The Citrindex: Part One Redux (Investment Philosophy)

Core L/S Portfolio Performance Tracking for Thematic and Single-Name Equity

As the trades we’ve been discussing for months (specifically the idea of shorting companies who have built up massive exposures to continuing growth of the US obesity rate) have made their way into the mainstream, we’ve made great money. And I’ve even got a little bit of recognition, in light of Barclay’s latest credit derivatives recommendation:

We discussed the performance of the baskets that make up my thematic equity exposures, we’ve discussed how I view thematic equity investing and the “Gartner Hype Cycle” and how I construct and counterbalance a thematic equity portfolio. Since I do enjoy talking (if you couldn’t tell), I am going to split the Citrindex: Part One article into two: the first will remain about portfolio construction and performance since inception of published positions. This one, only for paid subscribers, is going to highlight my investment philosophy.

That entails two major categories of discussion. Playing megatrends in thematic investing and constructing a good cross-asset macro-aware portfolio using them.

The first is how a megatrend propagates. Not in reality, no - we don’t care about reality here. Leave that to the academics. We care about perception, emotions and the delusion of crowds. You could be the greatest shot caller of investment themes and narratives in history, if you don’t know how to navigate the hype cycle you’re going to have a bad time.

The architecture of mega trend propagation in financial markets should serves as a roadmap for an investor navigating the ebbs and flows of thematic investing.

The theme emerges, often spotlighted by an archetypal beneficiary. For example, consider NVIDIA for AI, Eli Lilly or Novo Nordisk for GLP1, and Eaton for fiscal/electrification. You want to be long these.

More importantly, however, you want to be finding the names with significant operating leverage relevant to the theme. And you want that operating leverage to represent a huge increase in income. So these normally look like “shitcos” at the time. They are higher risk but much higher reward if the theme plays out.

At this stage, early second-order effects are typically not priced in. The archetypal stocks may trade higher for days, weeks, or even months before a fundamental event makes the market collectively recognize the trend. Notably, this usually happens for that specific name alone. Take Chegg for AI or Insulet and Inspire Medical Systems for GLP1s as cases in point. The strategy here is to short the laggards before this awakening and long the names who can ride this awareness from being near broke to a “pure play with significant leverage to the trend”.

This phase is the essence of thematic investing. Markets can become irrationally exuberant, and this exuberance can persist for years. During this time, latecomers may start championing stocks that are barely related to the theme, driven by FOMO. For instance, they might go long on a clinical-stage biotech company that mentioned GLP1s years ago, simply because they see established players in the space skyrocketing. This is the time to capitalize on both the long and short sides, eventually selling into the growing demand. Timing is crucial: a few quarters might take you from fair to overvaluation, but sometimes the cycle can last 3-4 years (recall the dot-com bubble).

By now, you'll have encountered myriad investment theses linked to the theme. The market will be flooded with companies that are tangentially related, at best, and are unlikely ever to turn a profit. Meanwhile, once-unthinkable scenarios may be playing out (perhaps airlines are actually becoming more profitable because of GLP-1s!), but the market's expectations will have entered the realm of the fantastical. This is the riskiest phase. Everyone has a name to “play ozempic” and they’re all terrible companies/Ponzi schemes/moonshots.

Once this apex of hype is reached, traders should have an action plan:

Reduce the size of your long positions, they’ve probably priced in ridiculous outcomes. Don’t sell yet, the hype cycle can and will go higher than you think. Puts are probably pretty cheap though (and when hype cycles unwind it is violent).

Identify new short candidates—stocks that have inflated on promises of convexity to the theme, without any fundamental backing. You can try shorting the same names you were long, but if you’re wrong on cycle timing you will get crushed so it’s wise to own some asymmetric upside (1x2 ratios can be decent here). During the short, accelerated mini-hype cycle of AI, we witnessed this phenomenon with names like Upstart and YEXT. Shorts can be very dangerous if you weren’t in tune with where we were in the hype cycle, but if you catch the inflated BS names on the downswing…

Monitor these new shorts for signs of weakness. Reflexivity will be at its peak, and two consecutive red weeks (underperforming the broader market) should suffice as a signal.

Once names begin basing and the mere mention of the theme elicits disgust in the general populace, begin covering. Use the ensuing profits from the short, if successful, to incrementally increase your positions in the true beneficiaries (your original longs) until the market reaches the trough of disillusionment. At this point, if your conviction in the theme remains strong, load up.

A prime example of executing this strategy would be going long on Amazon in 1996, then shorting Pets.com after taking profits, and finally using those profits to increase your Amazon position around 2002 during step 5, which is:

By the time the theme reaches its trough of disillusionment, the market can wrongly assume that the whole thematic construct was a fallacy (sometimes, however, it is correct - we will discuss how to recognize the difference later). This sentiment is often exacerbated by external factors like macroeconomic downturns or regulatory changes (think recession in early 2000 or initial perceptions of ACA impact). Now, the goal is to discern if the fundamental thesis behind the initial theme is still intact but temporarily overshadowed by these external factors.

If the core thesis remains unbroken, this is the golden opportunity to go long again on the archetypal beneficiaries at much lower valuations, now devoid of the previous speculative froth. The capital for this re-entry can be sourced from profits made during the shorting phase. Essentially, you're reaping the benefits of an earlier bearish stance to fuel a new bullish cycle.

Multi-asset diversification and macro hedges become especially useful at each inflection/juncture point, especially if your thematic longs are cyclical (it’s often the economic cycle that dampens the theme). While re-initiating long positions in equities, consider parallel opportunities in fixed income, currencies, or commodities that might be able to hedge an environment that is not conducive to the theme re-emerging or that may be influenced by the mega trend being realized as an impact in the actual economy.

Finally, as the market sentiment starts improving and the cycle restarts, the approach of gradually scaling down longs should be abandoned if you truly see the opportunity for a long term mega trend. These longs you have should be exclusive, only classic archetypal winners that are going to be very cheap if it turns out the disillusionment is wrong.

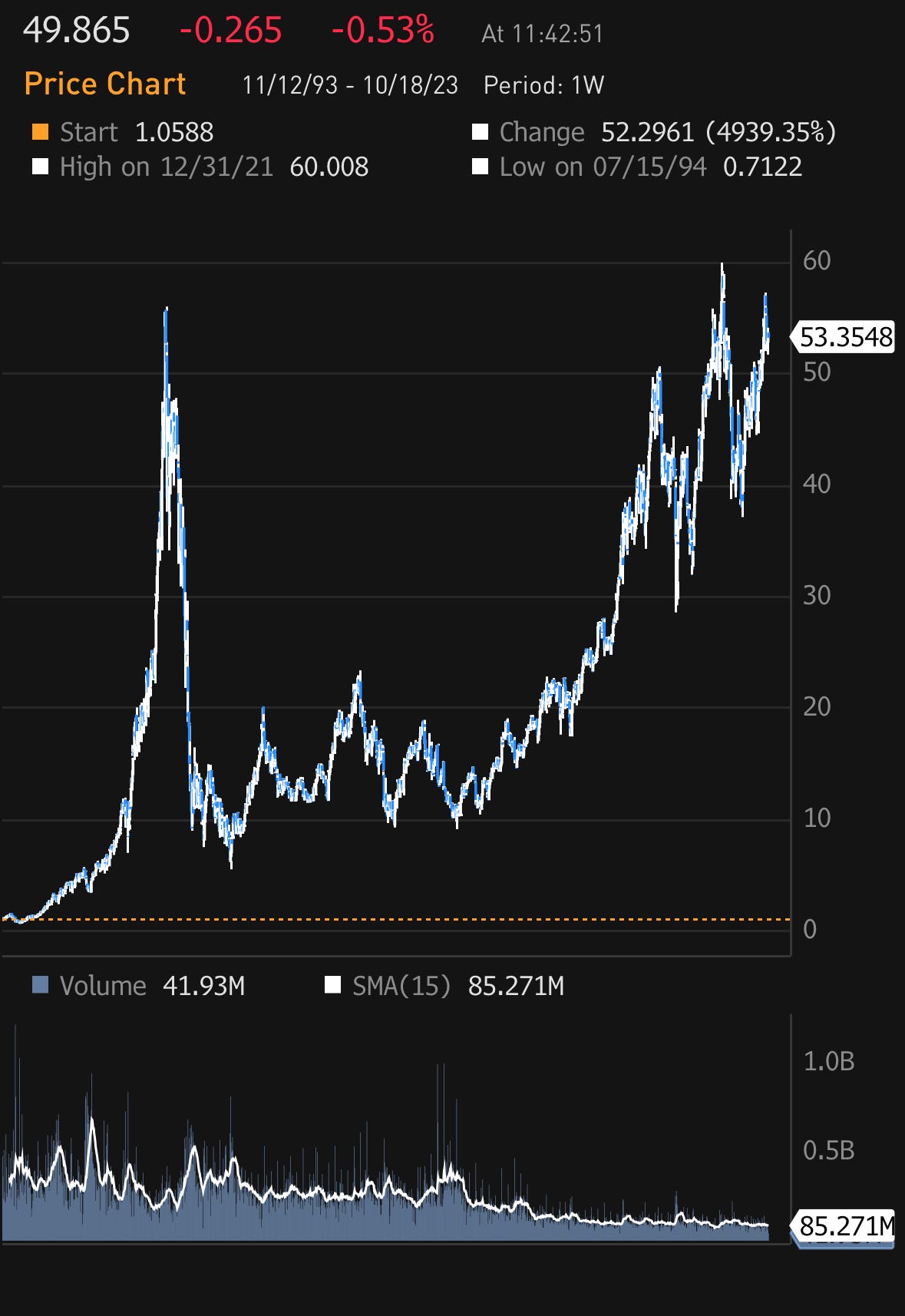

This is akin to a thematic investing "groundhog day," where each cycle offers a refinement over the last, and the seasoned investor knows just when to seize the alpha-generating opportunities. Eventually, it ends and the reality emerges. It’s up to you whether your goal is to play the bullish delusion, the bearish delusion, the reality or all three. This chart of Cisco from 1993 is pretty emblematic

:

The overarching goal is to operate in a realm that is predictive, not just reactive, capturing the essence of Soros' reflexivity theory while being multi-dimensional in asset strategy.Identifying the archetypal beneficiaries—such as Nvidia for artificial intelligence or Lilly for GLP-1—grants an early-mover advantage. At this initial stage, risk perception might be heightened as the theme has yet to gain widespread validation. The ensuing focus shifts towards identifying and shorting the laggards, thereby capturing the zero-sum nature of markets. This step acts as a counterbalance, offering downside protection against the long volatility of the pioneers in the field.

As the trend evolves, a reflexive feedback loop emerges, akin to George Soros’ theory of reflexivity, where the market becomes progressively buoyant but potentially delusional. The entry of capital into less deserving, trend-adjacent assets is a classic indicator of a bubble reaching its pinnacle. At this juncture, recognizing the transition in market sentiment from optimism to near-fantasy becomes crucial. It requires a blend of qualitative assessment of investor psychology and quantitative performance metrics.

The trading strategy for this phase—consisting of resizing long positions, harvesting profits from established shorts, initiating new shorts, and reallocating the gains to accumulate true beneficiaries—is both elegant and opportunistic. This approach is not confined to equities alone; it can be augmented by multi-asset strategies that involve commodities, currencies, or fixed income. For example, one could be long in AI-focused equities while shorting sectors resistant to automation and concurrently entering into interest rate swaps that anticipate macroeconomic shifts instigated by the trend. The core theme remains consistent, but the strategy allows for dynamic adjustments in response to market conditions.

The ultimate aim is to manage the thematic life cycle effectively, leveraging liquidity and conviction to double down on authentic beneficiaries when the market reaches peak pessimism, yet the fundamental thesis remains unbroken. In a historical context, this could be likened to being long Amazon in its early days, subsequently shorting dot-com busts like Pets.com, and using those gains to reinvest in Amazon during the post-bust period.

This holistic approach to thematic investing integrates both macro and microeconomic insights while taking into account market psychology. The goal is not merely to invest but to engage in strategic gameplay, capturing upside potential, mitigating downside risk, and having the agility to pivot between the two in a predictive rather than reactive manner. This method offers significant opportunities for alpha generation, fully aligned with the essence of thematic investing.

As markets inflate and reach their zenith, it becomes crucial to gauge not just the assets involved but also the speculative behavior surrounding them. The more divorced the price action becomes from the underlying fundamentals, the more likely it is a bubble rather than a sustainable trend. However, even within bubbles, like the dot-com boom, kernels of transformational technologies exist. The discerning investor separates the wheat from the chaff.

Determining whether a theme will transcend the ebbs and flows of market mania to become a lasting paradigm is both an art and a science, requiring a judicious blend of macroeconomic reasoning, micro-level scrutiny, and behavioral analysis.

The fundamental question to ask is:

Does this theme solve a problem or fulfill a need that is so universal and urgent that it could rearrange the existing market structure?

I have seen numerous ways to approach this. One I especially like is the “suffering & connection model”.

Most truly revolutionary paradigm shifts do one of two things: reduce suffering or increase connection. Most products succeed if they are more successful than their predecessors at reducing some level of suffering experienced regularly. Airplanes, gasoline, pharmaceuticals, energy drinks, even some SaaS.

Products or services that manage to do either—or in some rare cases, both—typically capture the zeitgeist in a way that makes them indispensable.

Consider how the invention of the automobile drastically reduced the suffering associated with long-distance travel and revolutionized mobility. Similarly, the rise of the printing press, the telephone, social media platforms…they’ve all exponentially increased human connection, albeit with its own set of new-age sufferings like privacy concerns and cyberbullying.

Products that solve perennial problems not only gain rapid adoption but also often establish a high degree of customer loyalty. These are the trends that are likely to survive the burst of speculative bubbles because they fulfill a fundamental human need or desire. If a theme possesses such transformative potential in the fields of suffering or connection, chances are it will persist.

Another lens to view this through is the sector's susceptibility to economic moats. Themes that allow for companies to build protective barriers—like network effects, scale advantages, or regulatory fortresses—provide a more robust platform for longevity. For example, Facebook's value isn't just in its software, but in its unparalleled network of social connections. Such themes are less likely to be fleeting fads and more likely to have staying power.

Portfolio diversification also plays an essential role here. A theme might be persistent, but that doesn't mean every asset within that theme will be a winner. Hedging bets across various asset classes—like equities, commodities, or fixed-income securities that could either benefit from or act as a counterbalance to the thematic trend—adds another layer of resilience.

Lastly, it is crucial to reassess the theme's vitality continuously. As Paul Tudor Jones famously said, "The most important rule of trading is to play great defense, not great offense." During and after market mania, meticulously revisiting the underpinnings of the theme will either provide a reason to double down or signal a strategic retreat.

To discern a long-lasting theme from a mere market fad, one must have a comprehensive understanding that spans from the macroeconomic landscape to the individual securities, laced with a psychological understanding of market sentiment. And at the heart of it, the question always remains: What's the trade?

RESPECTING THE EQUITY CURVE

The equity curve of your portfolio is the only line that matters, truly. All of the other lines are just sub-lines, compared to the equity curve.

Because of this reason, I really value the process of analyzing what’s worked and what hasn’t - regardless of the ratio of the former to the latter.

Seeing where your decisions have led, not just individual decisions but the complex, heady interplay of every decision you’ve made going back to the first cent - the value for a trader in analyzing that cannot be understated. Is your portfolio actually, genuinely capturing your views? You can find out.

Performance is always, unfailingly, brutally honest.

Now, paying close attention to your own performance can also have its drawbacks. It’s easy to lull yourself into a sense of security if you’re doing well - or even worse, become cocky and begin missing things. It’s equally easy to become too consumed by performance, creating issues where there are none beyond the natural dysfunction that forms a functional marketplace.

My advice here is to become addicted to winning.

The reason is simple: because it’s going to make you super paranoid about not winning. And that’s why it works. It’s going to ensure you watch out for your blind spots.

By necessity, if you’re consumed with winning (objectively - in the way the numbers on the screen reflect, not in the way where you’re concerned with coming across like you’re intelligent or consistently right or whatever - but just concerned with that number going up), then you will ultimately be equally as concerned with finding out the things that mean, right now or in the future, you may not.

As it goes with many trading truisms, Soros has already said it better:

True wisdom lies in embracing our fallibility. Rather than chasing the hollow high of being right, we must monitor our blind spots with humility. Success comes not from hubris, but from recognizing error, course-correcting quickly, and learning from mistakes. This mentality equips us to navigate uncertainty. And, as any trader or investor will tell you, uncertainty is when you make the big bucks.

Winning itself matters less than the insight we gain, but we only are capable of gaining that insight if we are somewhat obsessed with ensuring we do. In other words…

Our blindness is inevitable; remaining blind is unforgivable.

That goes double if you’re the one that keeps putting the blindfold on.

It’s probably kind of Bridgewater-esque. Radical transparency, between yourself and your own performance.

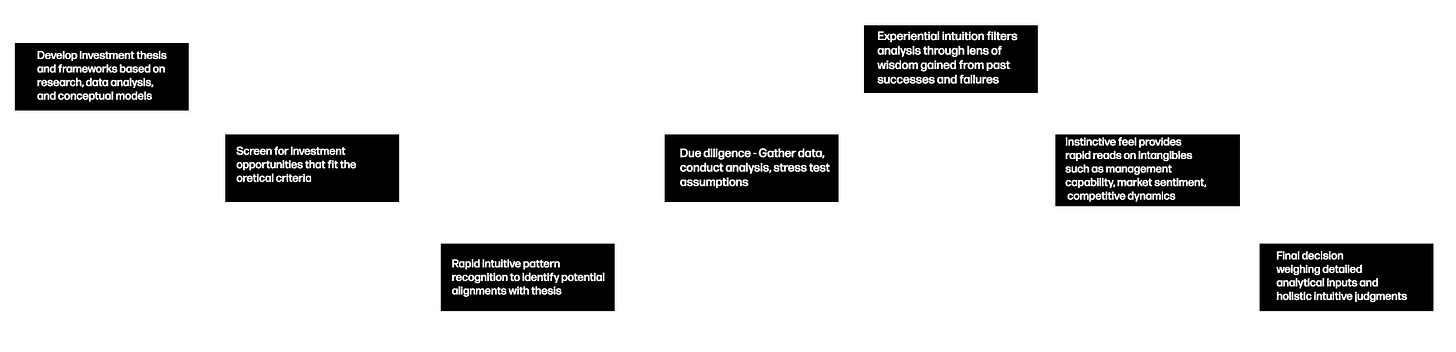

These are all steps, but they’re not linear. They’re constantly informing each other and adjusting expectations of one another. Overall, integrating intuition with robust theoretical underpinnings is the best way I could describe it.

The interplay of deliberate analysis and intuitive feel shaped by experience and pattern recognition, guided by a strategic lens, allows one to respond decisively when the real world conditions align with one’s thesis.

Results. more often that not, come from skill in synthesizing multiple modes of thinking and inputs. Evaluating outcomes effectively is the biggest input for ensuring the system stays defined.

Framework and Synthesis in Cross-Asset Portfolio Management

Now, let’s talk a bit about the more abstract aspects of risk versus reward, portfolio construction, synthesizing new information and expressing a trade in a manner that captures your actual thesis. It’s not as objective and empirical as the PnL component above, but these insights have served me just as well if not better than comprehensive analysis of my own equity curve.

As a subscriber, you may have noticed, throughout the past 5 months, that the range of things covered by this newsletter is a bit varied. I have written about selling 10s on the 2s10s30s, how to play Japanese Yield Curve Control with limited downside, how to capture the beneficiaries of AI and the second order effects of GLP-1s, et cetera…

I would not blame you a bit if you found yourself wondering as a new subscriber, looking at the varied and cross-asset nature of the themes covered YTD, “How does one effectively synthesize all of these various strategies and themes into one portfolio?”.

Here’s the process, as I see and utilize it:

1) Outline a macro thesis. This doesn’t just include macroeconomics. This is things that are not micro in scale. Thematic trends in global equities are given just as much “macro” weight as inflation or trends in rates. Our book is then positioned to take advantage of these trends using classical macro trades as well as unique implementations of equity baskets that minimize company risk and maximize convexity to the current trend.

2) Express the various themes within the overarching macro thesis. Within these larger trends, groups (aka “baskets”) of stocks are either bought or sold short in order to create a return profile that should benefit as long as the trend continues. This can include both positive and negative second and third order (“knock on”) effects, playing relative winners against relative losers, discovering persistent trends within industries that are exacerbated or magnified by certain developments et cetera.

The core focus of these baskets is threefold: elegance (see the addendum for an explanation), accuracy in selection and ease of implementation.

These baskets are carefully crafted in order to have factor exposure that more or less cancels each other out on the long and short side, leaving only the “selection effect” (aka alpha) of which the upside realized from the theme is recognized in. This is additionally accomplished via the utilization of fundamental analysis of the businesses inside these baskets, positioning and sentiment analysis on the securities and a thematically unique exclusion/inclusion scoring framework. This ensures our positioning is resilient enough to withstand higher conviction on the theme without getting shaken out due to unnecessary market exposures. Reassess when new information is presented, but remain reasonably detached from overreactions and fluctuations. That’s what the next part is for.

3) Position tactically to reduce volatility and smooth out unintended factor exposure. Outside of the trend, shorter term and large magnitude moves happen across asset classes that we monitor. We attempt to capture these moves, occasionally trading against the book to reduce our leverage to a poorly performing trend we still have conviction on. The style of positioning or investing should be regularly adapted to fit new regimes based on critical examination of existing performance. Most of the time this looks like trend following. Sometimes it’s very contrarian.

Implementing Elegant Solutions

If you’ve ever heard someone say “it’s all one trade, man!”, that’s essentially both the idea behind and the bane of this approach. I hate when everything is one trade. But the beautiful thing about this is that one trade has many lines. Consider 2022, everything was a “rates trade”. Would the Fed continue undeterred in their mission to rectify the inflationary impulse they had mistakenly identified as transitory? “Everything is a Fed trade” translated to “Everything is a rates trade” which, after the invasion of Ukraine, added the corrolary (due to the high correlation between rates and energy in inflationary macro environments) “Everything is an energy trade”.

None of these things were wrong. Anticipating the turning point on the parabolic rise of European Natural Gas (TTF, or the arbs associated with it) would have made you money across most asset classes. But that’s the thing - there were multiple lines in these trades. It’s all a rate trade? Okay let’s look at rate volatility, the interest rate exposure of undercapitalized financial institutions, how the projected federal funds futures curve is matching up with the ex post rate hike environment. If it’s all a rate trade, what’s the relationship between Japanese rates with their unique position and US? There are implementations among all these things that can create an entirely new equity curve that takes advantage of the “rates trade” but is completely uncorrelated to what rates do. Get it?

You know, it’s actually interesting. When people use the word “elegant” they’re, many times, using it in a different manner than how I am here. In casual conversation, it tends to conjure up images of the met gala, luxurious architecture, well-choreographed ballet dancers moving gracefully. Her luxurious dress embodied elegance and class. You find many instances where someone uses the word “elegant” when they would probably be better suited to saying “fancy” or “sophisticated”.

The manner in which I am using the word refers to something that is, per the other dictionary definition, “pleasantly ingenious and simple”.

If the solution is neat, accurate, reliable and easily implemented, then it is elegant. The more experience you have the more chance you’ve had of seeing someone utilize their portfolio exposures in a way that makes you say “wow that was so obvious in hindsight that the fact they were one of the few to do this is amazing”. I think this tends to occur more often in long/short equity investing than in other areas.

Here’s an example of what I’m talking about:

When a few banks collapse, and the 2s10s steepens in a 6 standard deviation daily move, putting on sixteen different exposures and legs is not elegant. There’s too much to track.

There’s too much chaos and flow and headlines and people going nuts. Especially if they’re all correlated to what essentially boils down to financial crisis beta. It’s just as hard to put on a single exposure, let’s say the 2s10s steepener or short oil in this case. You’ll eventually have to deal with things affecting your equity curve that are wholly unrelated to your view.

What is elegant, in my opinion, is a solution that takes into account the specifics.

I’m sure all my readers traded the SVB→CS collapse. There was a ton of money to be made on both the long and short side in banks. Buying PacWest preferreds at 15 cents on the dollar, or any number of quality regional banks trading at 0.5x TBV for a 3-month long +100% trade. But still, ultimately, your portfolio will have those exposures. You want something that can take advantage of it in a way that minimizes or offsets the kind of volatility that those trades could (and did) experience. And that’s where elegant long/short solutions come in, for me.

This was my solution to that problem, in “thematic equity”:

There’s secularly tight unemployment and a bank just failed - long pawn shops short staffing solutions (FCFS v. KFY outlined in a twitter thread from this period). This trade should begin to climb based solely on market sentiment regarding an economic slowdown.

The 2s10s steepener washed out yards of exposure in the flattener but is at risk of a violent reversal now that it is extremely crowded post 60+ bps of steepening, but there it’s relatively simple to calculate how the EVE / NII of banks will be affected by curve movements - most of them publish that info in their annual report (which had just come out and were relatively “fresh” in terms of exposures) - long JP Morgan v. short Bank of America. Even if the 2s10s flattens again, even if the economy is fine (which was a proposition that was being hotly debated, and I didn’t really have a solid view), JPM v. BAC still had potential to continue climbing because of the idiosyncracies present in each individual company.

So, “Macro-Aware Equity Long/Short” or “Thematic Equity” or “Portfolio Exposure Hacking” or whatever. I took a sizeable allocation that was already in cash from covering the SVB short & various macro trades I’d made that week and taken profit on, and I put into 25% long JPM, 25% long FCFS, 25% short BAC, 25% short KFY. Volatility weighted or market cap weighted would have also worked.

Elegant utilization of portfolio level exposures combines a bit of fundamentals, sentiment, narrative and macro-economic awareness with some thematic thesis to create a factor independent from the ones that everyone else is looking at - some return and risk vs. reward profile that is (hopefully) unique to the situation you’re capturing and retains downside protection via the potential it may benefit in a number of scenarios that don’t just include the worst case scenario. This trade didn’t need it to be 2008 again, like how getting into a bull steepener view when 2s10s was already up 60bps+ would have.

And here’s how that “elegant” solution played out over the two months between the first press release indicating stress at SVB to the fallout of First Republic being put into receivership.

And it gives you some cushion, as well.

Why? Because this exceedingly unique but logical trade you’ve created is not going to be crowded to the gills with levered up hot money players like front month crude oil or the 2s10s steepener trade. It’s going to probably move based on people expressing their views rather than getting margin called on volatility. Which means your own volatility will be lower. And we see that here, combining these four positions (just the two long/short positions, which I was pretty vocal about on twitter lol) results in a 600% higher sharpe ratio, compared to the index, during this two month period of extreme uncertainty:

And that’s the way I want most of my positioning to be expressed, I want them to capture a singular theme and then I want to build up a portfolio that’s exposed to themes that have asymmetry that can pick up the slack when certain ones underperform. That’s the way I want them to interact with each other.

For me, a portfolio is not be a hodgepodge of positions you believe are good, even if you’ve done the work and they genuinely are good positions! I have had some great single positions, but if all my portfolio consisted of was them the volatility would be insane. By utilizing the exposures and the way they might interact with events and each other, I can create a smoother equity curve similar to the one that our Citrindex has experienced since May. I’m looking forward to building upon it with you.

That’s all for part one! I wanted to make sure that the philosophy stuff was separate from the performance stuff for people who only care about the latter. 😉

Cheers,

Citrini