FREE EXCERPT: Viral Marketing

Upgrade your CitriniResearch Subscription at a Discount

Below is an excerpt from our recent State of the Themes dealing with our emerging focus on viral trends in marketing and the potential for brands successful in this realm to avoid disruption from AI. With small caps and retail finally catching a bid, we’re sharing it with all of our subscribers (free and paid).

This basket was published last Monday, and already more than a third of the names in it have climbed >5% since. If you’d like to get our full articles as soon as they come out, consider upgrading your subscription with a 21% off discount on annual plans in perpetuity, good until 9/1/2025, bringing the cost down to a little more than $80/month.

The Age of Virality

An Excerpt from our Q3 “State of the Themes”

Something weird happened to me the other day – something I can’t recall happening in quite some time. I had a question, some basic thing related to the new hobby I’ve picked up (gardening, which I highly recommend if any of you are looking for a non-neurotic time-sink to offset the stress of trading). Despite the fact that most of my serious searching has moved over to LLMs, I went to google search the answer out of habit.

I searched, Google’s AI generated summary came up at the top and answered my question perfectly, I closed out of the window, I went on with my day.

Doesn’t that seem weird? I mean, ostensibly, it is the purpose of Google. But I wasn’t served a single advertisement. No seeds of capitalism were planted in my subconscious mind. No solutions to my problem with the click of a button and a $99 credit card transaction were even presented.

Much ink has been spilled, even on this publication, about what AI means for advertising. How do we reinforce the models to push users to a specific solution or website? After all, LLMs will know everything about you. They’ll be able to deliver even better and more targeted ads. In the utopian vision, AI will only deliver you advertisements for things you know it needs and you will become significantly less annoyed by ads because you’ll associate them with saving you time. In the dystopian vision, these ads become all-consuming and impossible to resist as not just AI’s memory of your needs and desires drive them but AI’s knowledge of your own behavior and moral failings.

We aren’t the only investors that have considered how AI will impact marketing. Here’s the thing though: that’s a really difficult question to answer. It involves predicting multiple things about the future, it has a bunch of players vying for top spot. And “the foundational model providers will be working towards a future where they can route your inquiry to be answered by a model that is adept at getting you to spend money on things sold by entities that have, themselves, paid money” is not really an actionable investment insight.

To our great dismay and to the delight of SPV providers everywhere, OpenAI is still a private company. Right now, we’ve boiled the advertising question down to its simplest form - AI gets better at predicting who will buy, what ad to show, and what price to pay. Better predictions mean higher sales per ad dollar, so advertisers spend more through these platforms. That’s why we own ZETA and APP. If AI keeps getting a bit better each quarter at matching, pricing, and timing, both companies capture more budget and expand margins.

But beyond that, how do we position for the changing marketing landscape? Perhaps, we just position for who’s good at things that won’t change….

Viral Winners

Many retail names have gotten destroyed as the post-covid retail boom moderated, tariffs created margin fears, and small-caps in general lagged the mega-cap market. But as we expect rates to gradually moderate, attention return to the small cap arena, and consumer spending remain durable, we think it’s time to take some of these names more seriously.

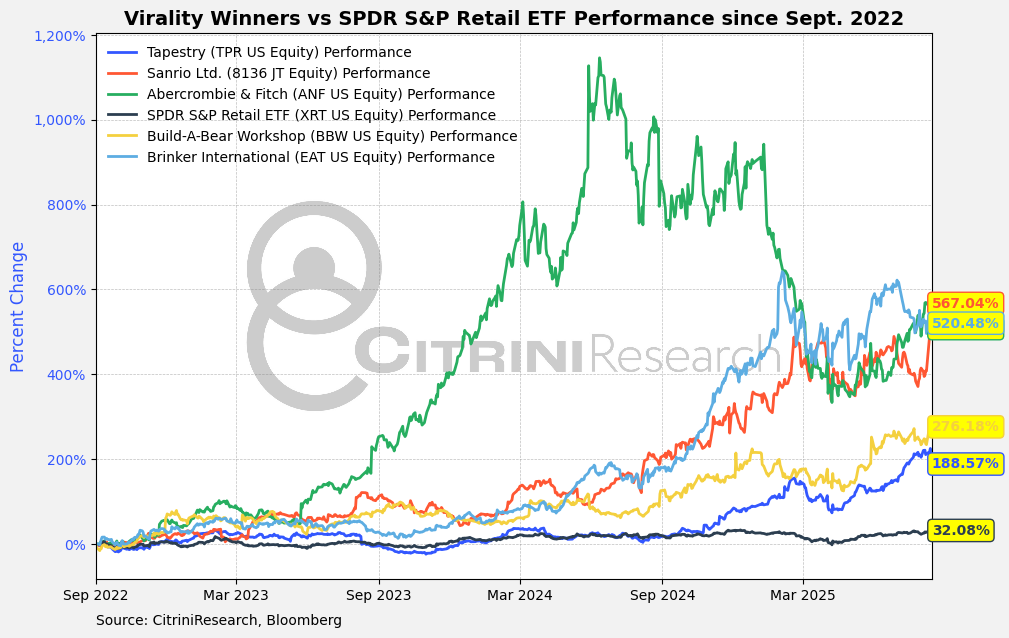

When we look on the kinds of retails names that have bucked the lackluster trend, we see a clear picture of who has been winning. So here’s the answer to our question: what happens when sleepy brands catch fire on socials?

These brands all have one thing in common - they’ve played the viral marketing game well. Viral marketing might be one of the few areas in advertising that doesn’t end up being disrupted or grossly changed by AI. The content that we consume might, but the way it is delivered won’t - and brands are taking notice.

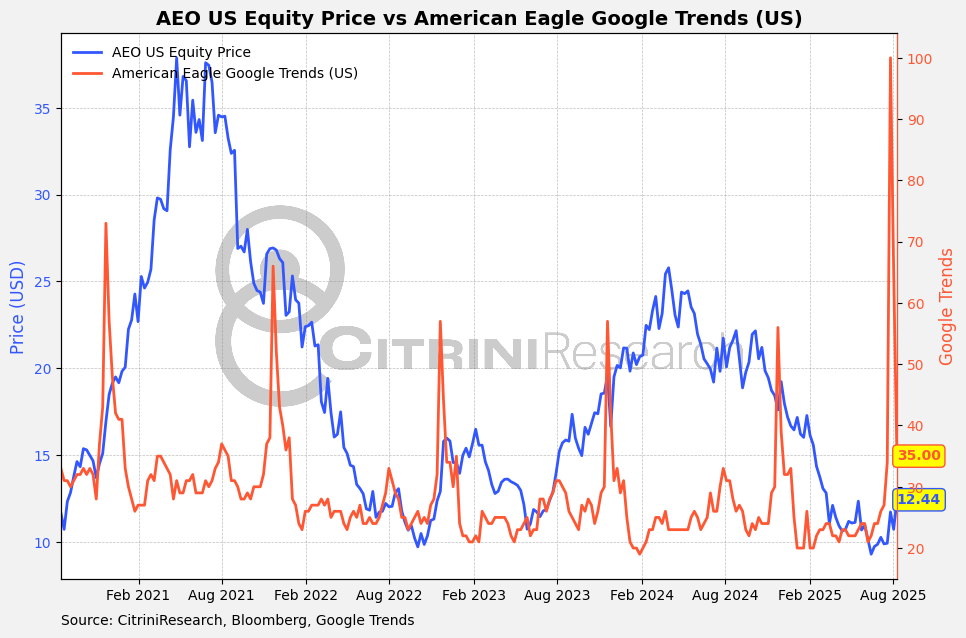

We just saw a great example of what happens when a marketing campaign goes viral, in a stock that’s been trading between 8-16x NTM earnings for the past 4 years - American Eagle:

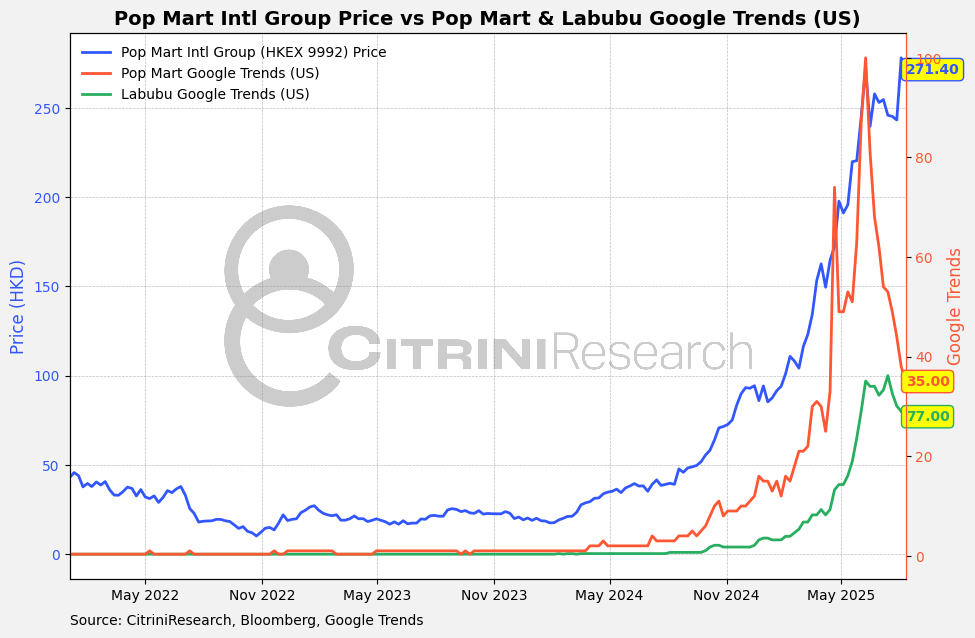

We’ve also seen this with Labubus this year - we rode the parabolic rise in PopMart shares in our China basket:

Finance always seems to be late to the game on turnarounds driven by social marketing - especially when they are targeting women. Abercrombie and Fitch’s turnaround story was evident to consumers long before the stock started going up. Currently, we see a similar thing occurring with Etsy’s Depop platform - becoming extremely popular with women ages 18-24 and spoken about extensively on TikTok and Instagram, but with the stock still in the gutter.

Like the seminal paper on Large Language Models - “Attention is all you need.” It seems extremely clear that when it comes to retail, the winners longer term will be names that are adept at becoming the center of social discussion like American Eagle after their Sydney Sweeney feature.

Our basket focuses on names that have had successful influencer-led marketing campaigns or otherwise viral moments that we believe are repeatable and provide a moat against AI-driven disruptions and insulate well against the extremely difficult-to-predict world of Generative Engine Optimization (GEO) as marketing adjusts to the age of AI. When we backtest, we can see the massive divergence occurring between those adept at virality and the rest of retail:

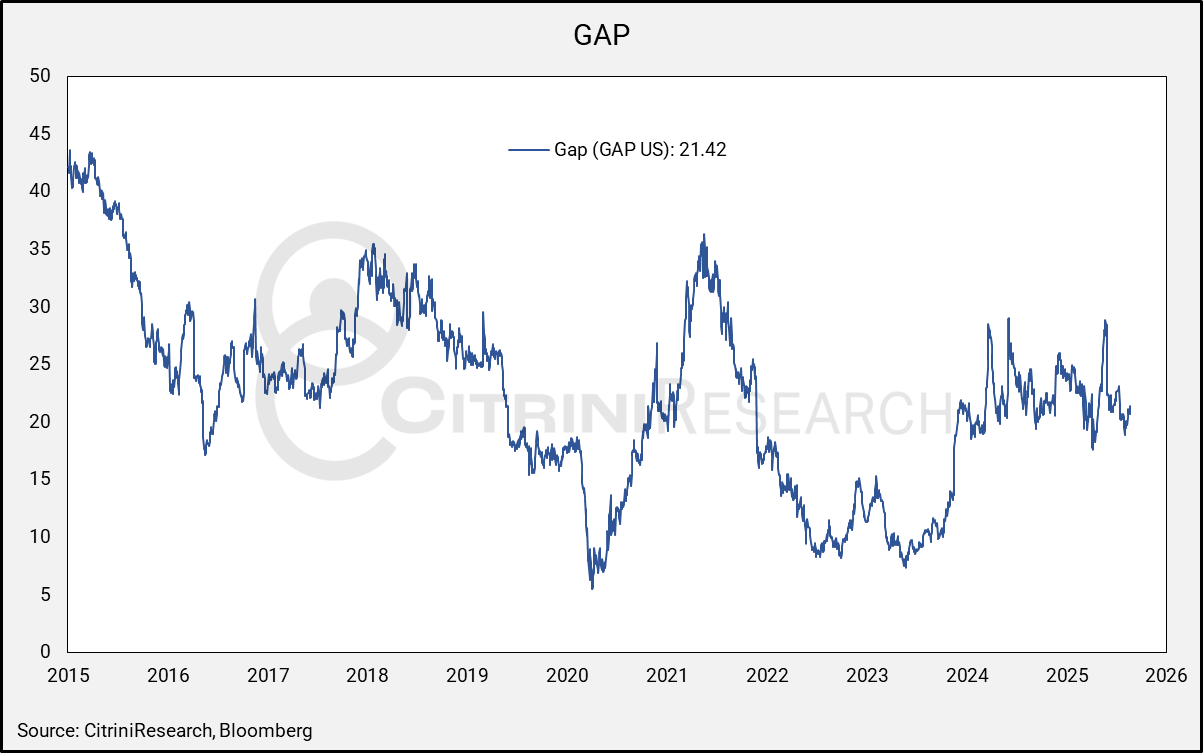

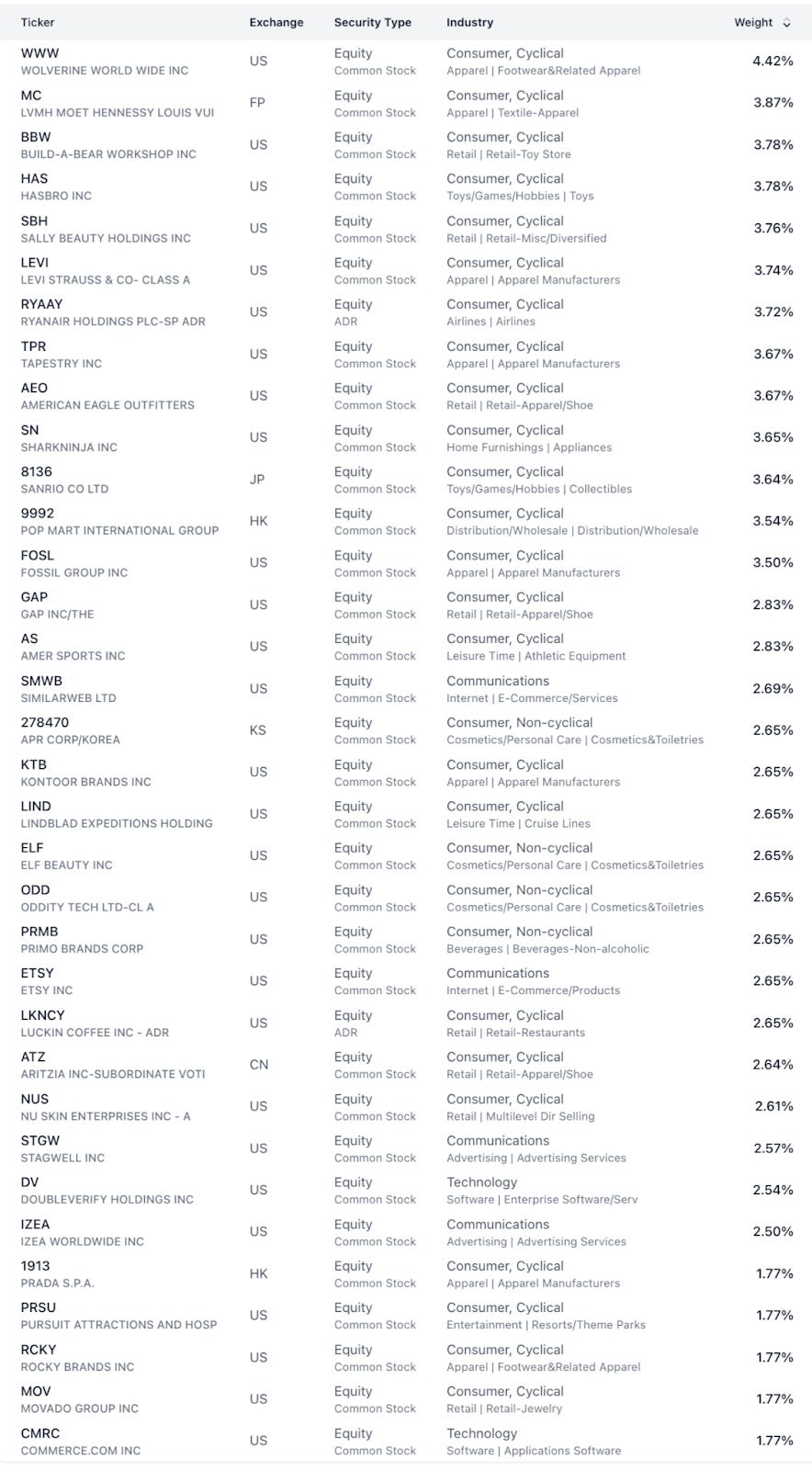

This is where the CitriniResearch community also gives us an edge - this is a preliminary basket based on historical success at viral marketing. We’ve already been alerted to three new viral trends by members of our community - one that is 60,000+ investors strong - in GAP, Miu Miu (Prada) and Amer Sports. When it comes to virality (and the tracking thereof), 120,000 eyes are better than two.

We feel strongly that, if we’re right about retail picking up from here, the best way to outperform in this sector is to align with companies that are successfully navigating the creator economy – whether that’s because of AI or in spite of it. And we’re in a unique position relative to traditional investment research to leverage the asset that is our community in detecting these trends.

GAP (GAP US)

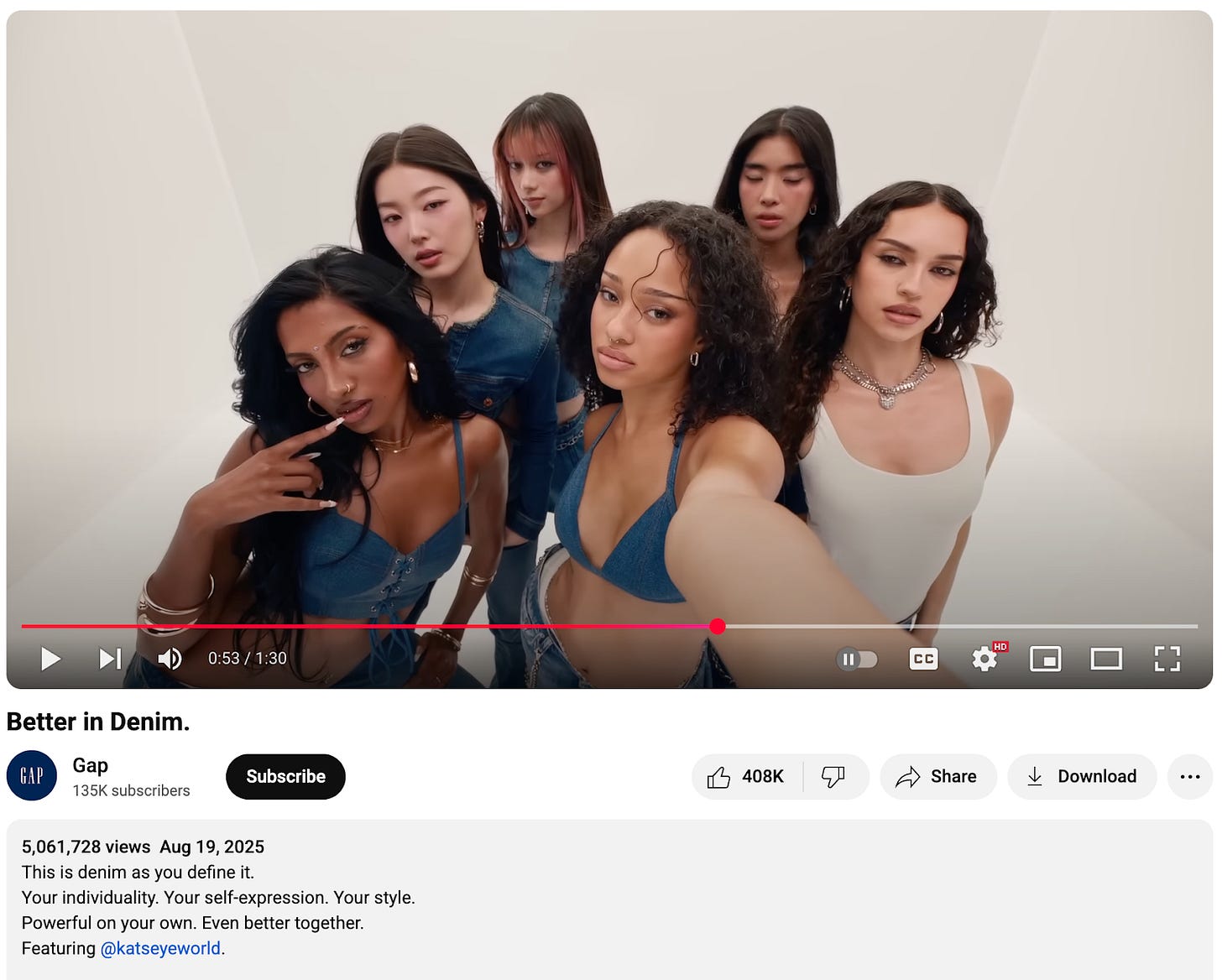

Last week, Gap released a jeans ad featuring global girl pop group KATSEYE that’s a diversity counter to American Eagle’s Syndey Sweeney ad. Gap seems to be positioning itself to pick up market share from those turned off by the AEO "Sydney Sweeney has good jeans” campaign.

Source: YouTube

In somewhat DEI-style language, the Gap campaign states:

“This is denim as you define it.

Your individuality. Your self-expression. Your style.

Powerful on your own. Even better together.”

It has over 5 million views on YouTube within the first week.

We don’t have much interest in the culture wars (we even argue that both ads are far more similar than different – hinging on unabashed aspirational sex-appeal featuring young, attractive women). What is interesting is that two dinosaur brands (AEO, GAP) that had been circling the drain of irrelevance for years are going viral and being imprinted on many new potential customers. We see this as a continuation of the trend of early-aughts mainstays finding new relevance with a tinge of “retro” brand appeal (see ANF).

If the jean brand you wear becomes a political statement, we’re happy to play both sides of the aisle. We’re adding Gap to our viral marketing basket.

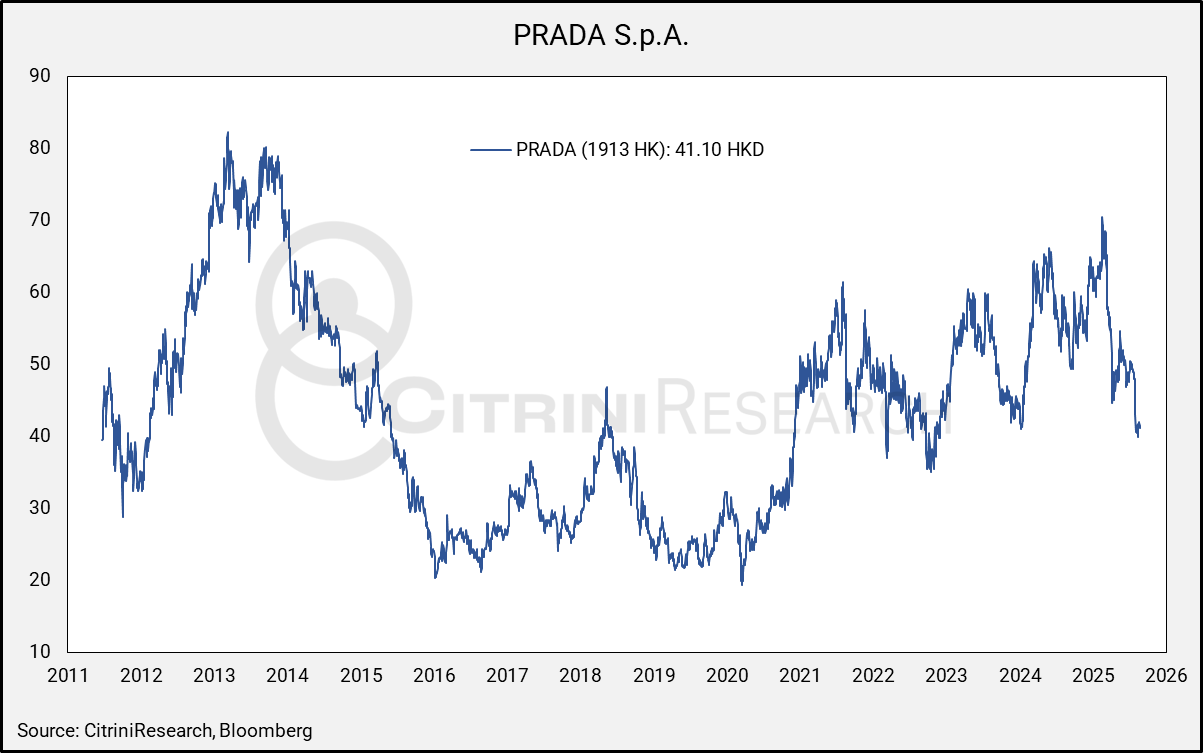

Prada (1913 HK)

Citrini often looks for thematic beneficiaries at cyclically depressed prices. As a category, luxury retail has languished in the markets and basically been left for dead. Sentiment on the industry is generally negative. One luxury name that stands out to us is Prada, primarily because of Miu Miu–currently one of the hottest brands in all of fashion.

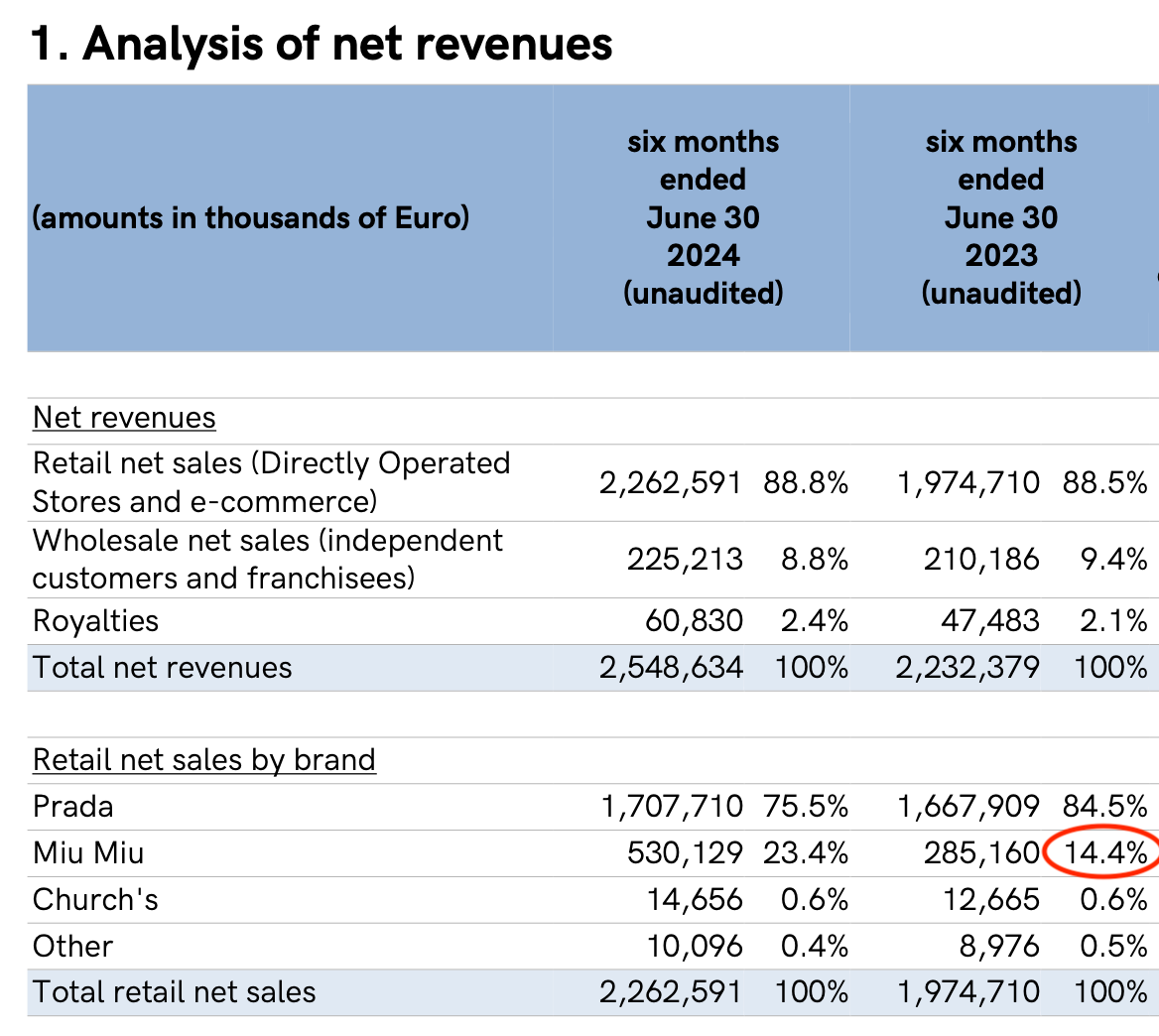

Much of Wall Street probably doesn’t know, or care, that Miu Miu is owned by Prada. There wasn’t much of a reason to; just two years ago Miu Miu only was mostly a footnote to the group’s performance.

Miu Miu is a homegrown brand, launched in 1993 and named after Miuccia Prada - granddaughter of the founder and current creative director of Prada.

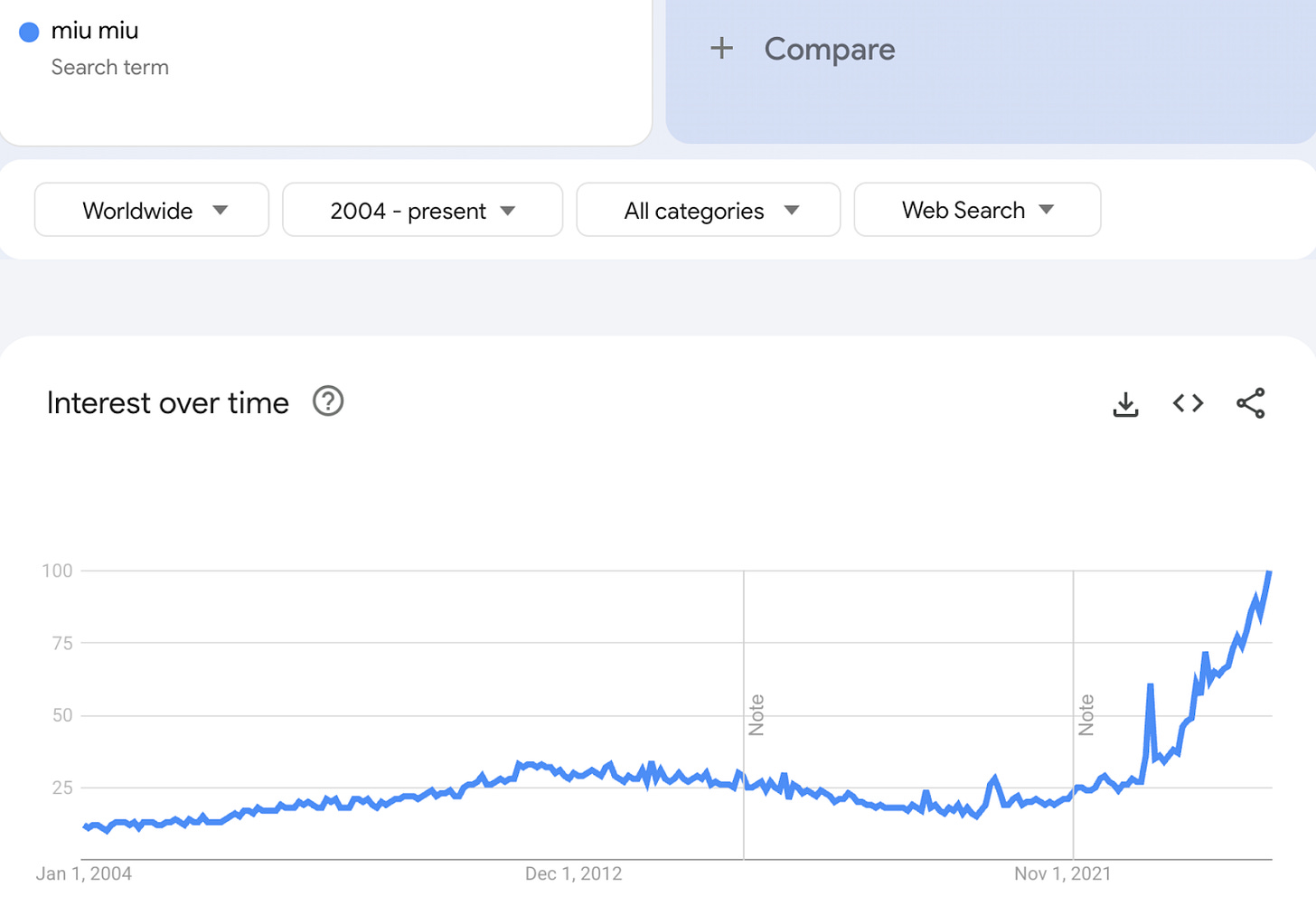

And while the brand has enjoyed periods of popularity in the past, it has caught the eye of the younger generation in just the past couple years. Google Trends shows that global search interest for Miu Miu began to sharply accelerate in 2022/2023 — quadrupling in the past three years, and setting new records as we write.

Source: Google Trends

After several years of rapid growth, the brand has also become much more financially impactful to Prada now. Miu Miu's share of overall Prada group sales has grown from 14% in H12023 to 32% in H12025, and is only continuing to increase. Miu Miu sales grew about 50% YoY between H124 and H125.

Source: Prada

Meanwhile, Prada is trading at a depressed valuation. The trailing P/E ratio is 14x, the very bottom end of the range since its IPO in 2011. A re-rating to the median P/E of 29 would represent a double in the stock price.

Source: Bloomberg

Given the bigger share of Miu Miu in the company as a whole and the ongoing growth of Miu Miu, back of the envelope math suggests that revenue growth for the Prada group overall could double from 8% YoY to 16% YoY in the next 12 months. That very well may catalyze a re-rating in the stock’s multiple.

Miu Miu is especially popular among Gen Z. From a variety of trend-following and fashion industry sources, we heard the following observations:

"Miu Miu is somehow one of the most popular brands right now–especially Gen Z but also just trending overall”

“Every it-girl is wearing it”

“NYC influencers will be wearing it at the US Open”

“Gen Z loves Miu Miu–there’s even an aesthetic called Miu Miu girl”

It seems that the Miu Miu brand is breaking out into the mainstream, beyond just fashion circles. One observer noted that it’s unusual for teens to even know about Miu Miu because the brand wasn’t that popular even two years ago and now it’s on their Christmas wish lists.

Source: The Lyst Index

The Lyst Index is a quarterly ranking of fashion’s hottest brands and products compiled by Lyst, the world's biggest and most intelligent fashion shopping platform. With 160m shoppers a year and the biggest data set in fashion, Lyst is a unique source of global fashion intelligence. The formula behind The Lyst Index takes into account Lyst shoppers’ behavior, including searches on and off platform, product views and sales. To track brand and product heat, the formula also incorporates social media mentions, activity and engagement statistics worldwide, over a three month period.

Likely to continue the momentum, Kylie Jenner is starring in the Miu Miu Fall/Winter 2025 campaign. It would be hard to think of a more relevant mainstream influencer today. In contrast, Cara Delevingne was the face of Miu Miu’s 2024 fall campaign–this represents the shift from niche fashionista to the broader mass market. Meanwhile, Kylie’s sister, model Kendall Jenner, is starring in Prada’s ads, as can be seen in Vogue’s September issue.

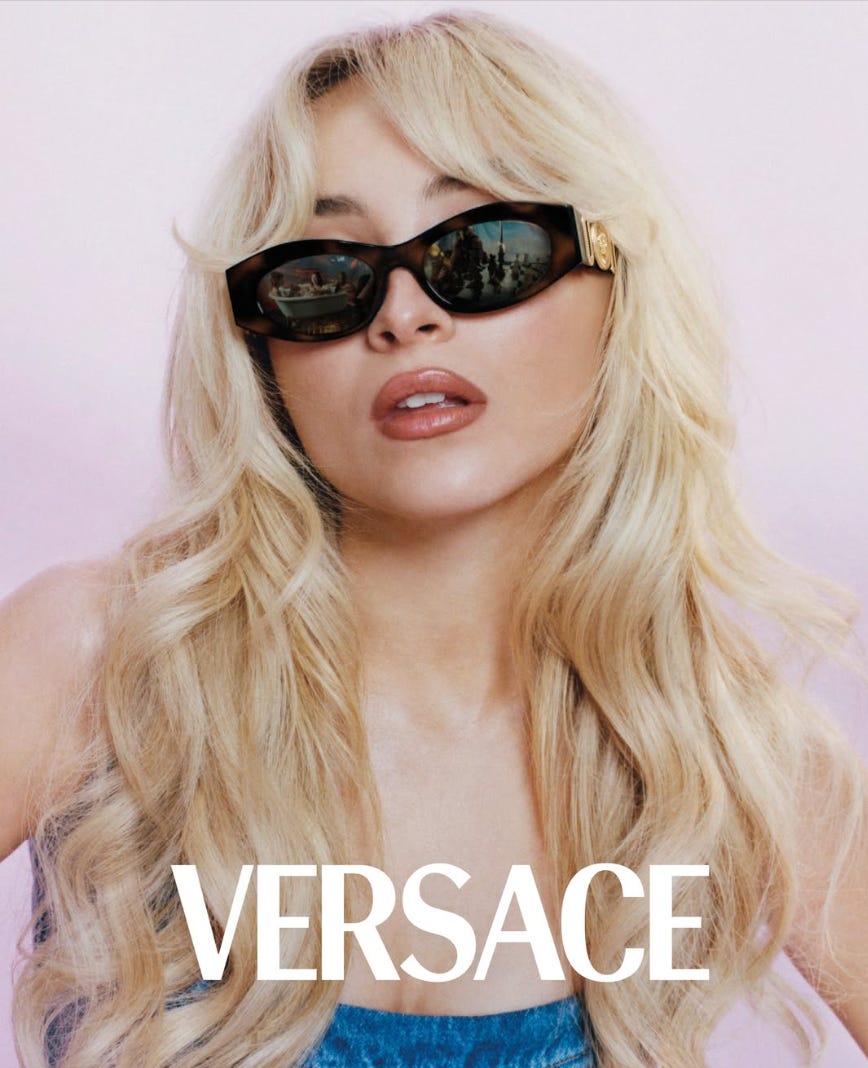

Prada’s Versace Acquisition:

Prada is also in the process of opportunistically acquiring Versace in a distressed sale from Capri, expected to close between Sep and Nov. Prada is buying Versace for 1.25 billion euros vs €1.8b that Capri paid for the brand in 2018. €1.25 billion represents about 10% of Prada’s current market cap. Versace is a globally recognized yet currently undervalued brand that Prada should be able to revitalize with the new generation.

Sabrina Carpenter (shown above) - whose next album is being released this week on August 29th, is advertising Versace, and specifically helping to re-popularize their “Biggie” sunglasses.

Given that the luxury market has been through one of the roughest downturns in 20 years, there is a bull case on catching the bottom of the cycle for traditional luxury while riding the Miu Miu momentum.

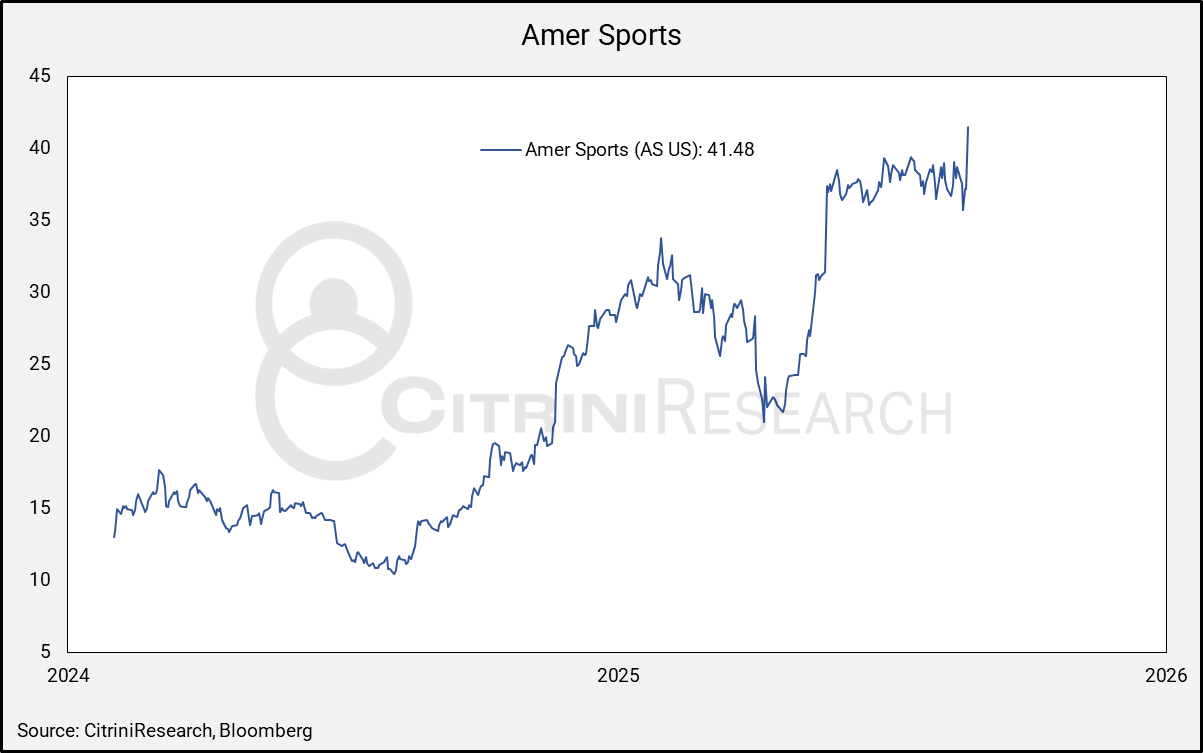

Amer Sports (AS US)

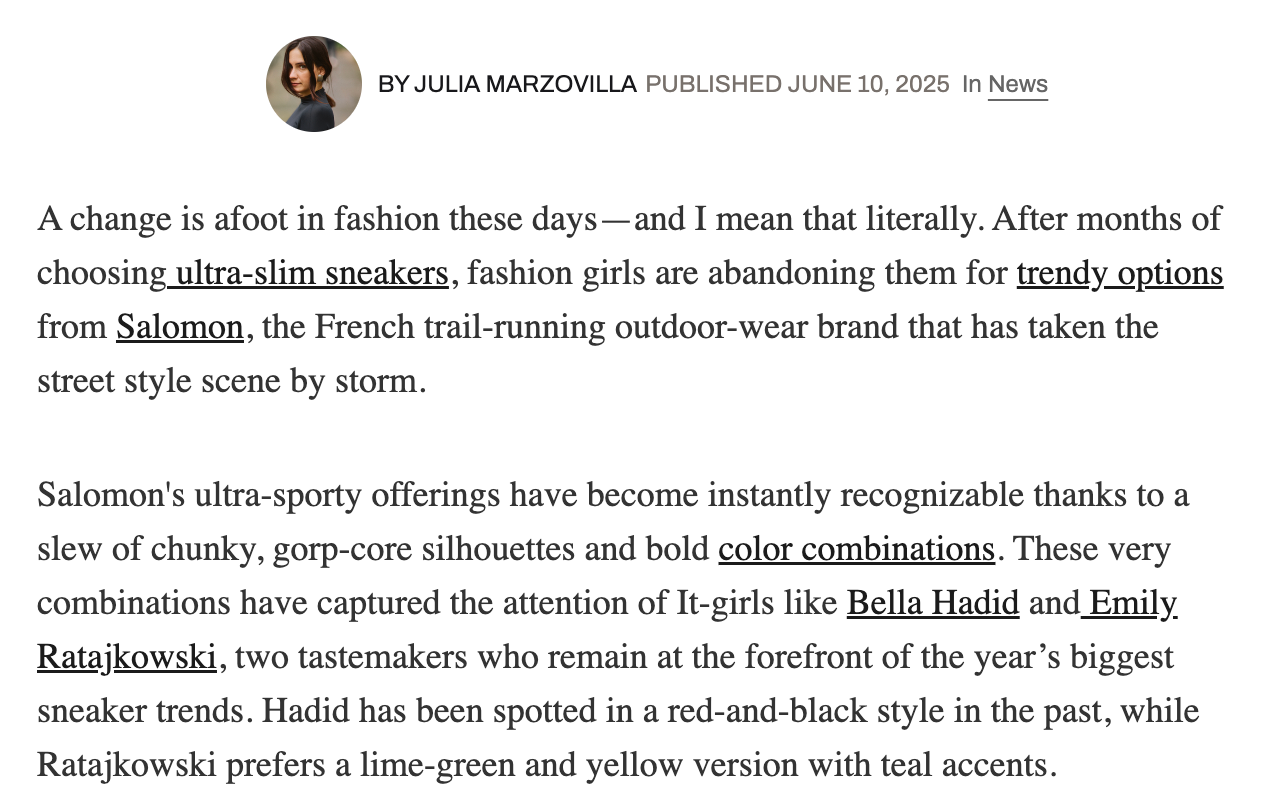

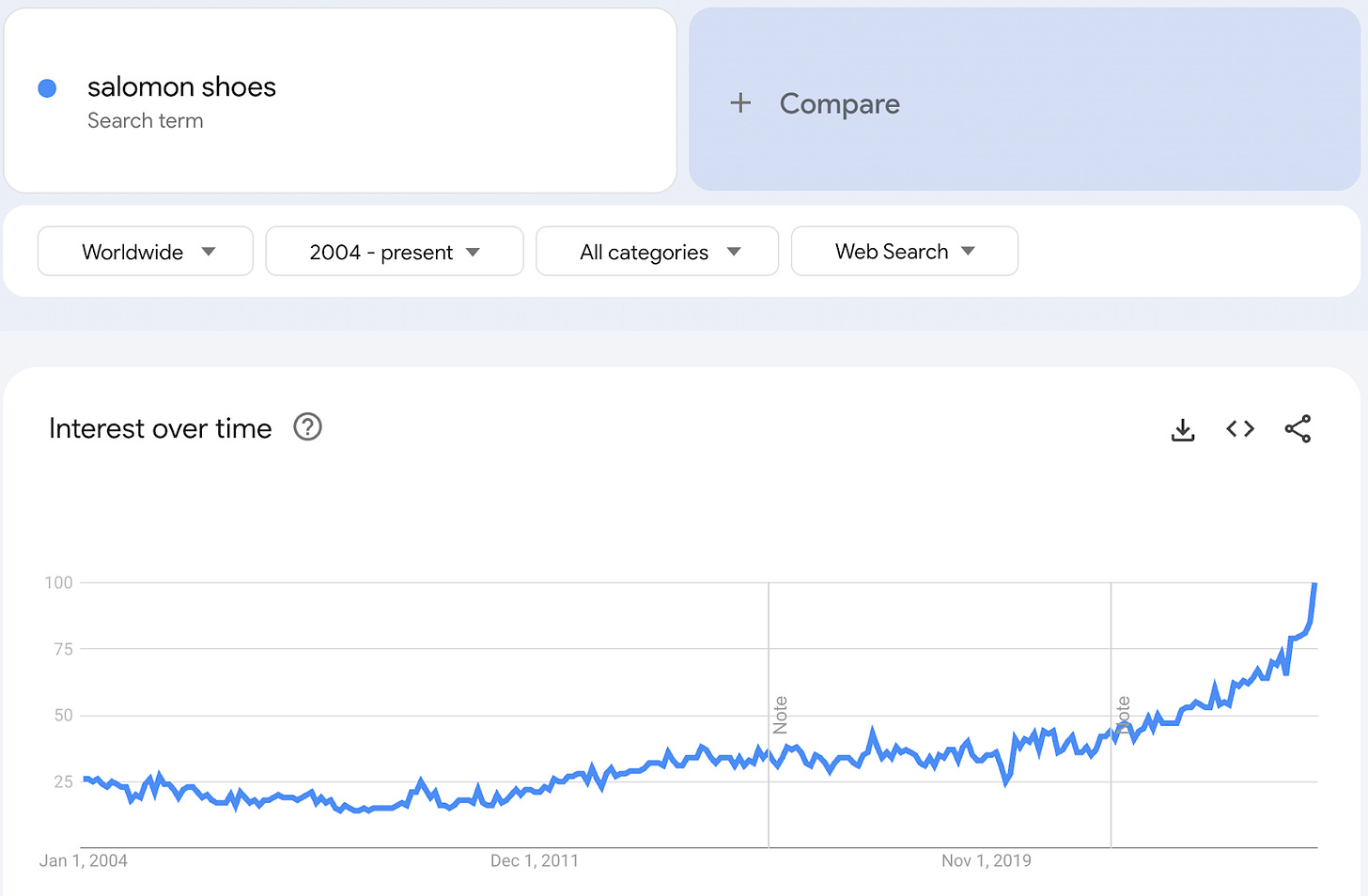

Salomon, a key brand in Amer Sports’ portfolio, has evolved from an outdoor performance brand to mainstream in-demand streetwear—riding the gorpcore trend and organic virality on social media.

Salomon has been able to garner a cool, “avant-garde” lifestyle image. This year, their shoes have been regularly seen worn by supermodels and celebrities such as Bella Hadid and Emily Ratajkowski. And now it’s regular women in their 20s and 30s in New York wanting them and starting to wear them.

Source: marieclaire

Source: reddit

Google search interest has grown by about 50% year-to-date.

Source: Google Trends

Salomon shoes have gone from a niche outdoor product to mainstream streetwear mass market, and awareness continues to grow…

The CitriniResearch Viral Marketing Basket

Here’s our list of names that are leveraging user-generated content (UGC), influencer marketing, viral campaigns, and creator challenges in a manner we think works out. Not all of them are SMID-caps, but we’ve certainly favored them given our continued macro thesis surrounding small and mid cap factor outperformance out to the end of 2025.

Our State of the Themes for the third quarter includes this thesis and more, as well as updates on our entire universe of currently active trends, narratives and thematic equity foci points for the rest of the year.