Market Memo: Peak Reopening

Take Profit in Chinese Assets, Rotate Broadly to US Semis & “MSTIP”

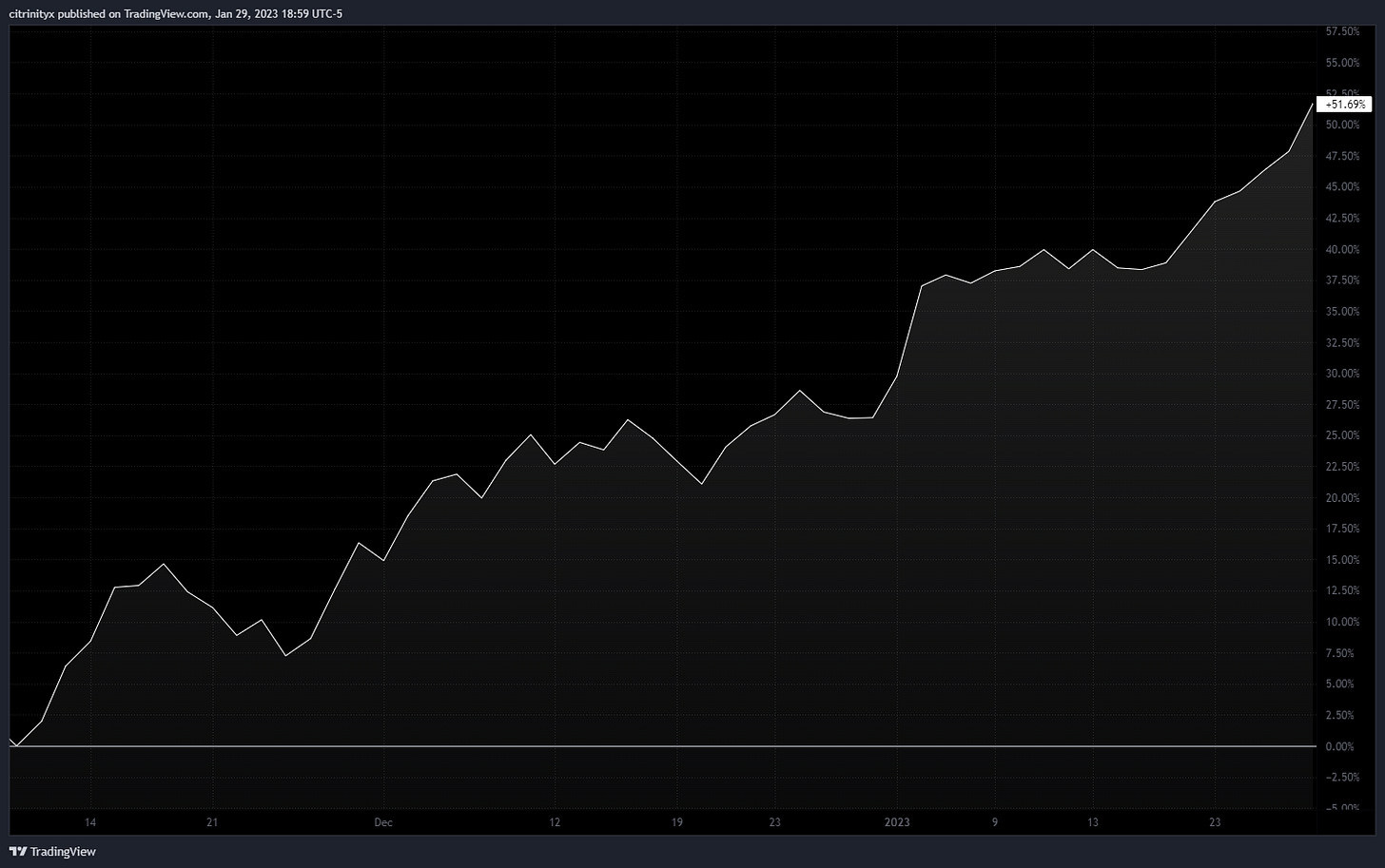

Chinese markets open tomorrow, following the first non-Zero Covid Spring Festival, as the broad cross-asset reopening rally in CN has reached the peak of inflated expectations.

Will we see a continuation regardless of economic issues orthogonal to Zero Covid? I think not (at least not now).

I had an excursion into Chinese Property Bonds & Property Developer Equity that was nerve wracking but very profitable.

The Premia Property Bond ETF (3001 HK) has seen a rise from 70RMB to 190RMB as some recovery optimism has been priced into more than half of the bonds the ETF holds and some are trading at almost impossibly optimistic levels now.

https://twitter.com/citrini7/status/1605675420510306304?s=46&t=Tt-ulcPIt-dE_32UNqC9Eg

I have completely exited the position, although it pains me to not just stick it somewhere and forget about it while earning the carry I think the risk that my 30% carry here actually ends up being more like 8% or less due to defaults is high and that current buyers of this ETF at a 7% yield are either insane, oblivious or both.

520 HK, Xiabuxiabu Catering Management Holdings, was on track to do ~ 1HKD EPS before SHTF. It’s on my watchlist but I will not put on a position yet.

Favorite plays for continuation are still the Chinese State Owned Enterprises (SOEs). A good way to express this is to go long the Chinese A shares ETF (ASHR) and then short the Chinese Ex-SOE ETF (CXSE). Since China seems reluctant to do consumer demand focused stimulus, the best shot you have at capturing recovery in the economy is in the companies to whom the CCP will direct capital.

I took profits from Shenzhen Expressway Corporation (548 HK), First Pacific (142 HK) and the pharmaceutical names I mentioned in the last post like Hengrui.

Reduced my holding in 1880 HK by another 25%, with only 10% of the original position remaining. 140 to 280 in 3 months is a bit too much, even if everything plays out - it’s “priced to perfection” now.

https://twitter.com/citrini7/status/1591656955604783104?s=46&t=Tt-ulcPIt-dE_32UNqC9Eg

An important lesson I’ve learned is that you shouldn’t differentiate between your price target being reached in 3 months or 3 years - if it gets there it’s time to manage your exposure. I’m happy with the win:

I also took profit on TCOM US & HTHT US.

I do expect travel will continue to rebound, but I’m also aware that, at this point, that’s well reflected in the price. There are better ways to play a rebound in Chinese travel now. Also, some areas of the Chinese economy that will likely see limited benefit from the zero Covid changes have been rallying alongside the most significant beneficiaries - this is shortsighted and naïve to the secular risks inherent in the Chinese economy that cannot be saved with a single policy pivot.

ASIA EX-CHINA (MSTIP)

I outlined in the last article my thoughts on geopolitically orthogonal southeastern Asian economy ascendancy in light of (indeed, despite) China’s economic woes as friendshoring and risk aversion drives capex spending towards them and away from China, not just from Western capital flows but from domestic Chinese capital flight as well (most evident in Singapore).

M.S.T.I.P = Malaysia, Singapore, Thailand, Taiwan, Indonesia & the Philippines (MSTTIP, I suppose, but Miss Tip)

I would have included Vietnam but I believe the political risk makes it not worth it. You may disagree based on your risk tolerance, but additionally corporate wage arbitrage is not infinite - eventually it settles - and Vietnam is approaching levels where it would need to be in order to sustain growth from apparel etc. Malaysia however is seeing excellent inflows from companies like SMCI building new factories for computing equipment.

In SE Asia, I added to my positions in Sembcorp (SCI SP), China Aviation Oil (CAO SP), San Miguel Food and Beverage (FB PM) & Delfi (DELFI SP) while taking profit in Genting Singapore (GENS SP).

San Miguel & Delfi in particular are favorites as part of my “MSTIP” thesis that Malaysia, Singapore, Thailand, Indonesia, Philippines & South Korea will see more significant GDP growth over the next decade than China as geopolitical tensions provoke supply chain concerns that shift demand away from China but in a manner that is not as significant as anticipated in areas like apparel and electronics which will still remain primarily in Asia. The corporate “wage arbitrage” can only go on for so long and it does tend to benefit the exporting countries significantly more than the importing countries in the longer term. For that reason I look to confectioneries, beverages (both alcoholic and non) and packaged snack food as significant longer term beneficiaries in SE Asian EM.

I think that if you are looking to hedge the extreme optimism surrounding the Chinese reopening priced in over the last 3 months then the best way to do so would be with a long puts on KWEB. I do feel that is one of the sectors that may begin to underperform others (especially as US investors are still very jumpy about China and any little piece of news or a bounce in the dollar etc. could send their hot money packing).

Rotating

One area that I think will outperform both in China and the United States is optoelectronics and semicap. I believe that the semiconductor cyclical trough occurred back in November based on a set of proprietary indicators. I have taken the profits from the travel play and rotated into Silicon Carbide (SiC), Optical / Optoelectronics, Semicap as well as foundries (much longer term play than the previous 3). I think that the risk/reward on being short semiconductors in general is bad here, and I’ve covered my shorts on AMD/NVDA following the reveal of chatGPT, but still prefer being long SMCI to being long NVDA right now (this may change).

For a long time in 2022, the only semiconductor names I owned were the following:

I have been expanding this list to include the sectors above and, in China, my favorite name in any of them is Zhongji Innolight (in Optical).

EPS is down about 6% from last year but that will make for easy comps next year (and this company loves easy comps - every time revenue or EPS growth YoY has gone down more than 5% they’ve managed to post 30%+ YoY increases the next year). If optical has indeed bottomed then that’s exactly what we should see this year!

From a global macro standpoint, I am still long MCHI vs. INDA, which got a nice boost from Hindenburg’s short report on Adani this week but I’m cautious going forward on it because of how vertical MCHI has gone and how resilient the “Indian Growth Story” narrative has been (not that I disagree with it, per se, just that the valuations are insane). There could be a pullback coming after more than 50% outperformance in China v. India.

The takeaway here is that I think China has met with optimism that was indeed warranted but got carried away. It’s time to sell or hedge, the returns from here are likely mediocre until other issues are addressed by the CCP.

Hey Mate, how do i subscribe? Big fan of your work so far.