Thematic Investing and Mega Trends

What is a "mega-trend" and how to position for them? Also - Q2 GDP Overview and Fiscal push/pull

An Introduction to CitriniResearch

Investing in Thematic Trends & “Megatrends”

I hit the ground running with my inaugural primers - Global AI Beneficiaries & AI Winners/Losers articles. I see two other significant themes I’d like to cover:

So, I’m using this interim period to explain part of my investment framework as it relates to what exactly “thematic equity” means to me.

First, what does a real thematic look like? There are differences between a theme (primarily a narrative that can capture the imagination - think curing cancer, commodity scarcity, climate change, financial innovation) and a megatrend.

It’s better to show rather than tell - here are the four Megatrends I currently believe will persist for years to come:

Triphasic Artificial Intelligence/Machine Learning Scaling, which I wrote about a few months ago in the Global AI Beneficiaries article.

Archetypal Positioning: Long Nvidia (NVDA)/Semis/Hyperscalers, Short Software (IGV)

GLP-1s, the proliferation of peptides for weight loss, specifically in the treatment of Obesity. The massive the second/third order effects their widespread adoption can have across the investment landscape from the resultant sharp reversal and sustained downtrend in the US obesity rate that I believe will begin next year. Expect producers and suppliers to outperform, “diabesity winners” and traditional supplement companies to underperform.

Archetypal Positioning: Long Eli Lily (LLY)+Hims & Hers Health (HIMS), Short ResMed (RMD)+Medifast (MED)

US “Fiscal Primacy” & “Legislative Pull”, a phenomenon in the US that I propose will involve a significantly outsized economic impact from fiscal policy relative to monetary policy that involves the “pulling forward” of domestic CapEx spending as the dirigiste paradigm in U.S. Fiscal Spending (the Inflation Reduction Act, as well as the Bipartisan Infrastructure Law and the CHIPS Act) buoying the U.S. economy and directly translating to increased earnings for specific companies — a theme that will undoubtedly dovetail nicely with expected AI capex tailwinds. This entails the death of “fiscal discipline” as a political touchstone in a bipartisan acceptance of deficit spending. Despite increasing partisanship, both sides will aim to pass fiscally stimulative legislation benefitting their own base rather than attempt to repeal the opposing parties’ legislation. Friendshoring/onshoring, electrical grid infrastructure, clean energy subsidies and semiconductor independence fit into this category as well.

Archetypal Positioning: Long Eaton (ETN)/Modine Manufacturing (MOD)

Premiumization & Hyperindividualization2] The economy will become increasingly driven by and in service of the highest quintiles of earners. This will reflect in persistent demand for premium experiences, relative outperformance for high quality / scarce products versus mass produced and macroeconomic shifts defined by an increased sensitivity to the wealth effect. Additionally, increased visibility into the lifestyles of this portion of the population through platforms like TikTok and Instagram will drive consumers to extend themselves on credit to “keep up with the Joneses” as excess savings from COVID is burned off.

Archetypal Positioning: TBD

The phrase “secular trend” is commonly used interchangeably but I would differentiate them. Thematic Megatrends are more defined by how they affect the market than the real world.

This adds in a distinctly non-secular aspect. Look at where and how NVDA was trading when the AI megatrend began (and remember that NVDA had been doing AI for long before that ChatGPT tipping pint).

Themes work best when they demonstrate a secular trend that occurs just as a cyclical inflection is occuring. This can be on the upside or the downside - narratives are deeply reflexive. The slowing of SaaS businesses due to the impact of higher rates was both a cyclical and secular trend that began with the response to inflation in 2022. NVDA being priced as if it would continue to undergo a drastic inventory glut due to cryptocurrency miners imploding in late 2022 just as everyone became aware of the AI narrative is another great example.

Understanding the likelihood, timeframe and magnitude of these trends and their implications profitably demands more time investment than usual. They tend to be the most time consuming and hardest to pin down, but they also tend to be the most rewarding.

Creating a framework for understanding how these paradigm shifts play out pays dividends when it comes time to decide whether to truncate the tails or not, as it becomes easier to appreciate the fat right tail.

I will be doing deep dives, 2-3 per year, that include my own framework for evaluating thematically exposed stocks you may already own or wish to own, an overview of the theme and how it effects the broader investment environment and a basket of equities I am using (either to gauge the performance of the theme or to actively invest in).

I always attempt to analyze these themes in a manner that maximizes reward and minimizes risk. Instead of looking to a future where there are two scenarios, one in which the trend materializes and plays out well and one in which it doesn’t, I like to ensure the basket capturing the trend can outperform the broader equity market in a number of scenarios.

For example, Artificial Intelligence may scale exponentially or it may not, but overall it will scale and involve significant investment into that scaling. Then that capex spending will enable the actual integration of AI tools and, if past cycles are any indication, the recipients of that capex may begin to disappoint as disruptions occur and commoditization of the technology becomes the norm.

This inflection in the largely semiconductor & hyperscaler beneficiaries of AI has occurred alongside what appeared to be a cyclical trough in many semiconductor subsectors (optical, GPU, datacenter infrastructure) and technology broadly. This is the best possible time to enter a convincing theme (and why we are excited about our Fiscal basket that is primarily focused on industrial companies currently priced for recession/overearning fears).

I eschew attempts to shoot for the moon with a thematic index of stocks that may only see significant outperformance in the scenario where the most rosy of AI outcomes is made manifest. Instead, I have attempted to overweight the “picks and shovels”. This is how I view most investments into themes, I would rather play the rising tide than the boat.

This qualitative risk/reward framework based approach has served me well in the past and I hope it serves your needs as well.

As I build out my coverage of the themes I am currently investing in, we will launch a tracking portfolio that will have a model allocation to all active baskets we publish. This will function more like an index than a model portfolio and won’t necessarily be designed to be replicated by readers, rather it will serve to give readers a good idea of how our themes are performing. Currently, it would be 100% allocated to AI.

This is the only article that I will ever publish that does not include an actionable investment idea - promise. So, without further exposition…

Thematic Investing and Mega-Trend Deep Dives

Or, “Why is this so long?”

We investors are typically inundated with information daily, regardless of how busy or important the day is, and maybe 2% of it will end up being actionable. This has been an issue for a while (see my piece on how it effected the bond market’s signal value in WWI here). My goal with this newsletter is not to add to the noise but rather provide timely signal value that’s easy to process (which is why I have been using Substack’s chat feature, here, to update on news related to names in the thematic baskets as well as more tactical positioning overviews - if you’re a subscriber please check it out).

My long form writing is primarily focused on these “mega-trends”. That is, themes of a certain magnitude and staying power that are worth thinking about beyond what fits in a few paragraphs. Examples of megatrends in the past include the digital revolution and personal (and later mobile) computing, the disinflationary impact of NAFTA and China’s economic development, the gravity defying ascendancy of the southeast Asian Tiger Economies, the economic shock and awe policies following the Global Financial Crisis and impact of quantitative easing, ZIRP and NIRP globally since, the demographic decline of developed markets and the melange clean/green/renewable foci amidst carbon concerns.

For me, in order to warrant an entire long-form post, there is a high hurdle. I’m a big believer that best pitches on individual situations should be inherently easy to communicate, able to be summed up in a couple sentences.

If I was capable of doing so that efficiently (I’m not), every insight I provided would be something like this:

While my actual analysis on that situation may have been in depth, the pitch in October 2022 was simple. One sentence could be expounded to a paragraph conveying the following:

“Here’s a situation: interest rates are headed 500 bps higher, off the zero lower bound - a historic rate of change that, in previous instances, resulted in issues for financial institutions poorly prepared for interest rate risk. Here’s a financial institution poorly prepared for interest rate risk: holistically speaking, it has leveraged a highly convex bet on sustained lower rates in three areas: the flightiness of its concentrated depositor base is positively correlated to rising interest rates, it has extended sweetheart loans to grow deposits rapidly and most of its HTM portfolio is in agency MBS that have progressively become longer and longer duration as rates rose. Commonly accepted ratios for expressing capitalization have not been sufficient to highlight to the market the severity of this situation nor prompt it to discount the bank’s equity to reflect that marking this bank’s entire balance sheet to market reveals they are one bad day from being effectively insolvent. Here’s a play: short the equity.”

Simple, right?

The problem is that trends are a bit more difficult. You don’t get a balance sheet or income statement for the whole theme, you have to weigh a number of variables across industries and individual companies. While a pitch like the one for SVB generally fits well into thematic trends (short SIVB equity as part of the wider macroeconomic theme of high inflation and rapidly higher interest rates following years of ZIRP fueled speculation), the themes tend to be transient by nature, their momentum comes and goes and the wide-reaching outcomes five are varied and difficult to predict. They’re not the kind of thing you base far reaching implications off of.

On rare occasions, however, themes begin to become persistent in a way that makes them, or at least their effects, easier to extrapolate.

Mega-trends typically occur in some sort of virtuous cycle, reflexively feeding into their own propagation and the creation of new virtuous cycles in other industries, asset classes and/or markets. The enthusiasm of investors and their persistent demand for shares of companies exposed to it allows companies to obtain financing (debt or equity) that can translate into improving fundamentals as they take advantage of potentially exponential opportunities using that money.

This is all to say that when a theme becomes a trend becomes a megatrend it makes itself known. Being early is important, but if you have to ask “is this a mega trend?” then it’s probably not.

This means it is a phenomenon in which the costs of analytical brevity are insignificant compared to the benefits of being early to invest at the beginning. As the theme progresses and gets more crowded, analytical brevity becomes extremely costly as fellow investors fail to understand what they own and contribute to increasing volatility. You’ll notice my primers will begin with a very broad, top-down nature and become increasingly in-depth as themes proceed.

My goal with writing these up is to provide a framework for investors, while being mindful of the potential pitfalls of hyped up themes that will ultimately have very little market impact on a longer timeframe.

The Gartner Hype Cycle is the enemy of the mega-trend, as investors can be correct on determining the magnitude of the paradigm but ultimately lose out by buying at the peak of inflated expectations and selling during the trough of disillusionment. Alternatively, correctly determining the difference between market themes destined to fade and mega-trends can provide investors with amazing buying opportunities.

Something to keep top of mind when investing in these trends is that they are very exposed to investor sentiment. That can be extraordinarily beneficial - provided everyone eventually comes over to your point of view. It can also be harmful, resulting in crowding, increased volatility & heightened exposure to momentum unwinds.

The first method one can use to navigate this is to have a deep understanding not just of the trend itself but of what the prevailing views and concerns are. This allows investors to find “mini-cycles” within trends as they progress. For example, eventually investors in the AI theme will become desperate for evidence that all this spending on GPUs is yielding results in terms of ROI. That might spark a mini-trough of disillusionment within the larger hype cycle, where physical AI infrastructure stocks like NVDA go down and drag the entire trade down with it — giving investors an opportunity to buy the dip for the next phase (digital infrastructure and enablers).

I believe the second best way to manage the risk of hype in thematic investing is to be “macro-aware”, as macro is by far the largest driver of investor sentiment (look no further for proof on this than how many narratives that were complete BS printed during ZIRP only to unwind completely plus some during 2022).

So, if that seems like something that appeals to you, I’ll be providing thematic primers, various market memos at what I believe are inflection points and explainers on trades that I like. I have a market / asset agnostic perspective in my own approach to investing and trading, so there should be something for everyone

The other aspect of CitriniResearch will be informing investors to become more aware of the risks and opportunities in macro, from a high level. This won’t be a macro newsletter, and there will be plenty of CPI and Jobs reports I say nothing of. However, sometimes I utilize macro instruments to hedge my own equity portfolio. Additionally, I will comment on macro when I believe it has a chance of impacting broader investor positioning in our chosen trends. All investment decisions should be, at the very least, macro-aware.

As always, thank you. It means a lot to me that you find my approach unique & differentiated enough to spend time learning about it.

Now, let’s look at the signals from the most recent big economic datapoint:

Q2 2023 GDP: Executive Summary (Below Paywall)

GDP growth was 2.4% annualized, beating expectations of 1.8%.

Inflation slowed more than expected based on the GDP deflator (2.2% vs 3.0% expected) and PCE deflator (3.8% vs 4.0% expected). The GDP report implies a June core PCE inflation rate of just 0.1%, below expectations, indicating signs of cooling.

Jobless claims fell to 221K, below expectations of 235K.

Inventories contributed less to growth than expected, only 0.1 ppt. Inventory continues to be drawn down rather than built up.

Personal consumption rose 1.6%, slowing from Q1. But business investment rebounded strongly, up 7.7%. Equipment spending was up 10.8% after falling 8.9% in Q1. Consumer spending slowed sharply as expected, but business investment was strong, possibly aided by government support for initiatives like semiconductor manufacturing and the domestic component requirement of the Inflation Reduction Act.

Housing investment fell 4.2% but is likely to rise in Q3. Government spending rose, mostly state and local, likely a continued impact from the ~$200 billion in funding for major public works provided by the IIJA.

Productivity likely improved in Q2, implying lower unit labor costs and higher corporate margins.

Outlook is for personal consumption to soften further in Q3/Q4 but increased business capex and government spending, continuing the trend.

Our read: inflation lower, economy stronger. Goldilocks for the near future. This will embolden investors to embrace the “soft landing” for the foreseeable future. Stay long growth equities and stay away from value.

The latest GDP report presents a mixed picture that adds to the confusion over whether the economy is heading for recession or a reacceleration of inflation. On one hand, growth beat expectations at 2.4% and jobless claims fell, suggesting continued economic momentum. But inflation slowed more than forecasted, personal consumption softened, and housing fell, pointing to cooling demand.

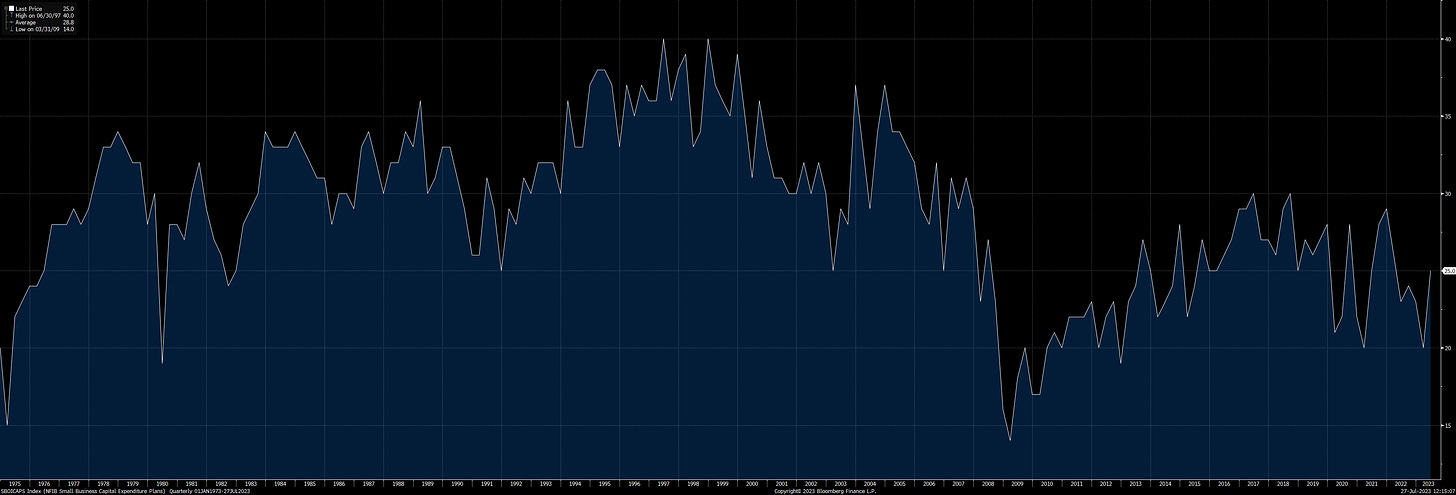

Although noisy, I found the business investment and equipment spending interesting when viewed in combination with the slowing rate of change for personal consumption. Together, they suggest an environment where consumers are increasingly anxious but businesses remain open to strategic investment. Companies may be trying to capitalize on still-solid demand while bracing for potential slowing ahead. Or they may be spending now in anticipation of a rebound. Either way, the percent of companies that report plans to increase capex spending has ticked up this year.

This divergence between business optimism and household caution can emerge in a transitioning economy when a slowdown is expected but not yet severe. Businesses often react more incrementally than consumers who sharply reduce discretionary buying. It could also be due to improved sentiment on the economy from businesses, spending involved in reshoring produjction, adding diversification or otherwise attempting to mitigate supply chain risks, the impact of inflation pulling capex spending forward due to expectations of further price increases or tax incentives and fiscal policy. I think the most significant impact here has been fiscal policy, which will be the topic of the next thematic article for paid subscribers. One last point is that the TCJA’s bonus depreciation rule is being phased out, with the first year deduction on “qualified property” as a percent of the purchase price being 80% in 2023 and then decreasing by 20% each year until 2027 when it reaches zero.

I think that’s likely to drive equipment spending in areas that bonus depreciation apply to, in the short term. Building improvements including HVAC and Solar do not fall under this category but have significantly been subsidized by the IRA. Overall, I believe it is likely that the business investment trend continues, even if personal consumption shows a period of weakness

.

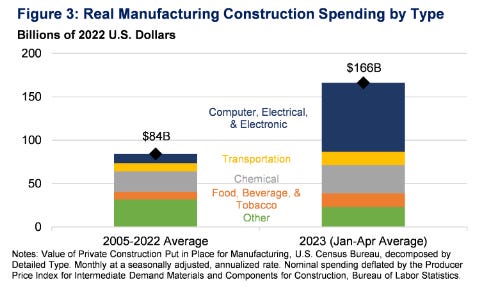

Real manufacturing construction spending has more than doubled since the end of 2021, aided by policy support like the CHIPS Act, the IIJA and the IRA. The increase is primarily driven by a spike in construction for computer/electronics manufacturing, which has nearly quadrupled. This trend is likely to continue, in my opinion.

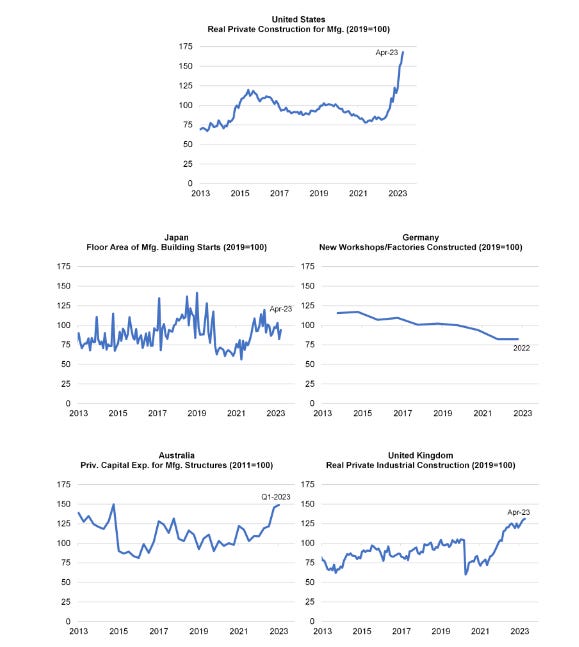

This is Private Construction Spending deflated by PPI for Construction Materials & Components. August 2022 (when the CHIPS Act and Inflation Reduction Act were signed into law) is marked on the chart. This has been a unique phenomenon to the US, which demonstrates that it is primarily a result of US fiscal policies.

The ambiguity surrounding the economy has its roots, at least in part, due to the impact & lagged effects of fiscal policy has been consistently underestimated by investors while monetary policy seems to have been consistently overestimated. How many criticized the Fed for hiking 75bps in the summer of 2022 or forewarned that there was no possible way they could ever hike more than 2% because they’d risk bankrupting the government through interest payments or sending the economy into another great depression. And at the same time, how many cautioned that the labor market would remain secularly tight for longer than expected due to a boom in construction from fiscal incentives? This is my point, and asset prices reflected this laissez-faire attitude towards fiscal for quite some time. Meanwhile, conflicting soft and hard data allowed both bulls and bears to cherry-pick data to support their case and the lack of clarity has kept both businesses and consumers on edge - unwilling to spend so freely due to fears of a recession, yet not so worried about recession that they shut their wallets entirely. As long as the macro picture stays opaque like this, it seems to sustain the delicate balance necessary for a soft landing.

We are currently witnessing what might be called a beautiful dance between fiscal and monetary. In the 1970s, fiscal and monetary fought in a manner that resulted in disastrous outcomes, but right now they are fighting in a manner that’s more Capoeira and less Cage Match. Their opposing moves seem to be gracefully counterbalancing. The fiscal boost helps cushion the economy from the full brunt of higher rates, preventing a severe downturn. Meanwhile, the rate hikes help temper the inflationary pressures from government spending.

Together, their contrary motions have averted the most damaging potential impacts of going too far in either direction. Unchecked stimulus could have unleashed runaway inflation, while unmitigated tightening may have triggered a deep recession.

Instead, the economy continues moving forward in a more modulated way. Growth remains positive, though clearly cooling from an overheated pace. Inflation is still high but showing early signs of easing.

So in many ways, it is a coordinated dance keeping the economy on a sustainable path. The partners may not always agree, but their balanced motions have helped avoid a worst-case scenario thus far. Whether this delicate choreography can continue smoothly remains to be seen.

The push and pull seems to have delicately avoided the thousand variables that might otherwise lead to a severe economic slowdown or persistently high inflation. Growth chugs along at a modest pace while inflation steadily drifts down and hopefully avoids any deflationary impulse. As long as neither side gains a clear upper hand in the data, it's the perfect recipe to keep the economy on a sustainable path between runaway inflation and severe recession. Of course, the dangers in this are apparent - durable goods spending fell from 16.3% growth to just 0.4% growth, and ahead of us lies the resumption of student debt repayments.

A common refrain among those who have been calling for a recession is a quote originally by Milton Friedman, which states “the lags of monetary policy are long and variable”. Most pundits have equated this with the observable lagged window between the beginning of a tightening cycle and when a recession begins and have labeled these lags as being 12 to 18 months. While I am not going to presume to know the intent behind Milton Friedman’s comments, I don’t think it’s necessarily wise to equate “long and variable” to “12 to 18 months”. The part that is more significant, in this cycle at least, is “variable”.

Plenty can happen during the course of a hiking cycle or, indeed, before it even starts that affects how and whether it impacts the economy in the intended manner. The lag of monetary policy is not just limited to tightening cycles, either. The psychology of investors at large is going to be, in some ways, reflective of the monetary approach. This is how we get “bad news is good news” and “bank failures are good for the stock market”.

Additionally, while monetary policy is unique there isn’t any specific reason why it should be so special as to have us assume that it is the only kind of policy that experiences these long and variable lags. The effects of fiscal policy, both intended and unintended, are so significant and varied that it would be highly unlikely they do not also result in lagged effects. Between the fiscally stimulative policy having its intended effects and the unintended effects of fiscal policy from the COVID pandemic (think of how much “excess savings” was produced indirectly by PPP fraud), it’s too simplistic to look at this cycle and say that we simply have to wait 12-18 months from the first hike and then wait for the recession to come.

Please consider subscribing if you’d like to read my upcoming analysis on the impact of these bills and fiscal policy in the 2020s, it’ll go in depth into current fiscal initiatives, why this theme extends further than just the IRA/CHIPS/IIJA and how it should be a primary consideration for your investment decisions. It will include my own framework for analyzing the impact of a bill on the investment landscape and will include a basket of equities I believe will benefit in an outsized manner from Bidenomics and bipartisan changes in how the US government approaches fiscally stimulative policies.

Indeed, I think people have been underestimating and are going to be shocked at the degree of impact the inflation reduction act has on infra and construction. Company calls have been talking about how packed their order books are, projects upon projects just lined up.

A) I’m not an economist, I’m a trader

2) jfc ffs