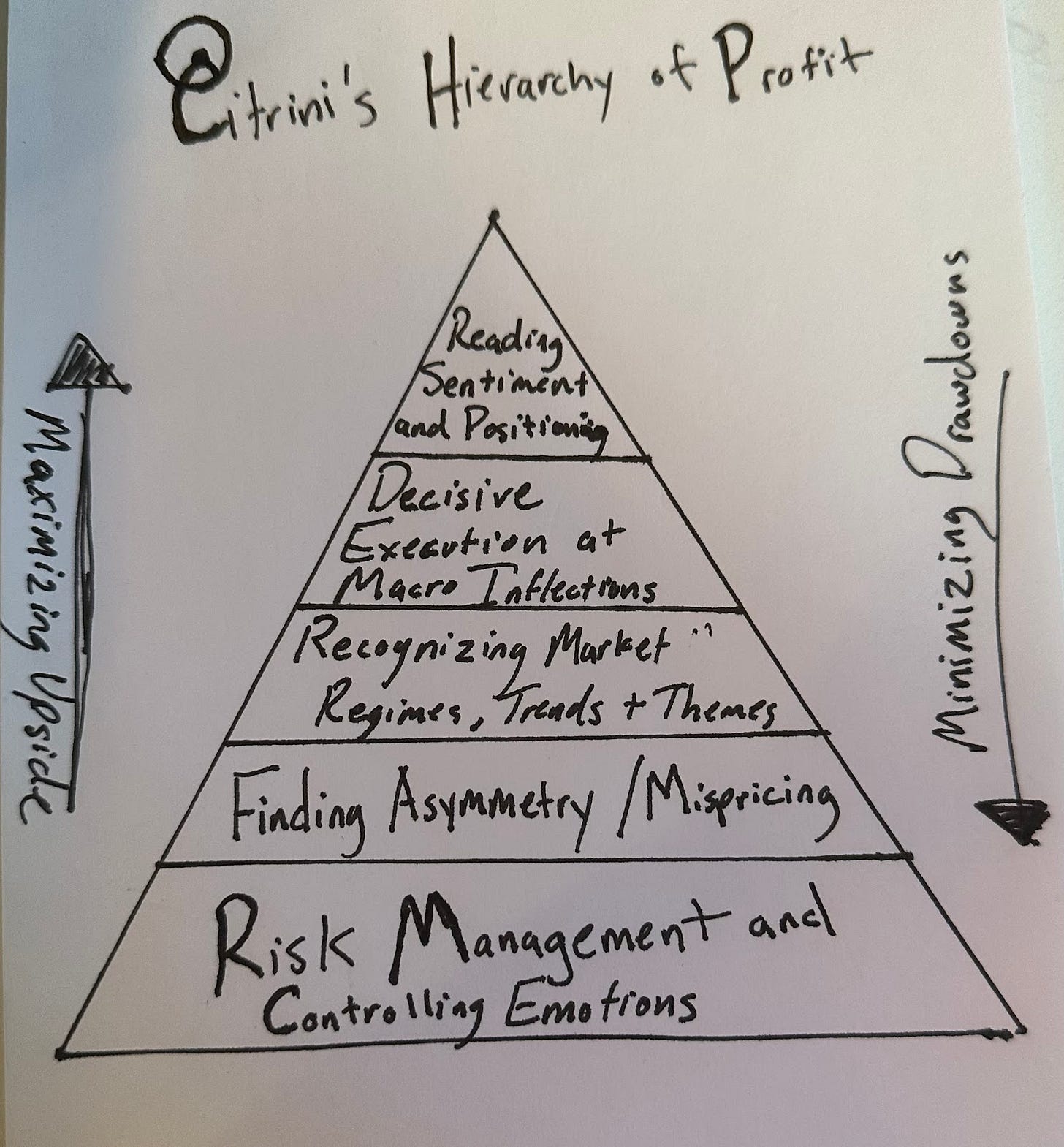

The point of the exercise is less about finding a bunch of surefire high conviction plays (if I could pull 24 high conviction trade ideas in a month I’d either be a billionaire or way too convinced on way too many things) and more about preparation..

Are they all great ideas? Of course not, there’s 24 of them. But they’re good to have in your back pocket as the year plays out, or maybe they’ll start a thought process that results in something you otherwise would not have happened upon. Think of this more like a watchlist for interesting things than a list of portfolio positions.

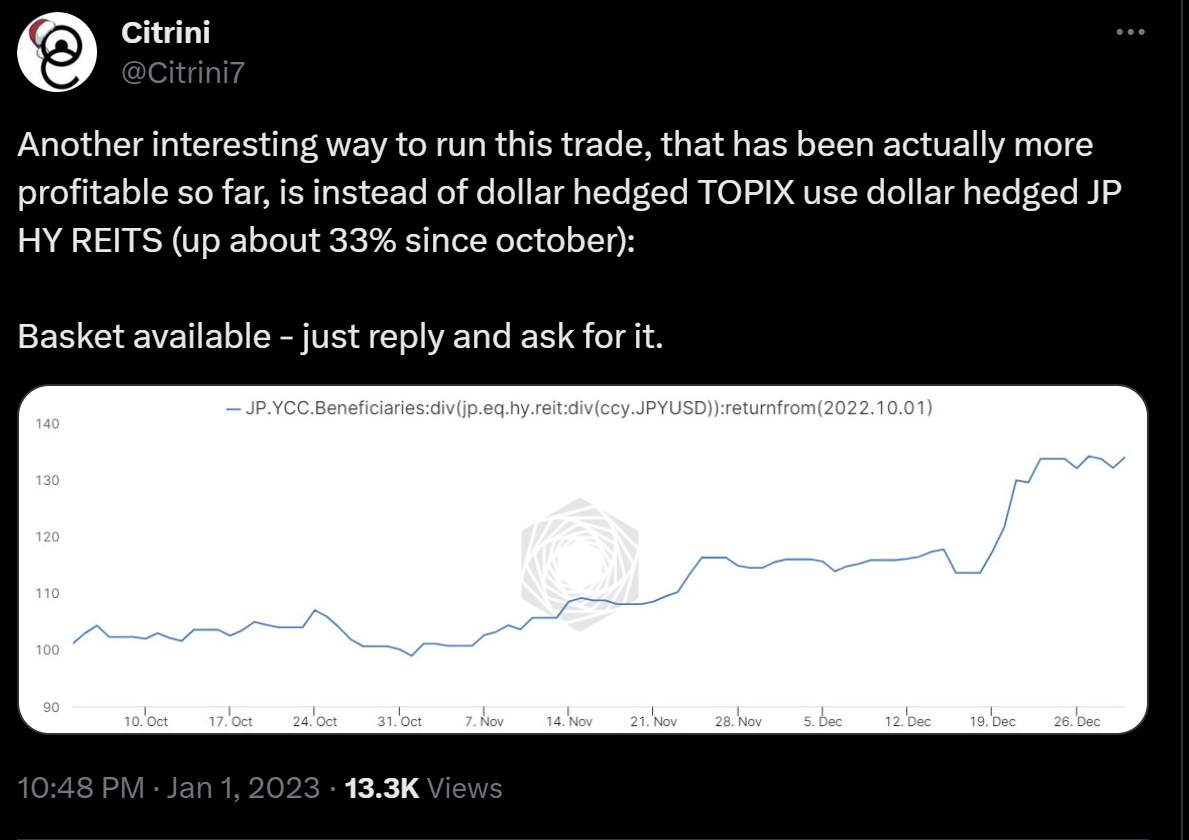

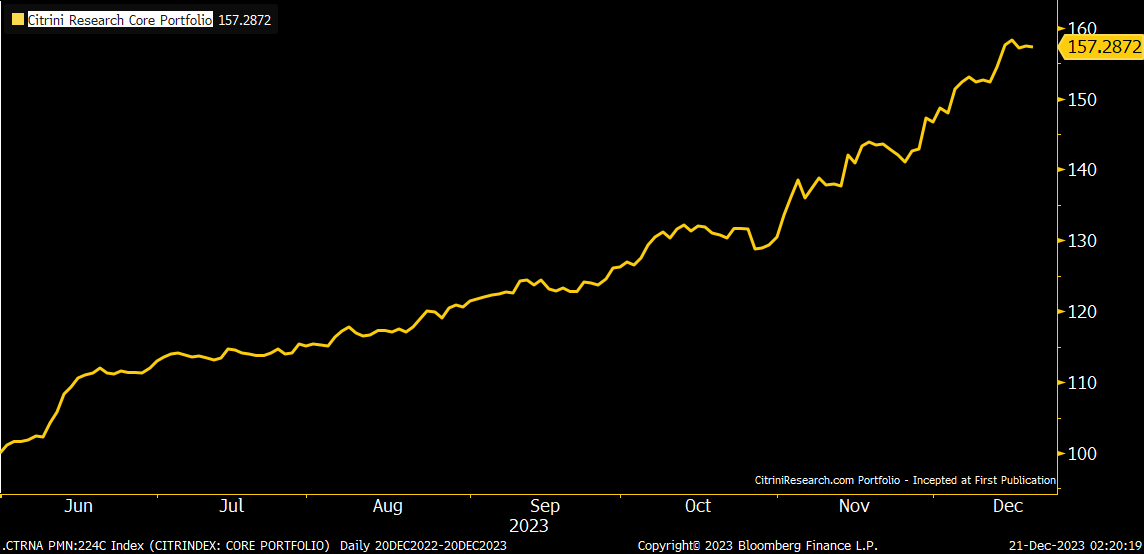

The first time I shared this process publicly was here on my twitter account at the end of 2022. I’m glad I did this, because I think it shows the potential of having a deep back catalog of trades ready for various scenarios.

We’ll go through the performance of the trades listed for 2023 at the end, so you can get an idea of what this exercise accomplishes (and what the hit rate is like). To preface, however, the main purpose here is preparation. Most of these ideas are things that are suited for reacting to developments throughout the year, or perhaps useful if current trends continue or even just solely presented to put something in front of you that you wouldn’t otherwise look at.

It’s the end of the year, an absolutely crazy year for that matter.

And that, of course, means we get to prepare to do it all again but differently. Here’s what I’m thinking…

Factor-Based Equity Trades

Trade Idea 1: R2K Interest Quintile Long/Short Baskets

I believe this could be a very useful strategy in the coming year, regardless of which way rates go, and these are baskets you want to be ready to execute on.

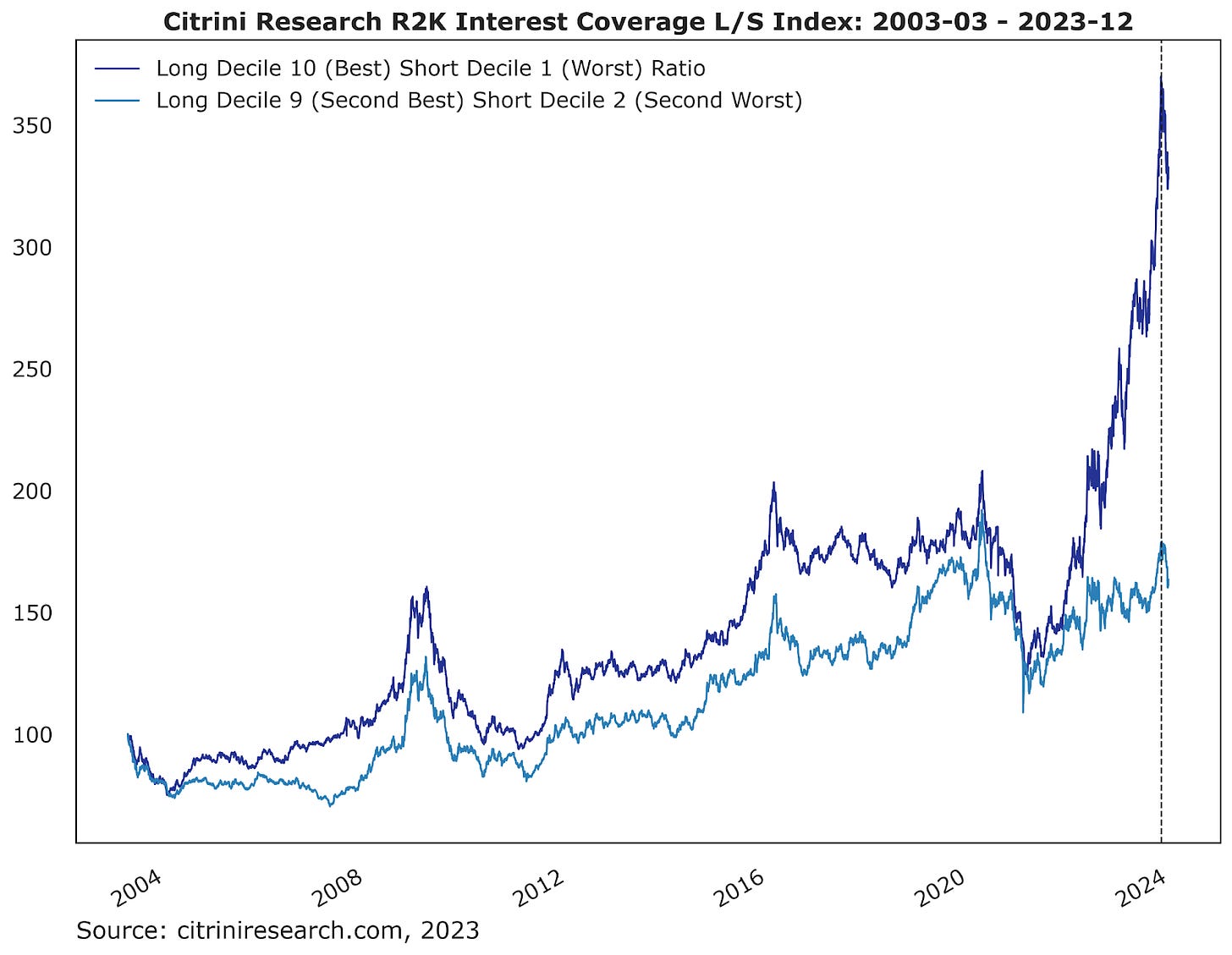

On quarterly rebalance dates, Russell 2000 (R2K) Index is sorted into 10 deciles (equal buckets) ordered from the highest interest coverage (Interest Coverage Ratio = EBIT/Total Interest Incurred) to the lowest interest coverage.

Since only securities, for which this metric is available, are included, each decile has about 115 securities. Each decile portfolio is equally weighted, quarterly reconstituted and rebalanced. The chart shows that in 2022 the long best interest coverage short worst interest coverage portfolio realized massive gains. However, recently in 2023, that tide appears to be turning as expectations of rate cuts in 2024 grow.

If we hit the refinancing wall with rates still at 5%, you should probably consider flipping this and going long the 9th decile and short the 2nd - expecting performance to mimic the 10/1 returns in 2023.

However, as long as rate cuts are actively being priced into 2023 the current trade is going to be a mean reversion of the Long Best/Short Worst strategy.

Here are the names in the best and worst interest coverage quintile baskets.

Trade Idea 2: CitriniResearch Small-Mid Cap 50

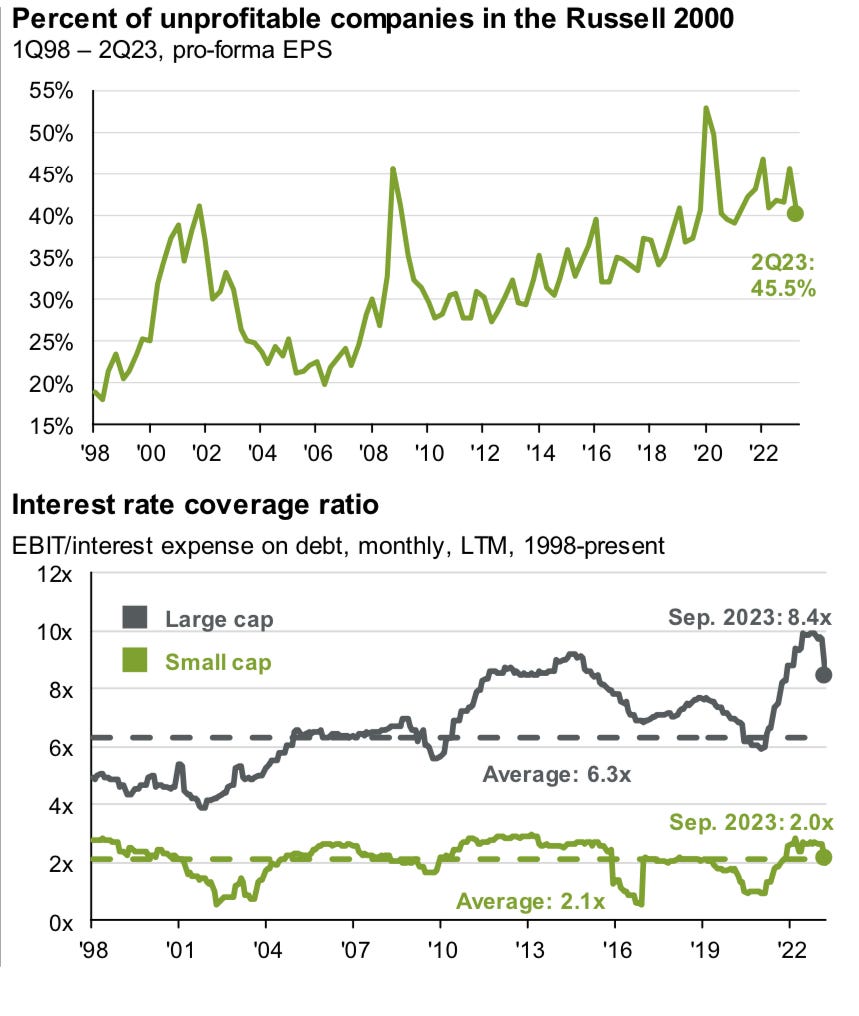

The potential of the US economy avoiding a recession as well as the significant, prolonged underperformance of small cap stocks has resulted in a few decent deals (even in small caps that are up YTD, the valuation is still depressed despite the recent rally). As we’ve discussed in the subscriber chat, the ways we are playing this so far have been long IWM/short SPY (RTY v. ES) and, more specifically, playing the unwind in megacap crowding with long RSP/short SPY.

For 2024, I’ve gone through the most compelling opportunities between 250M and 10B with a bias towards smaller companies. While it was a very compelling strategy last year to simply buy the underperformers, I think it will be a bit more nuanced this year as we enter into a potentially elevated rate environment with continued economic resilience (yet not as elevated as the market was prone to believe), because of this I’ve put together the 50 most interesting (whether from a business quality or valuation perspective or both) below that I will be monitoring closely with the intention of pruning it down to about 25-30 names. Currently our portfolio has a large-cap tilt due to the outperformance of names like ETN, LLY & NVDA. I would like to progressively make that more balanced as the year goes on, but with significant discretion. There are, in fact, a lot of small cap names that are quite screwed if rates stay high.

Here are the 50 Small-Cap names I believe are most compelling, it has a value tilt but is not exclusively value.

Thematic Equity Trades

Trade Idea 3 (Thematic Equity Basket): Long Blue Collar Jobs & Vocational Training

The economy has added many jobs, but many people are working 2-3 low-quality jobs. For these people, the current economy feels like a recession, and recessions tend to boost enrollment in vocational schools and higher education like nursing and trades. Companies like Adtalem Global Education (previously DeVry), Laureate Education (LAUR), Grand Canyon Education (LOPE), Perdoceo Education (PRDO), Universal Technical Institutes (UTI), Strategic Education (STRA) and Lincoln (LINC) all can benefit from the lack of qualified technical laborers in the United States resulting in significantly higher wages and many of them have benefitted from the “nearshoring” demand for skilled labor in Mexico and Latin America - like LAUR.

I’d personally implement this as a basket, equally weighting LAUR US, LOPE US, UTI US, ATGE US, PRDO US, STRA US and LINC US, however my first collaborator (poached from Fintwit Capital Management in during the latest rumors of a pod blowing up) has more conviction on the first one

Trade Idea 3a (Single Name Thematic Equity): Universal Technical Institute (UTI US)

Collaborator: LinsanityCapital

Universal Technical Institute (UTI US) is a system of technical colleges throughout the United States. Their main revenue segments accrue from vocational schooling within auto, HVAC, and industrial maintenance trades.

Wages within PPI trade services have increased dramatically from pre-pandemic trends. We believe this is a secular shift as younger demographics have opted for non-traditional income streams (social media, streaming, e-com).

Our overall view is that non-traditional income streams are currently peaking as they do not add any societal value or advancements. Heightened wages within the vocational trade will shift enthusiasm back into the sector - allowing UTI to experience a boosted profit cycle. Some of these changes are already being displayed within UTI graduation rates, up 16% vs. pre-pandemic.

Valuation: UTI currently trades at an attractive market multiple of 4x fwd EV/EBITDA. Management has guided for 10% FY top-line growth in 2024, which we believe is conservative due to recent industry trends. If incremental topline growth reaches management's base target we believe the stock can rerate to historic ~7.5x EV/EBITDA trends implying 45% upside in the name.

Catalyst: In 2016 UTI issued preferred equity to Coliseum Capital Management, LLC to secure $70mn in medium term funding. With the company's cash flow position now much more attractive, Coliseum has converted the entirety of their pref equity into common equity representing 1mn shares outstanding as of 12/19/2023. We view this as a major overhang lift, as the company can use incremental cash flow previously utilized in the private placement to fund capital investments and share repurchases.

Paywall Below, with 21 more trades:

Trade Idea 4 (Basket): Water

I am not going to bore you with the laundry list of reasons why water is going to be an important long term theme, but I will say that governments take a lot longer than investors to notice themes. I believe we will see more significant governmental focus on freshwater and filtration in the next couple years, which makes me think it is, potentially, finally time to execute on this theme.

There are plenty of ETFs focused on Water Resources, but I’ve been a bit pickier with my baskets - trying to capture as pure a play as possible. As a “humanity” problem, it’s probably a good idea to venture outside of the US with this one.

Here is the basket.

Trade Idea (Single Name Thematic Equity): Long Rotoplas

Collaboration Credit: Ian Bezek @irbezek - Ian knows way more about LatAm than I do and has absolutely killed it this year. I wanted to find something that had asymmetry since I missed the rally and he’s the person Investment Rationale for Long Position in Rotoplas anticipating Operational Turnaround Post-Management Change:

Rotoplas's underperformance since 2018 can be attributed to a growth-centric strategy that disregarded efficiency. However, the pandemic-induced management reshuffle has brought in a team focused on enhancing Return on Invested Capital (ROIC) and EBITDA margins. Their success in achieving these targets ahead of the 2025 deadline suggests a significant operational turnaround, underscoring a potential re-rating of the stock.

The reported shortage of over 5 million houses for Mexico's growing millennial population indicates a robust demand pipeline for housing. This demographic shift will likely drive increased demand for Rotoplas's core products like water tanks, pipes, and filtration systems. Given the essential nature of these products in new housing developments, Rotoplas stands to benefit significantly from this construction boom.

Despite the high interest rate environment in Mexico (11.5%), the inflation rate remains relatively moderate (in the 3% range). This disparity suggests a potential easing of monetary policy in the near future, which could improve the investment climate and bolster the performance of Mexican equities, including Rotoplas.

Over 10% of Rotoplas's revenue comes from Argentina, a market historically plagued by currency volatility. The company has faced significant foreign exchange (FX) write-offs in the past. However, the current political and economic shifts under the leadership of Javier Milei could herald a more stable and profitable business environment in Argentina, potentially reducing FX losses and even turning them into gains.

Rotoplas’s exposure to currency fluctuations, particularly the Mexican Peso (MXN) against the USD, presents an opportunity for a profit windfall. Should the Peso depreciate to a certain level (e.g., 19 USDMXN), Rotoplas could benefit from significant FX gains, given its large FX write-offs when the Peso strengthens. This could provide a tailwind in a carry trade unwind scenario.

Trade Idea 5 (Basket): Geriatrics & Elder Care

Aging populations have long been a focus in thematic equity investing but have regularly underperformed due to the higher concentration of REITs in combination with lower rates. That’s all about to change in my opinion:

Here is the sheet for my Elder Care thematic equity basket.

If there were more publicly listed stocks in the sector, it would be potentially interesting to look at a demographic dividend play that is long these elder care stocks and short early childhood care, but you are relatively limited there (I could only find a couple, of which BFAM US looks to be the largest).

Trade Idea 6 (Basket): Emerging Market Infrastructure Spending

Long EM infrastructure on increased impetus towards fiscal spending in emerging markets. This is a relatively simple thesis that is kind of a “you’ll know it when you see it” thing, so good to be prepared with some names:

Here is my EM Infrastructure Spending Basket.

2023 Thematic Equity Primers: Updates and Trades

Trade Idea 7: GLP-1 Developments

Recent & Future Developments:

The reintroduced Treat and Reduce Obesity Act (TROA) aims to modify current rules to allow Medicare to cover anti-obesity medications. This bill is presently under review by two committees: Energy and Commerce, and Ways and Means. It needs approval from at least one of these committees to be considered for a vote on the House floor. The Congressional Budget Office (CBO) is yet to provide a financial assessment of this proposal, which is expected to take into account the medications' direct costs, potential health outcome improvements, and any additional medical expenses for individuals using these medications. Despite enjoying support across party lines, the bill's progression to a vote remains uncertain. Factors such as the implementation of the Inflation Reduction Act, the current fiscal environment, and the upcoming 2024 U.S. Presidential election could impact its passage, making Medicare coverage for obesity medications by 2025 unlikely, with 2026 or later appearing more feasible. Currently, Medicare covers GLP-1 for treating Type 2 Diabetes (T2D), but it's not clear if this coverage will extend to the latest GLP-1 medications for obesity, especially if they are predominantly prescribed for other conditions already covered by Medicare, like cardiovascular outcomes trials (CVOT), chronic kidney disease (CKD), or obstructive sleep apnea (OSA).

I’m going to say something potentially controversial here but the only reason sales of GLP-1 drugs aren’t 50-100% higher is due to supply constraints. I have a feeling those constraints will soon be a thing of the past:

GLP-1s have been and remain significantly supply constrained by manufacturing - specifically in the autoinjector supply - but remain poised to dominate within the NVO/LLY duopoly as the results of their respective data campaigns become available.

Here’s a guideline for their current GLP-1 trials:

Trade Idea 7a (GLP-1 L/S): Long ZEAL Short GPCR & 4519 JP (Chugai)

ZEAL: Dapiglutide / GLP1&2 , ZP6590 / GIPR agonist

GPCR & Chugai: Fading Oral GLP-1 (GSBR-1290)/ORF Royalties

I’m sorry it took me so long to write this…as I was bitching about on twitter a couple days ago, GPCR went down 50% in a single day a week into the process of writing this. This was one of the first ideas I wrote down this article when I began writing on 12/8…when the chart still looked like it did above. Now it looks like this:

But this (ZEAL v Chugai) could still work, so I’m leaving it as is because it’s still a valid and important thesis that will matter in 2024. Second time that happened to me this month (first was with Macy’s).

Both GPCR’s GSBR-1290 and ZEAL’s Survodutide so far show inferior results compared to the drugs of Lilly or Novo, by having higher proportions of adverse effects that aren’t commensurate with increased loss of body weight. However, GPCR’s GSBR-1290 is able to be taken orally daily, which may have contributed to its outperformance over ZEAL recently.

In ZEAL’s pipeline is Dapiglutide, being a GLP1R and GLP2R dual agonist, not only finds potential use in obesity, but also for short bowel syndrome.

Also lurking in the background as a dark horse ZP6590, a GIPR agonist, being developed by Zealand (ZEAL DC) is designed to be used in conjunction with GLP1R agonists (Semaglutide), and has been shown to be able to enhance body weight reduction compared to Semaglutide alone.

As a relative trade, there is plenty of upside left for ZEAL while GPCR faces competition against oral versions of Semaglutide (Rybelsus), Amycretin and Orfoglipron (Oral GLP1R agonist, oral dual agonist for GLP1R and calcitonin receptor agonist, and oral GLP1R agonist respectively).

Danuglipron has shit tolerability, in our opinion you won’t be able to sustain patients on it with that level of side effects; people will just gravitate to Rybelsus if they must.

So that leaves you with Amycretin vs Orfglipron ; both oral; Amycretin does have higher body weight loss so I do see a scenario where Amycretin may be more dominant in the oral GLP market, but then it comes down to timing because Orfoglipron is much further ahead in the pipeline, Amycretin is further behind, but there are scenarios where it maaay get expedited. Of course, there is a salient point to be made for maintainers switching from autoinjector to oral, but I think they have to pretty much be neck and neck vis a vis side effects & efficacy for that to even be a conversation - and that doesn’t account for the fact that taking a medication once a week is excellent for patient adherence and I still think the aversion to autoinjectors is grossly overestimated. The focus on oral is maybe one of the few moves from NVO/LLY that I disagree with - they could make such better ROI by focusing literally anywhere else.

And, I know, it’s medicine - I’m supposed to provide empirical evidence. But let me just say - oral GLP-1s probably will absolutely wreck your liver. And the level of research that’s going to have to go into them to ensure they don’t is going to be the definition of capex intensive. I’m not just making this up - recall that PFE terminated lotiglipron because of elevated transaminases. Amycretin is the most promising oral GLP-1, especially in elderly populations (Calcitonin agonism = better bone outcomes) but probably by the time it arrives on the market Cagrisema is out and I think that’ll reignite the whole “do you want to be an oral treatment when there’s a much better autoinjector out there?”. For maintainers, that might be the case. But I digress, let’s continue.

Trade Idea 7b: GLP-1 Potential Body Composition Basket

LLY: Activin 2-B Inhibitor Bimagrumab (acquired from Versanis, in tests as a combo drug with Sema/Tirz) and LY2495655, Landogrozumab, (for pancreatic cancer)

BHVN: Myostatin Inhibitor Taldefgrobep Alfa

SRRK: Myostatin Inhibitor SRK-439 & Apitegromab

KROS: KER-065, Activin Receptor II Ligand trap (for DMD)

THTX: GHRP Tesamorelin (for HIV)

REGN: Trevogrumab (tested in combo with Sema)

Current weight loss drugs, based on targeting GLP1R, have the drawback of decreasing lean mass (muscle) and fat mass together. Although the ratio of fat loss to lean mass is still skewed towards losing more fat, future treatments that either allow muscle mass to be preserved or even increased, while only fat mass decreases could have great upside potential. One common target is Myostatin, a protein which normally suppresses muscle formation. Myostatin inhibitors, molecules that prevent myostatin from functioning, are being developed by a variety of companies, primarily for use in conditions where muscular dystrophy is excessive (Eg, Duchennes Muscular Dystrophy, Spinal muscle atrophy).

However, a myostatin inhibitor for the purpose of obesity, possibly in conjunction with GLP1R agonists could achieve the goal of preventing lean mass loss during body weight loss has been expressed by several companies.

BHVN’s Taldefgrobep Alfa (BHV-2000), a recombinant protein, has been shown to be able to increase lean mass at the expense of fat mass in a mouse model of obesity.

By itself it is also accompanied by improvements in insulin control.

KER-065 looks like a ligand trap for ligands of the Activin II receptor; whereas Bimagrumab is a direct receptor antagonist.

From what I read, the reason KER-065 was developed was because previous ligand scavengers had the nasty effect of also affecting BMP9 leading to some nasty side effects like severe gum bleeding; So they engineered a ligand trap, KER-065 which binds Activin more selectively than BMP9, the IC50 for BMP9 binding is around 9.1ug/ml. But then in the end, it still means it can bind BMP9 at a high enough concentration, so there is an upper limit on how high of a dose you can use before you get those side effects. Maybe it will be fine, maybe it won't be; but then in the meantime Bimagramab just side steps all these issues, because it binds the receptor directly & doesn't do anything to BMP9. The only studies we’ve seen on KER-065 were pre-clinical, best case scenario, the required dosage doesn’t give you bleeding gums, and you've got something that works as well as Bimagramab and a viable competitor, worst case scenario, it gets pulled because people are bleeding; However, it’s possible that KER-065 has a dosing advantage based on murine models & receptor density, but that’s very difficult to extrapolate from.

Obviously, Bimagrumab has its own side effects, like muscle spasms (expected), but then it would be weird if you didn't see KER_065 have the same side effects; albeit they may or may not be at a less severity, couldn't find any clinical data on KER-065 to be able to compare.

SRRK is aiming to use Apitegromab, in conjunction with a GLP1R agonist, semaglutide, for the treatment of obesity. In a preclinical mouse study, 3mg/kg of SRK-439 in conjunction with 0.04mg/kg Semaglutide preserved lean mass while reducing fat mass by 40%.

REGN owns Trevogrumab and have shown that Trevogrumab used in combination with Semaglutide can skew weight loss more towards fat (Although some lean mass was also lost in primate trials).

If you want a conjunction GLP1R + Myostatin inhibition play, SRRK and REGN. REGN is obviously a large cap, has many other drugs that can affect the trade, SRRK might be the pure play. BHVN is a pure myostatin inhibitor play.

In terms of the trade implementation, there is definitely a long play on BHVN and SRRK, but these may turn out to be simply hype cycles, in which case, shorting them against LLY would be the play on a reversal, if a reversal were to happen.

Myostatin inhibitors in the past have had a tendency to fail primary endpoints, not increasing muscle function in conditions like Duchennes Muscular Dystrophy; which some people believe means that myostatin inhibitors are not going to succeed in sparing lean mass loss during body weight loss from GLP1R. The problem with this type of analysis is that in a lot of those studies, lean mass actually increased, albeit only a small amount (5%), it was just that the increase in muscle mass didn't translate into any functional improvements, which was the primary endpoint for most of these studies. The caveats though are:

DMD patients in almost all those studies were also taking corticosteroids, which themselves impair muscle development.

A small increase in lean mass in DMD patients, means that this happened in spite of the constant dystrophy happening in the background.

Myostatin inhibition has the tendency to turn slow-twitch muscles towards fast-twitch muscles, but DMD is caused by mutations in dystrophin, which is needed to help fast twitch muscles not get rekt during muscle contractions; thus paradoxically, by turning more slow-twitch muscles into fast-twitch muscles in a DMD patient, who lack dystrophin, you're making them more likely to just damage their muscles even more.

Altogether, it means that you can't translate myostatin inhibitor results from DMD patients, to normal humans with functional dystrophin.

I've seen an argument float around that the lack of effect in DMD patients is due to some compensatory effect by other non-myostatin Activin Receptor ligands, like GDF-11; this is rank bullshit because in human cases where there is a mutation in only myostatin, you get massive hypertrophy and if there is any situation where you would expect compensatory effects, it would be a congenital mutation.

Having said that, when looking just statistically at the success of myostatin inhibitors in non-DMD cases, (Eg Lilly's Landogrozumab etc...) it’s a toss-up between those that increase muscle mass in humans, and those that don't increase muscle mass in humans. But just about every myostatin inhibitor, in pre-clinical studies, like mice/monkeys always show increase in lean mass. So there is a species difference to be spoken to, which may be due to the fact that mice just have higher levels of myostatin at a basal level.

By far Bimagrumab, from Versanis (now owned by Lilly) is what I consider the best bet for increased muscle/decreased fat combo drug. BHVN, KROS and SRRK can definitely ride along with them.

KER-065, although it does show higher affinity for ligands of interest, over BMP9 (which can cause bleeding gums), it still means there is an upper limit on dosing before you get that side effect, so it's a far tail risk in the background.

However, HALO’s partnership with LLY from what I understand, that dosing advantage of KER-065, could potentially be wiped out if ENHANZE ends up being able to enhance bioavailability of Bimagrumab to the extent that they could just convert Bimagrumab from a IV to a subcutaneous treatment.

Suffice to say, that just makes me even more wildly bullish LLY , knowing that HALO could also potentially do wonders for them, which you’re stacking on top of Retatrutide and Bimagrumab. The main point against HALO is that ENHANZE goes off patent in EU in ‘24 and US in ‘27.

Long Cloudflare & Crowdstrike/Short Okta, from “Cybersecurity Frameworks”

Right now, OKTA is experiencing a short squeeze. Luckily it's not that bad for us because NET and CRWD are doing quite well too, and we reduced this position by half a few weeks ago after earnings.

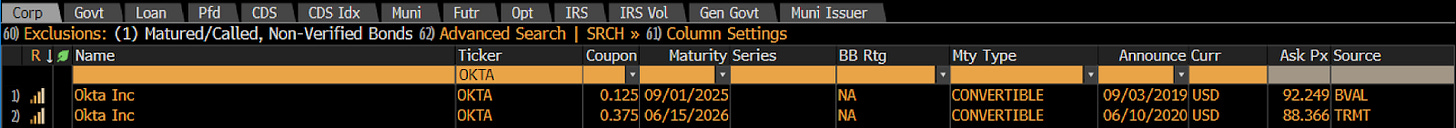

Still, OKTA screens well and is optically cheap into a year of anticipated increases in M&A. I think that makes for a dangerous environment of new years and holiday parties, idea dinners etc. where it’s going to get pitched and ultimately bought. I still have high conviction on the outperformance of NET & CRWD relative to OKTA and I truly believe that a) there’s a huge overhang from the potential that their system was similarly compromised during the MGM/CZR hack and they didn’t know/tell anyone (they also waited way too long to file the breach after BeyondTrust alerted them) and b) if PE really wanted to buy an IAM/MFA name - which they might, cybersec is a big theme in PE this year - I honestly think they’d have so many better options and they’d realize that Okta’s product is not as sticky as it seems.

Still, if you know anything about me, you know I follow the idea of doing “insecurity analysis” and I don’t want to be hurt badly if people continue bidding this up in the new year. I believe OKTA will continue to underperform our longs but I don’t think it’s going insolvent anytime soon, and they have some converts we can use to protect our position somewhat.

You’d have to buy about 20x as much notional in these bonds as notional in stock to completely be hedged deltas with it, but I don’t think that’s necessary. I really like cybersec as a continued theme, and I am high conviction on the underperformance here, so I want to keep on the short but also protect it a bit. What I’m going to do is purchase the same amount of notional on the converts, and then use half the anticipated cash flow (2.75% of the position) to purchase 20 delta June 2024 calls and bring up the protection a bit.

“Why bother?” is a pretty good question here but the way I see it the upside to the cybersecurity names we’re long over the next 2.5 years is pretty significant and I firmly believe that OKTA will continue to lag, and since the position is already up pretty nicely I think this is a good way to protect it. I do think there is a decent chance I will still have this position by the time the bond matures.

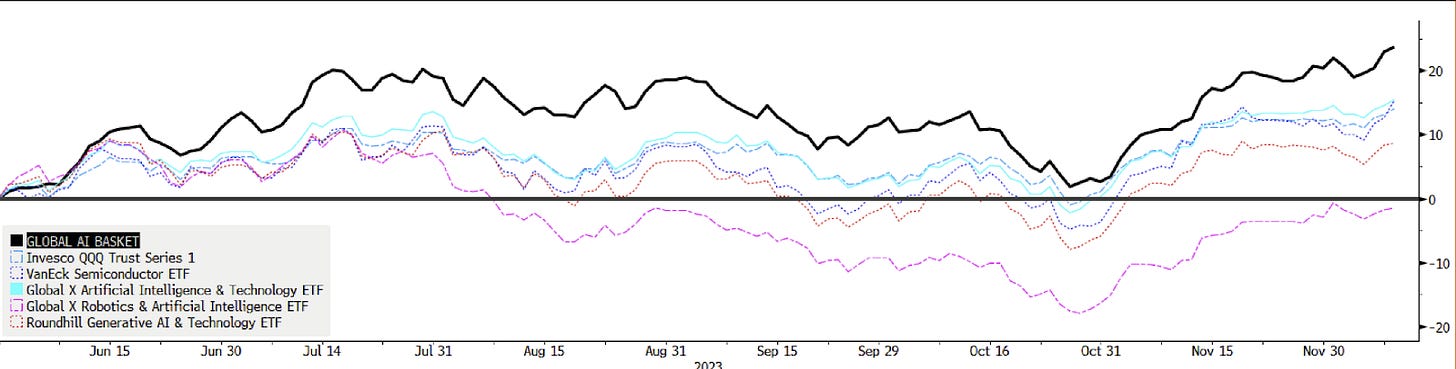

Trade Idea 8: Artificial Intelligence Developments

Collaborator:

AI Beneficiaries Article & AI Losers Article

Six Potential Developments in AI to Monitor in 2024:

The most significant developments in AI/ML relevant to investment opportunities, in our opinion, are:

Growth in AI Training Infrastructure:

The expanding infrastructure for training AI models underscores a significant opportunity, especially for companies providing essential components like optics, interconnects, networking, and memory. This "picks and shovels" approach aligns with the growing demand for robust, efficient, and scalable AI training platforms. Companies that manufacture these critical components are poised to benefit from the increasing complexity and computational requirements of AI systems.

Incremental Revenue for Infrastructure Providers:

Providers of servers, data storage, optical networking gear, and memory are likely to witness continued incremental revenue growth. These sectors are integral to the broader AI ecosystem, supporting the underlying infrastructure required for AI development and deployment. Any developments arising in next gen memory focused on decoupling bandwidth from chip size could be excellent investment opportunities, as could significant moves forward in memory and optical/networking technology. Look for signs that the overall networking and memory inventory correction is bottoming and to buy networking companies where AI demand is becoming material to top and bottom lines and pro-cyclicality is returning to the other segments of their businessSay you’re a new AI startup who has just been funded and you plan on training a foundation model. You spin up some ND H100 virtual machine instances on Azure to train your model, which is 8 H100s initially but can scale up to thousands with an upper limit of 3.2 Tb/s of interconnect bandwidth per virtual machine (each GPU in a v5 instance has a 400 Gb/s Infiniband connection.) As one of Microsoft’s flagship cloud offerings for AI, we can understand how the upper limit of bandwidth in these cloud instances represents an inevitable bottleneck for training AI models and an area of interest for the companies participating in this arms race to invest in.

Meta recently called out the challenges of IO protocol and component scaling falling dramatically behind AI model size scaling at their OCP summit. Cisco hinted on their most recent earnings call that we’re nearing the bottom of the inventory correction which likely means that the upstream supply chain had already bottomed. Marvell had sort of a strange guide but it was illustrative of this thesis - they are experiencing massive demand for the AI segments of their business (AI cloud and data center) but significant softness in the other segments of their business. Marvell’s strength in optical components should position them well for the continued structural demand for the networking components necessary for state of the art AI research and the cutting edge deployment of AI technology in commercial use cases.

Trade Idea 8a: Long Marvell (MRVL US)

In the same manner that semiconductors came into focus because of the overall AI demand, I believe networking (Nvidia, Arista Networks, Broadcom, Marvell, Cisco etc.) will experience a similar moment in 2024 as attention turns to the bottlenecks that exist in networking technologies. At some point in 2024, the inventory correction will bottom while AI demand remains strong and these companies will be in a sweet spot where they’re up against relatively easy comps and relatively cheap on forward earnings. Also, as the hyperscalers invest both in their own networking solutions and new technology from networking providers, this should continue to advance developments in AI.

We believe MRVL presents the best value currently relative to potential upside.

Of course, Nvidia is rolling out it’s H200 and B100 chips at some point in 2024. The H100 will be the first Nvidia chip to have (HBMe3 High Bandwidth Memory 3) and will have 141GB of memory at 4.8 Tb/s. The H100 has impressive performance improvements including nearly doubling inference speed on Llama 2, a 70 billion-parameter LLM, compared to the H100. Nvidia will follow up the H200 with the B100 product family and is also planning on upgrading its quantum and spectrum x technologies, offering 800 Gb/s and 1600 Gb/s transfer speeds by 2024 and 2025 respectively. Nvidia is also well positioned in the AI Data Center / High Performance Computing segment due to their NVLink and Infiniband technologies and their intentions of an accelerated product cycle as well as investments in their networking technology provide strong signals of the networking technology upgrades that are necessary to facility the future of Artificial Intelligence research and commercialization. However large Nvidia’s throne is, however, it only makes it more enticing for would-be assassins, which brings us to…

Emergence of GPU Competitors, ASICs and Diverse Silicon

The potential rise of a credible competitor to the current GPU market leader introduces a disruptive element in the AI hardware landscape. This competitor's engagement with the open-source software community and a possible industry pivot towards more versatile software solutions compatible with various hardware platforms could dilute the incumbent's dominance. Investing in such emerging players could offer significant upside, particularly if they successfully capitalize on this shift.

GPUs are expected to continue dominating AI workloads, and while AMD has a new entrant it will be difficult to scale with the margins they’re producing them on. NVDA’s dominance will eventually incentivize competitors to invest in R&D for alternative silicon solutions like FPGAs and ASICs - this is why Nvidia has attempted to widen this moat by strongly supporting Coreweave and why we’ve seen headlines of Sam Altman raising in an attempt to start his own GPU company. Companies that effectively diversify their silicon offerings and challenge the status quo could represent attractive investment opportunities, but this will take a significant amount of time, R&D and overall investment. ASICs would be very bullish for memory and optical while potentially disrupting NVDA as top dog.

Trade Idea 8b: Long Taiwanese AI Equities/Short TWDUSD

I believe the trade here is to go long dollar hedged Taiwanese AI beneficiaries, which will likely benefit in an arms race between the hyperscalers trying to break free from NVDA’s grasp and NVDA itself. Shorting TWD hedges a bit against this capital inflow failing to materialize and is protected by the fact that Taiwan will defend against rapid appreciation in its currency, additionally, it is positive carry.

Software Companies and Capex Capacity: Software companies lacking the capacity for significant capital expenditure on AI infrastructure risk falling behind. This divide creates an opportunity to identify and invest in software firms that demonstrate both the vision and financial capability to integrate AI effectively. Conversely, companies lagging in AI adoption might face challenges in maintaining competitiveness, potentially becoming targets for short positions.

AI Cannibalization Risk:

The risk of AI cannibalization, where advanced AI solutions supplant existing software and cloud offerings, remains a concern. This dynamic suggests a cautious approach towards companies that may be vulnerable to such displacement, focusing instead on those leading the AI revolution.

Trade Idea 9: Potential Policy Developments

I’m not going to write too extensively here because I know I’m going to be updating this theme relentlessly during the election cycle. If you haven’t already read it, the reason I wrote the Fiscal Primer when I did was to ensure it was prepared for 2024. You can read it here to brush up.

Still, there are a couple of ideas that are fiscal policy adjacent (or at least political) that I think are interesting.

The chart above looks at the relative monetary vs fiscal policy tightness. We measure policy tightness as follows (at quarterly frequency bc of the availability of aggregate macro variables like deficits). Monetary policy has “lagged” fiscal policy. While fiscal policy has tightened significantly from the depth of the COVID pandemic, monetary policy tightened later and remains tighter while fiscal policy has started to loosen.

Fiscal policy tightness is measured by surplus/GDP minus output gap/GDP. Higher surplus during periods of high output gap (actual output falling short of potential) is tight fiscal policy. Monetary policy tightness is captured by FFR minus real potential growth. Higher real potential GDP growth means the same level of FFR is less tight.

The manner in which these two policies end up converging again is likely going to be determined more by the election than by the economy. A Biden win is looking more like a possibility compared to a few months ago when markets were relatively convinced it wouldn’t happen.

If this momentum continues,, consider more of the beaten down fiscal beneficiaries that have benefitted from more liberal policies. Clean energy projects become more investable and economical in a soft landing scenario. Among stocks that took a significant hit during the second half as increased odds of a GOP victory were priced in that could also see tailwinds if current market trends see continuation are MAXN, NEE/NEP and AES.

Trade Idea 9a: Long Carbon Credits (EUAs & CCAs)

I believe that mandatory carbon credits remain a solid play over the long term, with downside protection from the regulatory environment of more liberal leaning regions and bipartisan acceptance. They are a good uncorrelated asset that can be paired with trades that may benefit from slowing industrial output, and could see significant upside in a Democratic reelection scenario with limited downside in a GOP victory.

EUAs are again approaching the lows they hit when the EU’s carbon policies came into question during the Euro energy crisis. I still maintain that the importance of carbon emissions to Europe’s median voter is such that it is unlikely to go beneath that floor. There is also a strong seasonality component here that makes buying around $60 a decent risk/reward - remember they can delete these certificates to depress supply & support price and if they are cheap enough it looks as if the program is incentivizing pollution.

Trade Idea 9b: Short Renewable Biofuel

Companies that have positioned themselves for increased renewable biofuel demand will likely continue to be disappointed in 2024. It is essentially a play on California, and I think that they will get hurt by the overbuild. Refiners like VLO, CVI and MPC have both invested heavily, and other biofuel pureplays like GPRE and GEVO could be good shorts this year. Additionally, short refiners seems like a fundamentally sound trade regardless

Single Name Equity and Equity Long/Short Trades

Trade Idea 10: Long Starwood Property Trust (STWD) / Short Arbor Realty Trust (ABR)

Collaborator:

Credit risk in real estate is shifting from office to multifamily and Arbor Realty Trust is at the center of the storm. Over 97% of Arbor’s $13.1 billion loan portfolio consists of short-term, high-LTV, floating rate, bridge loans for multifamily housing flip projects that have flopped. Massive growth in rents and property values throughout the first half of the pandemic brought a tidal wave of new, inexperienced capital to the space in 2021. But since then, rent growth has stalled and asset prices have already fallen by 17%. The successful turnarounds have already found permanent financing. The projects that haven’t are on Arbor’s books.

While the underwriting expectations assumed 48% rental growth through the bridge period, Trepp reports that rental rates in such projects have actually declined and occupancy has fallen. With interest rising by over 500bps since many deals were priced, debt-service coverage ratios (DSCRs) have fallen from 1.22x at origination to 0.74x today. In other words, the equity is underwater at current market prices and rents don’t cover the ballooning interest expense. Now balloon maturities are coming due. Unlike other mortgage portfolios with longer dated and staggered maturities, Arbor’s loans are on average just 13.8 months to maturity as of 9/30/23, meaning most will mature in 2024. The company currently holds just a 0.7% loss reserve against its multifamily portfolio.

Despite Arbor’s unique exposure to this credit risk, it continues to trade on similar valuation metrics (dividend yield, price-to-book) with many other mREITs with diversified, higher-quality assets, such as Starwood Property Trust (STWD).

While I cannot argue with the point that the trade may make more sense using a higher quality name like STWD, you’ll know if you’ve followed me for long enough that I have been fading the “office CRE” crisis by going long VNO & SLG since April 11th of this year.

If you are in a similar situation with a long on VNO/SLG bought near the lows, you may wish to consider selling ABR against it rather than exiting the position. However, be aware that this is doubling down on the “office CRE risk is overblown” thesis and adding the multifamily aspect, while going long STWD is simply expressing the view that ABR is subpar and more exposed to losses in multifamily.

Trade Idea 11 (L/S Basket): Long Inventory:Sales Growth YoY Improvement / Short Deterioration

2023 was an insane year

…buuuuut it was largely normal relatively speaking. When I say normal, I mean that this year was not influenced by extreme & economically external outlier event (for example., COVID-19 in 2020, Supply Chains in 2021, the Invasion of Ukraine in 2022). The geopolitical volatility this year, from a market impact perspective, was relatively muted and inflation continued to moderate. I believe this presents an excellent opportunity to evaluate the efficiency of management. Why do I say this? Because there aren’t really excuses this year. Yes the macro was uncertain, but it’s likely to remain so for at least the next year, so I think the signal value in retail is above average in looking at the past year.

As I’ve said before when I was shorting Restoration Hardware - there’s nothing I hate more than hearing the macro opinion of a CEO on an earnings call, because it’s always an excuse. I’m not talking about CEOs reporting the macro environment as they see it, I’m talking about when one decides its time to make economic forecasts based on their opinions. This is relatively simplistic but I believe suited for the current market environment. Overall, US retailers have seen inventory-to-sales ratio increased from 1.1 in September 2021 to 1.3 today, which remains below pre-pandemic levels.

A strategic long/short position focusing on year-over-year improvers versus deteriorators in this ratio appears compelling. The case for a long position on retailers showing year-over-year improvements in their inventory-to-sales ratio is grounded in efficiency and market adaptation. These improvers have successfully navigated the complex balance between supply chain resilience and consumer demand in one of the most uncertain environments in recent memory, a critical skill that speaks to skilled management.

I recommended a similar trade for semiconductors, although long only, in my August market memo.

I do believe it’s a good exercise to go a little further in analyzing the difference between this year and the years immediately preceding the coronavirus, supply chain constraints, inflation, labor shortages and rate hikes. Here’s what we uncover…which companies are using chaos as a ladder and which are taking the unlucky route underneath it:

Here is last year, compared to the 5 year average for Sales Growth & EBIT Margin pre-COVID:

Here’s how the consensus expectations for 2024 stack up relative to the pre-chaos averages:

The outliers:

A worsening ratio can be a symptom of several underlying issues: overstocking, misaligned product offerings, or lagging sales—all indicators of operational inefficiency. These companies will likely poorly adapt to either structurally higher input costs from labor tightness and elevated inflation or a recessionary environment - making this a reasonable hedge for a portfolio that is expressing the “soft landing” view. Overstocking leads to increased storage costs which are untenable combined with higher labor costs as well as the risk of markdowns, eroding profit margins. Furthermore, this is evidence of a misalignment with shifts in consumer demand trends post-pandemic and likely will continue to result in lost sales opportunities and a weaker competitive position.

Here is the data if you’d like to narrow it down further.

Trade Idea 12 (L/S): Long Topaz Energy (TPZ CN) / Short Permian Basin Royalty Trust (PBT US)

Collaborator: Michael Spyker, HTM Energy

Note: There is literally no other sector I’m more of a filthy casual in than energy equities. This one really is not a collaboration, I don’t actually know what an AECO is (and I refuse to learn). What I do know is that Michael has always provided me with top tier insights into energy when I find myself in over my head. It’s quite possible to be an effective generalist even in the most technical of sectors if you have educated people you can bother enough.

For defensive commodity exposure, few names screen better than Topaz Energy (TPZ CN) – a mid-2020 spin out from natural gas behemoth Tourmaline (TOU CN), Topaz holds ~6MM gross royalty acres across Canada, and over 600 net royalty locations across the best resource plays in Canada. Topaz currently pays a 6.5% cash yield, funded down to US$50 WTI and C$1.50/MMBtu natural gas, and trades at 2025E EV/DAFCF of 9x. 95% free cashflow margins provide extremely balanced exposure to both gas and oil prices, along with low overhead costs thanks to a governance agreement with their main counterparty (Tourmaline). Alongside their royalty portfolio, Topaz has a gas processing infrastructure unit generating $65MM of EBITDA annually (with a SoTP value at 10x EV/EBITDA and 3x ND/EBITDA implying a core royalty portfolio EV of $2.5Bn including $200MM of attributable debt) that covers ~40% of the dividend, and is contracted with 10 year fixed take-or-pay agreements.

Notably, among their royalty counterparties, they have almost 100% CAPEX capture, for no incremental investment. Topaz’ main oil-weighted payor (Tamarack Valley Energy) recently disposed of non-core assets, leaving Topaz with ~95% CAPEX capture on their core Clearwater heavy oil development properties. This high CAPEX capture manifests as strong organic growth on Topaz’ royalty lands. For example, in 2024 Tourmaline will finish the development of their NE British Colombia natural gas liquids development, netting Topaz an incremental ~750BOE/d of production (for context, FRU CN recently transacted in the US for 600BOE/d at C$112MM). Inorganic growth is also a specialty of Topaz’, with board chair Mike Rose having one of the best M&A track records in Canada. Even without incremental M&A, Topaz has the best royalty assets in the basin, with only core lands that are high-priority for their royalty payors. With line of sight to 4-7% annual volume growth over the next decade, it’s tough to not like the name for defensive commodity exposure.

For the friskier that want to pair this, we view Permian Basin Royalty Trust as an excellent funding short – both with cheap borrow, and a cheeky touch of carry between the cash yields (PBT US at 4% and TPZ CN at 6.5%). While Permian Basin Royalty Trust sounds like, well, a royalty trust, they pay into CAPEX, and don’t have core assets throughout the Permian (with their land map notably lacking acres in Midland and Martin counties. Given the outlook for NGLs remains bleak as we wait for more export terminal capacity into YE2024, we view a TPZ CN/PBT US trade as long quality, and per share growth/margin expansion factors. We’d also note that Topaz has no end-of-life decommissioning liabilities associated with their royalty production, so checks the ESG box (if anyone still cares) and plays into the mystical LNG themes which should serve to reduce basin level spot gas volatility, a positive for Topaz, who can’t market their volumes, this also makes the base for 2025/2026 comps juicy as AECO gas strip continue to stagnate in 2024. Street estimates have yet to really come down for 2024/2025 as gas prices have fallen, though the stock has front run that to some degree.

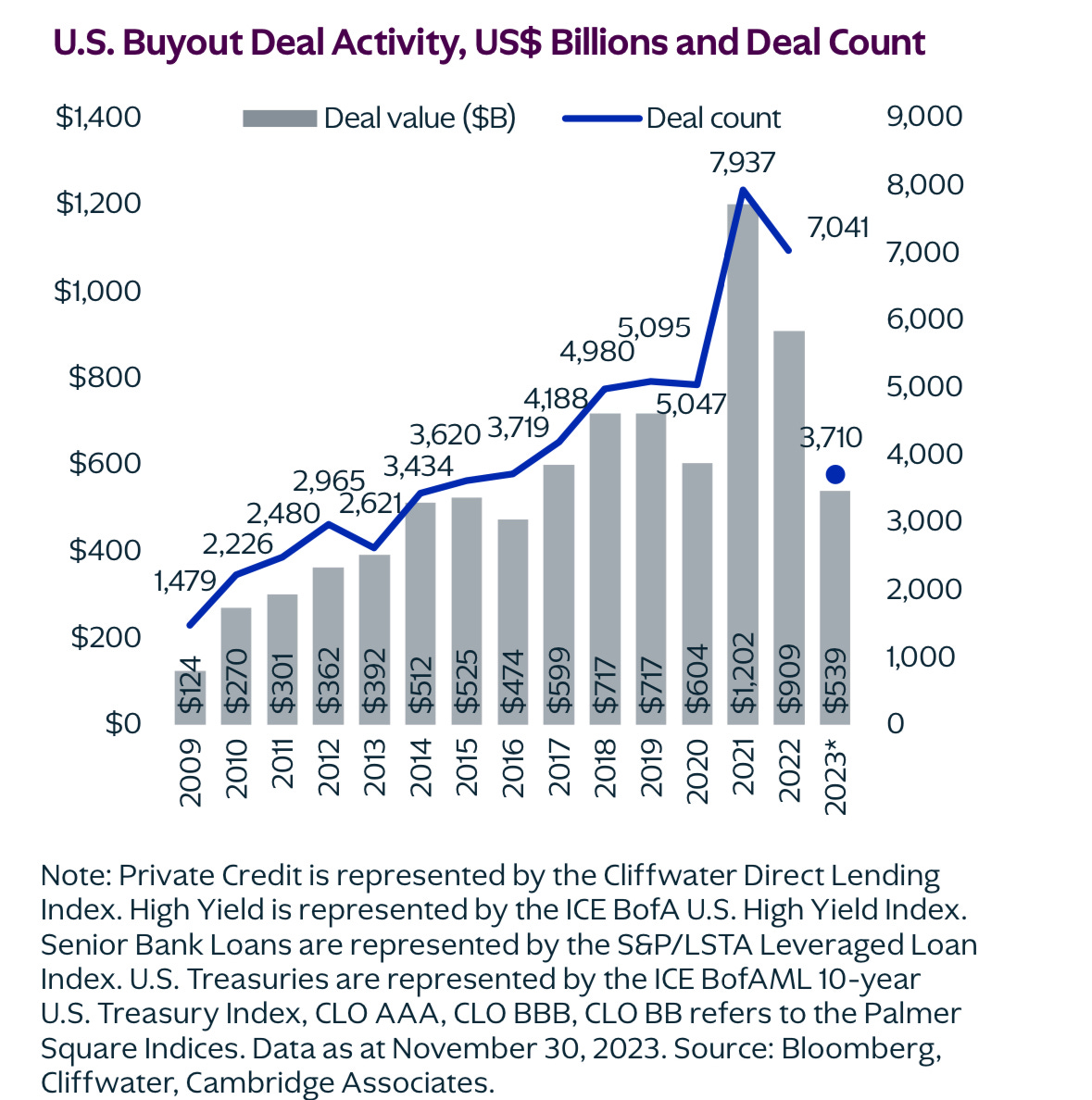

Trade Idea 13 (Long, Basket): Long Potential Buyout Targets for 2024

Deals have significantly tapered off, but money continues to flow into private equity. Outside of US Large Cap stocks, valuations in public markets are mostly below their average, with some markets like US Small Cap in the 5th percentile over the past two decades. These two points were just made by KKR in their 2024 outlook.

Typically, I would put no weight in the words of institutional investors, but the thing is in PE the people speaking are the same people that will be making the decisions to make these deals. And they’re all saying the same thing:

Expecting an uptick in public to private transactions, there are two sectors that seem poised to benefit, Healthcare & Tech.

My screens for the most likely candidates have turned up the following which you can view in this sheet here.

Running it as a basket seems to limit upside too much, it is probably better to be picky with about 5-6.

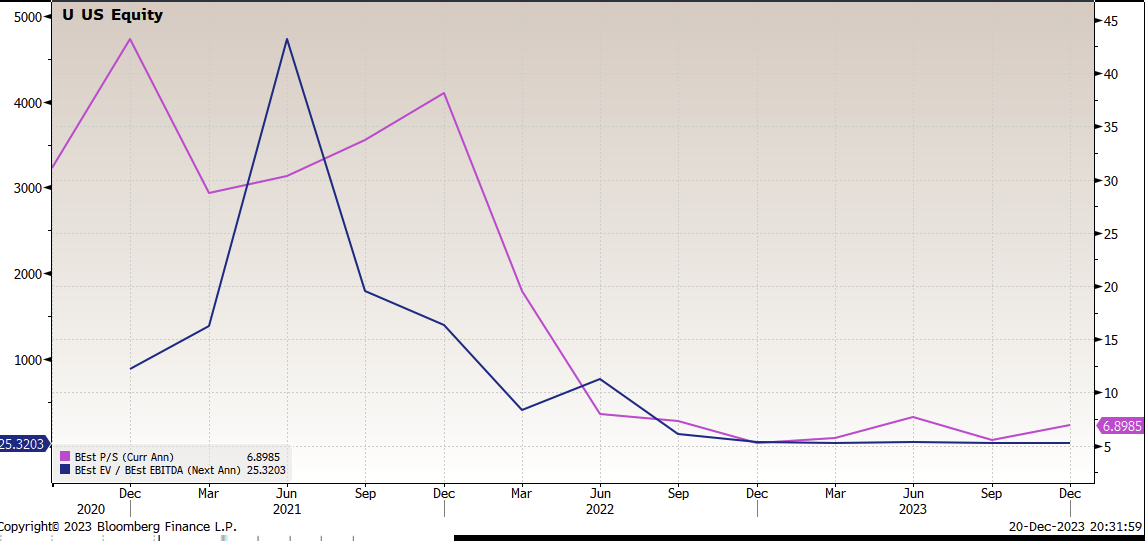

Trade Idea 14 (Special Situation, with L/S Potential): Long Unity (U US) / [Short AppLovin (APP US)]

Collaborator: Matt Kanterman

Main Points:

Unity Software (U US) presents an interesting takeover candidate after firing its long-time CEO and replacing him with a temporary executive focused on cost cutting.

Logical acquirers include megacap tech and possibly other game publishers, but Microsoft makes arguably the most sense.

Shorting AppLovin (APP US) as a hedge against sub-industry beta in the mobile game advertising and monetization market could help reduce the risk of this thesis.

Unity makes the eponymous Unity game engine, which is the most popular engine used in 3D game development by number of games made on it. However, most of these games are lower quality, casual mobile games as opposed to high-fidelity, “AAA” games for consoles and PCs. Unity competes for these AAA games with Epic Games’ Unreal Engine and proprietary engines such as Electronic Arts’ Frostbite and Take-Two’s Rockstar Advanced Game Engine (RAGE). Unity is also expanding into non-gaming end-markets to compete with other 3D design software companies with its “Digital Twins” strategy. This is also an early application of the Metaverse.

Challenges:

Unity is a fundamentally challenged company: as a pure subscription software for its core engine, the company fails to fully monetize its growing end-market. In Unity’s 2020 S-1 before its IPO, it estimated its Total Addressable Market at $29 billion (including both its core engine and monetization products) vs. the nearly $190 billion video game market in 2023 per Newzoo data and the estimated Metaverse TAM of $8-13 trillion, based on estimates from Citi, Goldman Sachs, Morgan Stanley and KPMG. Suffice to say, Unity’s core engine product as a pure subscription offering can never fully scale to capture a significant share of these end markets.

Unity responded to this by building out a suite of game operation and monetization products, enabling developers to more easily bring new titles to life, especially for casual and hypercasual mobile games. Unity’s acquisition of IronSource doubled down on its advertising monetization (admon) strategy, filling key product gaps in mediation and other areas. But more so than plugging product holes, this was a short term fix to get closer to Ebitda and cash flow profitability, as IronSource was already a profitable business and Unity on its own was nowhere close.

But then Apple’s push for a privacy centric network and the removal of Identifier for Advertising (IDFA) targeting was a gutshot for the entire industry. Apple’s latest push to ban fingerprinting (using basic device info to attempt to recreate these missing IDFAs, sometimes called “probabilistic attribution” if you’re fancy) will be another big hit to the industry. Unity claims to have already removed fingerprinting from its network and peers such as AppLovin will need to do so before Apple reportedly cracks down on this sometime in the spring.

Unity attempted to respond to these challenges by implementing a new pricing scheme, charging customers per install and other fees to more closely scale Unity’s revenue with that of its customers. Although this is fundamentally a sound strategy (and gets closer to Epic’s revenue share pricing of Unreal Engine), it received massive backlash from Unity customers of all sizes. The backlash was so bad that it led to CEO John Riccitiello retiring, but for all intents and purposes he was fired over this.

If you want to learn more about Unity’s fundamental challenges and outlook, listen to this podcast with Joseph Kim, the CEO of LILA Games, Brian Peganoff, the founder of Timber Advisors, and myself. And along with Eric Kress of Gossamer Consulting, the four of us provided updated thoughts after all of these latest events occurred.

Why a Takeover Makes Sense:

Unity appointed Jim Whitehurst, the former CEO of Red Hat, as an interim CEO. Although Whitehurst is a respected executive in enterprise software for his ability to turn around Red Hat, sell it to IBM and then his tenure at IBM, he has zero gaming experience. And his first efforts have been to massively cut costs, including killing off product segments that are non-core to the Unity engine. A good example is the shutting down of Weta Digital, the VFX company Unity acquired from Peter Jackson for $1.6 billion. Expect Whitehurst to keep cutting costs and culling non-core products to make the business more profitable, leaner and easier to sell.

Whitehurst was granted 200,000 Unity RSUs as part of his employment agreement, with a 50/50 vesting schedule for Feb. 25, 2024 and May 25, 2024. At the December 1 closing price, these were valued at about $6.5 million. Whitehurst is clearly not here for the long haul and, given his background in selling Red Hat to IBM and the fundamental challenges facing Unity that aren’t addressed by these cost cuts, it isn’t out of the cards that the end plan is to clean up the company, put a nice coat of lipstick on it and sell it to whoever comes asking.

Potential Suitors:

Potential suitors to Unity include most megacap tech companies, especially those with gaming ambitions like Amazon, Microsoft and Netflix, while other game publishers could be interested. Apple also could make sense strategically but they have never been a large serial acquirer so it reasons to not bet on them until that changes.

Of the above list, Microsoft theoretically makes the most sense. It can offer the Unity engine out of the Azure cloud to drive more Azure usage while also leveraging Unity’s engine and admon capabilities to build out its mobile gaming aspirations. If you recall, Microsoft claimed one of the key reasons it purchased Activision Blizzard was to build its own mobile app and games store, and Unity’s tools would be a good addition to this strategy. And after $69 billion for Activision, what’s another tens of billions more between friends? Microsoft spits off $60 billion and growing of free cash flow annually.

Microsoft could also bring the financial and technical rigor to help improve Unity’s core product suite and make it more competitive technically with Epic and others while also making it more profitable. Given the anchoring of Unity investors to the post-covid market highs for the stock, striking a deal at a reasonable price could be tough but strategically and at the right price for Microsoft, this checks a lot of boxes.

For similar reasons, Netflix and Amazon make sense, but given Microsoft’s specific focus on building a mobile games business, they make more sense at this juncture. Netflix would need to show a demonstrated focus on monetizing games independently from subscriptions for this to make sense, rather than relying on games as a simple churn reduction mechanism as they are now.

Valuation:

To assess Unity’s valuation, we need to look at it both as a takeout candidate and as a standalone. As of December 1, Unity traded at 6.8x 2024 revenue, 25x 2023 22x 2024 Ebitda. If no deal materializes, it’s not unreasonable for Unity to trade down to 5x revenue or lower, but that’s not a ton of downside. In a takeout, Unity could fetch closer to the 8-10x revenue it was trading at before the runtime fee fiasco, which implies a price of about $40-50 in a takeout (using Unity’s guidance for 480 million diluted shares). This puts it at about 30-40x Ebitda.

Unity could also rally to these higher valuations standalone over the next year or so if the turnaround story takes hold, the overall bullish sentiment for speculative tech/software continues to lift valuations and recent price increase efforts provide a boost exiting 2024 into 2025. But this also contrasts with potential fundamental risks noted above.

L/S Implementation: If you are worried about the health of the overall admon market, especially with the risk of Apple’s stricter crackdown on fingerprinting, you could hedge the admon industry beta by shorting AppLovin against a long Unity. These two have been a pretty good pair trade for quite a while now, flipping back and forth depending on industry dynamics, the ongoing struggles internally at Unity and macro factors (including Unity being a popular Ark stock).

Trade Idea 15: Biopharma Plays

2 Longs, 2 Literal Punts (Actual Gambling, Be Forewarned), 1 Short

Long IMVT US & ROIVUS

The impending $7.25B deal with Roche for Telavant positions ROIV to have approximately $12 in total value, while the current market price is $10.35, suggesting significant undervaluation. With a track record of delivering a 110x return on capital for Telavant, ROIV offers substantial upside potential in a biotech sector characterized by investor apprehension. Anticipated catalysts include capital return to shareholders, a likely sale of their 57% stake in IMVT, and the potential value from LNP litigation. Additionally, approved drugs like Vtama and the prospect of billion-dollar assets like Brepocitinib contribute to ROIV's optimistic outlook, making it an appealing investment in a sector seeking confidence and growth.

Long ALXO US - Evorpacept (ALX-418)

CD47 inhibitor. Promotes immune system recognition of tumours. Not specific to any particular tumour, could have broad applicability as an adjunct therapy for many different types of tumours. Strategy is to use it in combination with already prescribed therapies for different types of tumours. Gastric/Gastroesophageal junction cancer, Urothelial cancer, Breast Cancer and multiple myeloma are what they have in the pipeline, but plenty of room to expand into other tumour types.

Long BPMC US - Elenestinib

Specific KIT D816V inhibitor. The D816V mutation in the KIT gene is associated with a genetic form of systemic mastocytosis (Mast cells mediate allergic responses, mastocytosis is when mast cells become excessively active and numerous; in a really dumbed down way, systemic mastocytosis can be thought of as a body-wide allergic reaction). This is a very targeted therapy, very clean in its mechanism meaning that you would expect high efficacy with low side-effects (Since it doesn’t mess with other molecules in the body, only the mutated KIT protein).

Short SAVA US

Cassava therapeutics have begun phase 3 studies with Simufilam, for treating Alzheimer’s disease. The background science makes no sense, the lead scientists having jumped from one explanation to another over the years (A7 nicotinic receptors binding Amyloid-beta, Brain insulin resistance, interaction with opioid receptors, stabilization of filamin A), which has led to this chain of incoherent explanations that seem to want to check off a list of key buzzwords. Several papers associated with the company have been retracted, over concerns about data fabrication (Editing photos); many other papers that have yet to be retracted have received the same criticism. No source data was provided by the scientists of SAVA to rebuke claims of data fabrication. No independent lab has reproduced their results.

The patchy science of SAVA came under attack by a group of scientists in 2021 who pointed out these issues. However, their credibility was questioned as they didn’t disclose their ownership of puts on the stock, casting doubt on their motives and their statements, making it seem self-serving.

Despite their questionable motives, the criticism raised was relevant and never addressed by Cassava. Attrition rate of Alzheimer’s drugs is already very high (High 90s %), very unlikely that SAVA has managed to stumble onto a cure.

High borrow rate and high IVs make both buying puts and outright shorting and holding somewhat unattractive. A potential catalyst is the announcement of phase 3 results near the end of 2024 (Estimated to be October 2024), which may provide an opportunity to get short into an anticipated large one-day decline (overcoming the negative carry from longer term borrowing) or short stock and write puts against it (Covered Put).

Trade Idea 16: Global Macro Rapid-Fire Round

Nobody actually wants to hear anyone talk about macro so I’m going to keep these short:

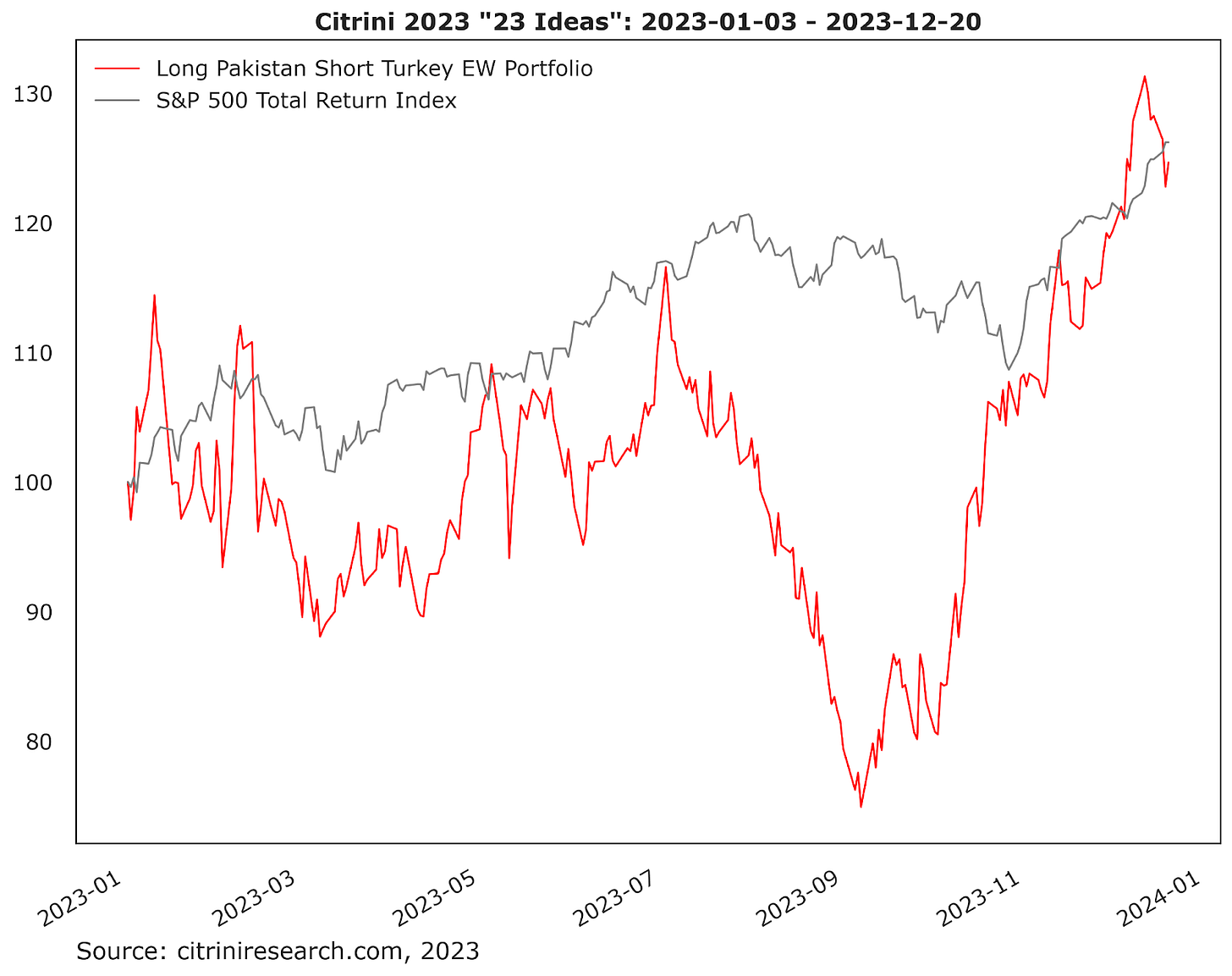

Long Pakistan (PAK US)/Short Turkey (TUR US):

Pakistan: Demographic Dividend/Geopolitical Advantage/Relative Valuation/Increased Investment from MENA countries

Turkey: Overmanuevering in Geopolitics has a shelf life/Foreign Denominated Debt/Crowding on “Inflation-Protected Equity Thesis” risks a violent unwind on either Turkish inflation moderation (lol) or increased crypto adoption (through facilitated capital flight or directly)

Long Mexico (EWW US)/Short Colombia (GXG US):

Cognizant of recession risks this play takes advantage of nearshoring tailwinds increasing the attractiveness of Mexico as a business destination & continued USMCA benefit as well as Mexico’s increasingly diverse economy and plays against Colombia on higher commodity dependence & internal political unrest.

Trade Idea 17: FX

Short GBPAUD:

Reasoning: It went below the line

Short EURNOK

Reasoning: Described in “Global Macro Trading for Idiots: FX”

Short CHFJPY

Reasoning: Described in “Global Macro Trading for Idiots: FX”

Trade Idea 18: Commodities

18a) Oil + 60/40:

Long Oil Calls as a complement to a traditional 60% Equity/40% Bonds portfolio, a hedge against a reacceleration in (headline) inflation due to geopolitical risk or supply shocks.

It’s essentially risk parity. Not perfect, but would probably work in the worst case scenario. I would do 5-10% weighted ATM and/or slightly OTM calls on CLM4 and CLZ4, respectively, and allocate the rest to 60/40.

Long Lumber

Long Coffee (KC), Sugar (SB), Cocoa (CC) / Short Orange Juice (OJ)

Long Corn / Short Soy

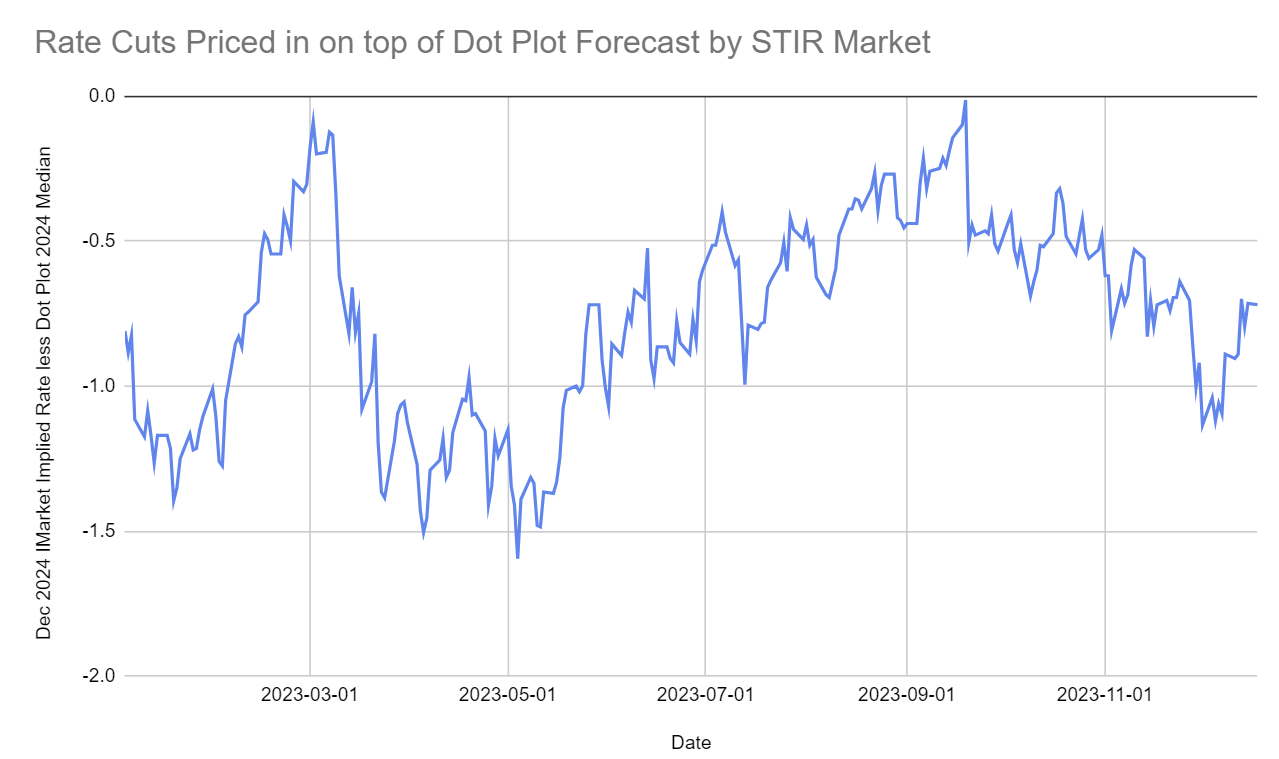

Trade Idea 19: STIR

While the current probability priced into SOFR futures for 2024 is possible, it’s probably unlikely that we get 150bps of cuts if current conditions continue to materialize.

Still, if I was going to wait for a signal to fade the cuts priced in, I’d probably wait until it was a bit more drastic. What we see looking at the December 2024 Fed Funds rate implied by the SOFR market and the median dot plot projection is that the best signal value is in expecting more rate cuts to be priced in (and getting long bonds) when the market agrees with the Fed’s projections - it’s happened twice in 2023 and both times were peak hawkishness:

But to the question of whether it’s time to actually fade the rate cut enthusiasm, all I see from this chart is that the market can get much more enthusiastic. What the people yelling at the sky about how “150bps of rate cuts in 2024 is impossible!” are failing to grasp is that the STIR futures curve (while probably more of a forecast than most commodity curves) is not purely a prediction. It’s a base case (the dot plot, typically) plus a premium in case rates above 5% lead to some sort of significant deflationary impulse like a financial crisis that causes cuts to actually be much higher.

As you can see on the chart above, the base case was pretty much the only thing priced in pre-SVB. Then we saw 150bps of extra cuts priced in by the end of 2024 (which would have brought rates down to about 2.5%) which were slowly priced out until peak hawkishness arrived immediately prior to the week of the QRA/BoJ/FOMC in October.

We’re actually pricing in less rate cuts, compared to the dot plot projection, right now than we were before it was released. You can’t currently say there’s asymmetry in fading these cuts, even though you’d probably be correct you’re simply not being compensated enough for the tail risk present (I believe you would be at 200bps of cuts priced in).

If you’re very convinced, however, one way to play it oculd be the H4Z4Z5 spread - currently pricing about 50bps more cuts into 2024 than 2025. Being long this fly (selling Z4) could work in either a scenario where the Fed sticks to their dot plot projections and only cuts 75bps in 2024, while pushing the cuts out to 2025, or in one where the economy significantly weakens in H2 and the Fed begins an accelerated cutting cycle that sees even more significant cuts in 2025 than those in 2024. I believe the former is more likely, but I still think the trade is more of a Q2 thing.

Trade Idea 20: Credit

This would have been a better trade a few months ago but I still think it may have some juice in it: Long CCCs. Basically a soft landing trade, for two reasons: (1) spread compression, high yield has generally come in a lot but at the lower end its still pretty wide (2) short-end rates, CCCs are generally pretty short duration, so they will benefit if the curve resteepens via the short end coming down. Net issuance in the HY market remaining tight is a key element of this trade continuing to work.

Trade Idea 20a: Long EM Local Currency Bonds (EMLC US)

If anticipating EM follow-along with Fed cuts this could present much more significant upside and much better carry. This seems a more attractive option than EM equities currently, although there are some good options there we will discuss later.

Trade Idea 20b: Long Busted Converts on Higher Growth (ICVT US)

Economic growth accelerating in 2024 without a concurrent increase in inflation would provide a pretty great environment for all these busted converts as a long gamma trade on the embedded call options on a bunch of, let’s be real, shitcos (and some okay companies with really crazy bubble-level strikes).

Miscellaneous Trade Ideas

Trade Idea 21 (Basket): Long 2022+2023 IPOs in Accelerating Growth

Simple thesis, if you’re playing accelerating growth. IPOs during market downturns tend to outperform on reaccelerations.

Here is a list of all the currently trading IPOs since the beginning of the bear market.

Trade Idea 22 (L/S): Long US Office & Home Furniture/Short International

Trade Idea 23: Long International General Insurance (IGIC US)

Collaborator: Cluseau

IGIC is a growth name trading at a deep value multiple, with a global presence (32.7% of rev from UK, 10.6% US, 10.1% MENA) in speciality long-tail and short-tail insurance. Taken public in 2020 through a SPAC, $IGIC was left-for-dead as COVID ravaged the energy industry. It has since transformed itself from a forgettable, regional name into a global behemoth, acquiring Energy Insurance Oslo in Norway in 2022, and expanding into the U.S. short-tail energy insurance market in 2023 (15% QoQ growth).

The father-son duo own 14 Million shares ($172 Million, 31% of the company) and stand to earn an additional 2 Million earnout shares which vest only if IGIC hits $17 by 2027. The company continues to report record quarterly earnings, with $0.79 in the most recent quarter and $2.22 in the first nine months of 2023, a 33% improvement over the comparable 2022 period. IGIC is conservatively run and has half its investment portfolio in short term CDs, and the other half in high quality corporate bonds with a remaining duration of 2.5 years and a current yield of 3.7%.

As the corporate bonds mature, IGIC is poised to be a significant beneficiary of the current rate environment, and grow investment income which currently comprises only 25% of total income. With tangible book value of $11 a share, a forward P/E around 5, industry leading metrics since the father-son duo keep operations lean and mean, and nearly $45 Million in capital returns in 2023 ($1 Million in dividends, $30 Million in share repurchases, $14 Million to retire dilutive $11.50 strike 2025 warrants) IGIC trades like a value trap, but has all the markings of a growth name with a bright future, and a highly invested and component management team.

If yields remain higher for longer, IGIC stands to gain significantly from heightened interest income, and if yields fall, a P/E of 5 clearly represents a low multiple for a name that clearly prioritizes shareholder returns. IGIC is still erroneously classified by many sources as a SPAC, and hasn’t had correct financials on Bloomberg since 2020 and thus flies under the radar on essentially all scanners

Trade Idea (L/S) 24: Long Daktronics (DAKT US)/Short Stroeer (SAX GY):

Stronger end markets (German Recession), DAKT well positioned and better diversified

Potential Tail Risks in 2024

I feel I should put the same disclaimer again - tail risks are definitionally unlikely. However, that being said, it seems we hit on some relatively fat ones last year:

Number 4 happened. Number 7 kind of happened in China (but not really, CNY just went down alot - no crisis yet). The likelihood of Number 6 is definitely higher now. 3 almost happened during the Prigozhin thing. So, here’s what I think the main tail risks are this year (in no particular order).

Cyberattack on US Infrastructure Amid Global Tensions:

Market Impact: Immediate volatility in sectors like utilities, cybersecurity, and insurance.

Investment Opportunities: Potential long positions in cybersecurity firms; short positions in vulnerable sectors.

Global Macro Implications: Altered global trade and currency markets; increased demand for safe-haven assets.

US Domestic Political Unrest in a Contested Election:

Market Impact: Short-term market volatility; consumer sectors potentially affected.

Investment Opportunities: Short positions in directly impacted sectors; long positions in defensive sectors and safe-haven assets.

Global Macro Implications: Potential weakening of the US dollar; altered investment flows due to increased country risk.

Rise of Information Warfare and AI-Enabled Disinformation (Deep Fakes):

Market Impact: We will likely see at least a few of these during the election, I’m going to call it “CambridGPT Analytica”. Cui Bono will become an even more important question when reacting to election or policy specific headlines. Erosion of digital trust affecting social media and tech sectors.

Investment Opportunities: Long positions in AI-driven security firms; short positions in sectors reliant on digital trust.

Global Macro Implications: Potential regulatory changes in tech; shifts in consumer behavior towards privacy-focused products.

Houthi Activity Disrupting Shipping Lanes:

(This is kind of already happening, as evidenced by the fact that most westbound ships have already turned to go around the cape of good hope)

Market Impact: Disruptions in global shipping, affecting oil and commodity markets.

Investment Opportunities: Possible long positions in alternative transportation or energy shipping stocks; short positions in directly affected sectors and Israeli shipping (e.g. ZIM) as a funding short

Global Macro Implications: Potential spikes in oil prices & shipping rates; regional geopolitical tensions affecting global trade patterns.

I do not like to play geopolitical theses as it is inherently unpredictable, but I do think there will be opportunities in the deescalation of Ukraine and some sort of detente. As I have been saying for about a year, Ukrainian govvies present good risk reward. Also, one of the more overlooked beneficiaries of this is Georgian-exposed equities.

Engineered Conflict Involving Venezuela:

Market Impact: Volatility in oil markets, regional instability impacting Latin American markets

Investment Opportunities: Long positions in non-regional energy producers; short positions in vulnerable Latin American markets or sectors.\

Global Macro Implications: Rebalancing of global energy supply; potential shifts in currency markets, especially in emerging market currencies.

Treasury Basis Trade Blow Up:

Market Impact: Dislocations in bond markets, affecting interest rate-sensitive sectors

Investment Opportunities: Opportunities in fixed income arbitrage; positions in interest rate-sensitive stocks like real estate or utilities.

Global Macro Implications: Wider implications for credit markets; potential central bank intervention affecting currency and commodity markets.

Market Upset Candidate Becomes Front Runner:

Market Impact: Uncertainty leading to market volatility, especially in sectors sensitive to policy changes.

Investment Opportunities: Short positions in sectors potentially negatively affected by the candidate's policies; long positions in sectors likely to benefit.

Global Macro Implications: Potential shifts in investor sentiment; changes in fiscal and monetary policy outlook affecting currencies and equities

US-China Trade War (Redux)

Market Impact: Supply chain disruptions and increased tariffs and risk to inflation forecast, accelerated relocation of manufacturing bases, reduced US agricultural exports to China, affecting commodity markets. Monitor Chinese Trade rhetoric during the campaign trail & CCP response, examine 2016 trade war playbook.

Investment Opportunities: Diversify into companies with minimal exposure to US-China trade tensions.Focus on alternative suppliers and companies with a strong domestic market presence. Hedge against volatility using safe-haven assets. Consider short positions in sectors highly susceptible to trade war impacts.

Global Macro Implications: Monitor fluctuations in capital flight assets like USDCNH, Gold and Crypto. Stay informed about shifts in global supply chains and potential alternative regions benefiting from these changes.

A Second Wave of inflation

Market Impact: If you don’t know by now, how do you have any capital left?

Useless Macro/Market Forecast:

This will absolutely be wrong. It’s silly to think I could predict the entire year of macro, and I’m much more reactionary in my macro trading than anticipatory. Still, here’s what I think.

On the headwind side, structurally higher inflation, supply chain inefficiencies, aging demographics, the complexity of energy transition, the looming exit of Japan from easy monetary policy, potential overshoots by central bank policy out of inflation and into deflation, significant risks to corporate income statements if rates remain restrictive and excessive DM government indebtedness pose challenges.

Additionally, elevated geopolitical tensions globally and the fact that we live in “interesting times” provide a rationale for a cautious approach. It is important to recognize, as well, that the lagged effects of monetary policy are real regardless of how resilient the economy is to higher rates - still the question is not whether we get a recession, but when and how severe. Delinquencies are on the rise and excess savings are beginning to return to pre-pandemic levels. The Fed will have to make a significant decision whether or not to renew the BTFP, especially now that OIS+10 has fallen lower than 1yr rates and banks can effectively arbitrage the program.

However, there are many investors who have been spooked into sitting idle due to this laundry list - something that has and continues to provide fuel to the upside.

And it’s not all bad, the tailwinds offer a more optimistic outlook, driven by industrial automation, a potential Asian rebound, labor productivity enhancements, widespread digitalization, a global infrastructure supercycle in both DMs & EMs spurred by a persistent fiscal impulse and the urgent push for decarbonization. There’s been a significant disconnect between fiscal and monetary that will likely resolve in one direction or another over the next year or two:

As you all know, I’m a reactive trader - not proactive. I don’t cling to thesis. I discard hundreds of ideas and preconceived notions in a year, never to be revisited. While I tend to have more confidence in things like single-name equity theses and thematic trends, it’s important to recall something that MacroTactical said to me once: a year is an eternity in macro. Things change rapidly, and I adapt to that. Now that I’ve got this outlet, you’ll be apprised of my thinking as well. That being said, I’ll share my (almost certainly wrong) forecast for where we go from here if current trends continue.

I see a year of subpar returns on the SPX, following initial continued strength from the current rally with difficulty holding gains above all time highs despite spending time above them, as the most likely outcome. I think the right tail risk is more significant than the left tail until the election, when those odds can reverse if Republican’s don’t do well. A break above ATH > 4800 on SPX will likely be sustained with some volatile conditions, the risk of a reversal likely would only materialize in the second half.

As the year goes on I believe it would be wise to rotate into defensives and form a barbell strategy with small-cap and value. For now, however, it’s wise to continue doing what has worked in terms of large cap tech, industrials, semiconductors and minimal bond exposure.

Lord Fed has wished to contribute and suggests this trade: selling the Dec24 5200/5000 call spread here for 96.5, to fund a Dec24 4500/4000 put spread which costs 75.

I think that we will see inflation stabilize in the 2%-3% range. I believe the first cut from the Fed comes in June 2024 and that the ECB ends up cutting more this year than the Fed despite a lower starting point on rates. The ECB will not cut before the Fed does.

I see ten year yields ending the year between 3 and 3.5%, with a yield curve that is slightly (~25bps) inverted. I believe there will be more volatility in bonds than there is in stocks, with yields going as low as 3.25% after a brief revisit to 4.5%, but ultimately that the 60/40 portfolio begins to outperform 100% equities in the second half of 2024 due to multiple favorable scenarios for bonds. I think the negative stock bond correlation begins to return to markets in earnest beginning Q4 2024.

My rates forecast (10yr) is below:

I believe that the bulk of the Fed’s cuts will come after the election. The US dollar will likely continue to decline in Q1 but strengthen in the back half of the year.