Macro Memo: The Powell Struggle

Boredom Plants the Seeds of Correction or Dotcom Déjà Vu

In this piece, we provide an update on:

US economy and job market

Tariff and Inflation Risks

Market correction and/or repeat of Dotcom Bubble

“The Powell struggle”, rate cuts and housing unlock

Bond yields and housing unlock and cyclical sectors

US - China Talk

Macro Positioning

Our diagnoses and predictions have mostly borne out to be accurate:

Tariff inflation risks were overstated [Yes]

Services disinflation continues and overwhelms goods inflation [Yes]

General US economic resilience with a softening labor market [Yes]

The Fed makes good news insurance cuts [Not quite, yet.]

US - China tension continues to take off-ramps [Yes]

Rare earth and the importance of strategic leverage [Yes]

European outperformance in FX & Equities would taper off [No/Not yet]

Our last macro memo broke our 100% YTD hit rate in STIR trading - we managed to catch a bit of a move up in Z5 but haven’t seen any follow through

The Upshot

The US economy will continue slowing without breaking

Overall inflation flat or lower despite tariff effects on goods prices

“The Powell Struggle” leads to fiscal - monetary convergence

Tariff uncertainty resolves

The Fed to signal openness to rate cuts

Falling long yields to unlock housing market

In June, we wrote that the U.S. economy was “humming along.” Two months later, that characterization still fits - there is a distinct lack of fresh macro drama, the likes of which prompted us to begin doing monthly macro updates. Since autumn 2024 our stance has been consistent: headline growth remains resilient even as the labor market cools and disinflation progresses. The intermediate calls that flowed from that thesis have largely been validated, but the macro trading regime has shifted. For the past two years, successful macro traders have largely been those that were focused on fading overreactions at key moments in rates and FX.

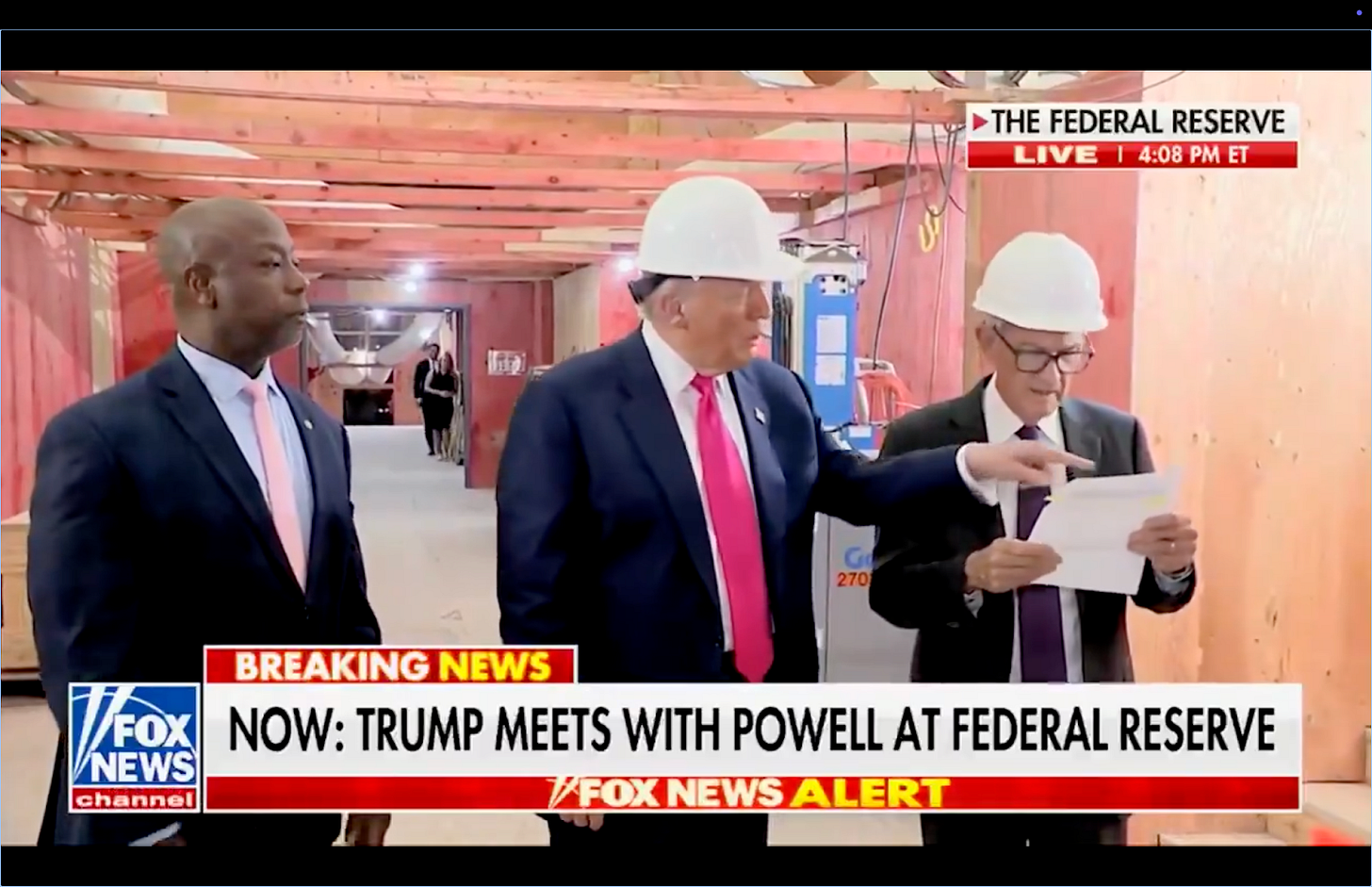

President Trump’s recent showdown with Fed Chair Jerome Powell—what we call The Powell Struggle—marks the end of that lull. We now anticipate a transition from Trump’s failed public pressure campaign to a more strategic effort to engineer macro conditions that justify rate cuts. With inflation cooling, the trade war de-escalating, and dovish voices gaining traction within the Fed, we expect the door to policy easing to open soon. This emerging political–monetary convergence sets the stage for a gradual decline in long-term interest rates.

As summer winds down, both the economy and the market stand at a crossroads. Should we expect a re-acceleration of the economy and an end to the two and half year favorable disinflation process? In terms of the stock market, do we see a macro catalyst that triggers a long-awaited pullback? Or will markets continue to grind higher on secular bullish narratives like continued AI capex spending, deregulation, a more supportive tax policy and crypto adoption against a still-supportive macro backdrop. In the latter scenario - a continued strong economy with companies riding the coattails of secular trends despite elevated valuations - we start to get distinct vibes for the potential replay of the Dotcom Bubble that we alluded to in January.