Who Holds the Cards?

Macro Backdrop of the Trump Trade War II

How should we think about “macro” in this current environment?

The Upshot

When we wrote “Global Macro Trading for Idiots: Part 4” in July 2024, we commented that the traditional macroeconomic indicators of a recession within the next year (the Sahm Rule, the Fed’s yield-curve based model and inversion of the yield curve, etc.) all meant that if we were going to have a recession, it was going to come in the next 12 months.

We’re nearing the end of that window, but we’re hardly out of the woods given the policy curveballs that have been thrown into the mix. Still, outside of the downward pressures created by the tariffs, the US economy continues a trend of further cooling labor market and further disinflation.

While tariffs create enormous bimodal uncertainty, could there be sufficient resiliency in the US economy to withstand tariff shocks long enough to get through to the other side? Could a sudden reversal of trade policies also reverse gloomy growth expectations as the Fed’s jumbo cut in 2024 Sep did?

We lean towards the view that recession risks are at present overstated, based on the current macro and micro data. While some level of economic slowdown is almost guaranteed, certain corners of the markets may have priced in even more.

However, there is a large disparity between the pricing of a recession in areas like bonds (especially the front end of the curve) and oil vs. equities. On equities broadly, we see a sideways trend emerging for indices that will be marked by rapid overreactions in both directions and extreme dispersion.

The enormous uncertainty of tariffs ultimately stems from a geopolitical realignment shock that is at least in the short term determined in the mind of a man and a tweet. In his book “Geopolitical Alpha”, Marko Papic says that predictions are better made from the perspective of “constraints” rather than “preferences”.

We all know what President Trump’s preferences are, but what are his constraints? We would lay them down as the following three categories:

- Debt refinancing needs and the “moron risk premium” originally observed in the UK;

- Tax bill passage and preservation of political capital;

- Recession risk and “don’t want to be Hoover”.

President Xi has constraints too, notwithstanding the wolf warrior bravado, China is indeed under serious economic pressure to find an off-ramp. This likely explains China’s recent exemption of certain US imports as well as the overtures to open trade talks, but we’ll focus on the US and macro in this piece.

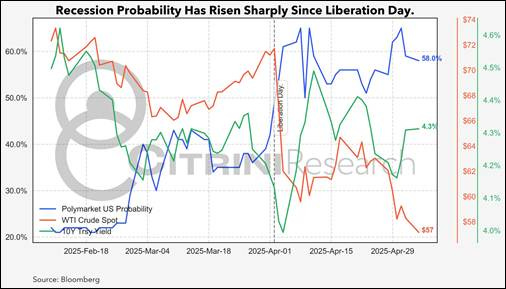

Since Liberation Day, recession odds have sharply risen, pro-cyclical assets such as crude oil have sold off but stocks have returned to levels from before the event.

Meanwhile, the continued heightened recession risks are clearly a concern for the administration notwithstanding their claims to the contrary. The White House does not want the US economy to sink into a deep recession, which puts Republican control of Congress hence their support in peril and their rest of their legislative agenda in jeopardy. Collectively, this guides us towards thinking that the administration, spearheaded by Treasury Sec Bessent, would be eager to pursue off-ramps on the trade war.

There is a lot of noise and speculation about what the tariffs may cause businesses to do and how they may usher in devastating rolling bankruptcies and a deep recession. For example, we’ve seen the deck from Apollo painting compellingly a rather bleak picture of an impending Voluntary Trade Reset Recession.

In this piece, we’ll to focus on the data points that have guided us well up during this cycle up to this point to help cut through the noise and get to a balanced assessment of where we are and where we will likely be over the next few months. Our takeaway is a bit more constructive than where we think consensus is.

Here’s how we see it: