CitriniResearch Q1 Review & Outlook

Core Portfolio Performance Review, Changes & Macro Outlook

Too busy for April Fool’s today, as I’ve got some new ideas spurred by some much needed vacation time that I definitely did not spend half of thinking about how to be positioned for next quarter…

Okay, I’m lying.

Anyway, I’m going to get right into it.

First, we’ll examine our core portfolio’s performance during Q1. We’re going to cover some serious ground even though Q1 was kind of boring (in the sense that it’s rare nowadays for some cataclysmic event to not occur in Q1 - I mean…ZERO pandemics, banking crises or new Fed hiking cycles? what is this, amateur hour?).

This article is going to be both backward and forward looking, first we’ll cover the Citrindex performance for Q1 down to the individual basket level to ensure our themes are still working and make some adjustments to fit the rest of the year more accurately (as I see it playing out).

I have some adjustments, the most drastic of which will be to our new election basket. I’ll go briefly into some recent and future developments as they pertain to our themes, like the upcoming SURMOUNT-OSA data from LLY that could get Tirzepatide approved for obstructive sleep apnea and the impact of AI on the power grid - as well as potential impacts from the rebuilding of the Francis Scott Key bridge on our Fiscal Beneficiaries basket. We’ll also discuss a potential AI moonshot speculation and briefly touch on recent Chinese econ data.

Finally, I’ve got my own reaction to the FOMC that occurred while I was on vacation. Additionally, I’ve got an interesting guest. As I often evangelize the merits of regularly being challenged on your own view, I realized that I haven’t presented to my readership an counter macro view. So, I’ve got a great one from a colleague who I noticed has a drastically different view but has never gotten into stupid twitter fights about it - promising (and oddly rare), right? That should help us stay aware of risks to our current “base case” as 2024 plays out.

Let’s begin…

CitriniResearch Core Portfolio: Q1 Performance

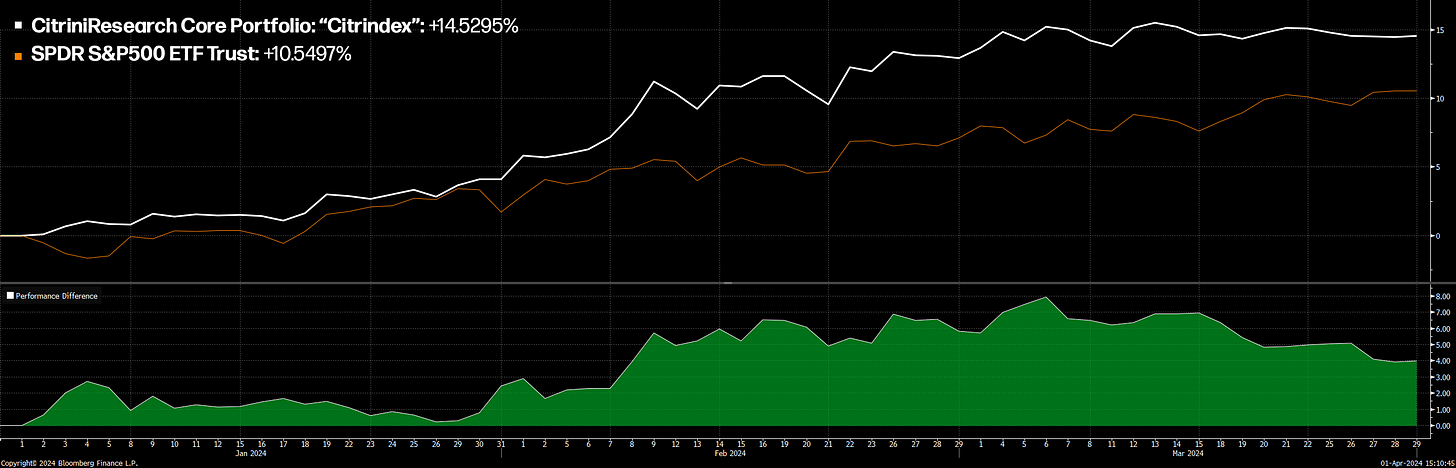

Consistent with the fact that our thematic exposures have continued to play out both in the real world and in markets, our core portfolio has managed to continue to outperform the S&P500, stacking onto an already impressive (if I can say so) 2023:

Our thematic exposures continue to work and result in outperformance versus the S&P500, however for the month of March the core portfolio underperformed SPX by about 180bps:

This was primarily due to our hedging, which I believe was a good decision (we’re up 88% since May 2023, of course I’m going to hedge aggressively), and some underperformance in healthcare and energy relative to the benchmark for March.

Still, there are no excuses for underperformance. Going forward I will be attempting to find more asymmetric hedging opportunities and be more selective about our entries, being aware that just because the portfolio is up 87% since we began implementing it does not necessisitate being overly cautious unless there is a legitimate reason to begin an aggressive hedging strategy.

Here’s the current weighting of the baskets in the core portfolio:

As you can see, with our March 31st expiry hedges rolled off, we are currently running +70% net long. That’s fine…as long as the market keeps going up. I’ll be watching some simple trend indicators like the 21 day exponential moving average to begin exploring adding on shorts, but I do have some ideas for that as well.

If you missed it, I crowdsourced a “AI stupidity = maximum” basket from my Twitter followers that will really come in handy if it the rally begins weakening significantly or it turns out that ChatGPT is just a bunch of dudes in the Philippines furiously googling every time we ask it a prompt...unlikely but I like to be prepared). I’ll share that a bit later. If I sound a bit paranoid about a downturn it’s not because I think it’ll be catastrophic, just because I think it kind of…has to happen soon?

While I was running the metrics for the portfolio I came across this:

Yes, it’s nice that our sharpe is so high, but the fact is mine has never really been exceptionally high. My trading strategy does take advantage of diversification effectively and this is more or less the perfect environment for thematic equity, but I’m much less concerned with my own sharpe ratio (you can’t eat sharpe ratio) and much more interested in the benchmark’s…

SPY has a 4+ sharpe ratio for the past six months. I’m not bearish but that’s relatively unsustainable, I think, and I would not be surprised to see a natural pullback to recent SPX highs. Still, there is no reason to rush in with paranoia in a trending market - that’s how you end up underperforming real bad. So, we continue to ride.

As always you can check out the Core Portfolio on the Citrindex tab:

The Citrindex

The Citrini Research Core Portfolio These articles are for Paid Subscribers only. Please view them below.

Let’s see how our individual thematic baskets have done Year-to-Date, and do a brief checkup on them:

Global AI Longs Basket: +22.3%

The CitriniResearch Global AI Basket finished the first quarter of 2024 with a total return of +22.3%

Overweights

Here’s what I said in our last Thematic Update about overweight names in our AI basket, which you can read by clicking here.

Honestly, that decision to overweight Hanmi/Onto/Micron/SK Hynix is looking really, really good. It’s up about 40% since I wrote the above:

I just wanted to point that one out separately, because I know it’s a hot topic. But the real call was actually Hanmi Semiconductor, which is up 147% since that article and 438% since we highlighted it as a prototypical “picks and shovels” name in our first ever thematic primer on AI May 31st, 2023.

I’m still convinced on all of these points from January - especially bullishness on memory, which seems to have bottomed even independent of AI demand. I still remain bullish on connectivity as well, but more so on memory as the telecom overhang to connectivity has proven more resilient than anticipated. I’ve increased the weight a bit further on Micron, SGH US, SK Hynix on my continued bullishness on memory that was mentioned in our January review. Speaking of our “State of the Themes” article:

The State of the Themes

The State of the Themes Our thematic equity baskets have done pretty well, and I’m happy that’s the case. But, if I’m being honest, there’s nothing in trading that makes me more paranoid than being right.

Our decisions as far as deletions/underweights and additions/overweights proved to work out pretty well, with the former outperforming the latter by a little less than 10% since publication:

It’s not sexy, but this is basically what makes a portfolio manager. Consistent evaluation of decisions and how they stack up to reality. We’ll do a couple more adjustments as we enter Q2 (again, AI is the most rapidly changing of our themes).

Here are the deletions and additions, as well as any other adjustments, I’m making to the AI basket: