Election 2024: Three Weeks Out

Recalibrating our views after a wild few months on the campaign trail

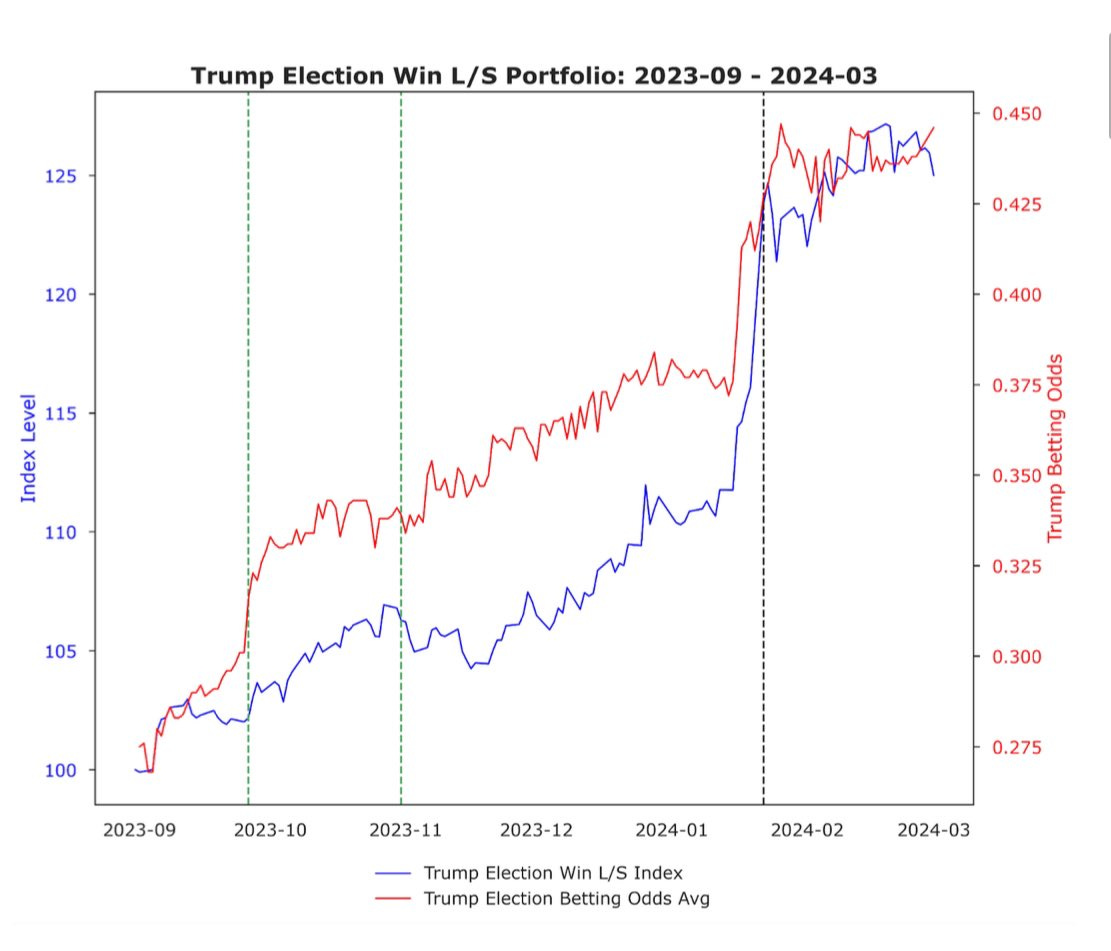

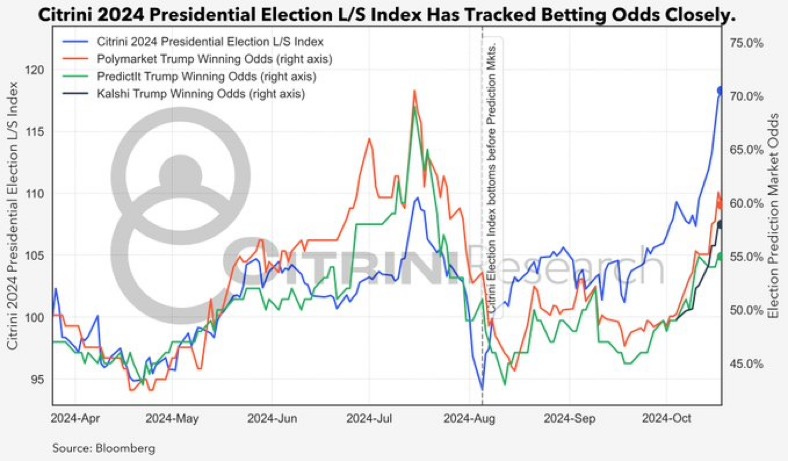

I am incredibly proud of the job we did with the election basket. The performance of our Trump L/S basket (published March 5th)—meant to express stock-market-based odds of a Trump win—bottomed and rebounded strongly on August 2nd, ten days before Predictit and two full weeks before Polymarket (the betting sites).

Some people love formulating a comprehensive thesis on single name equities. I love constructing baskets. Baskets require combining/neutralizing various exposures to isolate a specific theme—whether that be AI, GLP-1s, or US politics.

So what goes into making a basket that you can trust as a reliable signal? First you need a methodology. Then, you probably need to break it a little.

In efforts to create a GOP vs. DEM ‘24 L/S basket, our starting point was likely the ending point of many other firms (not naming names).

We screened for securities that had shown a strong positive or negative correlation with GOP election odds or outcomes over the past five elections. This gave us a starting pool of 400 securities—200 potential longs and 200 potential shorts.

Our process began where most of our peers’ had likely ended.

We knew that would not be enough. Clichéd expectations about party priorities and sector impact wouldn’t suffice and past performance likely would result in a subpar product. The performance of ICLN vs XLE during the Biden presidency offered a cautionary tale on that.

So, we used more recent windows in the market where partisan policy was the primary driving factor of returns to narrow it down even further. We created categories: tax policy, energy policy, foreign policy, economic policy, idiosyncratic factors, etc.

We began with the obvious - tax policy. This formed a narrowed category - TCJA vs IRA beneficiaries. 25 names each. They had performed as expected around previous dates significant to these policies/elections.

With that done, we began to explore more idiosyncratic areas. What were the asymmetric setups on a sector level? What would be the same as the last presidency of each candidate, what would be different ?

We focused on the qualitative aspect. We brainstormed through earnings and expert calls and debates about names that hadn’t been quantitatively included based on backward-looking correlation but should be qualitatively included based on forward-looking reasoning.

We narrowed down the policy categories to the most succinct possible and had the workings of an initial basket.

The performance was acceptable, but we needed to ensure it expressed our views as well as possible and didn’t simply attempt to overfit to what odds had done.

We created new screens based on each of these categories and did channel checks to gather more information on how significant the policy impact could be for the names in this coverage. We eliminated some redundant additions and rounded out some thinner ones.

We also realized that we did not want to make the call for our clients whether Trump or Biden (now Harris) would be bearish/bullish. So we set out to create two basket implementations: one net long, one market neutral.

On March 5th we released our baskets, along with a framework of how to play it: the tax policy baskets would be better to play “reality” (post-election outcome) while the overarching election basket would capture expectations/odds pre-election.

We made sure throughout the year to highlight to clients when the basket was tracking odds well (for example, the entire month of May was lockstep)…

More importantly, we highlighted when they diverged. The first pronounced divergence followed Trump’s attempted assassination. Betting probabilities on a Trump win jumped significantly ahead of our basket’s performance—by July 15, we wrote to subscribers this was likely a top in the immediate term.

The second, of course, was the divergence in the beginning of August when our basket bottomed and began gaining significantly while GOP victory odds decreased dramatically for another two weeks. We took this as a signal to advise clients the Trump trade was back on.

This is the difference CitriniResearch provides. My goal is to reclaim basket exposure strategies from the sell-side, dominated by low-effort baskets simply used to sell more trades. Rather, our efforts present them as they should be: uniquely structured risk/return.

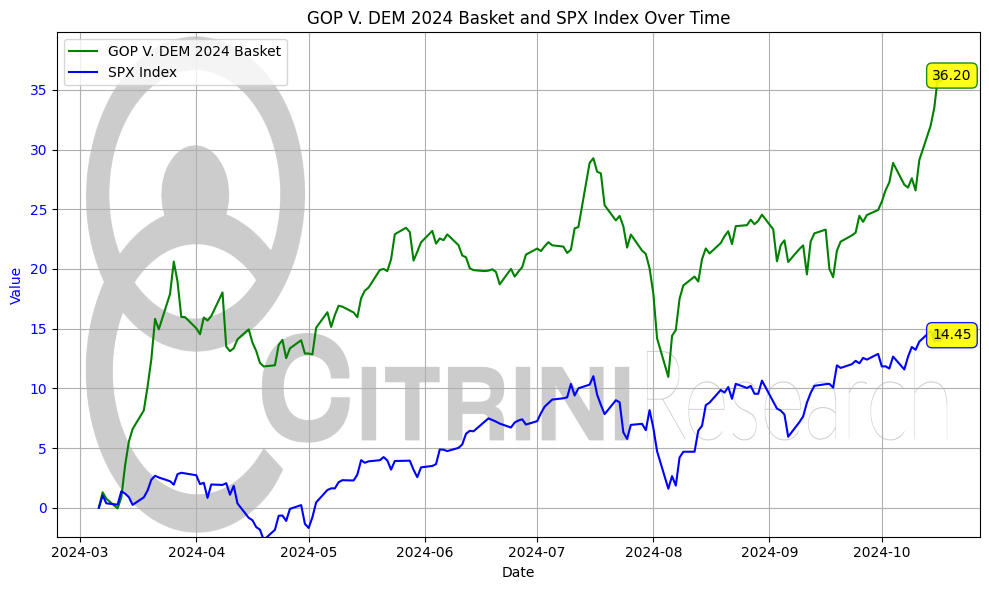

P.S. I know baskets have been used to defer responsibility before. “Oh, we were just creating an index to track x, y, or z, we didn’t actually think it would be a good trade”. Not us. The ONLY thing CitriniResearch writes about or will ever write about is what we believe are good trades. The return since publication (03/05/2024) of the GOP vs DEM L/S basket that we recommended investors use, is +36.19%, for +21.74% of outperformance over SP500