As I have mentioned before, two of the four themes I have mentioned are Artificial Intelligence/Machine Learning and US “Fiscal Primacy” in which fiscal policy provides a supportive role to the economy that significantly outpaces monetary policy. I was in the middle of writing the third thematic primer on US Fiscal Policy (Inflation Reduction Act, IIJA, CHIPS Act) when this name reported earnings and as I looked into it more I felt that I should try to get it out as soon as possible because it represented a significant opportunity. Because of this, the next thematic primer won’t be out for another 7-10 days, I figured this was more time sensitive!

Long Thesis: Celestica, Inc. (NYSE: CLS)

(I wanted to get this out Friday evening after CLS’ earnings were brought to my attention but I was not able to write fast enough. Now today CLS is up another 5.6% so I am going ahead with what I’ve got and will edit it on the go.)

Written with input from @QFResearch

Celestica is a full-service provider of hardware platform and supply chain solutions, offering end-to-end development, design, manufacturing, and fulfillment services for complex electronics. The company's core capabilities span printed circuit board assembly, test development, precision machining, systems integration, and global supply chain management. Celestica produces components like circuit boards, cables, power supplies, and optical modules as well as integrated systems such as servers, switches, storage arrays, aerospace & defense electronics, and diagnostics equipment. The company leverages its expertise in engineering, prototyping, manufacturing, and logistics to serve as an outsourced manufacturing partner to leading OEMs in industries from data center infrastructure to healthcare.

Through its two major business segments, ATS and CCS, this company is directly at the intersection of two themes that I believe will drive significant growth over the next decade: AI/ML Hyperscaler Capex Spending and IRA/IIJA-driven Renewable Energy Investment.

Celestica is aligned with strong secular growth trends in end markets like AI, hyperscaler capex spending, aerospace/defense, biomanufacturing and green energy. Besides just being positioned for significant upside due to LT growth trends, CLS represents an attractive investment opportunity given its strong cash flow generation, discounted valuation relative to peers. resilient business model as a full-service design/manufacturing partner for critical tech industries & balance sheet position well positioned to take advantage of long-term growth trends. The company perhaps best exemplifies the "picks and shovels" model we are bullish on in Artificial Intelligence, providing essential outsourced services and bottleneck solutions for complex end products across sectors like aerospace/defense, communications infrastructure, and enterprise data centers.

It maintains deep customer relationships with leaders in these fields that allow it to leverage its global manufacturing footprint.

The company is executing well operationally as evidenced by recent margin expansion and earnings growth, and discounted for materially irrelevant reasons.

CLS EBITDA

CLS Gross Margin

CLS has a record of generating solid organic revenue growth complemented by accretive acquisitions. Management is disciplined in targeting acquisitions that augment the company's capabilities, are accretive to earnings and align with its strategy to focus on executing higher value-add businesses through transitioning the revenue mix towards more advanced, high-margin services. Examples of this include the acquisition of PCI and Allied Panels.

The company maintains a strong balance sheet with net debt below EBITDA, with 374.5m in cash on hand and 411.6m in net debt. Despite the recent run up, the stock trades currently at 10x NTM Earnings, 6.6x EV/EBITDA and 7x Price to Cash Flow, representing a discount to peers. I estimate gross margin expansion to low double digits by 2026 and see 2024 EPS at $2.7 and 2025 EPS at $3.00. I believe CLS represents an opportunity with 40% of upside in the next 24 months. Despite the fact that it is up significantly YTD, this is a margin expansion story. I would be aggressive on any pullbacks going forward, which may be provided by a catalyst I detail later.

Key Facts

CLS Historical EV/EBITDA:

CLS Historical P/E (NTM Est.)

CLS Business Description

Source: CLS Company Filings

CLS has deep customer relationships and a highly resilient business model, evidenced by its ability to grow revenue during economic downturns. The company is focused on diversifying its revenue mix towards higher value-add businesses, which builds stickier customer relationships.

CLS generates significant free cash flow, with low capital expenditure needs given its asset-light operating model. In 2021, CLS had net income of 103.9 million, which grew to 145.5 million in 2022 and currently has a trailing twelve month net income of 168.3 million. The company has averaged $183 million in annual FCF over the past three years and has a trailing twelve month FCF of $242 million. This gives CLS the capacity to fund acquisitions and investments to drive growth.

CLS has an attractive business model that generates steady FCF, upside from long-term growth trends, and a reasonable valuation. CLS has the characteristics to drive strong shareholder returns over a long-term investment horizon. We see upside from multiple expansion as CLS continues expanding margins.

CLS Gross Margin

Source: Bloomberg

There is further upside from CLS's exposure to sustainably growing and well positioned industries like communications, aerospace/defense, and health tech. Celestica operates through two business segments – Advanced Technology Solutions (ATS) and Connectivity and Cloud Solutions (CCS).

The ATS segment consists of the aerospace & defense, industrial, energy, health-tech, and capital equipment markets. ATS has grown revenue at a 9.2% CAGR over the past 3 years, which we believe will continue to grow steadily at that rate, if not higher, due to increased spending on defense, renewables and industrial as spurred by fiscal policy including the Inflation Reduction Act and IIJA. Capital Equipment is likely nearing a trough if it has not made one already. In Q1 22, CLS hinted at a strong offset effect in 2024 of weakness in capital equipment from A&D:

A - Rob Mionis{BIO 2019397 <GO>}

I think in aerospace, we're expecting a stronger second half versus first half. I would say it's a dynamic of commercial versus defense. On commercial, we see a steady recovery, getting better sequentially quarter-to-quarter-to-quarter. And on the defense side, we have some new programs that we've won that will be ramping towards the back half of the year.

When you go into segments, business strategy [ph] is very hot right now, it has been. And commercial aerospace, I think in North America air traffic is recovering. In China and Europe, it's lagging a little bit relative to North America, but I think it's steady growth.

A - Mandeep Chawla{BIO 20185907 <GO>}

And then what we'd also say though is we're pleased with the sequential improvement that we're seeing in A&D. It probably won't get back to full recovery until 2024 though. And so as capital equipment over time may moderate, we do believe that we have an offset that can happen in the outer years with A&D.

Q - Todd Coupland{BIO 1556221 <GO>}

Okay. Great. Appreciate the color. Thanks a lot.

Source: Company Earnings Call 04/2023, Bloomberg

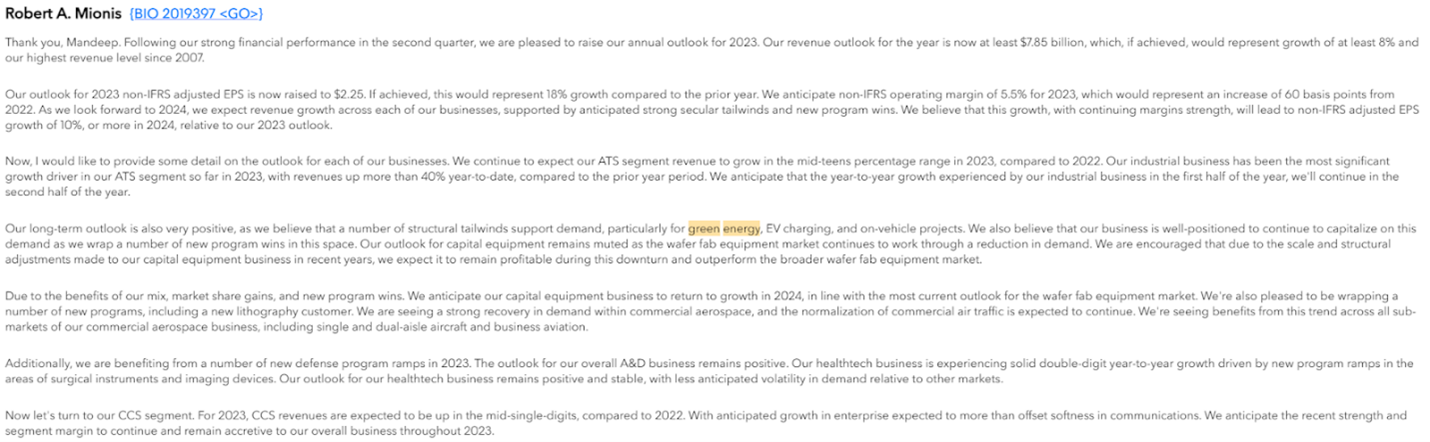

And yet, in the most recent earnings call, they stated they anticipate the capital equipment business to return to growth as soon as 2024:

Our long-term outlook is also very positive, as we believe that a number of structural tailwinds support demand, particularly for green energy, EV charging, and on-vehicle projects. We also believe that our business is well-positioned to continue to capitalize on this demand as we wrap a number of new program wins in this space. Our outlook for capital equipment remains muted as the wafer fab equipment market continues to work through a reduction in demand. We are encouraged that due to the scale and structural adjustments made to our capital equipment business in recent years, we expect it to remain profitable during this downturn and outperform the broader wafer fab equipment market.

Due to the benefits of our mix, market share gains, and new program wins. We anticipate our capital equipment business to return to growth in 2024, in line with the most current outlook for the wafer fab equipment market. We're also pleased to be wrapping a number of new programs, including a new lithography customer. We are seeing a strong recovery in demand within commercial aerospace, and the normalization of commercial air traffic is expected to continue. We're seeing benefits from this trend across all sub-markets of our commercial aerospace business, including single and dual-aisle aircraft and business aviation.

Source: Company Earnings Call 07/2023

The ATS segment will see steady growth provided that Capital Equipment has bottomed, which the Company believes is the case.

In its CCS segment, CLS is poised to benefit from increased spending on artificial intelligence and machine learning by hyperscalers and data centers. CLS’ CCS segment plays a key role in the AI value-added supply chain, as this slide demonstrates:

Source: Company Filings

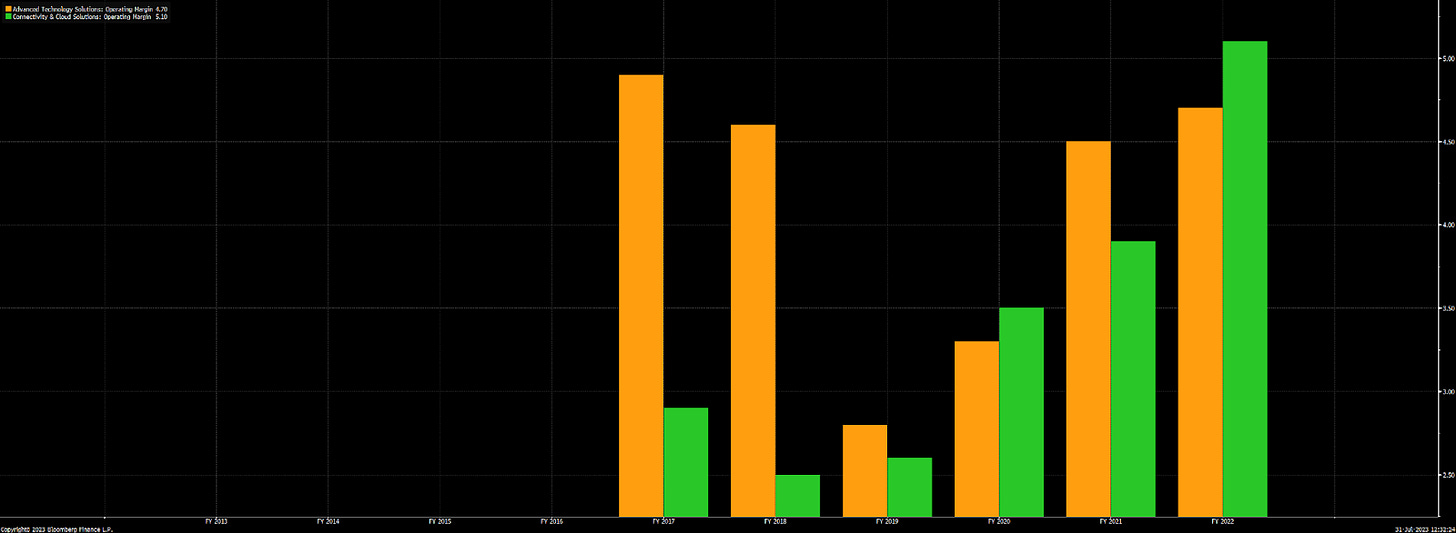

Gross Profit by Segment (ATS in Green, CCS in Orange)

Operating Margin by Segment (ATS in Green, CCS in Orange)

CLS Opportunity:

The CCS segment serves the communications and enterprise end markets. Communications includes telecom infrastructure while enterprise consists of servers and storage. CCS has grown revenue at a 5.9% CAGR over the past 3 years.I expect the CCS segment to accelerate growth to a 10%+ CAGR over the next 3 years, driven by several tailwinds.

In order:

Migration to 800G data center networking which increases ASPs, complexity, and value-add for Celestica

I believe there is no plausible scenario in which 800G adoption does not increase over the next twelve months, and there is similarly no outcome where that increase does not result in CLS seeing a 50-60% increase in EPS & 20-30% increase in revenue YoY.

Ramp up of artificial intelligence implementation by hyperscale customers, increasing server demand

Comps going forward should be very forgiving

Overall data growth requiring more communications infrastructure spending

800G

400G vs 800G:

400G refers to 400 gigabit per second data transmission speeds. This has been the mainstream technology for high-speed data center switches.

800G is the next generation, doubling the throughput to 800 gigabits per second.

As a leader in advanced networking infrastructure and manufacturing, the rise of 800G strongly benefits Celestica. 800G is forecast to grow significantly (double digits in 2023/4) driven in part by Google’s move away from 400G. This aligns well with the company's strategy of focusing on high-value, leading-edge technologies. Celestica is well positioned to capitalize on the coming investment cycle in 800G driven by AI computing demands. We expect 800G to increase as a percentage of Celestica's revenue mix over the next few years as data center networks upgrade to this new technology generation as the adoption of 800G provides a multi-year tailwind for Celestica as AI workloads necessitate next-generation network capabilities.

From CLS Management on their most recent earnings call:

Celestica is involved across the 800G value chain - from designs, PCBs, modules/subsystems to final integrated networking equipment - which will be essential to the future-proofing of data centers:

Advanced PCBs: 800G requires very sophisticated printed circuit boards to handle the high speeds and complexity. Celestica has expertise in designing and manufacturing these types of advanced PCBs.

Optical transceivers: 800G networks rely on high-speed optical transceivers. Celestica manufactures specialized optical modules and components.

Networking equipment: 800G deployments necessitate new routers, switches, and other networking gear. Celestica assembles and integrates these complex systems.

High-speed cables/connectors: Celestica produces cables and connectors engineered for 800G network speeds.

Testing: The company provides design, validation, and testing services to ensure 800G systems meet technical requirements.

Supply chain: Celestica leverages its scale and supply chain expertise to procure key components for 800G manufacturing.

800G technology provides the massive bandwidth, low latency, and high-density switch connectivity essential for AI computing at scale. 800G network speeds enable data centers to process the huge datasets required by AI workloads in real-time without hitting throughput bottlenecks. This technology effectively "future proofs" networks as AI continues rapidly advancing. Industry projections forecast 800G will comprise over 50% of data center switch ports by 2024 as its adoption ramps significantly to power AI. The shift from 400G to 800G data center networking is positive for Celestica and should benefit the company's mix and margins:

Benefits of 800G for Celestica:

Higher ASPs and Margins: 800G technology commands higher average selling prices, which directly benefits Celestica's revenue and gross margins.

More complex PCBs: The printed circuit boards for 800G are more advanced and complex. This plays to Celestica's strengths in advanced PCB design and manufacturing.

Higher value-add: 800G requires more sophisticated design, testing, and configuration services. Celestica can charge higher prices for these value-added services.

Strategic alignment: The shift to 800G aligns well with Celestica's strategy to move towards more advanced, high-margin service offerings.

The migration from 400G to 800G by hyperscalers in data centers will allow Celestica to further improve its mix towards higher value, higher margin programs. This will ultimately be a tailwind for the company's profitability and demonstrates good execution on strategy. Demand is forecast to remain strong for the forseeable future and multiple upwards revisions have occurred this year.

The AI and hyperscale related growth drivers I described would predominantly fall under Celestica's Connectivity and Cloud Solutions (CCS) segment. The CCS segment serves the communications infrastructure and enterprise data center markets and consists of networking, servers, and storage offerings. Growth from AI chip adoption, high-speed networking, advanced server platforms, and other data center infrastructure to support AI workloads would primarily flow through Celestica's CCS segment.

Source: Company Filings

CCS has extensive capabilities and customer alignment in these high-growth data center areas that stand to benefit from AI-related capital spending by hyperscalers. AI workloads require more advanced server capabilities - faster CPUs, accelerators like GPUs and FPGAs, higher memory, and storage. This drives demand for upgraded server platforms where Celestica has strong capabilities. Adoption of AI chips like GPUs and TPUs increases the complexity and component density of server motherboards. This plays to Celestica's strengths in complex PCB design and manufacturing. Additionally:

AI workloads drive more stringent requirements around power, cooling, and reliability. Celestica can add value helping hyperscalers design robust systems to operate optimally in dense data center environments.

Implementation of AI at scale necessitates high-speed networking infrastructure. Celestica is a leader in cutting-edge networking technology like 800G which aligns well with hyperscaler bandwidth needs.

Celestica can leverage its deep customer relationships with hyperscalers to be designed into next-generation AI-focused platforms early. The company's scale, global footprint, and supply chain expertise make it a strategic partner for hyperscalers ramping AI spending and capacity worldwide.

In summary, Celestica is well positioned to capture a disproportionate share of AI-driven data center infrastructure spending given its capabilities, customer alignment, and strategic supplier relationships.

The shift towards 800G technology aligns well with Celestica's strategy to focus on higher value, margin accretive programs. CCS also has potential for operating leverage as revenue scales.

In addition to strong end market growth, Celestica stands to benefit from operating leverage as revenue scales. The company has demonstrated the ability to translate revenue growth into outsized operating profit increase. For example, in Q3 2022, Celestica grew revenue by $102 million quarter-over-quarter while operating income increased $11 million - representing a 10.8% incremental operating margin. On a year-over-year basis, revenue grew by $222 million while operating income grew 23.7%, again highlighting operating profit leverage. In summary, Celestica's CCS segment is positioned to drive above-market growth in the coming years through positive industry trends and continued strong execution.

As Celestica continues growing organically and gaining market share, we expect their operating margins to further expand from operating efficiency and greater absorption of fixed costs. This incremental profit flow-through underscores the earnings upside if the company can achieve its targeted 10%+ CCS growth. The operating leverage provides an additional tailwind for Celestica as revenue accelerates.

Like others in the industry, Celestica faced some recent inventory digestion and demand slowdown for non-AI related business. However, we believe this headwind is temporary and should reverse soon as excess inventories are worked through. As supply constraints and lead times normalize, CLS could see a lifting of constraints and increased margins in both CCS and ATS as detailed in their most recent earnings call:

Source: CLS Earnings Call July 2023

On top of the macro recovery, Celestica has significant growth drivers from the ramp up of AI and transition to 800G networking. These secular tailwinds are still in the early stages, providing a long runway for growth. The AI and 800G trends will ultimately overshadow any temporary inventory corrections, driving strong revenue acceleration over the coming years. Celestica is well positioned to capitalize on these tailwinds given its capabilities and customer alignment.

From CLS Management (Earnings Call, July 2023)

Given Celestica's growth drivers and momentum in its Communications & Cloud business, the company's 2024 financial projections look conservative :

Revenue growth of 8.9% in 2023 and 5% in 2024

EBITDA growth of 9.5% in both 2023 and 2024

These projections assume Celestica's non-AI and capital equipment customers bottom out and remain stable. However, they do not appear to fully reflect potential upside from strong 800G networking adoption and next-gen AI server deployments.

Even assuming the company hits the low end of their long-term CCS target of 10% annual growth, Celestica's revenue could surpass projections. And EBITDA has the potential to outgrow the forecast through operating leverage gains.

If secular growth trends in AI, communications infrastructure, and advanced server platforms accelerate as projected, Celestica has meaningful earnings upside versus their conservative 2024 targets. The projections don't fully factor in major product cycle drivers.

From CLS Management (Earnings Call, July 2023)

Outside of any AI related data center capex spending benefitting CCS, the ATS segment has continued to see strong growth as supply chains and spending have normalized. Importantly, Celestica has exposure to several end markets that align with favorable government spending trends. In Q3 2022, the company's aerospace/defense and green energy revenue grew 20% year-over-year to represent 45% of total sales.

These markets stand to benefit from policies like the Inflation Reduction Act which includes over $370 billion in energy security and climate investments. The Infrastructure Investment and Jobs Act also provides a boost for sectors like electric vehicle infrastructure, renewable energy, and defense.

Q - Maxim Matushansky{BIO 22815032 <GO>}

Yes, good morning. You mentioned strength in ATS was from kind of new program ramps, the overall market demand and also the improved materials availability across the -- across ATS and industrial AT and HealthTech. Given that you increased the ATS outlook for Q2 and you had no kind of adverse revenue impact from supply chain constraints, I'm wondering how much of the strength in the ATS was from new program ramps versus improved materials availability?

A - Rob Mionis{BIO 2019397 <GO>}

I would say, Maxim, the large majority of the improved growth is driven by new program ramps, especially in our industrial business. Our industrial business has great exposure to some of these green energy projects. A lot of what the US Government is doing on the Inflation Reduction Act is adding fuel to the fire with respect to demand.

We have very strong backlogs of these programs, and these programs are material constrained. So, while material constraints are easing in some of the other areas in the ISC area, industrial area, we still have a fair amount of material constraints given the very strong demand that we have.

Q - Maxim Matushansky{BIO 22815032 <GO>}

Okay, and just wanted to circle back on the hyper scalar demand. Now that we're approaching kind of the mid part of the year, I'm curious whether you're seeing any changes in that demand for your customers. And sort of you mentioned that some of that has shifted to potentially proprietary commute -- compute. Can you just comment on kind of the changes in the demand from hyperscalars and anything new from those conversations over the last, over the last few quarters?

A - Unidentified Speaker

Yes, our hyperscalar segment is still continuing to grow, as I mentioned, where we believe that hyperscalars will grow about double digits this year, but they are shifting their spend. They do have inventory in the pipeline, larger in the areas of networking.

Those strategic buffers were put in place last year and they're consuming those down. And once those buffers are down, they'll probably return to growth. But they are shifting their CapEx spend more towards these AI and ML investments, which will be ramping up through the year and into next year. So, that's where we -- in CCS, we see a large portion of our growth coming from proprietary compute. And we're serving multiple customers that are not just hyper scalars but OEMs as well.

From CLS Management (Earnings Call, April 2023)

Celestica's strong positioning in growing aerospace/defense and green energy verticals provides a policy tailwind. Government incentives and spending prioritization of strategic areas like national security, renewables, and EV adoption can drive above-market growth for Celestica's exposure to these key end markets. This was mentioned in the most recent earnings call when CLS increased its guidance for 2023:

My base case is more optimistic than that of consensus, due to the combined impact of AI capex - currently grossly underestimated by analysts - and green energy/industrial/defense mega projects in the US. Combine this with our working assumption that Capital Equipment has bottomed - if all of these metrics see acceleration as we have projected, Celestica is positioned for significantly above consensus revenue growth and even more significant margin upside. Transitioning the mix towards higher-value solutions in Communications & Cloud, currently 25% of sales, can drive incremental profit flow-through. My base case sees a clear parh to $3 of EPS in 2024.

While operating margins are currently depressed due to high COGS from the manufacturing model, we see a path for multi-year upward trajectory driven by mix shift and operating leverage.

The catalysts to this view include capital equipment bottoming & seeing strength in 2024, an attractive valuation of 7.2x 2024 EPS, management that is focused on execution and accretive acquisitions and a strong cash position / balance sheet. Additionally, the stock may experience a rerating as its connection to AI capex becomes apparent. This makes up our bull case which sees CLS earning $4 of EPS in FY2024. That would have CLS trading at just under 5x FY2024 EPS.

Source: CLS Corporate Filings

Another interesting potential catalyst for Celestica is the conversion of the multiple voting shares (82% of which are owned by Mr. Scwhartz of Onex Corporation) into subordinate voting shares(“SVS”), which will result in a more balanced voting structure with Mr. Scwhartz’s/Onex’s voting interest reduced to 15.8% of the SVS. This normalization opens pathways for CLS not previously recognized. Onex choosing to sell down their stake may be a provides an attractive buying opportunity and clear the way for potential M&A in the name as its structure normalizes.

Source: CLS Company Filings

For investors with a long-term horizon, Celestica provides leverage to critical technology growth trends as a strategic design and manufacturing partner to industry leaders. The company's inexpensive valuation and improving margin profile make the risk/reward attractive at current levels.

ENTRY: BELOW $20.50

CLS has run up significantly since the earnings and there is a bit of an overhang from the ONEX shares that I believe will create a good buying opportunity. Below $20.50 is a good price to pay on a pullback and I believe we should target an entry with an average cost of $20. The future is unknown, so perhaps this represents going paying $21 for a half-size position $21 and then $19 for another half on a pullback, or paying up now to get in at $20.50 in size.

I believe a good maximum risk downside target in the bear case is $17.50. With our price target (as shown below) at $31, $2.50 of risk to make $11 is a good deal.

4:1 risk vs. reward as our base case strikes us as a very attractive opportunity.

DCF Model for Celestica

CLS Company Financial Highlights

I have a position but it’s not as big as I’d like it to be. As I mentioned in the article above I am still doing due diligence, I’ll be updating the article over the next week with info and a bear case.

Great write up and opportunity