Progress Report

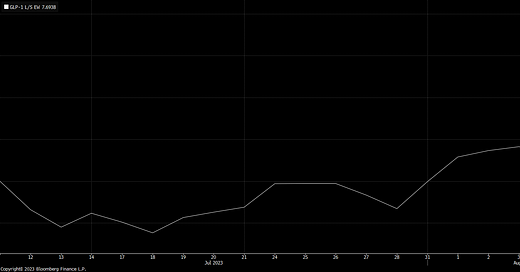

Updating after LLY and NVO’s monster earnings as well as not so great earnings from RMD, here’s where we are in terms of returns the first month of the GLP-1 basket:

The first month saw the GLP-1 Long/Short Basket up 7.69% , which slightly outperformed the GLP-1 Long Only Basket (to my surprise):

The AI Global Equity Beneficiaries Basket is up 15% and after a strong June & July is currently consolidating:

The Standalone Short AI Losers Basket has been more volatile, only up about 70bps since publication on June 16, but is serving its purpose in smoothing out drawdowns from the AI winners:

Thematic Baskets: Earnings Update

“In 5 years time, long LLY short RMD will be viewed in the same way we view long Apple short Blackberry.”

I am okay with looking at earnings on an individual basis, but when it comes to a theme nothing really captures the zeitgeist like what people say on the calls across the market.

This memo is to keep track of those things in the first two baskets we’ve covered (AI and GLP-1s). I will update it retroactively for the current basket in the article I’m writing on Fiscal Policy. The earnings review is free, the rest of it is behind a paywall. This is going to be the last article with a significant free preview for a while, so enjoy!

Earnings Call Review:

This past earnings season gave a great opportunity to look and assess how things are going. Some of the more unorthodox inclusions (even ones that I took a bit of pushback on) have been the most promising, including Vicor, Hanmi Semiconductor and Applied Opto.

Hanmi Semiconductor beat their EPS estimates by 20,852%. That’s a real thing that happened. HBM bonding, baby.

Elsewhere in the significant beats out of the AI basket you have 6510 JT, LuxNet, BELFB (beat estimates by 72% on EPS, 3% on sales and EPS estimates for the NTM are 5% higher than they were 5mo ago), VICR (65%, 9% and 41% respectively), VRT (63%, 7.4% and 34% respectively,), SGH (63%, 2% and 23% respectively).

Other surprises to the upside included ANET, PLAB, 8035 JT, PSTG, 2377 TT, NTNX, 4062 JT & of course NVDA (probably a good idea to get used to that last one).

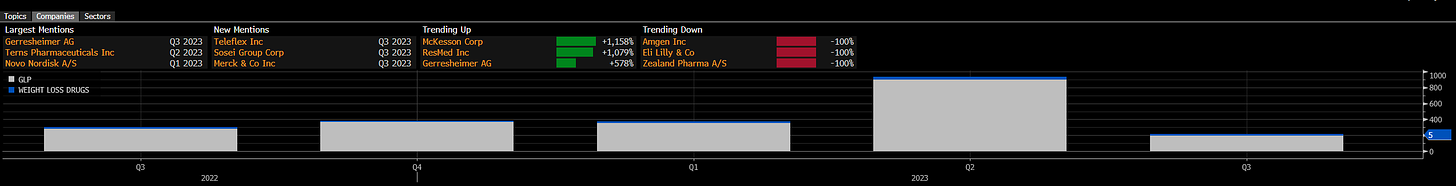

GLP-1 mentions absolutely skyrocketed this season and made me relatively happy with my timing. Three of the GLP-1 shorts reported earnings that were materially terrible and were more than likely directly results of these drugs.

Across the basket, GLP-1 drugs were mentioned 52 times this earnings season, compared to 26 times during the same one last year. A 100% YoY Increase.

Across the market, GLP1 drugs were mentioned nine hundred times for this most recently reported earnings (Q2, except for a few weirdos). Pretty good.

I’ve got some great soundbites. Seriously, the best soundbites:

GLP-1 EARNINGS DOWNLOAD

First up - Eli Lily:

Eli Lily surged 15% after boosting guidance and reporting higher than expected earnings and revenue growing by 22%, mostly due to Mounjaro. I’m not exaggerating when I say “mostly due to mounjaro”, either.

Let me just say that I haven’t read an earnings transcript this good in pharma since I read the Pfizer Viagra transcripts from the 90s. They also seem very bullish on their triple agonist Retatrutide:

Mike Mason was throwing out some absolutely awesome statistics here that I’d otherwise truncate, but believe deserve to be read in full:

Their biggest concern seems to be supply chain related regarding the availability of autoinjectors:

And on the same day, Novo Nordisk reported Wegovy study results that show semaglutide can reduce the risk of adverse cardiac events by up to 20% in obese and overweight adults. That’s a huge deal, especially for insurance coverage, which should derisk the reimbursement and medicare arguments. It’s something that I mentioned would likely show up in the data in the last article “Upgrading from Overweight”.

Whatever the best case scenario was for NVO and LLY when I wrote the GLP-1 article a month ago, it’s happening. Here’s a reminder that the tirzepatide trials SURMOUNT 3 and 4 lead to more than a 26% reduction in mean body weight over the entire course of treatment.

And they reiterated this:

These data reinforce our understanding that obesity is a complex, chronic disease for which multiple treatment approaches, including lifestyle modification and effective medications, are needed. We believe tirzepatide is well-positioned to be one such treatment option. Accordingly, we submitted an application for tirzepatide for chronic weight management to the FDA during Q2. The FDA granted this application priority review designation, and we anticipate FDA action by year-end.

TRIUMPH-3 will widen the indications, potentially, for Retatrutide in Obesity induced Obstructive Sleep Apnea and Knee Osteoarthritis:

An interesting dynamic emerges with Lily who has an existing GLP-1 drug (trulicity) that has a worse side effect profile and is primarily used for T2D. I don’t know if I’d call it cannabalization but Mounjaro increase more than made up for the decline. For those worried about costs, it’s worth considering that when Retatrutide is released, the below may be the outlook for Tirzepatide. The competition will obviously come in the form of other companies with other drugs, but it may also come in the form of the same company having their various GLP-1s compete:

However back you can be without it first having been over, that’s how back we are.

Next up, a name that’s maybe not seeing as much success, Medifast:

Don’t worry though! They want to…get into GLP-1s so they view it as an area of growth.

Okay, I guess? Should have done it 9 months ago when WeightWatchers did?

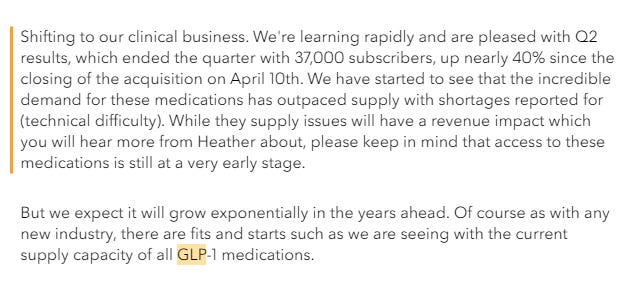

Next, Sequence (WW) is doing great. Their only problem is that there isn’t enough Ozempic for them to sell:

You can’t blame them. Even LLY couldn’t predict how successful these drugs would be:

(Same analyst was maybe playing a mind game here to get them to reaffirm that Mounjaro is going to be obesity approved by eoy 23. Or maybe he forgot about that. Either way, great job Chris)

Supply chain issues are, in fact, transitory. Take it from BDX, they can’t ramp quickly enough:

And so is Stevanto (STVN)

They‘re the first to tell you. As the 2nd biggest player worldwide in cartridge based autoinjectors, business is good.

UNH is still playing it safe, after all, the longer they go without paying for the drugs the more money they make now. People will still take them and they can wait a year or two to capitulate once LLY releases a barrage of data that makes the conclusion inevitable.

THIS ONE IS MY FAVORITE.

RESMED @ GS 44TH ANNUAL GLOBAL HEALTHCARE

SHOT (JUNE 12TH 2023)

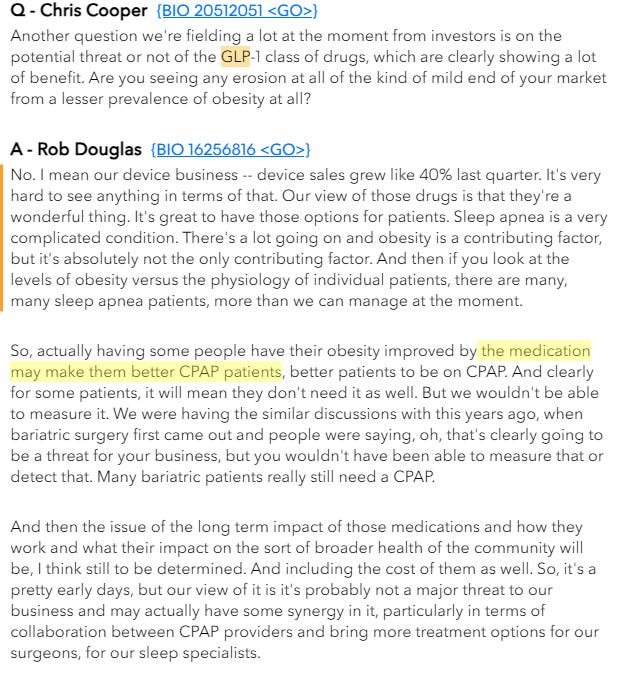

Apparently not being fat is absolutely excellent for CPAP numbers?

CHASER (July 27 2023)

Wonder what happened there?

Can’t possibly have anything to do with GLP-1s, after all, those are basically excellent for CPAP numbers….right?

…right, Michael?

A lot of moving parts!?!? That’s a bit more pessimistic than last time. What happened to the supercharged CPAP patients? I get his (badly made, poorly defensible) point here is that the side effect profile is better on CPAP (also, total BS that the only side effect from CPAP is “marks on your face”). But he clearly gave up the bit, he’s talking about insurers banning covering these meds like it's a good thing. But unless they’re as bad at math as he is, they’ll realize that this is a huge benefit with little cost in the longer run.

Sounds desperate. And ill-informed. But I don’t really think he’s ill informed, I think he just thinks the analysts won’t actually realize that people won’t need to take these drugs for the rest of their lives and his math doesn’t make any sense.

Nice quarter, guys.

Gerresheimer is ready to spend:

Next up, Cigna. They’re doing the UNH thing too but they at least admit that patients are extremely interested in these drugs:

And, listen, Eric…

I don’t want to tell you how to do your job. But those behavioral modifications are not going to work. Why not? Because they never have in the history of behavior, regardless of what some pilot study results are, and nothing has changed in that regard. And if you pay an actuary to tally up the costs from obesity to your company over the next 50 years and then tally up the costs of GLP-1s I’d bet you find out you could pay double what Lilly wants and still turn a profit.

But they’re waiting for data. Understood.

Inspire apparently thinks that people not being obese will not have an effect on their TAM because their MoA isn’t approved for patients with a BMI above 32.

So it’s actually interesting here, they’re basically saying that since their product works better for patients that aren’t morbidly obese but rather just obese, GLP-1s will bring more people down from morbid to obese and the net effect on their TAM will be minimal. I don’t know if that will be true. I don’t think they do either. It really depends on how effective they are in 5 years rather than right now, but I think that it’s a huge risk. I wouldn’t want to take it, if I were an investor. There are more promising medical devices out there.

Again, I’m not saying he’s wrong. I’m saying I’d maybe buy this stock if it were priced like a melting ice cube. It’s not.

And fwiw, Suraj here did not “get a little confused” here. This is pretty much spot on.

Next one, Insperity INSP.

Insperity got hit on the fact that people want these drugs because a) they don’t want to be fat and b) the drugs make them not be fat.

And Mr. Paul Sarvadi believes that’s a fad. It’s a reasonable expectation. He thinks its a fad because people are using these drugs for weight loss when they’re supposed to be for diabetes:

Thank God Wegovy isn’t approved for weight loss, Mounjaro (nearly twice as effective) won’t be approved for weight loss in less than 6 months and diabetes isn’t the most common comorbidity with obesity.

Oh wait.

LTH is probably okay, pickleball isn’t necessarily a weight loss activity. But I found his response funny so I’m including it:

This is kind of a big one. ISRG is admitting that maybe they’re having to do less knee and hip replacements because of GLP-1s.

They don’t admit it, but the fact they even mentioned it is pretty cool:

Anyone remember the last fad weight loss drug that got surgical robotics companies talking on earnings calls? I don’t.

Accolade Telehealth says their business has seen a benefit from increased demand for GLP-1s.

Terns’ is still focusing on oral GLP-1s and they sound optimistic:

Sharon really grilled Planet Fitness (PLNT) management here and the reply was…lacking, for the same reasons I described in my original GLP-1 article:

INMD InMode confirming the bull case. People that lose weight need abdominoplasty more often. It doesn’t matter if its from Ozempic or not:

Even McKesson is making money off the higher prior authorization demand:

Last one. Back to the surgical names with Teleflex.

NEVERMIND I HAVE A NEW FAVORITE.

I have a very simple question for you regarding a medical procedure.

Would you rather take Ozempic to lose weight or be TITAN STAPLED?

I literally can’t anymore the last one made me laugh in real life.

That’s all for GLP-1’s, lets move on to Artificial Intelligence.

Sorry. One sec.

Titan stapler lmaoooooo1

Okay. Paywall now, we’re going to do the same earnings review for the AI basket and then review performance on these two baskets + the AI losers as well as provide some angles of viewing fundamental metrics on these names since earnings.