Free Preview: Citrini’s AI Picks for Phase 2

Plus: An Announcement on the Future of CitriniResearch

It’s been a good start to the second year of Citrini Research!

I am really excited about our current portfolio allocation and wanted to share a free sneak peek at a few of them from our A.I. Annual Thematic Review (published 6/2/24) with all subscribers.

Before I do that, however, I have an…

ANNOUNCEMENT:

CitriniResearch has begun annual-only subscriptions.

Monthly billing will no longer be offered to new subscribers.

On July 1st 2024, the only pricing available for new CitriniResearch subscribers will increase to be $999/year (from $799/year currently).

The price when you upgrade to paid subscriber is locked in for life. I have never hiked prices on existing customers (only for new) and I never will.

Additionally, except for our Holiday Charity Sale, we will no longer be offering any discounts, sales or special offers after July 1st.

If you upgrade before then, you will lock in and save $200 per year compared to someone who becomes a paid subscriber on July 2nd.

As always, thanks for being a reader!

Now, let’s check on how those picks are doing…

AI Thematic Review: Highlighted Picks for 2H24.

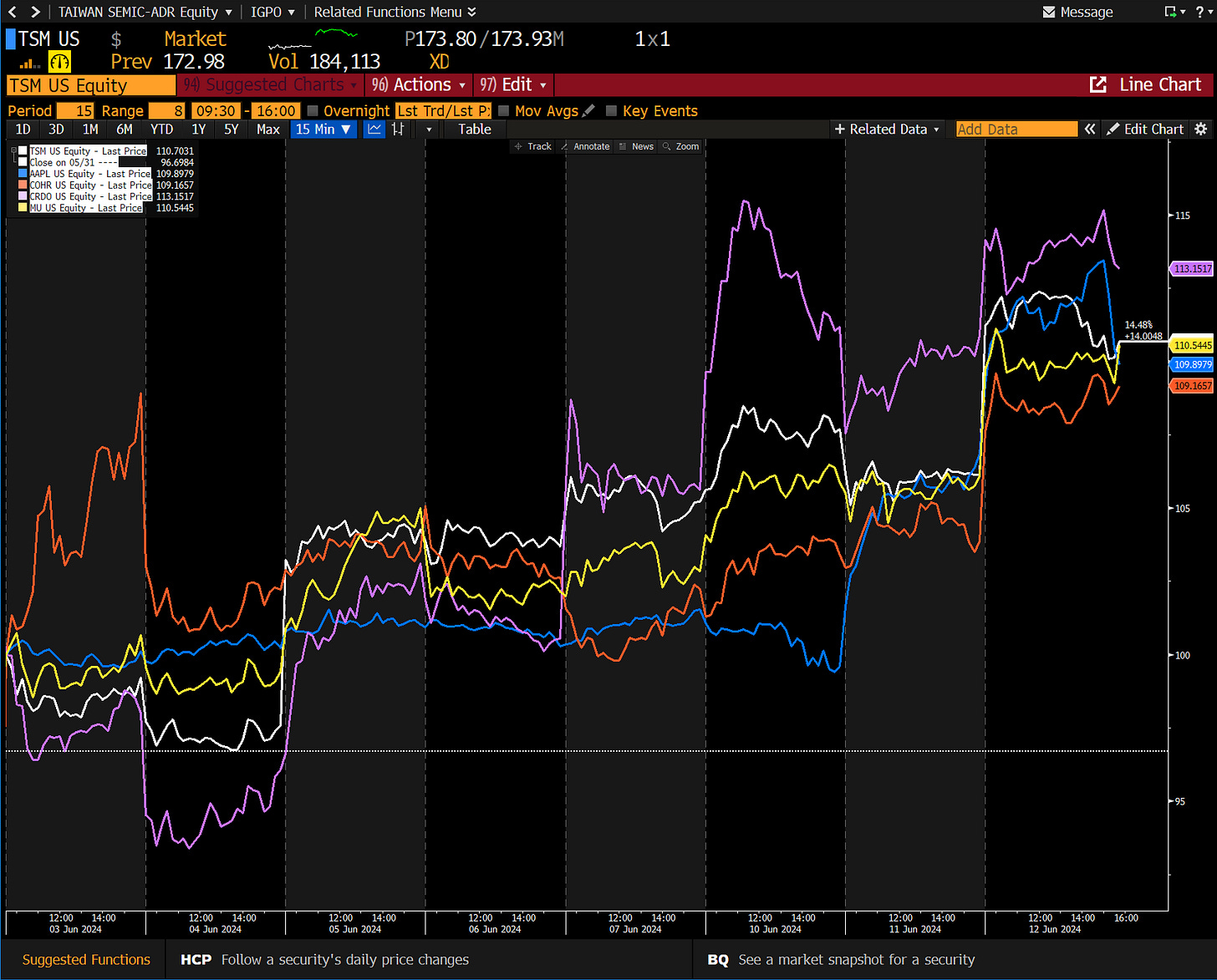

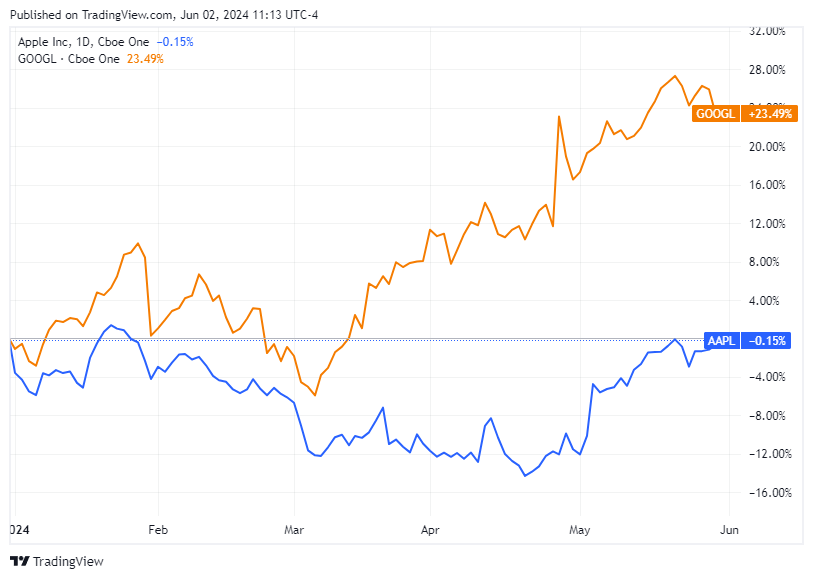

Our reiterated favorites for our AI thematic basket have performed very well month-to-date since the Citrindex’s annual update posted two weeks ago, and I am sharing a sneak peek at our views on a couple of them.

While paid subscribers received this at the start of June, it’s all still very valid.

The Cost of Trust:

Subbing Apple in for Google

Takeaways:

NEXT PHASE IN AI ADOPTIONS: AGENTS AS AI ASSISTANTS

APPLE WELL POSITIONED TO CREATE A “SSO FOR YOUR WHOLE LIFE”; CONTROL OVER HARDWARE/SOFTWARE ECOSYSTEMS THROUGH A SINGLE AGENT

FUTURE OF PCS = SCREENS AS PORTALS TO COMPUTE

EDGE AI: USE CASES UNCLEAR FOR COMPUTING ON DEVICE WHILE COMPUTE CONTINUES TO SCALE, SEEMS GIMMICKY BUT OEMS LIKELY TO STILL SELL SOME.

NOBODY NEEDS AN “AI COMPUTER”.

MARKET WILL EVENTUALLY PAY ATTENTION TO GOOGLE’S POOR EXECUTION

GOOGLE NOW AT RISK FROM OTHER HYPERSCALERS IN AI, AND UPSTARTS IN SEARCH

TRUST A KEY FACTOR IN NEXT WAVE OF AI, DELETE GOOGL IN AI BASKET & ADD AAPL

CONSUMER TRUST BECOMES A DECIDING FACTOR IN WHO WINS “AI WARS” - MORE THAN THE SEARCH WARS

What is the next step for artificial intelligence, conceptually?

I don’t mean this literally. This isn’t ‘how can we strengthen the supply chain’ or ‘what does this do to the Fed’s dual mandate?’

If the first great wave of adoption was driven by chatbots and large language models, what is the motif of the next layer in this thematic Matryoshka doll?

Let’s start with some easy serves... it won’t be full self driving, sorry-not-sorry. Quantum computing and paradigm-shifting advancements in semiconductor design will surely be driven by AI/ML, but not quite yet. One possibility that we discuss here is within robotics and manufacturing tech, a loose collection of very micro problem-specific solutions.

As we noted in our initial AI primer as well as throughout this piece, mainstream AI adoption will come in waves. What we second and third phases approach will actually likely look more like dozens of developments in areas branching out towards the most impactful use cases. What this means for us as observers and participants is that, despite how it may feel to the contrary in moments of euphoria when a quarter of a trillion dollars in market cap is added in a few days – this great technology super cycle will still adhere to the ebbs and flows of the venerable S-curve.

It is fair to say that we have actually witnessed a significant deceleration in innovation and novel adoption over the last year. That is of course not to say that absolute AI activity has declined nor is it to say that edge operators have made internal advancements, but the hypothetical growth rate has moderated and this is to be expected and embraced.

“But you just said that Nvidia posted the greatest quarter in financial history! And they just raised guidance!!”, you may say.

Yes, that is true, but it is for the next cycle, and that is an important distinction when reading through to the broader market and individual opportunities within it, especially when looking all the way down stream, where the fish have the farthest to swim and most to risk along the way.

The next great frontier in artificial intelligence doesn’t seem to be drug discovery, life-like computer girlfriends, or even automated salad assembly. No, dear reader, the next great frontier in artificial intelligence adoption is almost certainly going to be you.

“Personal compute is dead, long live personal compute” – NVDA CEO Jensen Huang on Q1’25 earnings call (paraphrased)

This may seem to fly in the face of everything you have heard in the media – that compute capacity is the new oxygen and the secrets of the universe are just a few more floating point operations away, but that that statement is not directly at odds with Jensen’s sentiment.

It may not be intuitive that Nvidia – which doesn’t make any mobile components whatsoever – would proudly proclaim and encourage the downfall of the personal computer.

In the future, the very near future in all likelihood, there will be no PCs, there will only be screens – portals into an amalgamation of compute resources.

Some compute will be done on device, related to sensitive information and identity verification which is very possibly AI’s version of the ‘last mile home’ problem. In other words, the heavy lifting benefits greatly from economies of scale, but the real utility for the consumer comes from high touch execution and personalization.

Enter Siri.

Siri is not simply a chatbot, nor is it just a set of pre-recorded voices. Siri, by most accounts, is not even a particularly good product.

What Siri has the potential to be, however, is much more. The ultimate personalization layer for agentic AI assistant: a truly differentiating product that is not the result of Apple’s own unique technological breakthroughs or supply chain virtuosity. a product of Apple playing the long game to earn your trust for this very moment.

It must be noted that while this long term strategy seems deliberate – there are external factors that have made this effort a bit less daunting, missteps by competitors that allowed the execution-focused Apple to win simply by keeping themselves in the game. Google and Meta, though for very different reasons, have both seemingly fumbled the ball of being the ‘last mile home’ solution in personalized AI deployment.

It probably isn’t news to you that people really, really hate Meta. There are myriad reasons from a poor response to foreign election interference to a seeming disregard for minors and other vulnerable groups that has become a major concern on both Instagram and Facebook Blue. This isn’t a Meta takedown, though. As a matter of fact, Mark Zuckerberg’s leadership in leaning into AI-linked spending has almost certainly spurred this arms race that has allowed Nvidia to become the most centrally important company in the entire stock market.

In short, Mark is right about the Metaverse, there will be alternative societies that are instantiated solely in a virtual world that is actually just a building in a field in Altoona, Iowa. This is not the endgame of artificial intelligence, however. Entertainment and enabling social interactions can be, and have been, very lucrative lines of business but paradigm shifting and world changing it is not.

Google, on the other hand, has tried to use its impressive cash flow generation to diversify away from the digital space, with well publicized moonshot investments in autonomous driving, robotics and physical devices with the Android operating system, among others. What this has seemingly created is a culture of complacency, almost as if by winning Browser War II it has cemented its place as the world's port of entry to the web.

Google has very publicly made investments in both internal and external artificial intelligence and machine learning projects with a variety of end use cases. This has led to an even more public string of embarrassments that have threatened Google’s reputation as a keen operator and responsible capital allocator deserving of trading on trust that it will deliver either scientific or financial results within a reasonable timeframe. It has always been a matter of trust.

Unfortunately for Googlers, it really does seem that the markets’ once-robust trust in longtime-CEO Sundar Pichai has eroded to the point where some outside observers see him as a liability, the lost captain of a rudderless ship drifting perilously close to the breakers. Tensorflow – Google’s suite of machine learning and accelerated compute APIs - has been instrumental in the democratization of AI development, but it simply is not a business nor a moated, mission-critical vector for scientific research like Nvidia’s CUDA is.

The term jack of all trades, master of none comes to mind.

This is particularly ironic, because ‘to google’ is literally a verb in the Miriam Webster dictionary. Pre-Alphabet, Google’s singular focus on mapping out the world wide web more was the genesis of this positioning.

The final nail in the coffin for pulling the trigger of this trade has been the rollout of Google’s AI search assistant, which is integrated into the Chrome browser. The rollout of the embedded search summary tool has more-or-less confirmed widespread concerns about the quality of Google’s proprietary AI operation. Where questions abound regarding the true intentions of OpenAI – another matter of distrust – the uncertainty surrounding Google is a bit more existential.

These are just two of a spate of half-comical, half-terrifying responses to user inputs in the time since the rollout began. Bugs are bound to come up in technology, hallucinations are a part of inference-based models, but the preparation and response surrounding this may be more symptomatic than superficial. The broad Google response to these hallucinations has been essentially “most of the responses are fine!” which is really a concerning position to take.

To be generous, this is disastrous public relations. To be realistic, this is non-existent quality assurance in a very asymmetric product rollout.

In other words, there was not very much to gain, tons to lose, and they simply did not cross their Ts and dot there Is. The justification for the error tolerance here is that the hallucinations were the result of “abnormal user inputs” and not indicative of the model’s true capabilities, which may be true in a strict sense, but how on earth is that commensurate with a corporate culture of excellence and leadership? I promise you that there are more than enough people playing ping pong or riding unicycles around the office that could have tried to break the model, for the explicit purpose of saving the company from embarrassment, and more urgently, helping to stop the bleeding in terms of their fellow Googlers. Of course, it is not up to individual employees to ensure that entire projects are completed to acceptable spec, but it certainly is the job of an army of product managers and their superiors. In any organization, this starts at the top and flows from managers ultimately to products. In this sense, Sundar Pichai (a former product manager himself) is responsible for this rollout as, even from the outside, it was entirely predictable and should have been aborted.

Not only is Google not particularly good at AI, they are particularly bad at faking good AI as evidenced by the clearly scripted Gemma rollout within the Gemini ecosystem earlier in 2024.

Employee’s don’t seem to trust Sundar, outwardly criticizing his $200m 2023 compensation package in the face of a very public reduction in force. Investors don’t seem to trust Alphabet, an amalgamation of a number of valuable but possibly poorly run assets. Most important to this conversation, though, is that Google’s broad consumer base has received a taste of what is in the pipeline via some rather tame product releases, and the early returns have been far from inspiring. Simply put, if Google cannot execute or innovate at the basic levels of artificial intelligence deployment, how are we supposed to view them as a serious player in the space? What’s more, if Google’s response to clearly botched product rollouts is as blasé as it has been in recent weeks, are we really supposed to trust them with our most personal data like family photos and medical records? We already do, to some extent, through Gmail, Google Play Store, and the rest of the G-suite but that is based in the linear world and the portability of that credibility to the exponential world has been called into question, with no-one to blame but Google’s middle- and upper-management for allowing a culture of complacency to creep in.

So, where does this leave us?

Well, I would say that the above actually paints a family portrait of Big Tech that shows a very uneven response to AI adolescence with some better able to control their hormone levels and emotional reactions than others. Microsoft/OpenAI clearly have the most maturity in this group, but have the most virulent detractors and the biggest target on their back. Amazon is content to dominate in the linear world, which actually is probably a decent strategy. Meta is something of a renegade that is marching to the beat of their own drum, setting industry-wide capex expectations. Google is the former gifted kid that is running into growing pains in high school classes and unfortunately is dealing with quite the case of acne. That just leaves Apple, the surrogate mother hen of the group that just so happens to have spent its childhood laying the groundwork for exactly this opportunity, and they seem primed to win.

Which company out of that group has the lead in biometrics?

What about real time location data?

Most importantly, which of these companies is intimately integrated in every facet of our lives?

If you need to buy something, Amazon is a great choice. Google, with Maps, Drive, and YouTube still has a window into the consumer, but inferring important facts like identity from search is a challenge. Apple is the only one of these companies that can see everything. Everything we want them to, the things that we use their products to share - graduation photos for example - and also we don’t want the world to see. Text messages, personal financial data, very often our communications during some of the worst and most vulnerable times in our lives. I don’t mention this because I think Apple will directly leverage all of this highly personal information, but because it is evidence of the trust that comes with the company's ecosystem.

This may be obvious to some but the relationship between Apple and iOS is very different to that of Google and Android. There are at least two layers between them and the user, the device which is made by, for example, Samsung, and the flavor of the operating system, which is open sourced and is heavily modified before shipment to the end user. This gives Apple full control over its universe where Google is more the steward of Android and only has limited entry points into the physical device. I mention these differences to highlight how consumers, which skew wealthier and younger, trust Apple with vital information that the other companies would only get access to if it was volunteered to them.

We delete Alphabet (GOOGL US EQUITY) in our AI Basket, fearing further slip-ups eventually testing investor confidence and patience, and add Apple (AAPL US EQUITY) in its place.

It was always just a matter of trust. In its first year of existence, the AI basket has been extremely broad, looking solely to capture any name that could theoretically have upside from AI. The reasoning for this diversification was simple - AI was evolving rapidly and we didn’t know where the benefits would accrue outside of semiconductors and hyperscalers, so we bought em all.

Now, a year old, the theme is older. More mature. Nvidia will need to see a larger swath of companies and government agencies embrace AI if they want to continue growing - everything from sovereign states to shipbuilders to drug companies.

Overweighting TSMC

Takeaway:

OVERWEIGHT TSM ON FAVORABLE VALUATION, AI TAIL GROWING AND POTENTIAL AUTO CYCLE IMPROVEMENTS

TSMC in particular is starting to look very bullish as the auto and analog cycle appear to be turning, the lower valuation continues and the market seems to be relatively unconcerned with China-Taiwan worries (as evidenced by the recent “Taiwan news” that had zero impact on the stock - bad news good action is important) at the same time that the AI tail is growing.

TSMC reported a recovering automotive segment in the fourth quarter of 2023 and has continued that trend. Although inventories have continued to climb and the overall sector has continued to see sequential revenue declines QoQ, there has been a shift in guidance. From only two companies last quarter (Renesas and Rohm) guiding for QoQ growth, now Nvidia, Qualcomm, Infineon and Analog Devices are also anticipating growth and seem to be calling for the bottom of the cycle.

The combination of a potentially recovering automotive semiconductor market alleviating the drag on TSMC’s performance and the ongoing strength in AI chip demand could create a bullish scenario for TSMC. If the automotive sector begins to contribute more positively to TSMC's bottom line, while the AI segment continues its robust growth, the company could see improved financial performance and potentially a positive re-rating of its stock price.

The hopes for a recovery in the automotive segment (which is taking a lot longer to materialize than originally anticipated) is also bullish for another area of AI that is exposed to it and, therefore, has not gotten the AI rerating in full force: computer vision and automation.

First we were focused on language. Now, with Siri and OpenAI’s ScarJo troubles, there’s focus on speech. Vision – beyond the interpreting and generation of videos for deepfakes (not the kind of vision we’re talking about here) – has yet to be in the spotlight. But that may change. That brings us to an addition I’d like to highlight…

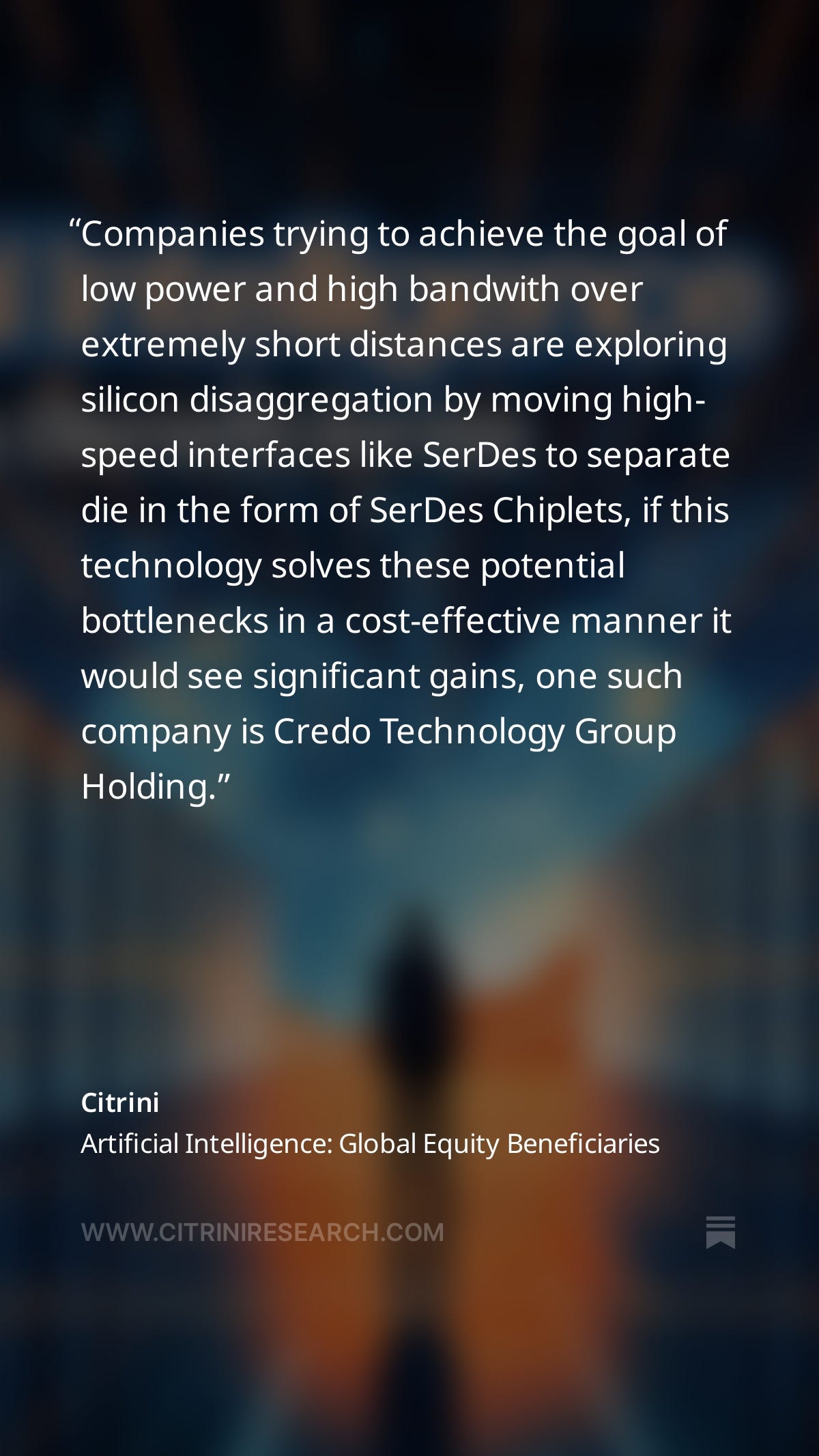

Credo Technology

Takeaways:

CRDO EXECUTING WELL, STILL MORE UPSIDE

OVERWEIGHT CRDO IN BASKET

AEC UPTICK MATERIALIZING

Credo Technology Group (CRDO) finds itself in an advantageous position to capitalize on the exponential growth of AI, thanks to its specialization in providing customized, high-performance connectivity solutions tailored for the most challenging applications within data center environments. The accelerating demand for AI workloads necessitates higher bandwidth and enhanced power efficiency, making Credo's cutting-edge products, such as Active Electrical Cables (AECs), Optical DSPs, and SerDes chiplets, crucial elements in the infrastructure supporting AI.

Credo is up +140% since we originally went long on it in the AI basket last year, but their execution makes me think they have even more upside.

Credo has demonstrated impressive execution, achieving record-breaking revenue in both fiscal Q4 and the full fiscal year 2024. Notably, AI-related deployments constituted a significant portion, nearly three-quarters, of its Q4 revenue. The company has successfully diversified its customer base and expanded its product portfolio, securing production ramps with new hyperscale customers and broadening its AEC engagements. Credo's unique approach, which emphasizes close collaboration with clients and the customization of hardware and software features, has been instrumental in forging robust partnerships and maintaining a competitive advantage.

As Credo looks to the future, the company anticipates that the surge in AI adoption will continue to fuel its growth trajectory. It expects a significant uptick in AEC revenue during the latter half of fiscal 2025, with AI-related revenue projected to experience a twofold increase year-over-year. Additionally, Credo is making notable strides in its Optical DSP business, particularly with its Linear Receive Optics (LRO) DSP solutions, which offer substantial power savings while ensuring interoperability. The company is on course to realize its target of generating 10% of its fiscal 2025 revenue from optical DSPs.

With the AI revolution in full swing, Credo's unwavering commitment to delivering high-performance, energy-efficient connectivity solutions that cater to the specific requirements of its customers sets the stage for sustained success. Bolstered by its robust execution, growing product offerings, and expanding customer base, Credo is well-equipped to leverage the surging demand for sophisticated connectivity solutions within the AI infrastructure landscape.