Can You Hear Me Now?

The Coming Optics Shortage & Telecom Suppliers' New Dawn

Introduction

You might have heard, but this AI thing has companies building quite a few data centers. With a veritable arms race in progress, the number of data centers being constructed has exploded.

Simultaneously, each data center is becoming more dense. As we approach the limits of on-chip performance in our pursuit of more capable Large Language Models (LLMs), companies are increasingly "clustering" chips together. That sounds a bit bottleneck-y, right?

You might be wondering if we are doing a rerun here, after having covered interconnects inside the server a couple months ago, but no. We’re not talking about connecting your GPU to your CPU, we’re talking about connecting the data center to everything else (including other data centers).

These clusters are getting so large that they have to be distributed across physical spaces organized as campuses. Each one of these clusters has to be connected to the other clusters, and then each data center needs to be connected with the other data centers.

Every cluster and every data center represents a node in the communications network.

It’s not just the number of these nodes that has inflected upward in parabolic trajectory, it’s the quantity of data they’re transmitting along the network. It isn’t just data centers. Everything from your smartphone, to your PC, to your smart thermostat, and robot vacuum…all nodes, all in need of communication. And, what’s more, more communication as they get more advanced.

Your eventual AI assistant and the AR / VR headset you’ll use to interface with it (at least until holographic communications are ready), the surgical robots and the industrial automatons executing commands with nanometer precision, each will represent another node. The future is a story of nodes—or, more specifically, a story about more nodes communicating with each other.

Communication between nodes occurs across spans.

Spans are the connections across which information is transferred. They can be physically wired networks or invisible wireless ones. As they carry more information between an exponentially growing number of nodes with ever-increasing demands for speed and bandwidth, spans are becoming increasingly crucial in our modern world.

The expansion of networks, particularly through the deployment of fiber optics, is not just about meeting current demand. It’s also about future-proofing for anticipated needs. As network coverage broadens and capabilities increase, it unlocks new use cases and markets, such as smart cities, autonomous vehicles, and industrial automation.

Our techno-utopian future hinges on the capability of these spans to meet our growing needs.

And there are plenty of companies that will rise to the task.

The bad news first: The spans are not up to the task.

With all of this new demand for connectivity, you might expect that there has been massive new investment in connectivity. On the contrary, the companies responsible for building and maintaining our communications networks have significantly underinvested, not just for future demand, but for the demand that exists right now.

The good news: that creates an excellent opportunity for investors like us.

Our Thesis: When Cyclical Depression Meets Thematic Inflection

Two of the most lucrative approaches for generating excess returns in financial markets are timing a cycle and identifying a secular trend. CitriniResearch focuses primarily on secular trends, but it always helps to have a favorable entry point.

The most rewarding investments in secular trends occur when those trends materialize during periods where the sector in question is out-of-favor with investors due to a temporary cyclical headwind.

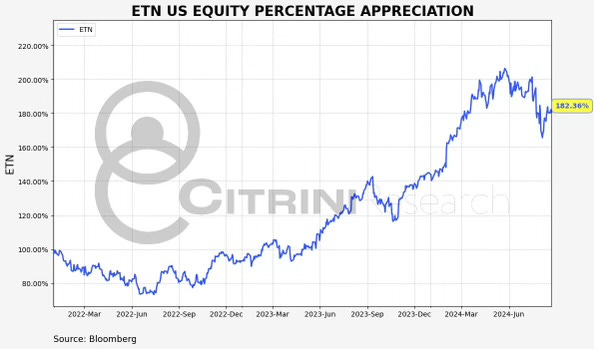

These kinds of opportunities do not present themselves often, but when they do, they often lead to extraordinary returns. Take, for example, our “archetypal Fiscal beneficiary” - Eaton Corporation (ETN US).

At the time of our publishing, the market consensus was extremely pessimistic on cyclical industrials like ETN, despite the impending wave of government largess that would translate into significant business opportunities for the company.

The result? Significant equity appreciation.

Perhaps the most widely revered example is one you’re already thinking of…

Nvidia (NVDA US) traded at an extremely cyclically depressed valuation following an epic inventory glut and the seeming implosion of cryptocurrency mining that had driven demand for GPUs.

Nvidia announced $1.32 billion in inventory write downs when they reported their FQ2’23 results in August of 2022. At the same time, the company saw revenues that were $1.4 billion short of expectations. NVDA fell 44% over the next two months before putting in a low.

The trough of NVDA’s inventory cycle coincided with one of the greatest secular trends of our generation—the widespread implementation of machine learning and artificial intelligence in real-world applications.

Coming out of this period of cyclical excess supply, the combination of the upturn in the cycle with secular tailwinds from AI led to NVDA’s share price increasing by more than 1200% from trough-to-peak over the next 18 months.

Today, we face a similarly enticing opportunity in specific areas of telecommunications like Ciena (CIEN US).

New, AI-driven connectivity demand is set to reverse depressed telecom capex.

Short-term cyclical forces (inventory right-sizing) are coinciding with long-term secular trends (structural realignment of capital allocation). To borrow a sports metaphor, the bases are loaded and our cleanup hitter is lurking in the on-deck circle. In other words, the timing could not be better.

We are entering a generational network upgrade and enhancement cycle aimed at incorporating generative AI into our everyday environment. Let’s dive in…