GLP-1s: The Second Serving

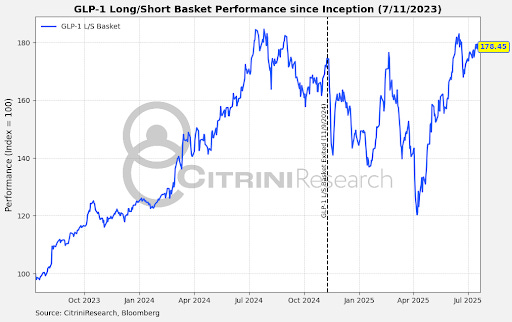

Revisiting our GLP-1 Basket

In case you missed it, our new portal allowing real-time tracking and performance on every thematic basket we cover and our model portfolio recently went live at citrindex.com

Introduction

Two years ago, CitriniResearch’s third-ever thematic primer “Upgrading from Overweight” made a host of bold claims about the new class of weight loss drugs, GLP-1s. First, that GLP-1s represent a breakthrough addressing one of the largest health crises in history - the obesity epidemic. We argued that GLP-1s would become ubiquitous, following a trajectory similar to Lipitor or Viagra. Widespread adoption, in turn, would lead to the first “downtick” in the U.S. obesity rate for the past four decades. That has begun:

Secondly, while we expected GLP-1 manufacturer share prices to increase in the near term, we were unique in predicting that long-term second-order effects of a successful weight loss drug would be the most enticing trade as competition heated up for the manufacturers (leaving only a few key “winners”). While many of our trades on these second-order effects had strong performance (shorts on obesity related medical devices, alcohol suppliers, and unhealthy foods), we felt that moves were primarily the result of the market attempting to “front run” the impact.

This concern, combined with the risk of patent cliff and compounded pharmaceuticals/grey market peptides on GLP-1 manufacturer economics, caused us to exit the basket in November 2024. We realized a 75% gain over the span of 14 months, and promised to continue monitoring what we believe is a generational inflection.

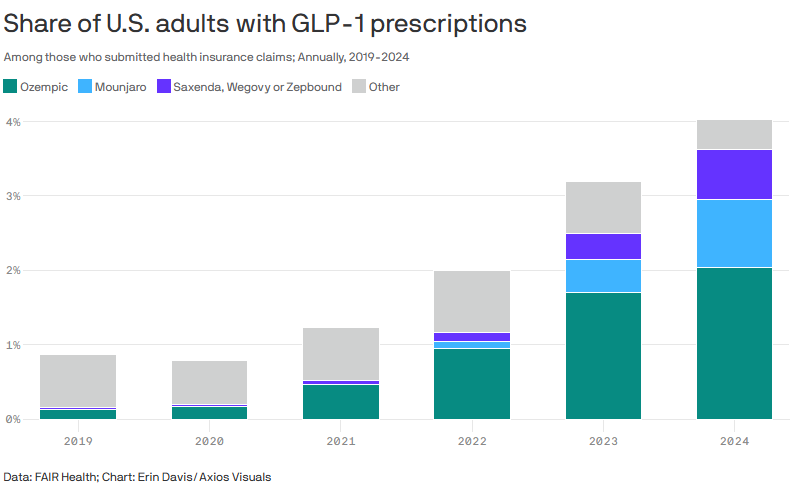

Now, the thing about second-order effects is that the first-order has to play out to some critical degree. Based on prescription numbers, it is clear that more and more people are using these drugs. At the end of 2024, nearly 4% of U.S. adults had a prescription for GLP-1 drugs.

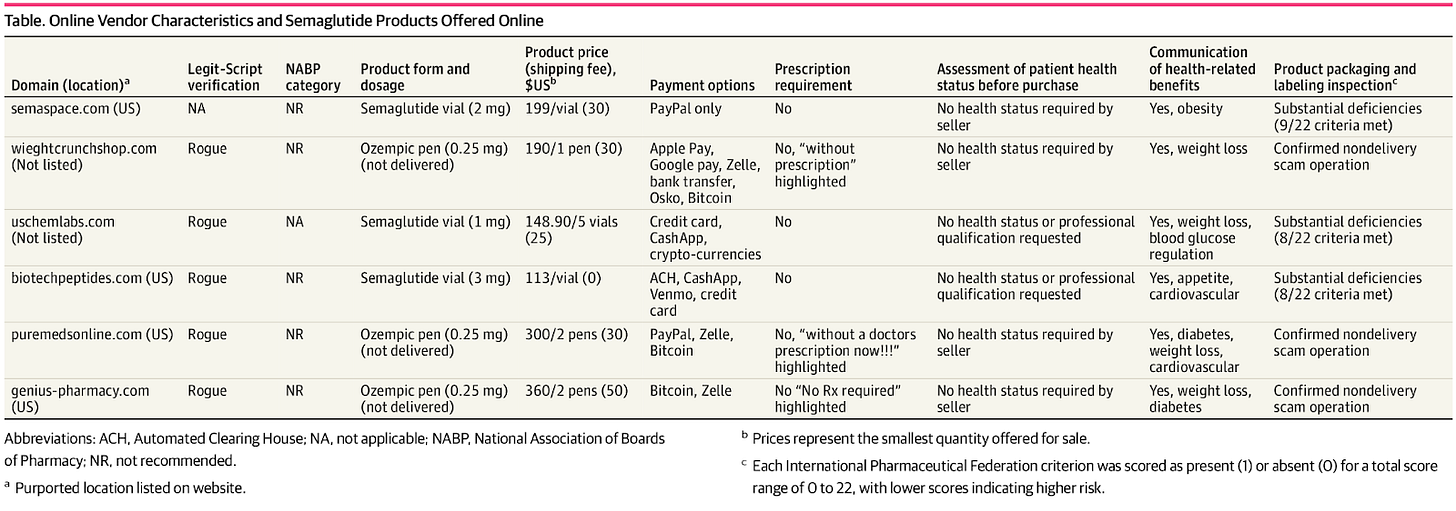

With more than 30% of the U.S. adult population suffering from obesity, one might think that is a drop in the bucket. But these numbers don’t take into account the massive trend in grey market peptides or compounding pharmacies (like Hims, Ro, Musely and others).

With or without a prescription, it’s likely that the number of patients actually on GLP-1s is 2-3x higher than official statistics suggest. A study published in JAMA confirmed that GLP-1s, or at least Semaglutide, is practically over-the-counter in practice, with hundreds of online vendors dispensing without a prescription:

Two years ago, my evidence for GLP-1s entering the zeitgeist was “Can you believe Ozempic got mentioned at the Oscars?!”. Last week, on a ten minute walk down the street in Manhattan, I spotted three signs on the sidewalk for MedSpas advertising GLP-1 treatment. It’s safe to say that our original thesis regarding the “reflexive nature of a successful weight loss drug” has been proven correct.

So, as we rapidly approach a critical mass of people (not just Americans - China just approved its first GLP-1 drug for obesity) receiving these drugs, we have to consider something. We can’t just focus on the number of patients on GLP-1s, but must look to the number of patients having been on GLP-1s for long enough that second-order effects (including negative ones) will begin making themselves known beyond a doubt.

Many of the downstream impacts that we’ve speculated in theory will now become increasingly obvious on income statements. This will only accelerate as we see an explosion of generics and me-toos crushing the cost-curve.

Ironically, the market – which once expected an immediate, pronounced materialization – has now become comfortable with the idea that these slower moving changes aren’t coming at all. This complacency comes just as we are reaching a critical mass of adoption, impacting consumer behavior at scale.

After two years of covering GLP-1s, and roughly eight months after we took our basket off for the first time, we’re ready to put it back on – this time with an increased emphasis on the impacts most unappreciated by the market.

In this report, we cover:

The Manufacturers and Supply Chain

A Second Time Around for Second-Order Effects

Ongoing Therapeutic Innovations & Clinical Data Review