26 Trades for 2026

A Thematic Watchlist for the New Year

Introduction

Our Approach to the “Year Ahead Outlook”:

It’s a bit of a ridiculous premise isn’t it, the “year ahead outlook”?

Just because the number on the end of the calendar changes, you’re supposed to have a better idea of what happens over the next twelve months? I don’t know about you, but if I felt strongly that I knew what was going to happen over the next twelve months, I would not wait until December to share it.

As speculators, we spend the majority of our time trying to be right about the future. That tends to be a good thing—efforts spent towards being right (or at least less wrong) tend to be rewarded.

It doesn’t take a long or storied career as an investor to have numerous realizations that you’ve missed something very obvious in hindsight. Our vocational emphasis on accurate forecasting sometimes hurts us more than it helps. Becoming too in-the-weeds risks stifling the creative process that is a prerequisite to developing differentiated views.

Once a year, we drop all pretense. Just for this exercise, our primary focus isn’t being right at the right time. Instead, we look at what’s occurred in the passing year and what might occur in the year ahead. Without any of the pressure surrounding “this has to happen or else I’m wrong,” we find that the ideas tend to more closely approximate the truly unpredictable nature of how things will unfold.

Instead of an “outlook”, we create our Twenty-Something Trades. You can take a look at last year’s to get a better idea.

The end result is a long list of ideas. Some we think could be real winners, some are preparation for a specific scenario or eventuality, some we simply want to keep on our screen. Our aim is to minimize the risk of intellectual blind spots.

Are they all going to be good trades? Of course not, there’s 26 of them. Think of this as a thematic watchlist.

The purpose of this article is to put as many relevant ideas in front of you as possible, in hopes that one of them resonates at some point during the next 12 months. If you think one of these trade ideas is hilariously wrong, GOOD. Don’t keep it to yourself – we could end up finding the right trade from that discussion.

It’s the end of the year, another absolutely crazy year for that matter. Now, we get to prepare to do it all again… but differently.

2025 Scorecard

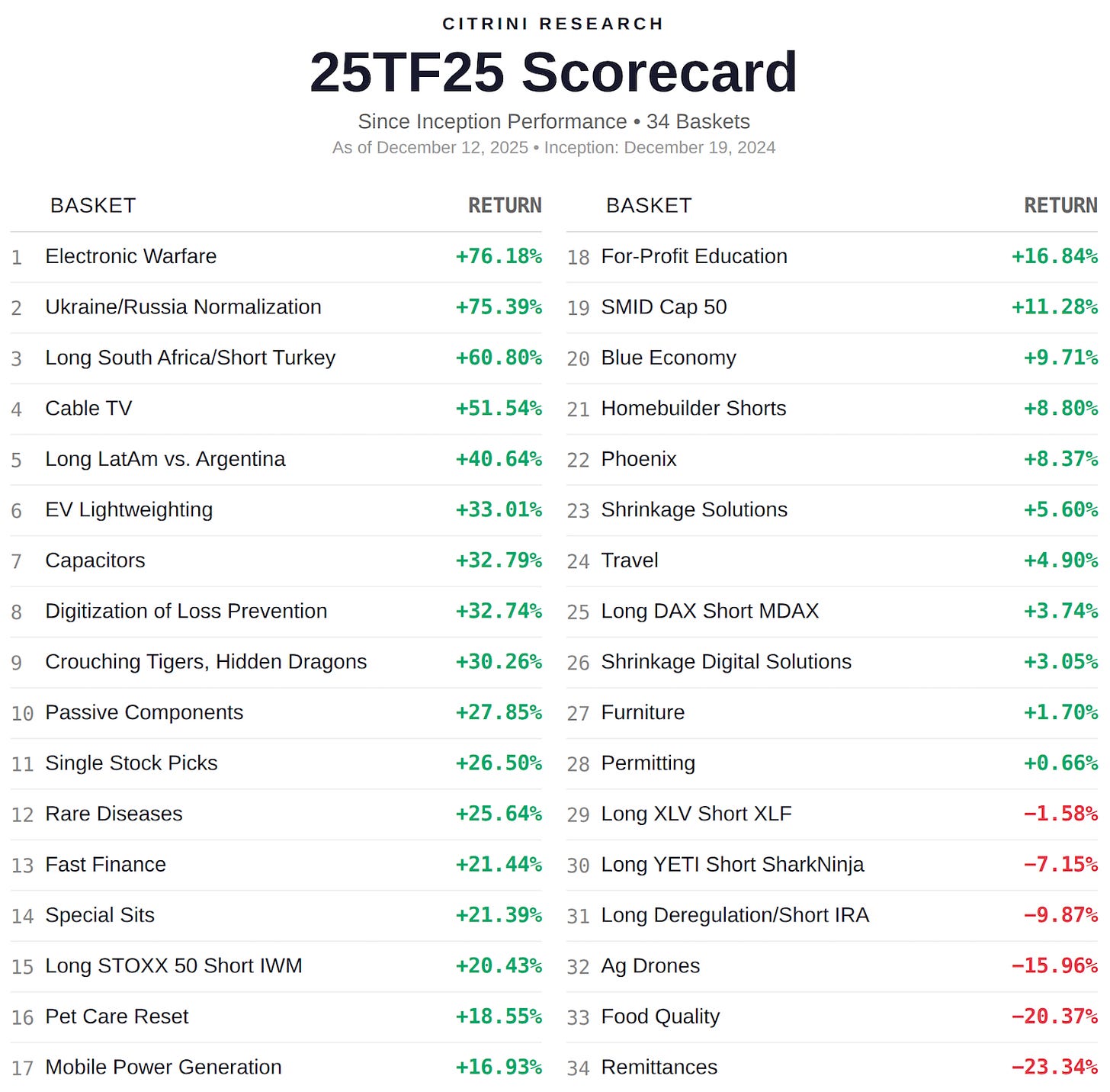

First, let’s revisit how last year’s thematic watchlist performed in 2025. Since publication, a little more than half of our ideas outperformed the S&P 500 and more than 80% had positive returns.

We caught some good themes (most of our drone names doubled, our Ukraine normalization picks crushed it, and South Africa rode the gold rip to crush Turkey). We also had some ideas that really did not work (why did we think remittances would go up while the Trump administration ramped deportations? I don’t remember, seems silly in hindsight).

Here’s our scorecard, incorporating all the 25 Trades for 2025 (some themes had more than one expression) that were covered in the article:

We had similar dispersion in our single stock picks - some big winners (Allient doubled on Rockwell returning to growth and robotics tailwinds, we correctly anticipated the success of ARQT’s Zorvye), some big losers as well. As of writing, the average return on an equally weighted allocation to our single names was +26.50%, still handily beating the S&P 500 by more than 10 percentage points.

Now, as my regret for sticking to the 2X Trades for 202X format grows each year, so too does my commitment to the bit. With that out of the way…

Let’s get into it.