Preface

“Nothing is so permanent as a temporary government program”

-Milton Friedman

Thesis and Objective: We have entered a new fiscal and geostrategic regime that will be markedly different than the previous decade and see government spending exercising a persistently outsized role in corporate profit trends. The pandemic accelerated powerful fiscal and economic shifts already underway, heralding a new era that could bring meaningful change to both the micro and macroeconomic landscape.

Pre-2020 secular trends that first appeared in the post-GFC decade of “lowflation”—the rise of US-China competition, a gradual power shift toward labor, populist undercurrents in DM democracies and a move from laissez-faire to bipartisan embrace of dirigiste and activist fiscal policy—have rapidly gained momentum.

While this is a huge theme, encompassing diverse and varied impacts that can be written about at length, we will particularly focus on the interplay of industrial policy and the implications for private companies, in particular legislation such as the IIJA and IRA, and what potential further actions might occur under future Democrat or Republican Administrations. Stocks, especially, routinely underestimate the outsized impact of fiscal policy on the economy, while regularly overweighting monetary policy’s impact.

After the Global Financial Crisis, Western economies experienced tepid global recoveries, so-called balance sheet recessions, in which households (and firms to some extent) in advanced economies repaired their balance sheets by paying down debts. It was a decade of lows: low aggregate demand, low corporate real investments, low productivity growth, low inflation, and historically low interest rates. Without fiscal policy expanding materially, central banks took it on themselves to do most of the heavy lifting, spending more than a decade trying to boost inflation with measures that skewed heavily monetary (cutting rates and buying assets).

In the balance of the 2020s, industrial policy combines elements of supply-side policy (it aims to foster certain industries, so it changes rather than pushes out the supply side), and demand-side policy (subsidies or direct spending are new fiscal dollars). Deficit spending is ultimately a significant boon to corporate profits, but the specificity of current fiscal support (in stark contrast to the broad based nature of fiscal measures during the pandemic) necessitates a delicate approach. We will present a framework for identifying equity beneficiaries in this new regime while balancing the current macroeconomic risks.

A Disclaimer:

This article deals with politics and economics, something I have zero formal training in. I believe that in order to be an effective generalist investor, you must be willing to defer to specialists - this is why in previous thematic trend articles I have always invited those with more experience than me specific to the theme to chime in and expand on my ideas.

For this primer, I’ve asked Steve Hou and Steve Miran to join me in analyzing my own thesis regarding the economic implications so the article may include the approach of those who have the requisite experience to opine authoritatively on the manner.

To be clear, the below reflects my views alone, and does not necessarily reflect the views of the two Steves, who sometimes agree with each other, and sometimes disagree with each other, or their respective employers. If you’re wholly uninterested in macro, you can scroll all the way down to the equity discussion :).

Politics is always a sensitive area, especially now. To be extra clear, I am (and by extension, this publication is) eminently apolitical in its approach to financial markets. Personally, I have never witnessed an instance where strongly held political views were a boon to a trader’s PnL, yet I have witnessed on numerous occasions a deleterious effect from failing to act with an objectively analytical approach.

The fact of the matter, in my view, is that that trillions of dollars have been and will be transmitted through to the economy, from the government to mostly the private sector, and that the era of laissez-faire Republicans vs. dirigiste Democrats is less the case now than it has ever been before. As we’ve been witness to these past few years, both parties are tending more often to embrace expansive spending (albeit, with different goals). Every dollar of government deficit spending is a dollar of corporate profits, and those profits determine how the securities we invest in perform (sometimes, other times the vibes are in charge).

This means we’re going to dispense with political biases and apprehensions associated with partisan views and objectively analyze who the likely winners of a continued dirigiste approach by the US government, and what that continued regime means for us operating in the markets. We’ll cover both macro and equity implications.

This primer is focused solely on preparing an investment framework to capture outperformance related to the trend of higher deficit spending. It is not a commentary on whether this approach is sustainable over the long-term or not. Trust funds for Medicare Hospital Insurance and Social Security are expected to run out, respectively, in 2031 and 2033, while the shortfalls in the first year after trust fund bankruptcy are expected to be respectively 11% and 23% of scheduled benefits.

Additionally, while stimulus enhances growth and productivity, it also accelerates inflation and can introduce idiosyncratic risks. Interest rates rise with higher nominal growth, and financing expansive monetary policy is done through the issuance of debt. The kicker is a mounting debt burden made more unserviceable by higher rates. Supply-side stimulus brings corporate profits and economic gains today at the potential cost of fiscal instability tomorrow. While policymakers must balance these outcomes to maximize sustainable, equitable growth, we simply have to observe and anticipate it in the most effective manner possible to turn a profit.

Because of the upcoming 2024 presidential election, this is a much more nuanced “megatrend” than the previous two, but it is one nonetheless that should not be ignored.

I am publishing this right now as we are entering both an election year and the end of the US Fiscal Year (September 30th, FY spending bill must be passed by Jan 1) where a potential government shutdown and political brinkmanship will be front and center, providing numerous catalysts (both negative and positive, potentially) for names exposed to the theme. I will be regularly updating subscribers on how I am viewing and implementing this, and will provide commentary on developments in the potential government shutdown.

I strongly encourage you to join the chat and be part of following up with questions and discussion topics on this theme, as well. I write these thematic equity primers (which tend to be quite long) with the thought in mind that these trends will play out over years, and hopefully readers will utilize it as a tool, coming back often to stoke new ideas. Please enjoy!

With that said, let’s do it.

Introduction: US Fiscal Primacy

"Money ain't got no owners, only spenders."

-Omar Little, The Wire

This piece will focus on prospects arising from a new fiscal regime of robust, targeted supply-side spending in the US - both to fulfill partisan aims, to appeal to growing populist impulses by the voting public and to address real needs in the US economy such as advanced manufacturing and decaying infrastructure.

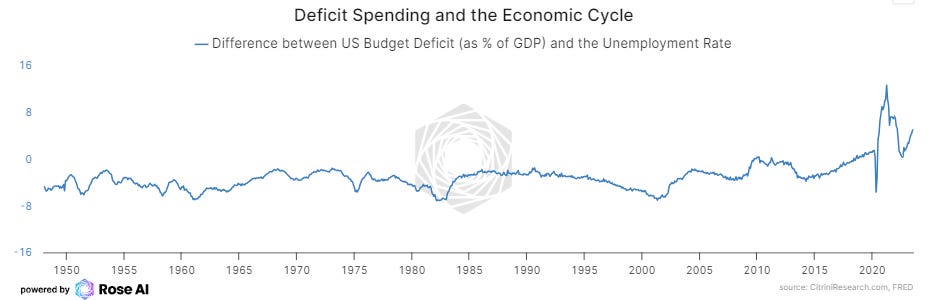

We contend such fiscal activism will likely grow more aggressive, specific, and countercyclical in its intensity, while remaining procyclical in its general utilization. Fiscal stimulus relative to the economic cycle is currently at unprecedented highs outside of pandemic relief and the bulk of the benefits from existing industrial policies (the “big three”, IIJA/IRA/CHIPS) are likely to begin to filter through to the private sector in 2024.

It is highly likely in our opinion that the actions taken related to fiscal policy will have a more important impact on the US economy, from here, than those taken related to monetary policy.

Source: Bloomberg (courtesy of Steve Hou)

Despite a macroeconomic picture that looked exceedingly treacherous in the beginning of 2022, the US economy has managed to navigate it in what may have been the most benign potential manner (thus far). We contend that this is due to a “beautiful dance” in which the supportive impact of fiscal policy has managed to blunt the most drastically negative impulses of monetary policy while permitting a gradual disinflationary impulse.

The macroeconomic implications of this fiscal imperative could continue to be vast, with probable impact on inflation, government debt issuance (and interest rates), supply chain dynamics, margins and resiliency in traditionally cyclical industries and companies.

In the market, fiscal policy will likely continue to confound all but the most savvy investors, providing clues for informed investors on the true likelihood and severity of economic downturns and resulting in companies commonly believed to currently be “overearning” to persistently see higher profits for longer than expected (especially if a severe economic downturn is avoided). While we do not contend that fiscal policy would be sufficient to completely relieve the negative impact of an economic downturn on these cyclical companies that make up policy beneficiaries, we do view it as blunting the impact for the most exposed among them.

Following the invasion of Ukraine, it is safe to say that most governments and international corporations understand that the days of predictable, interference-free global supply chains and frictionless trade are over. While globalization will remain resilient, as is its nature, rising geopolitical struggle means that at any moment a war may break out, sanctions may be imposed, and you may be unable to trade with your normal trading partners. This leads to capex being pulled forward, especially when incentivized by fiscal policy, for investments in supply chain resilience, near/friend/reshoring, and ensuring business continuity.

In positioning to take advantage of this theme, it is important to be aware of the political environment. We believe there are several aspects of the current climate which will generate related policy outcomes, regardless of who controls Washington, including:

Continually deteriorating geopolitical environment and erosion of a stable and trustworthy global supply chain.

A shift away from clearly defined partisan views on fiscal responsibility and a bipartisan aversion to fiscal austerity following the GFC that is both, in part, the cause and effect of a gradual populist undercurrent in developed market democracies

Recognition that industrial policy is a potent tool for developing resilient industrial capacities and staying on the technological frontier and continued support for advanced manufacturing, domestic infrastructure and semiconductors

A significant and rapid advance in technologies that have widespread battlefield implications, resulting in a reduced capacity to tolerate economic downturns that may stifle innovation in these areas and give up the upper hand

PAYWALL BELOW: This thematic equity primer is for paid subscribers. Please subscribe for access to the rest of the article, as well as equity basket and investable universe spreadsheets. Thanks!