With the yen carry trade putting AI on life support for now, we’re examining an industry that has weathered multiple storms over the last few years and suffered due to the crowding in of capital into momentum sectors.

Against consensus, we believe this industry is putting in a durable trough after a plethora of false starts and is poised to resume benefitting from multiple secular tailwinds for years to come. We’re outlining this thesis briefly and will revisit in to be more in depth when the VIX goes back below 20…

Healthcare Investors, Meet the Cycle

The unprecedented nature of the COVID-19 pandemic and its aftermath led to many new experiences for all of us. For many healthcare investors, it introduced them to a cycle.

For the last twenty years, healthcare innovation has been a classic megatrend. As we have written in describing our approach to investing in megatrends, they tend to be persistent, durable, and supported by multiple self-reinforcing, reflexive themes.

Healthcare innovation has been driven by a powerful combination of factors. Favorable demographics have played a crucial role. Simultaneously, technological advances in diverse fields have catapulted the advancement of life sciences to the forefront of public consciousness. Biology, materials science, and both organic and inorganic manufacturing techniques - just to name a few - have seen massive strides over the past couple decades.

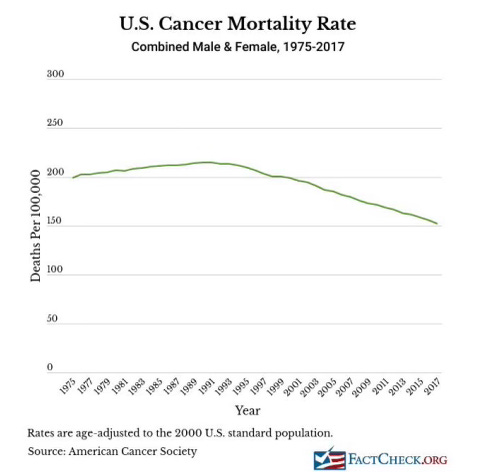

Take immunotherapy, for example. Just six or seven short years ago, a diagnosis of Stage IV Non-Small Cell Lung Cancer would have been a death sentence. “Get your affairs in order and make sure you’ve taken care of your last will and testament” might be a refrain the oncologist delivering the diagnosis was all too familiar with.

Now, with the advent of drugs like Keytruda, Opdivo, Yervoy and others, survival rates are steadily increasing.

Together, these developments have unlocked transformational new products and businesses.

New treatments beget more new treatments. Patients living longer consume more medical devices and pharmaceuticals. It is a virtuous cycle that will only accelerate from here. In immunotherapy (CIT) alone, there is an entire cottage industry that has developed dedicated to improving it.

And the result of this process?

Enormous value creation in the healthcare sector.

It’s our strong belief that once this cyclical normalization plays out, we will resume the trend we saw for the past decade. In many ways, this is not entirely dissimilar from the blown up carcass of large cap growth tech in 2022 recovering to be the secular darling of every investor on or off Wall Street in 2023.

The process, unfortunately for healthcare investors - who could, at least until 2022, commiserate with semiconductor investors - was viewed as largely acyclical by the time it imploded.

That set up for a devastating cyclical downturn that’s just now seeing durable green shoots as economic uncertainty to the downside comes into play. The threat of stagflation after years of ZIRP was simply the worst case scenario at that point in the cycle for healthcare.

No matter what happens to real economic activity, people still get sick. Life sciences are viewed, broadly, as defensive because of this fact. And it’s not just that - they’re lower rate beneficiaries as well. Indeed, the secular growth profile of much of the healthcare industry meant that lower interest rates from economic weakness supported their multiples even as their revenues were unaffected.

As we have observed of megatrends, this process has not been linear.

Investors riding this theme enjoyed more than 15 years of significant and relatively consistent excess returns compared to the rest of the equity markets until 2021-22, as the chart below makes clear.